Question: Is it possible to retire on $500K (i.e. $500,000) in your 50’s and 60’s?

Unfortunately, not all of us are great savers. Most financial articles will recommend that you’ll need at least $1 to $2 million dollars in savings before you can even consider retirement.

But the reality for a large segment of the population is anything from that. To give you an idea, a study from the Government Accountability Office found that those savers between the ages of 55 to 64 have an average of just $104,000 in their retirement accounts.

This is not surprising at all. With the responsibility of saving for retirement having shifted from company-sponsored pensions to individuals, the shocking truth for many people will soon be “whatever you have saved is all there is”.

Even though the easy answer is to simply continuing working full-time, sometimes “life” has other plans for you. Health issues, taking care of spouses, job elimination, and dozens of other challenges may force you to consider retirement earlier than you may have previously planned.

Therefore, the question remains: If you’re in your 50’s or 60’s and short on retirement savings, how do we make the most of it? How can we stretch those dollars to give you the best and most reliable outcome possible?

In this post, we’re going to thoroughly explore your options and see how we can retire on a $500,000 nest egg. (Note that you can still follow along and re-work the examples if you’ve got other levels of savings. The logic behind the strategies will still apply.)

Disclaimer: Some of the links in this post to useful tools we recommend are affiliate partners. This is at no additional cost or risk to you. To learn more, check out our Privacy Policy.

1- Exercise Lifestyle Moderation

First things first, if you’re going to have any chance of success with retiring on just $500K, then we need to get real:

You’re going to need to really concentrate on making some lifestyle changes and exercise a strong sense of moderation when it comes to your spending.

Let me be blunt: Nothing in the strategies we’re going to suggest will produce anything close to the type of glamorous lifestyles you might see on TV or in magazines. Images like these portray lifestyles that a majority of the population will unfortunately never achieve. So do yourself a favor – ignore them.

Instead: Focus on the things that really matter to you. Why? Because they’re going to help you stay the course when it comes to your money!

What Matters to You?

Chances are that if you are even thinking about retirement, then you value the one thing that should matter to us the most: Time.

Time is something that we’ve spent our entire working years trading for money. And at some point, we reach a cross-roads where we’d rather spend our time doing something else other than going to our jobs.

Maybe its spending more time with your spouse, your children, grandchildren, etc. Maybe its finally traveling or taking up a hobby that you’ve always wanted to pursue. Maybe you’re just finally ready to be done!

No matter what your reason is, let that be your motivation! Let it be the thing you prioritize above all else.

Why? Because when it comes to your money, focusing on the priorities that matter the most to you will be the things that will help you stay on track.

Work Your Budget

The Internet is a sea of success stories of people who have learned how to retire on less than $1 million.

If I could find one common element to nearly every story I’ve read, it’s this: The secret of retirement success (on any income) was in budgeting their money and becoming very careful with their spending.

What’s the best way to do this?

A budget is nothing more than simply understanding how much money is going in and how much money is going out. And as long as you can make sure less money is going out than in, then you’re going to be okay!

Just like someone who is on a diet and counting their calories to make sure they don’t exceed the number they are allowed for the day, the same good habits can be applied to your finances finances to make every dollar count as well.

Again, I can’t stress this enough: Let the thing that motivates you help keep your spending under control.

To help you get there, here’s a few helpful links:

- 1,000 Ways to Save

- The 10 Best Practical Ways to Budget Your Money and Save More

- Monthly Budget Not Working? Why An Annual Budget Is Better

- What is the Minimum Retirement Savings You Could Comfortably Live On?

Okay! So now that we’ve made retiring successfully a priority and understand how a budget will make that happen, let’s get to the nuts and bolts of how much retirement income we can expect with a nest egg of $500K.

2- Start With The 4 Percent Rule

If there’s one fear that most people share when it comes to retirement planning, it’s this:

How much money can we withdrawal safely each month from our nest egg (our $500,000) without running out of money too early and having to return to work full time?

To answer this, a very useful starting point is to consider something called the “4 Percent Rule”.

What is the 4 Percent Rule?

