Have you ever wondered what sets you apart from people who retire young?

All over the Internet, you can find incredible success stories of regular folks who were able to pull off the impossible.

But what is their secret? How do you retire young in today’s world when so many of the odds seem stacked against you.

It’s one of my personal hobbies to read these stories and look through the details to see what makes them different. And you want to know what I’ve noticed?

It’s not that they won the lottery or received a huge inheritance. It’s also not that they were necessarily big-time executives earning way more money than you and I.

No, the answer is actually much simpler than you might think. Most of the early retirement success stories I’ve read have one theme in common: They all involved extremely high savings rates.

It’s true. You can find this in nearly every case. But just exactly how high of a savings rate are we talking about? Let’s consult those who have actually retired young to find out.

Disclaimer: Some of the links in this post to useful tools we recommend are affiliate partners. This is at no additional cost or risk to you. To learn more, check out our Privacy Policy.

How Much Money Do You Need to Save to Retire Early?

So what is the right proportion of your savings to stash away if you want to kiss the cubicle goodbye?

Probably one of the oldest cited blog posts come from Jacob at Early Retirement Extreme. In this article, he lays out a chart describing how many years each level of savings frees you:

- If you save 5% if your income, you can take 1 year off every time you work 19 years.

- If you save 50% of your income, you can take 1 year off every time you work 1 year.

- If you save 90% of your income, you can take 9 years off every time you work 1 year.

Is this actually true? Check out these choice selections from some of the more popular early retirement blogs and see for yourself.

- Mr Money Mustache calculates it would take 10.9 years to retire if you saved 64% of your income.

- Mr and Mrs 1500 from the blog 1500 Days: “Right now, I think in our most efficient life, now that we’re not doing that, we save at least 75%. And our life isn’t compromised. We’re very happy. (From an interview on the Mad Fientist podcast).

- Jeremy from the blog Go Curry Cracker: Our overall savings rate started relatively low (albeit high by average American standards), but as income rose and we learned how to be more efficient with our spending, our savings rate passed 70%.

- Brandon from the Mad Fientist: My savings rate in 2014 averaged over 73% but I expect that number to be higher this year because my expenses have dropped dramatically.

- Frugalwoods from their blog Frugalwoods: Mr. Frugalwoods and I finally did the arithmetic on our 2014 savings and expenditures (as I’m sure you’re all relieved to know). While in any given month of 2014 we vacillated between saving 65%-82%, our average savings rate for all of 2014 is 71.4%. Woot!

Noticing the same trend as I am?

Yes! If you want to do something as extraordinary as retire early at a young age (like in your 30’s or 40’s), then you have to do something as extraordinary as reach a remarkably high savings rate!

But why is this the key?

How Does a High Savings Rate Help You to Retire Young?

One of the most interesting and often under-appreciated facts about achieving a high savings rate is the way in which it positively affects your whole financial freedom plan.

What do I mean by this?

To put it simply: When you’re putting more money away in your nest egg for retirement, you’re not just simply saving money. You’re also training yourself in the present to live / need less income. Therefore, your target nest egg amount in the future should decrease.

And guess what?

A higher savings rate + lower nest egg target = you reaching financial freedom that much quicker!

Just look at how the math plays out with these simple examples:

Scenario 1 – 10% savings rate

- You earn $50,000 per year and save 10% or $5,000 per year.

- This means you’ll need roughly $45,000 of retirement income per year, and should therefore save up a nest egg of $1,125,000.

- At this rate, it will take you approximately 42 years to reach this goal! Ouch!

Scenario 2 – 25% savings rate

- You earn $50,000 per year and save 25% or $12,500 per year.

- This means you’ll need roughly $37,500 of retirement income per year, and should therefore save up a nest egg of $937,000.

- At this rate, it will take you approximately 27 years to reach this goal. Getting better!

Scenario 3 – 50% savings rate

- You earn $50,000 per year and save 50% or $25,000 per year.

- This means you’ll need roughly $25,000 of retirement income per year, and should therefore save up a nest egg of $625,000.

- At this rate, it will take you approximately 15 years to reach this goal.

Starting to notice something?

As we move from Scenario 1 to 3, not only are you saving more money each year, you’re also reducing your ultimate savings goal. Together, these two aspects are accelerating you closer and closer to your goal of achieving financial freedom.

You might even think of this as the double-ended approach to early retirement. You save now in the beginning, and it results in needing less in the end. Double-impact for your efforts!

By the way – Want to know how we did those retirement calculations just now? It’s a lot easier than you think. Read our article How Much Do I Need to Save for Retirement? The Incredibly Simple Answer.

Why Can’t I Just Invest for Better Returns?

You might have looked at the previous example and said to yourself: Hey, I’m pretty smart! Why can’t I just pick a few winning stocks, double my money a few times, and then retire early?

The problem: Nearly NO ONE is ever successful at picking high yield returns – even stock brokers and hedge fund managers!

