If you’re wondering “Can I contribute to an IRA and a 401(k) this year?”, then you’ll be delighted to know that the answer is most likely: Yes.

For most middle income families, the good news is that both spouses can usually contribute to both types of retirement plans.

With a 401(k), eligibility is pretty straight-forward. Your employer will either offer one or they won’t. The employee generally just has to meet the employer’s requirements which might be being 21 years of age (or older) and having worked with the company for a minimum amount of time (such as one year).

IRAs, on the other hand, are accounts that you set up yourself. If you want to start one, you simply pick a reputable financial institution and apply. Its really no more difficult than opening a checking account.

The real question, however, is which type of IRA you will be eligible to open and whether or not it will benefit your tax situation in any way.

The IRS has several requirements about the contributions you can make which are mainly affected by your income level and tax filing status.

Despite the stipulations, having the ability to save your money in both an IRA and a 401(k) is an incredible way to build your nest egg. Every contribution you make is an opportunity to avoid paying taxes one way or another. Therefore, I encourage you to consider your options and take advantage of the one that best works for you.

In this post, we’ll take a look at the different types of IRAs and see what the rules are for being able to contribute to each one.

Three Types of IRA Contributions

Generally speaking, there are two main types of IRAs:

- Traditional – Taxes are deferred until you retire

- Roth – Taxes are paid up-front

You can learn a ton more about the differences between traditional and Roth IRAs in this post I wrote here.

Now, here’s where it can get a little confusing. For these two types of IRAs, there are actually three types of contributions you can make:

- Deductible traditional

- Non-deductible traditional

- Roth

Here’s how each one is different.

Deductible Traditional IRA Contributions

A deductible contribution to a traditional IRA is what most people think of when they think about contributing to a traditional IRA.

Every time you make a contribution, it can be deducted from your taxable income for the year. That means you don’t pay any taxes on this savings up-front. Any tax payments on your contributions and the earnings you accumulate are delayed into the far-off future when you retire someday.

This is a great arrangement for anyone who thinks they will be in a lower tax bracket when they retire in the future.

Qualifications

For your contribution to qualify as tax-deductible, you need to meet 3 different criteria:

- Tax filing status (single, married filing jointly / separately, etc.)

- Your MAGI (stands for “modified adjusted gross income” and is generally calculated when you file your taxes)

- If you or your spouse are covered by another retirement plan at work.

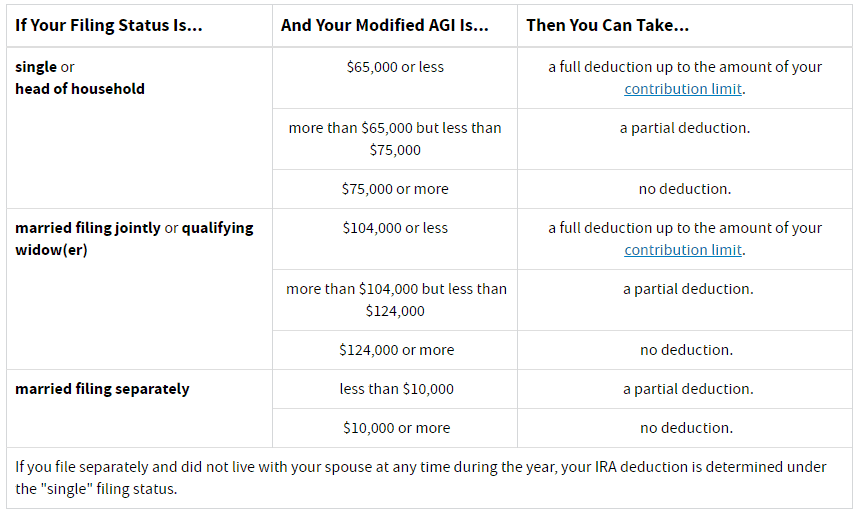

The full requirements for 2020 from the IRS website can be divided between whether or not you are covered by a retirement plan at work.