The 4 Percent Rule is a popular guideline widely accepted in the financial planning community. It comes from a study that was conducted from a financial adviser named Bill Bengen to determine what the optimal safe withdrawal rate should be. After looking back at several decades of historical market returns, his conclusion was that a retiree could reliably withdraw 4 percent of their initial nest balance for at least 30 years with inflation adjustments.

What does that mean? To put this into context, if you have a nest egg of $500,000, this means you could safely withdraw a starting balance of 4% or $20,000 and then adjust for inflation every year after that … regardless of what your actual portfolio value is.

For example:

- Year 1 = $20,000 (or $1,667 per month)

- Year 2 = $20,600, an increase of 3%

- Year 3 = $21,218, another increase of 3%

- And so on …

Statistically according to the 4 Percent Rule, no matter how your investments perform, your nest egg would not run out for at least 30 years. In fact, according to financial guru Michael Kitces, after 30 years less than 10% of the time does the retiree EVER finish with less than the starting principal.

For a lot more information about how all of this works, you can read a very exhaustive article I wrote called “The 4 Percent Rule – Everything You’ve Ever Wanted to Know”.

Test the 4 Percent Rule for Yourself

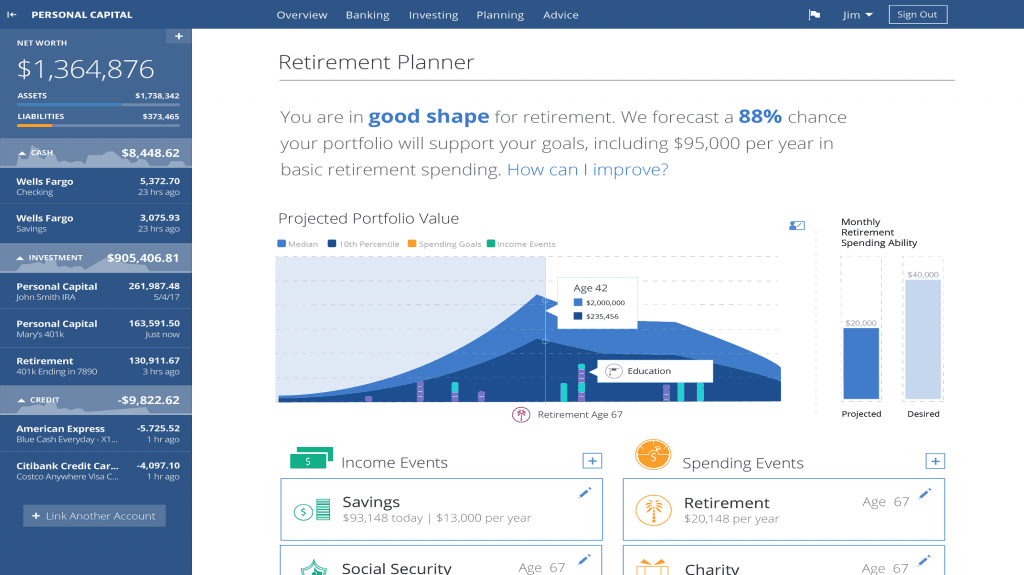

Skeptical that the 4 Percent Rule actually works? You can see this in action for yourself using any number of free online calculators. Personally I like Personal Capital’s Retirement Planner. It gives you a graph showing exactly how long you can expect your money last and your probability for success.

To make it as accurate as possible, all you have to do is create a free account and then link out to your external retirement funds. From there the Retirement Planner will create a personalized portfolio projection based on 5,000 Monte Carlo simulations showing you the best and worst-case scenarios for your nest egg based on your input. It’s way better (and more fun) than trying to crunch numbers on a spreadsheet. Definitely give it a try!

Avoiding the Age 59-1/2 Penalty

You might be saying: Wait! I thought you can’t make withdrawals from retirement accounts until at least age 59-1/2.

… And you’d be right (mostly). The IRS has a rule that if you try to take your money out of a traditional 401(k) or IRA account before age 59-1/2, they will impose a 10% penalty on the withdrawal.

