When it comes to retirement accounts, there’s one debate that almost everyone must consider: A Roth IRA vs. Traditional IRA – Which one is better? What are the differences, and how do I know which one is the right one for me?

As someone who has both a Roth and a Traditional account, let me tell you: Each one has traits that can be very valuable to you in their own way!

In general, no matter which one you choose, you’re doing a great thing by taking advantage of a unique opportunity from the IRS to save and grow your money without having to pay taxes right away (or in some cases, never).

Over time, when compared to a “regular” savings or investment account, these tax-advantages will add up in an incredible way. For some people, this might mean an additional five, six, or seven figures of wealth in their nest eggs over time!

But just like many decisions in personal finance, the devil is always in the details. Choosing either a Roth or Traditional account will determine exactly how your savings gets taxed, how it grows, when you can withdraw it, and even what happens to it after you pass away.

With so many variables to consider, how will you know which one is really the better choice for your money?

Fortunately, our comprehensive guide below will tackle each one of the theses questions and break down everything important that you need to consider. More importantly, after understanding a few key concepts, you’ll gain confidence in your decision about going with one type of account over another.

So with that said, let’s start by learning about the differences between a Traditional IRA vs Roth IRA.

What is the Difference Between a Roth vs. Traditional IRA?

The decision as to which type of IRA to go with really boils down to one very important question:

Would you like to pay your taxes now or later?

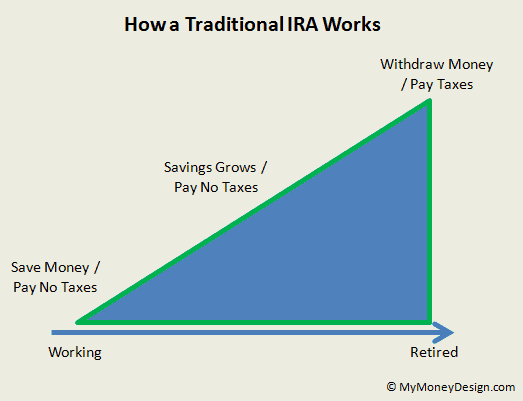

How a Traditional IRA Works:

With a traditional IRA, the process works as follows:

- You earn an income and decide that you’d like to save a portion of it into the traditional IRA.

- Whatever you save gets subtracted from your gross annual income at the end of the year when you file your tax return. In other words, you pay no taxes on this saved income for the year.

- Your contributions grow throughout the years as the investments you’ve selected fluctuate in value. During these years, you still do not pay any taxes on your contributions or the earnings they generate.

- Finally one day, you retire. When this happens, you dip into your traditional IRA and make a withdrawal. Now that the money (contributions and earnings) has finally been withdrawn, you will pay taxes on it.

This is why traditional IRA distributions are often referred to as “tax-deferred”. In exchange for saving for retirement, the IRS has allowed you to delay paying tax on this income and its earnings until you retire and finally use the money.

If you already have a traditional 401(k) plan through your employer, than you will notice that this process of deferring taxes on your savings is very similar.

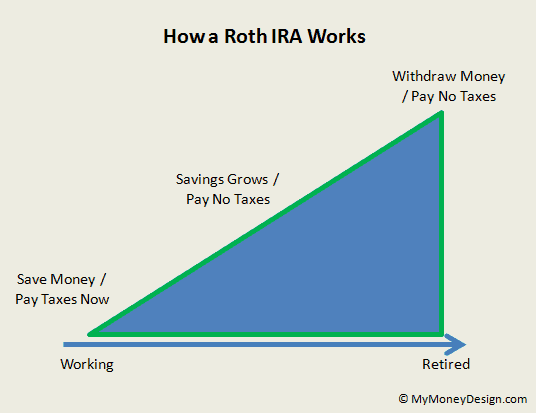

How a Roth IRA Works:

By contrast to a traditional IRA, with a Roth IRA, the rules for paying taxes are the reverse.

- You earn an income and decide that you’d like to save a portion of it into the Roth IRA.

- Whatever you save gets does not get subtracted from your gross annual income at the end of the year when you file your tax return. In other words, you still pay taxes on this income for the year just like all the other income you’ve earned.

- Your contributions grow throughout the years as the investments you’ve selected fluctuate throughout in value. During this time, you do not pay any taxes on your gains; nor will you ever.