Yes, everyone at one time has heard a story from a friend or relative where they picked a “hot” stock and made a ton of cash. But what they usually leave out of the big picture is that this was probably a one-time event. Or, worse, that they lost money on ten other stock picks before finally picking a winner! Over time, it’s simply a losing strategy.

Mutual fund legend Jack Bogle, founder of the incredibly popular investment firm Vanguard, is famous for publicly declaring that “85 to 90 percent of fund managers fail to match their own benchmarks”. Instead, he advocates that the common investor would be better off purchasing shares of a simple index fund that merely tracks the overall market performance. (This idea has become so popular that it has a financial cult following of people called “Bogle-heads”.)

The take-away: You CAN’T control the market. You CAN’T beat the market. The best you can ever do with your investments is to simply match market returns.

Therefore, the only place YOU really have any control is the volume of money you invest; your savings rate.

How Can You Increase Your Savings Rate and Retire Early Too?

I think the message is pretty clear: If you want to be like these early retirement success stories and reach financial freedom as quickly as possible, then you need to boost your savings rate as much as possible.

Sounds simple enough …

But the hard question is “how do you do that exactly”?

Start With Creating an Early Retirement Plan

No one ever gets in their car or boards a plane to go on vacation with no destination in mind. Financial freedom at any age is no different!

If you want to retire early, then you’re going to need a plan. And if you want to retire at lot earlier than everyone else, than you’re really going to need a good plan!

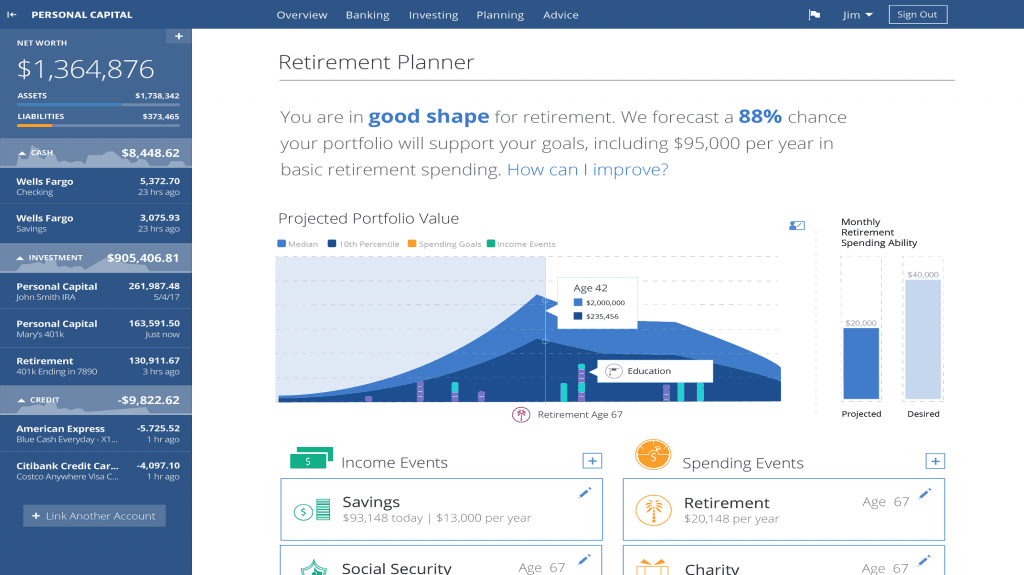

The best place to start is with a free retirement planning tool like this one from Personal Capital.

The way it works is simple. After creating your profile and linking your outside retirement funds, it then takes your nest egg and estimates how long your money will last (best and worst case market returns). From there, you can tweak the variables to make improvements, increase security, and run different scenarios.

Bump Up That Savings Rate!

Once you’ve got a plan together, from here on out it’s game-on to optimize your savings rate!

Where should you start?

The biggest hitters will be to begin with the following places:

- Budget your money! These practical tips will be helpful.

- Get a better job.

- Fight off lifestyle inflation.

- Take advantage of tax-advantaged retirement savings like 401(k)’s and IRA’s.

- Also take advantage of other tax-advantaged savings tools like FSA’s, HSA’s, and 529 college savings.

- Saving thousands of dollars on travel.

- Refinancing your mortgage.

- Paying less for your vehicle.

- Getting a better insurance rate.

- And so many more …

Little by little, the more you work on each of these points, the more money you’ll have to stash away. And that will get you closer and closer to your goal of becoming financially independent.

Who knows. Maybe it will be your early retirement success story I read next!

Readers – What do you think is the best way to retire young? How important do you believe the role of savings rate plays? Are there other strategies that can be useful too?

Photo(s): Unsplash

Saving early can do wonders for you later on that your future self will be thankful of. Here’s one of the retirement advice that made a mark on my mind: Don’t Wait. Start saving with your very first paycheck, and let compounding work for you.” And it did! Hopefully, young people will take advantage of the time that they still have and start saving soon.

Breaking it down into savings percentages like 5%, 50% and how much time you can have off from those savings is excellent. People value freedom and how that can be achieved.