However, you should know that you’re not necessarily “stuck”. For people myself who are determined to retire long before age 59-1/2, I spent years collecting as many strategies and tricks for getting around this rule. Eventually I complied them all into a single ebook called “How to Unlock Your Savings Before Age 59-1/2 Without Penalty”, and I guarantee you’ll find plenty of useful tips in there.

Minimize Your Taxes

Please note that for the 4 Percent Rule, it is always assumed that your withdrawals are taken pre-tax. This means you will still need to pay taxes on this money.

However, you can easily side-step this problem if you can find a way to save or convert your retirement savings into a Roth IRA. Remember that with a Roth IRA, all of your contributions are available tax-free and penalty-free. The capital gains portion is also available tax and penalty-free, but not until after age 59-1/2.

3- Don’t Forget About Social Security

Social Security is something that a lot of U.S. tax-payers forget about when it comes to retirement planning. But if you plan to retire on $500K, you are going to want to make sure you get every penny you’re entitled to.

You can determine how much money you’re scheduled to receive by going to Social Security’s website and logging into your account. According to their figures, the average payout is approximately $1,341 per month or $16,092 per year. Of course this amount will vary depending on how long you’ve worked and how much you’ve earned over the years.

Generally speaking, you can start collecting your Social Security benefits starting at age 62. Therefore, depending on how old you are now and how much money you’ll need, you may want to gauge your retirement date around this criteria. It could mean yet another reliable income stream for you.

Combining the average reported Social Security monthly benefit with withdrawals from our nest egg savings example, this means you could be looking at:

$1,667 + $1,341 = $3,008 of total income per month (or $36,092 per year total).

Double-Down with a Spouse

Don’t forget: If you’ve got a spouse who has also worked and paid into the Social Security program, then you’re both eligible to receive benefits. So be sure to check into each individual’s account.

Got a While Until Social Security?

Is your plan to retire in your early 50’s, and therefore it will be a while until you are in your 60’s and can start receiving Social Security? If so, no problem. We did a study to see how much higher of a safe withdrawal rate you could start with at a younger age if you expected to start receiving Social Security later on. On average, the future benefit added approximately 0.5% in the near term. Click here to read the full study.

4- How to Increase Your Safe Withdrawal Rate

Let’s go back to the 4 Percent Rule and see how we can optimize it further.

How long do you need the money?

First of all, remember that we said the “4 Percent” figure is tied to a period of 30 years. According to another famous paper on safe withdrawal rates known as the Trinity Study, if you only need your nest egg to last for a shorter time period (perhaps thanks to an upcoming annuity, pension, or some other delayed income stream), then you should be able to use a higher rate. For example, a portfolio with a 5% withdrawal rate for 20 years would have almost the same probability for success as one with a 4% withdrawal rate for 30 years (94% vs 96%).

(Alternatively, if you’re much younger and want your money to last for 50 years or more, than you might have to go with a lower rate such as 3.5%.)

Playing the Probabilities

In the original paper about the 4 Percent Rule, the author had determined that in the worst of economic conditions this safe withdrawal rate would last for a minimum period of 33 years.

However, there were many periods throughout history where higher safe withdrawal rates ended up working out just fine. The problem is that no one knows when those safer periods are going to happen. Therefore, this becomes a question of probability: What kind of odds do you need to feel safe? 100%? 90%? 85%?

Technically, you can increase your withdrawal rate to any number you want. But of course the higher up you go, the more your odds of success decrease, and the greater your chances of running out of money increase. Again, we can refer to the Trinity Study to see what kind of probabilities they predict.

Using the Shiller CAPE to Safely Gauge a Higher Withdrawal Rate

So how can you predict when a higher safe withdrawal rate might be okay to use?

An economic value known as the Shiller CAPE can be used to gauge whether the market is over or under-valued. It’s been shown that this factor correlates to market returns over the next 15 years, and this can help us determine whether or not higher withdrawal rates may be safe.

In a famous paper from financial researcher Michael Kitces, it was found that the safe withdrawal rate could be adjusted as high as 5.5% when the Shiller CAPE was equal to 12 or below.