- Finally one day, you retire. When this happens, you dip into your Roth IRA and make a withdrawal. Any money you withdraw from it, contributions or earnings, will be tax-free (since you’ve paid taxes on it once before).

This is why Roth IRA distributions are often referred to as “tax-free” income. In exchange for paying your taxes up-front and saving towards retirement, the IRS will allow you to make withdrawals tax-free when you are retired.

If you work somewhere that offers a Roth-style 401(k) plan, than you will again notice that this process of paying taxes up-front in exchange for tax-free distributions later is very similar.

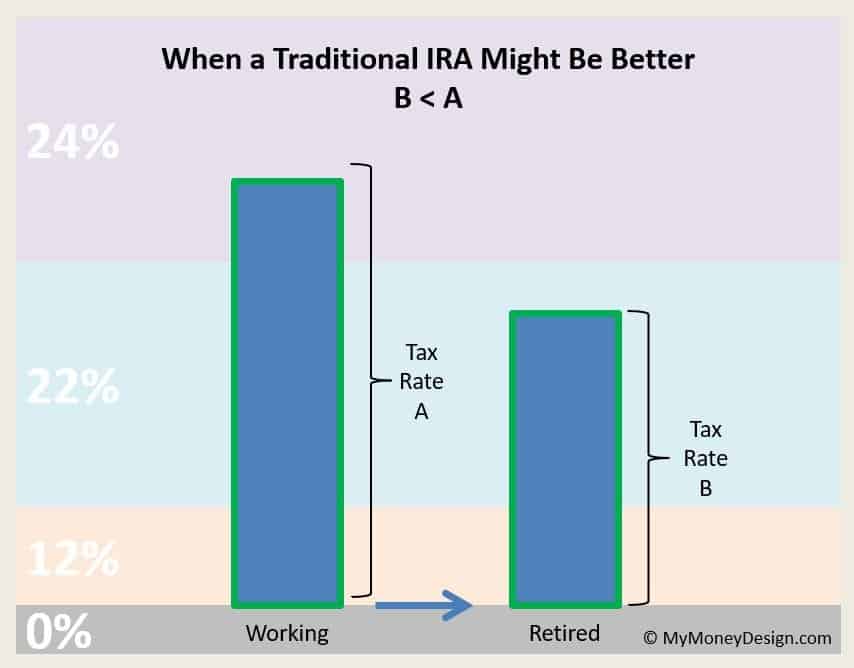

Which One is Better? – The Tax Implications

Are there times when a Roth IRA will be better than a traditional IRA, or vice versa?

Absolutely! However, to truly answer that question, you have to look at your personal financial situation and determine two very important things:

- Your tax rate now

- Your tax rate when you retire

Example Where a Traditional IRA is Better:

Let’s say that during your working years, your household income is $100,000 per year. You and your spouse decide to make a plan for retirement where you will only need $60,000 per year to cover your living expenses.

Let’s assume you file your taxes as “married filing jointly”. If you paid taxes now on your retirement savings while you’re working, you’d be in a higher tax bracket than when you retire.

Therefore, using the traditional IRA and waiting to pay your taxes would be the better option.