If you are covered by a plan at work:

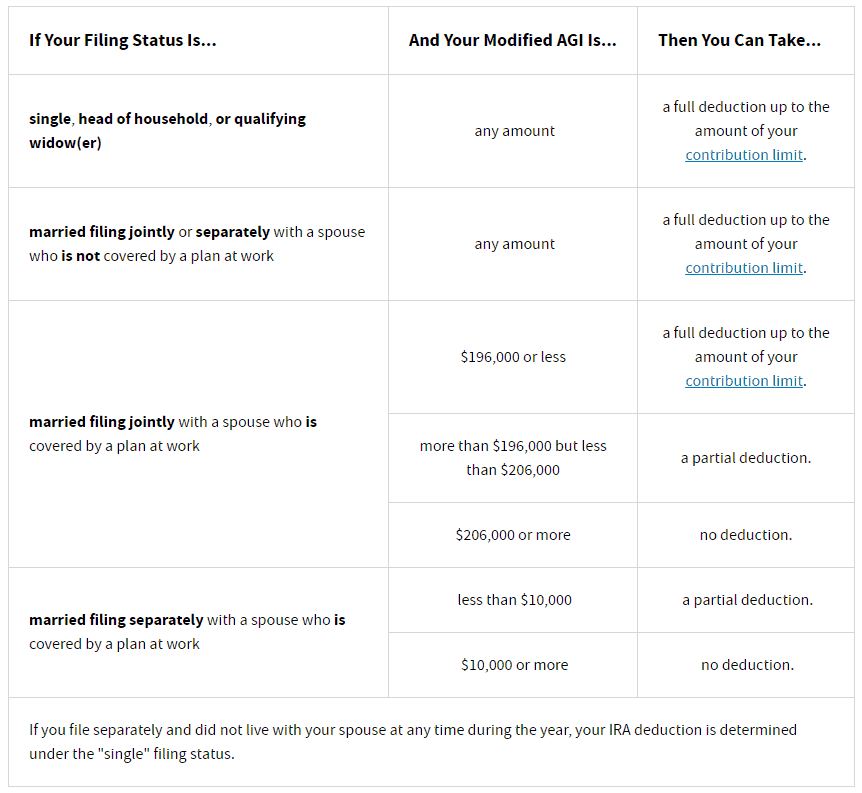

If you are not covered by a plan at work:

More on this below when we talk about non-deductible traditional IRA contributions.

Roth IRA Contributions

Contributions to a Roth IRA are a little less complex when compared to a traditional IRA.

By design, Roth IRA contributions are not tax-deductible at the time that you make them. You pay taxes on them up-front and receive no tax benefit when you file your income taxes.

However, these contributions plus any earnings you accumulate will grow tax-free. Even when you someday retire, both the contributions and earnings can be withdrawn without any tax payment due. (The opposite of a traditional IRA.)

This can be a great strategy for anyone who believes they will be in a higher tax bracket when they retire in the future.

Qualifications

In order to make a contribution to a Roth IRA, you only need to meet 2 criteria:

- Tax filing status

- Your MAGI

You don’t have to worry about if you or your spouse are covered by another retirement plan at work.

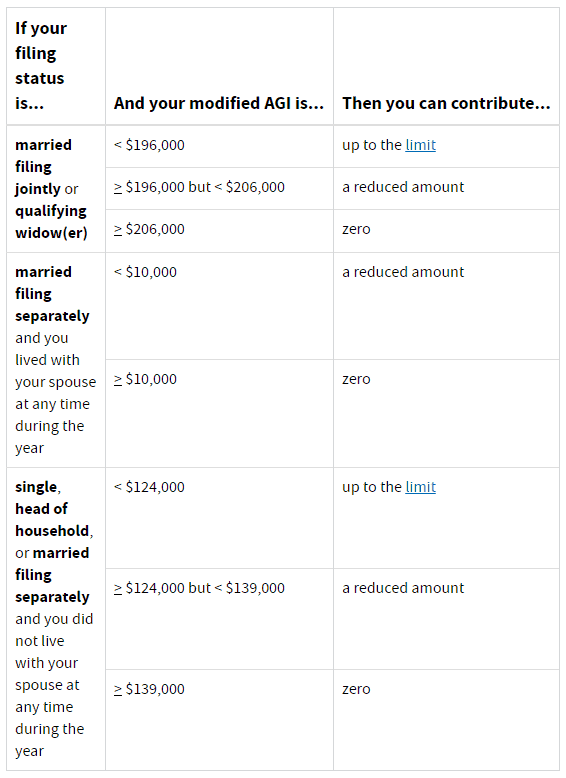

For your MAGI, note that as you earn more money, the IRS will begin to reduce how much you can contribute to a Roth IRA. You’ll be able to make what’s known as a partial contribution. As your income increases, your elidgibility may phase out altogether.

Here are the full requirements for 2020 from the IRS website:

Non-Deductible Traditional IRA Contribution

If it so happens that you earn too much money to be able to contribute to both a deductible traditional IRA and a Roth IRA, then there is still one more option for you to consider: A non-deductible traditional IRA.