Combining This All Together

Taking everything we’ve said in this section into account, if we can squeak out another 1.0% on top of our previous safe withdrawal rate, then this will yield another $5,000 of additional income per year.

This brings our annual total income up to $41,092, or $3,424 per month.

5- Reducing Inflation Adjustment to Get More Up-Front

One aspect of the 4 Percent Rule as well as many other safe withdrawal rate studies is that they all mostly assume that you will compensate for inflation each year. In other words, you’ll add about 3% to the prior year so that your money maintains the same amount of purchasing power.

However, if you were to delay or even reduce the amount your inflation adjustment, this could allow you to start the whole process using a higher rate.

How much higher are we talking?

If we again refer to famous Trinity Study, it was shown that when the retiree makes absolutely no inflation adjustments at all, they could actually start off their retirement withdrawing as much as 7 percent! Now while that may not be practical (and I certainly wouldn’t recommend it), the idea does give you some indication of how this strategy could work to your benefit. Adjustments to your inflation rate could alter your withdrawal rate somewhere between 4 and 7 percent.

To more accurately quantify the situation, I did my own analysis and was able to demonstrate how something as simple as reducing your inflation rate by 1.5% per year would allow you to start your retirement with a safe withdrawal rate that is 0.5% higher than what you would have normally started with.

Lots of Us Already Don’t Adjust for Inflation

While you will certainly have to make some adjustments to your income over time to account for inflation, this may not necessarily have to happen every year or to the same degree as most financial planners would recommend. Think about how many times you or people you know may not get a raise this year (or several years in a row). But we don’t go bankrupt. We find ways to adjust and make due.

Assuming this strategy allows us to yield yet another 0.5% on top of our previous example, then this will yield another $2,500 of additional income per year.

This brings our annual total income up to $43,592, or $3,633 per month.

Bonus: Alternative Strategy – Dividend Income

If our suggestion in Tips 4 and 5 of playing the odds with different withdrawal rates seems too risky, or if you’d like to seek a potentially higher rate of return, then I will introduce you to an alternative strategy: Generating income using dividend paying stocks.

Dividends are the payments you receive as the owner of stocks from certain companies; usually from their profits. Thousands of companies offer them. Generally, as a shareholder, you will be paid on a quarterly basis. These payments can be any domination and are always subject to change.

One very popular retirement income strategy is to build up an entire portfolio of dividend paying stocks and then live off of the payments they generate. You literally don’t have to do anything except be a shareholder of the stocks.

Where to Look

Even though the stock market as a whole tends to pay an average of around 2 percent, it is possible to build a portfolio that pays around 4 percent per year. Two places you could start looking would be The Dogs of the Dow and The Dividend Aristocrats.

Often times too you’ll see magazine articles or blog posts claiming to teach you how to pick dividend paying stocks that pay an average of 5 percent or more. However, be careful! The higher the dividends you’re after, the more complicated it will be to deliver consistent results. If you’ve never purchased or traded individual stocks in the past, you might want to consult a professional first.

Pros & Cons

As with any strategy, there will be pros and cons to it.

One of the best parts about it is that you never have to touch the principal investment (in theory). You will only live off of the dividends. So no matter what happens to the stock market or what price they fluctuate to, it will not matter as long as the dividend payments continue to roll in.

However, in practicality, you won’t necessarily want to cut yourself off from the principal completely. If an emergency were to occur (… and one always does …) and you needed to sell your stocks, the last place you’d want them to be is down in price.

Furthermore, it is never recommended that a retiree holds their entire nest egg in 100% equities. The fluctuations you might experience in portfolio value might be way outside your personal tolerance for risk.

For the dividends themselves, there is also no guarantee that the stock will continue to pay at the same level or higher for forever. Though some companies have a much better track record than others, this is still no promise.

Also, beware of chasing after dividend yields that seem too good to be true. For example, there are stocks out there that pay 10% dividend yields. But that doesn’t mean the stock is necessarily any good or that they company will continue to pay at this level forever. Make sure that you only invest in strong, reputable companies that will continue to produce results.