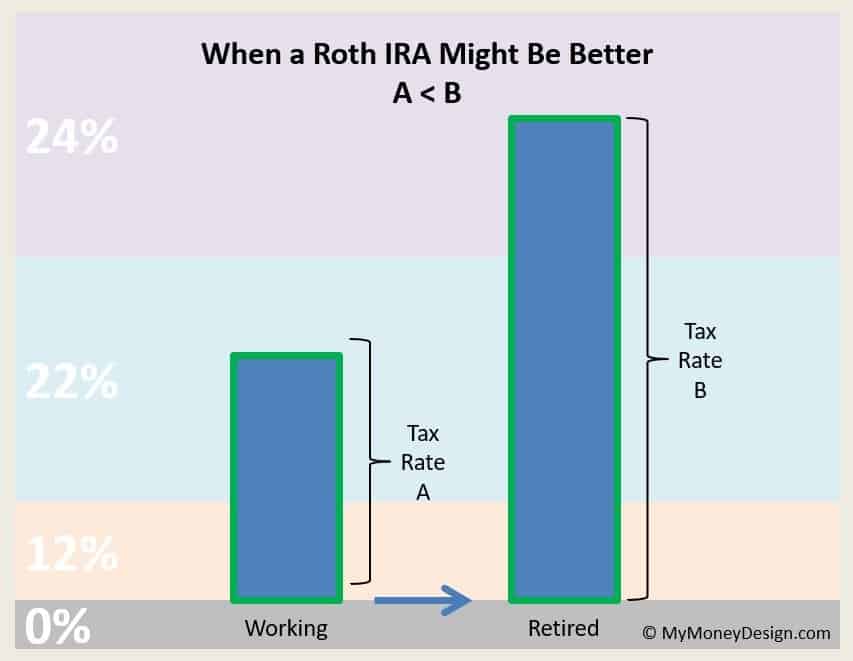

Example Where a Roth IRA is Better:

Now let’s take the same scenario, but only this time we’ll reverse everything.

This time, you’re earning $60,000 of household income per year. But when you retire, you’re on track to bring in $100,000 per year of retirement income. In this case, you’d be in a lower tax bracket now than when you retire.

Therefore, it would be better to go with the Roth now and pay taxes while your rate is lower.

A BIG “If”

This is all, of course, assuming nothing drastic changes between now and then with the tax code. It also assumes that the government doesn’t make any changes to the rules for Roth IRA’s. For example, what if they suddenly started adding some small, new redemption fee or tax at the time of retirement?

Let’s hope not ….

Is It Possible to Pay No Taxes At All?

Yes!

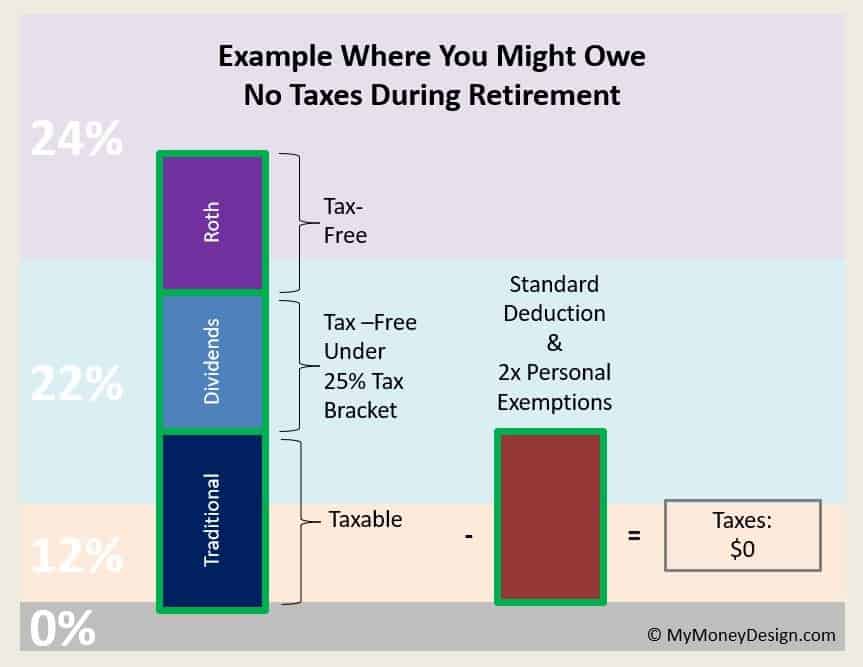

I want to emphasize that there are lots of ways to lower your tax bill. If you’re clever, you could structure your income so that you owe nothing at the end of the year.

Example: Let’s say you’ve been saving for years using a combination of traditional IRA, Roth IRA, and taxable investments (such as dividend paying stocks).

You plan to get retirement income from the following sources:

- $10,000 from your Roth IRA

- $20,000 from your traditional IRA

- $10,000 from your dividend stocks

Because of the way that taxes work, you would owe nothing on your Roth IRA distributions. You’d also owe nothing on your dividend stocks because you’re under the $75,900 threshold for dividend income (assuming married filing jointly).

So the only income we need to consider is that from the traditional IRA. But remember that you get to subtract your standard deduction and two personal exemptions ($12,700 + (2 x $4,050) = $20,800) . Because these subtractions are greater than the income from your traditional IRA, your taxable income drops to $0.

Yes! You’ve paid NO taxes when you first saved, NO taxes on the earnings, and NO taxes at retirement. Well done!

