Passive income is just that – money you make passively!

More specifically, it’s money that you earn by doing by doing as minimal or little work as possible.

Unlike your job where you have to work in order to earn an income, passive income comes from assets you own that generate earnings by themselves.

You might be tempted to call “B.S.” on passive income, but you’d be dead wrong if you do. Nearly everyone who is retired is a living example of passive income at work.

How is that?

The savings that they’ve built-up and invested over their lifetimes has now grown to a size where the earnings it generates is enough to live off of.

Consider a person who has saved $1,000,000. If those investments paid them just 4% per year, then they could live off of that $40,000 for pretty much the rest of their lives!

Retirement savings aren’t the only example of passive income that people use regularly. Any income generating asset could do this:

- Monthly dividend payments from stocks that you own. Jim Wang from Wallet Hacks mentioned that he earned $55,153 in 2015 from his dividend investments.

- A rental property where the tenants pay you rental income each month. Paula Pant from Afford Anything reported earning $11,521 from her collection of rental properties in June of 2016.

- Royalties from an eBook that you sell online. At last check in in 2015, ebook guru Steve Scott said he made $26,457.51 from his books for the month.

- Affiliate income from blogging. One of my favorite success stories is Michelle from Making Sense of Cents. As of the end of 2016, she made $979,321 for the year! How incredible!

Go back to the traditional setup of having a job and notice the difference. If you suddenly stopped going to work, then you’d be fired and your income would cease. You “have to go” to your job.

But the concept of passive income is different. You’re not “going” to anything. Instead, you’re planting seeds … financial seeds that will flourish and grow over time.

- The dividend checks appear as long as the company has earnings and pays dividends.

- The rental check shows up as long as the tenant pays their rent.

- The profits from the eBook roll in as long as people are interested in your product.

- Visitors will click on your affiliate links for days or years after your blog goes live.

In each of these situations, money is made regardless of whether or not you go to your job.

Although this may sound like a buzz-word or trend, it is actually so significant that it is recognized by the US Internal Revenue Service (IRS). Because of the nature of the income, it has its own set of taxation rules and in some instances may be an advantage over your traditional job earnings.

Passive Income Still Takes Some Work

One of my favorite things to read online is when some smart-aleck claims “there’s no such thing as passive income“.

As I’ve just shown you, of course there is!

But to their point, what these people are trying to argue is that no income is free. Getting or creating that asset requires at least some kind of “work”; especially in the beginning.

Taking our examples from above:

- You’d need to research which stocks are most stable and pay the best dividends before you invest.

- You’d have to purchase the home, possibly renovate it, and then find tenants; not to mention any upkeep or maintenance.

- You’d have to actually write the eBook, publish it, create a website to sell it, and then promote it.

- You’d need to create, write, and promote a blog.

Of course you would! I couldn’t agree more.

But the beauty of passive income is that after the initial “work” is done, the asset can more or less go into autopilot mode and continue to make money. All you need to do is minimal maintenance to keep it running. In other words, you’re creating more value with less effort.

Believe me! I’ve done this for years with my investments and blogging. Even though it took a while to build both up, nowadays it’s pretty great to see them generating money without me having to do a lot to keep it going.

Again: That’s much different than going to a job everyday in order to make an earning. You could go to your job every day for 30 years and then suddenly stop. You’d likely be disciplined or, worse, fired. And then the income would stop.

But that’s not true with passive income strategies. In each of our examples above, the earnings could be amplified to no limit. Earnings could be made while you are at your normal job, relaxing, or even sleeping.

So in summary, let’s just agree: Passive income is about increasing your value-to-effort ratio. The more money you earn with less effort, the higher your gain!

How Passive Income Works

To really understand this value-to-effort ratio connection to passive income, it will help to look at a practical example.

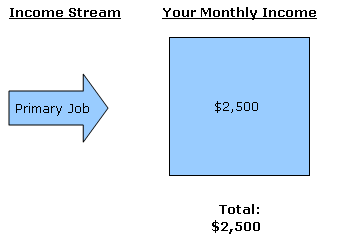

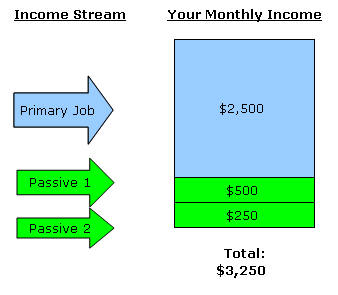

With your regular job, you make a certain amount of money based on the number of hours you work or based upon your contractual salary.

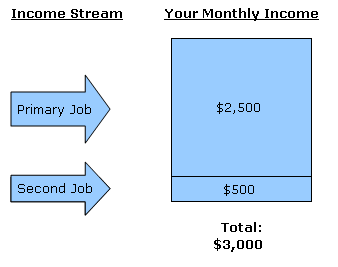

Let’s look at the constraints of this setup. Suppose you wanted more money (who doesn’t?). It is highly unlikely that you can simply increase the amount of money you make. Until you get a raise or new job, this number is basically fixed. So logically your next best option would be to simply get a second job to try to increase how much money you make each month.

Although this may work, it will require you to give up a significant number of additional hours to devote to this other job. The problem then becomes that you unfortunately will soon have to deal with a physical constraint of there only being a maximum of 168 hours each week. Therefore:

• You will eventually max out how much money you can make due to the constraints of how much money you make and how many hours you have to work with.

Even if you somehow never slept or ate, you would still only be limited to 168 hours each week. And really, who wants to work EVERY HOUR OF THE DAY?

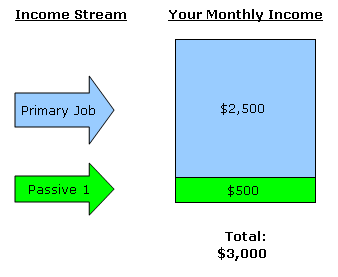

Let’s say you don’t get a second job but decide to start a passive income revenue stream using one of our examples above.

The great thing about passive revenue streams is that you can have as many as you can handle. Suppose now you get two of our examples from above going.

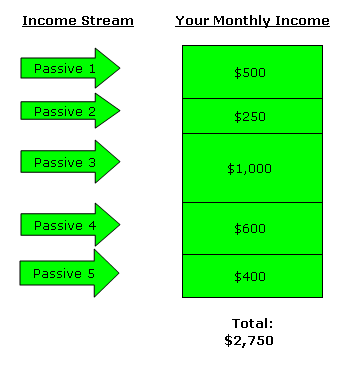

Ultimately, there is nothing stopping you from getting as many streams going as possible – so many in fact that passive income now replaces your job income entirely. This is often the goal for many people who seek passive income because it gives them the freedom to become their own boss and set their own schedule.

… and why stop there?

I can think of dozens of examples of bloggers and other Internet entrepreneurs who are earning five to six figures per month! When it comes to passive income streams, the sky is the limit!

What Are Some Good Passive Income Ideas?

I’m glad you asked!

We’ve got a whole list of them on our passive income ideas page for you to read and learn more about. Some of these are things I’ve tried myself while others are things that I’ve read other people having success with. Find a few that sound interesting to you, and give them a try for yourself!

Featured image courtesy of FreeDigitalPhotos.net. Skeptical Cat from Flickr.