Technically, you are always allowed to make a non-deductible contribution to a traditional IRA. There are no income restrictions.

However, with non-deductible contributions, you do NOT get to deduct the contribution from your taxable income for the year. That means you will pay taxes up-front on this savings, but not when you retire. (… Almost like a Roth IRA.)

Then, here’s where things get different. The earnings you make off these savings are tax-deferred and delayed into the far-off future when you retire someday. (… Not the same as a Roth IRA.)

Why make a non-deductible IRA contribution?

Even if you can’t benefit from deferring taxes on your contributions, its still an advantage to defer them on the earnings you will make.

Generally, if you were to take your after-tax money and invest it in some mutual funds, at the end of the year you’d owe taxes on any earnings you’ve accumulated due to capital gains, interest, dividends, etc.

But if you invest this money inside an IRA (even if non-deductible), then you get to defer these taxes. That means your earnings will effectively grow tax-free until you withdraw them someday for retirement.

Deductible vs Non-Deductible Traditional IRA Examples

Because the eligibility requirements for traditional IRAs can be a little confusing, it might be helpful to go through a few examples to illustrate when your contribution can be tax-deductible:

Example 1:

- If you are single and your MAGI was $50,000 AND:

- You are covered by a retirement plan at work = Full deduction of your contribution.

- You are NOT covered by a retirement plan at work = Full deduction of your contribution.

Example 2:

- If you are single and your MAGI was $100,000 AND:

- You are covered by a retirement plan at work = No deduction.

- You are NOT covered by a retirement plan at work = Full deduction of your contribution.

Example 3:

- If you are married filing jointly and your MAGI was $100,000 AND:

- You are covered by a retirement plan at work = Full deduction of your contribution.

- You are NOT covered by a retirement plan at work but your spouse IS = Partial deduction of your contribution.

- You and your spouse are NOT covered by a retirement plan at work = Full deduction of your contribution.

Example 4:

- If you are married filing jointly and your MAGI was $200,000 AND:

- You are covered by a retirement plan at work = No deduction.

- You are NOT covered by a retirement plan at work but your spouse IS = no deduction.

- You and your spouse are NOT covered by a retirement plan at work = full deduction of your contribution.

Roth IRAs and High-Income Earners

If you’re really stuck on the idea of contributing to a Roth IRA, BUT you earn too much money to be eligible, don’t worry. There’s still a way you can do this …

You’ll need to use a technique called a back-door Roth IRA conversion. In a nutshell, what you’ll do is:

- Make a non-deductible contribution to your traditional IRA.

- Contact your financial institution and ask them to convert the funds over to a Roth using IRS tax Form 8606.

Pretty simple! You can find out a lot more about Back-Door Roth IRA conversions at this article I wrote here.

Backdoor Roth IRA conversions can be pretty useful, especially if you’re someone who plans to retire early like me. By converting your savings from a traditional to a Roth style account, you’ll be able to access this money and use it without having to pay the penalty for withdrawals before age 59-1/2.

IRA Contributions Later in Life

If you happen to still be working in your 70’s and would like to keep making contributions to your IRA’s, then there are a few things you’ll need to know.

Unfortunately, you’ll no longer be able to make any contributions to a traditional IRA. This is because by the time you are age 72, the IRS will start to require you to start making something called RMD’s (required minimum distributions). Effectively, the IRS makes you start taking money out of your IRA, or you will face a staggering 50% penalty! As you might guess, its because the IRS has allowed you to defer taxes for long enough and wants to start collecting those taxes you owe on these savings!

Since there are no RMD’s on Roth IRA contributions, you are allowed to keep contributing to one if you wish.

Get Your Full 401(k) Employer Match

While it’s awesome that you want to contribute to both your 401(k) and your IRA, you may want to prioritize one over the other first in order to maximize your money.

Generally speaking, most people should contribute in the following order:

- Contribute as much as needed to your 401(k) to get your full employer match. This number will differ for each person.

- Contribute up to the maximum amount of your IRA.

- Go back to your 401(k) and contribute to it until you’ve reached the IRS max.

You can find out a lot more about these steps in detail at this article I wrote here.

What If I Have a Roth 401(k)?

If your employer offers a Roth 401(k) plan in addition to a traditional 401(k) plan, and you’ve decided to use it, then it changes nothing. All of the same rules we’ve gone through above will still apply.

Photo credits: Unsplash

Leave a Reply