Which IRA Came First?

Here’s some fun trivia for you to impress your friends at parties …

Traditional IRA’s were established in 1974 after the Employee Retirement Income Security Act (ERISA), a plan that was enacted to protect the interests of employee benefit plan participants.

Roth IRA’s began in 1997 after the Taxpayer Relief Act was established. They are named after Senator William Roth, the chief legislative sponsor of the plan.

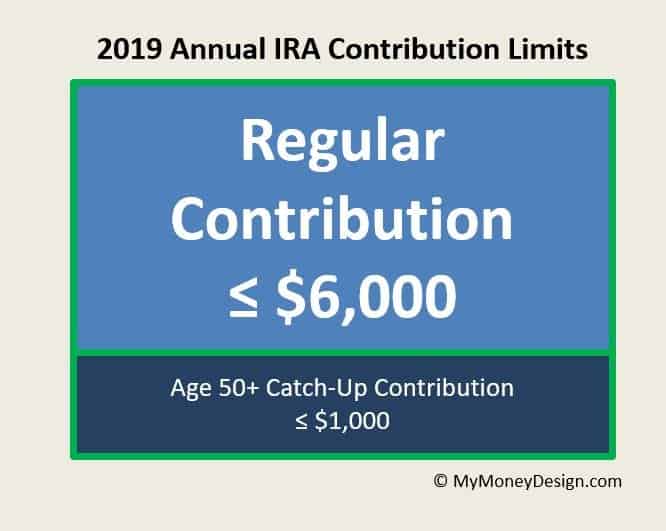

What are the IRA Maximum Contribution Limits?

As of 2019, the maximum contribution per year to an IRA is $6,000 per person.

In a house where both the spouses are eligible, both people can contribute separately to their own IRA’s for a total of $6,000 x 2 = $12,000 per household.

Your contribution can be to either to a traditional IRA or a Roth IRA, or any combination of the two.

For example: Assuming eligibility is met, you could put $4,000 towards your Roth IRA and $2,000 towards your traditional IRA for a total savings of $6,000.

However, you could NOT contribute $6,000 to your traditional IRA and $6,000 to your Roth IRA because your total contribution of $12,000 would exceed the $6,000 limit.

Catch-Up Contributions for Older Contributors:

If you are age 50 and older, you have the option to increase your maximum contribution by $1,000 to $7,000 total. You will often hear this referred to as the “catch-up” contribution. This gives older contributors the ability to save more since they are closer to retirement and may need the extra amount to help achieve their savings goals.

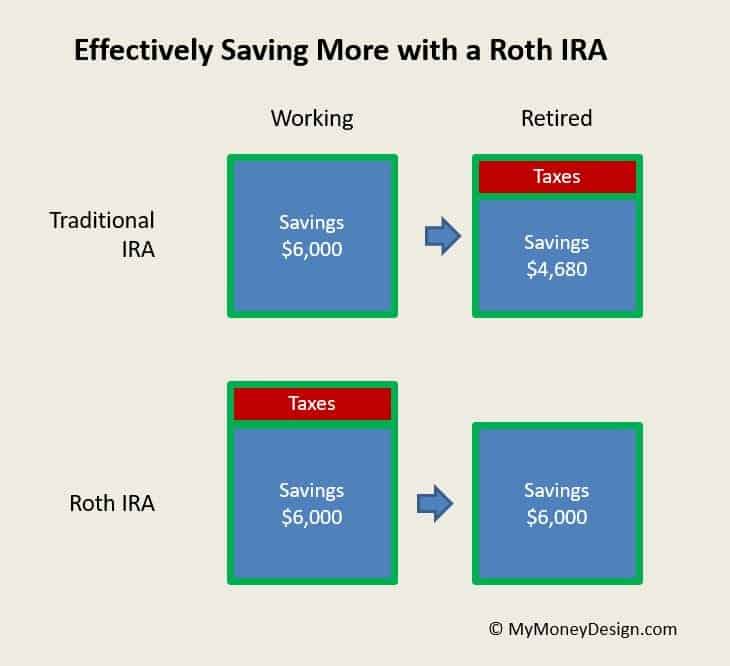

Effectively Saving More with the Roth IRA:

Because of the tax implications of “pay now” or “pay later”, many financial enthusiasts will argue that you effectively get to save MORE of your money with the Roth IRA.