6- Leverage Part-Time Income

Retirement doesn’t necessarily have to mean “no work at all”. There are lots of retirees who gladly welcome the opportunity to work 1 or 2 days per week earning a little part-time income.

For example, if you have any talent at writing, you could easily earn $1,000 per month by picking up a few assignments at $50 to $100 each from any number of online job boards. The great thing about this particular example would be the flexibility that it would provide. You could choose when and where to work, and complete them at your leisure.

Of course there are hundreds of examples we could through: Consulting, sales, teaching, coaching, photography, graphic arts, crafting, … and many, many more.

A Little Work Might Be Good For You

Though the idea of going back to work, even for just a little bit, might not sound appealing, there is a psychological factor that you may be underestimating. One of the biggest complaints retirees have is that quite frankly: They get bored.

They suddenly have all of this new found time on their hands and they have no idea how to fill it. In attempt to find some semblance of purpose or even just to be social, they gladly welcome the opportunity to take on a new part-time job – perhaps doing something that they’ve always had as an interest or hobby.

Suppose we assume you are able to find a part-time gig generating an extra $1,000 per month. This brings our example up to $55,592 per year or $4,633 per month.

7- Tapping Your Home Equity

Last but not least, if you own a house, then you might be able to tap into its equity using one of two ways to provide an additional source of income.

Downsize / Relocate

The first would be sell your house out-right. By selling your house and moving to a smaller one and/or relocating to a lower cost of living area, you could unlock your home’s value and add it to your nest egg.

The good news too is that for many middle class Americans the profit from the sale of a home (up to $500,000 for married couples) is tax-free.

This has been a strategy used by many retirees, including one of my favorite early retirement success stories, “The Charltons”. In their awesome ebook “How to Retire Early”, they talk about how they were able to generate $300,000 in equity from the sale of the home which in turn helped them to retire in their 40’s.

Reverse Mortgages

If you like your home but would rather not move, another option on the table would be to use a reverse mortgage.

Okay … so I know reverse mortgages often get a bad rap. But to be fair: Just like any financial product out there, I’m sure there are lots of legitimate options available.

The way a reverse mortgage works is that the lender gives the home-owner a pre-determined amount of money (usually some percentage of the value of the home). When the owner moves, dies, or the lending term ends, the owner then has to pay the lender back.

According to a very detailed calculator provided by retirement researcher Wade Pfau, a $200,000 house may be able to yield as much as $776 per month ($9,312 per year) in extra revenue.

This brings our cumulative example up to $64,904 per year or $5,409 per month.

Keep in mind that if you are considering this option, you must first be 62 years or older to apply. Also your home should be paid off or nearly paid off.

Conclusions

Though a retirement based on $500K may not be very luxurious, given the current state of retirement savings in the U.S., it may become a forced reality for those who have little options. Therefore, we need to have strategies for stretching our dollars as far and safely as possible. By exercising lifestyle moderation, sticking to a budget, and staying within the confines of the tips we’ve explored here, then you’ll be putting yourself in the best possible position for success.

If you’re still a little ways away from retirement and have more time to save, then I encourage you to check out my ebook “Save Better!“. In this book, I’ll teach you exactly what tools to use to make the most of your savings, avoid taxes, and maximize your returns.

Readers – What do you think? For those people in their 50’s and 60’s who may be forced into retirement, what advice can we offer them? How can someone retire on $500K while striking a balance between safety and comfort?

Images courtesy of Pexels, Pixabay, Flickr, and FreeDigitalPhotos.net.

A lot of great ideas thrown in there, especially the idea of part time income. As for reverse mortgages, they have their place, I’m sure, but from what I’ve heard, I’m a bit leery of them. An accountant I know told me of horror stories of people whose kids thought they were getting the house but now they weren’t and all these legal issues that came about.

I’m glad you didn’t mention a HELOC when you got to the “Tap into your home equity” section. It’s great to have for emergencies, but not something that a retiree should use to “enhance” their lifestyle. Debt is the last thing you wanna deal with in retirement.