Here’s the argument:

With a traditional IRA, you set aside $6,000 for the year and pay no taxes on this amount. Therefore, you’ve saved a net of $6,000. Of course at some later date when you are ready to retire, the assumption is that you will pay taxes on this amount. For example: If you’re in the 22% tax bracket, then $6,000 x .22 = $1,320 for a net of $4,680 available to spend.

With a Roth, the numbers work out differently. Even though you have the same restrictions to save $6,000 for the year, remember also that you have to pay taxes on this contribution. Putting the two elements together, that’s a net out-of-pocket withdraw of $6,000 into your Roth and $1,320 in taxes for an effective $7,320 applied towards retirement. When you finally get to the point of retirement, you pay no taxes on that $6,000 contribution. Therefore, the entire $6,000 is available for spending.

Contribution Deadlines for IRA’s

Your last opportunity to contribute to your IRA is always the tax-filing deadline of the following year. For 2018 contributions, the last day is 4/15/2019. In other words, as long as you invest before this date, you could put $6,000 in your IRA as your 2018 contribution and then add another $6,000 going forward for 2019.

Who Can Contribute to an IRA?

Generally speaking, any U.S. tax-payer can contribute to an IRA as long as they’ve earned a taxable income this year (i.e. they have a job). Non-working spouses who have a spouse that earns taxable income and files jointly are also allowed to contribute to an IRA.

If your taxable compensation was less than the maximum contribution limit for the year, then your taxable compensation becomes the new limit.

That last point is especially important for children who have a part-time job and their parents encourage them to stash their savings in an IRA. For example, if you earned $3,000 for the year, then the most you can contribute to your IRA is $3,000. However, keep in mind that the contribution doesn’t necessarily have to come from the child. If the parent wanted to reward the child for working the summer job, then they could make the $3,000 contribution on the child’s behalf, and this would be acceptable.

Traditional IRA Deductions:

Traditional IRA’s are an interesting thing. As we said, most anyone with a taxable income can contribute to one. But the question is whether or not you’ll get a tax deduction.

What’s a tax deduction?

Remember in the very beginning of this article how we said that if you save your money in a traditional IRA, you don’t have to pay taxes on it for the year? That’s called a tax deduction. That savings got “deducted” from your taxable income.

Well, as it turns out, the ability to take this deduction and delay paying taxes on your savings is only available to certain people.

How do you qualify?

Your ability to take an IRA deduction will depend on two important factors:

- Are you covered by a retirement plan at work?

- What your MAGI (modified adjusted gross income) is. (… That’s the amount of money you reported earning on your tax return.)

Here are the 2019 tax year limits if you covered by a plan at work:

Example: For a married couple filing jointly, your MAGI needs to be $103,000 or less to be able to deduct the full amount. Up to $123,000, you can take a partial deduction. At $123,000 or higher, there is no deduction.

Here are the 2019 tax year limits if you are not covered by a plan at work:

Example: For a married couple filing jointly, your MAGI needs to be $193,000 or less to be able to deduct the full amount. Up to $203,000, you can take a partial deduction. At $203,000 or higher, there is no deduction.

If there’s no deduction, would I still want to contribute?

Yes. Remember that once your money is inside the IRA, it will grow tax-deferred for years. Not having to pay taxes on the capital gains every year can add up significantly over time.

Roth IRA’s:

Roth IRA’s are slightly more straight-forward with their requirements.

With a Roth, you either “can” or “cannot” contribute to them. This will be based on your MAGI. Here are the IRS limits.

Example: For a married couple filing jointly, your MAGI needs to be $193,000 or less to be able to contribute the full amount. Up to $203,000, you can make a partial contribution. At $203,000 or higher, no contribution can be made.

Age 70-1/2:

After age 70-/12, you can no longer contribute to a traditional IRA. You can however keep on contributing to a Roth IRA if you wish.

Where and How Do I Start an IRA?

You can start an IRA with literally an financial institution or bank out there. There are thousands of options.

Personally, I like to use the company Vanguard. They are the largest mutual fund company in the world, and they have the lowest fees of any provider I know of.

Most places will request that you invest some nominal amount of money to start your IRA; usually $2,000 or more. I believe the Vanguard STAR fund has one of the lowest minimum investments at $1,000.

Once you’re invested, you can then make much smaller contributions (again, according to whatever rules the financial institution has in place.) For example, with the Vanguard STAR fund, additional contributions must be $1 or higher.

Generally, most people will invest in mutual funds when they open an IRA. Those mutual funds can then invest in any number of assets: Stocks, bonds, international, real estate, gold, etc.

You can also invest directly in those assets within your IRA. However, this should only be done after you’ve had some experience with investing.

What Are the Withdrawal Rules for Traditional and Roth IRA’s?

Though the intention with any tax-advantaged retirement account is not to touch your money until much later in the future, in short, there are ways to access your money if you truly want to.

Traditional IRA’s:

For traditional IRA’s, the rules are making withdrawals are very similar to a 401(k) plan. Any distributions prior to age 59-1/2 will be subject to a hefty 10% penalty and applicable taxes. There are a few exceptions to this rule such as a first-time home purchase, qualified education expenses, death, etc.

In extreme circumstances where you really need the money, the government will allow you to take an interest-free, short-term loan. However, you only have 60 days to pay the money back.

If early retirement is something you’re aspiring to achieve, not that you can also withdraw your money via the tax code section 72(t) by taking something called SEPP (Substantially Equal Periodic Payments). This is where you are allowed to withdraw a pre-calculated amount of your savings each year without penalty for at least 5 years or until you turn 59-1/2 (whichever is longer).

Note that after age 70-1/2, you enter into the reverse of this scenario: You have to start taking required minimum distributions from your IRA or face hefty 50% fee!

Roth IRA’s:

For Roth IRA’s, the process is not as straight-forward.

You have to think of your Roth IRA in terms of two parts: Your contributions and the gains that they have earned.

Your contributions are always penalty-free and available for withdraw because you’ve already paid taxes on this money. This again can be helpful for early retirement planners who are trying to find strategic ways to bridge the gap between whenever they retire and age 59-1/2.

However, your gains are not available for withdraw until age 59-1/2 unless you want to pay the 10% penalty fee. Afterwards, they are available for withdraw tax-free and penalty-free.

Also keep in mind that there is a little known rule that the first time you start a Roth IRA, you need to keep your contributions inside the Roth for at least 5 years in order for the gains to become tax-free. If you withdraw your contributions before this, then any gains they’ve accrued will not be tax-free, even after you reach age 59-1/2. Once you’ve reached this 5 year threshold, you don’t have to do the same with other contributions or even other Roth IRA’s. It’s just on the first one.

Unlike the traditional IRA, Roth IRA’s do not have required minimum distribution rules since you’ve already paid taxes on the contributions and the earnings are tax-free. Therefore, you could keep as much of your money in the Roth for as long as you wish. If you’ve got secondary motives for building your fortune such as leaving money to an heir, then this might be a useful strategy to explore.

What is a Rollover IRA?

Anytime you have an old 401(k) or other retirement fund that you’d like to move over to your preferred financial institution, you can do so by performing what’s called a “rollover” into a Rollover IRA. For all intents and purposes, think of a Rollover IRA the same as a traditional IRA.

When I left my old job, I simply rolled over my old 401(k) into a Rollover IRA with my other retirement accounts. Not only were the anticipated annual investment fees lower, but it also made life easier to have everything in one spot.

Be careful! You can elect to move a traditional 401(k) to a Roth Rollover IRA. But when you do, you’ll be on the hook for paying all the taxes that are due as part of that conversion! For example, if you have $500,000 that you intend to rollover, this $500,000 would get added on top of your taxable income and leave you on the hook to pay upwards of 40% taxes for the year!

The same would be true of you moved a Roth 401(k) into a regular traditional Rollover IRA.

To keep things safe, be sure to only do “traditional to traditional” and “Roth to Roth” rollovers.

Conversions

Traditional to Roth:

It is possible to convert portions of your traditional IRA to a Roth. When this happens, you owe taxes on whatever amount you wish to convert.

As simple as that may sound, this process is actually a very popular loop-hole known as the backdoor Roth conversion.

For people who earn too much to contribute to a Roth IRA, they can still do so by first making a non-deductible contribution to a traditional IRA. They can then convert any amount of this savings over to a Roth. By doing so, the potential earnings they will make move from being tax-deferred to tax-free.