Not that a retiree SHPULDN’T have a HELOC. They should, just not for this purpose. Extreme emergencies only.

Sincerely,

ARB–Angry Retail Banker

Thanks! A lot of people really under-estimate the power of part-time income. I get it … you’re not technically “retired” if you’re working. But what a difference it makes to your nest egg needs if you’ve got $1,000 or $2,000 coming in each month. If you’re struggling to save up to the conventional recommendation of $1 million and really falling short, then part-time income could be your ticket to making retirement happen. And lets not forget – Unlike whatever it is you’re trying to retire from, this part-time job can be doing something you actually LIKE doing like coaching, teaching, building, photography, etc.

I get what you’re saying about the reverse mortgage tip and honestly debated whether I should include them or not. Again: Put yourself in the shoes of someone who is late to the saving game. On paper a reverse mortgage could make retirement come true. But just like all other financial products, you have to be careful of who you go with. I think of it like annuities. Annuities get a really bad rap. But not all of them are bad. I’m sure the same is true of reverse mortgages. Compared to a HELOC as a way of creating an income stream in my elderly years, I’d look into the reverse mortgage first.

I am new to thinking about early retirement.

No one talks about the cost of health insurance or being able to afford it!

Any advise would be appreciated!

Thank you!

Good for you for beginning to think about early retirement. Health insurance is a tricky subject. And it certainly doesn’t help that its a topic that always seems to be on the rocks as far as upcoming changes, etc.

Perhaps a good place to start might be here:

https://www.caniretireyet.com/retirement-health-care-options/

We have done it on a lot less. I did sell our house, and bought a motorhome and we travel the USA. So manybpeople say you need a million or a million and a half. Not true! You can do it on a lot less but your lifestyle might need to change a bit. But you’ll love it…

if you have 500k in retirement $$ and about 140k in regular savings with SS incomes for both together of approx. $5k per month, does this change the idea of retiring poorly with only 500k in retirement $$? also if both into their mid 60’s ?

Enjoyed the article. I’m not certain where the $1 million figure came from but it seems that what a person needs for retirement is a function of lifestyle choices and other income (e.g. social security) that supplements retirement savings. And I’m not sure that the 77 year old retiree will be spending the same way as the 65 year old retiree might.

I’ll find out soon enough but I don’t think most folks need nearly the amount that the experts say they need to have a comfortable retirement.

A good article, and I’d like to add a couple of things to consider.

1. If you have a spouse, you get two Social Security checks per month — yay! — until one of you dies. Then it’s just one check a month. Many people will qualify to get the larger of the two checks, so there is that.

2. Health insurance is a huge issue for which there are few good options. Much depends on where you live, and whether your employer offers anything to retirees. I’m planning to work until 62, when my employer will let me retire and stay on their health plan by paying the full amount — still far less than going on the private market.

3. My retirement planning revolves around two questions: what will our monthly income be when we’re too old to work part time, and what will it be for the surviving spouse. Adding part time income is easy at age 65, not so much at 85, at least for most people. (Of course, the other big part is “what will our expenses be at those times” but that’s harder to figure out from this end, especially with health care.)

Great insights. Thanks.

It’s extremely disparaging to find that $500000 is not enough to retire on, and a great majority of people are in that situation… perhaps our government can come up with housing quarters for seniors who missed the mark! Or should seniors just hope they die before they’re broke? Americans come to the side of every country globally…….. perhaps they can address America’s broke seniors and implimant a solution?

Great post and a lot of good info for anyone considering early retirement before Social Security age with less than $1mm in the bank. I retired almost 10 years ago at age 51. Used IRS rule SEPP 72t for penalty free access to my retirement accounts before age 59 1/2 and all with much less than $1mm. I also took advantage of opportunities of interest and passion both full-time and part-time which is rewarding in many ways. It is amazing how different and enjoyable work can be when you do it because you want to, not need to. And yes, I do include Social Security in my long-term retirement planning. Happy to see you include that in your post as many don’t.

Haven’t the laws changed such that withdrawing 401K after 55 is very easy.

You either get laid off or retire and it is yours without penalty.