This is also a useful technique for early retirement planners. Any money that gets converted becomes penalty-free after a five-year waiting period. Therefore, you could effectively create a “ladder” of penalty-free distributions year after year.

Roth to Traditional:

If for some reason you need to convert your Roth savings over to a traditional account, you can perform what’s called a “recharacterization”. This can be done simply by contacting your financial institution and filling out the appropriate paperwork.

IRA Beneficiaries

Traditional IRA’s:

If you leave your traditional IRA to your spouse, then they can treat it as if it was their own. However, if you leave it to someone other than your spouse (such as child or grandchild), then they will be required to pay taxes on it as well as take required minimum distributions.

Roth IRA’s:

Roth IRA’s can be left to anyone tax-free. However, they will still have to make required minimum distributions.

Conclusions: Which IRA Really Is Better?

Okay! So now we know everything there is to know about IRA’s. After all that, which one is really the best?

As you might guess, there’s just no simple answer. There are several factors that will play into your decision. And the amount of weight you decide to give to each of those priorities will ultimately determine how much better one type of IRA is over the other.

In closing, if we consider all things to be equal, then I would lead with the following decisions:

- See if you qualify for a deductible or non-deductible traditional IRA.

- If you qualify for a deductible traditional IRA and you believe your tax rate will be lower during retirement, then go for the traditional IRA.

- If you don’t qualify for a deductible traditional IRA but you believe your tax rate will be lower during retirement, then still go for the Roth IRA.

- If you believe your tax rate will be higher during retirement, then go for the Roth IRA.

Want to know more about IRA’s, 401(k)’s, and other interesting ways to save more for retirement? Please check my ebook “Save BETTER!” to learn about some strategies you can use to maximize your wealth building efforts.

Readers – What factors do you consider when choosing between a Roth IRA vs traditional IRA?

Images courtesy of Flickr and Pexels

Last year I was able to work tax free for half the year. You bet your butt I was saving everything into my Roth at work AND maxed my Roth IRA.

Nice work! That’s exactly the kind of angle we need to take when it comes to tax optimization.

Thank you for writing this. I actually didn’t know there were deduction limits when using a traditional. If you are over that limit it just makes it like a brokerage account. Why not just say you can’t contribute if you are over those limits? I guess the only reason to contribute if you couldn’t deduct would be if you were over the income limit on the Roth and wanted to do a backdoor Roth.

Thanks Grant! I’m glad you enjoyed it.

Yes, it can still make sense to contribute to a traditional IRA even if you can’t deduct them because 1) the earnings will still grow tax-deferred and 2) you can always convert them to a Roth. Of course, converting to a deductible traditional IRA or Roth IRA first would be better if you’ve got the opportunity.

This is a terrific write up of Roth IRAs and Traditional IRAs. I think I read the other day that people tend to save the same amount of money whether it’s in a traditional account or roth account. So the study was saying to use the Roth portion since you probably won’t save more than that. I thought that was a fun tidbit of info that I didn’t know.

Interesting … I have found this only to be (somewhat) true if you invest the max. If you invest below the max, your odds are likely better with the traditional, both during your savings year and beyond. Here is the post where I work out the calculations on a 401k plan (the same logic would also apply to an IRA).

There are no earning limits associated with Roth IRAs. Investors who make more than the IRS stated amount need only to open a traditional IRA, then immediately roll it over to a Roth IRA. There are no tax implications with this if the money is rolled over prior to any investment income is made. It’s called a Back Door Roth IRA Conversion. Totally legal and most brokers will do it for you.

Of course; great addition. A back door Roth IRA conversion can be used if you earn over the IRS income limits to contribute to a Roth. This is especially helpful too if you plan to retire early. But we should make it clear that this is a loophole. If the IRS ever decides to close it (and hopefully not anytime soon), then the normal income limits would apply and you would no longer be able to contribute if you exceed them. Perhaps I will write a post to clarify these points for the readers.

Great breakdown and I believe in the end they both sort of look the same numbers wise. Different tests have been done in the PF space to prove it.

Thanks! Depending on your spending / saving / taxes, it is possible that they could end up in very similar places. In more static situations, I’ve calculated that the Roth only is better when you contribute the max. If less, than the traditional ends up with more. (Example with a 401k plan)