If you’ve got questions about how 401(k) matching works, there’s only one phrase you need to remember: Don’t leave free money on the table!

401(k) employer matching contributions are one of the biggest reasons why American workers should utilize their 401(k) plans. Simply put, they are an opportunity to earn more money from your employer without any extra effort.

When some generous employers match their employees’ 401(k) plans dollar for dollar, this is effectively the same thing as getting a 100% return on your investment! When was the last time you found an investment opportunity like that? And what’s crazy is that all you have to do to take advantage o this opportunity is to merely participate in your company’s 401(k) plan.

Yet millions of working Americans are passing up this chance to get free money every year. According to the Motley Fool, approximately 20% do NOT contribute enough to their 401(k) plans to get their full 401(k) match.

Think about it this way: If your boss was walking around the office passing out free $100 bills, you wouldn’t let this chance to get free money pass you by. But when people don’t contribute enough to their 401(k) plans to earn their full employer match, they are basically missing out on the same opportunity.

For years, I’ve watched my 401(k) employer matching contributions add up on top of my personal contributions. Not only does this increase my overall nest egg balance for the year, but it also creates more wealth volume for compounding returns to work their magic and grow exponentially.

When done correctly, 401(k) matches can add up to tens or even hundreds of thousands of dollars over the years on top of your personal retirement contributions.

So to better understand how you can maximize this benefit and not leave money on the table, let’s dig in to how 401(k) employer matching works and add an extra six-figures to your nest egg!

What Is a 401(k) Contribution Match?

A 401(k) contribution match is when your employer deposits money into your 401(k) retirement plan alongside the contributions you’ve made.

Why do they do this? Employers will often make matching contributions as a way to encourage their employees to be more active participants in their 401(k) retirement plans.

How Does a 401(k) Employer Match Work?

The way a 401(k) employer match works is simple.

For every dollar that is taken out of your paycheck to go into your 401(k) retirement account, your employer will also give your 401(k) the same or some percentage of your contribution.

These employer contributions are then generally capped up to some pre-determined ceiling.

For example: Let’s say you earn $50,000 per year, and you’ve got an employer who matches dollar for dollar up to 5% of your salary. If you periodically contribute 5% into your 401(k) for a total of $2,500 for the year, then your employer will also contribute $2,500 on top of that for a total of $5,000 at the end of the year.

The Tax Benefits of 401(k) Matching

Just like your contributions to a traditional 401(k) are taken out before your income is taxed, employer matches are also treated in the same way. They are “tax deferred” meaning you do not pay any taxes on them at the time they enter your 401(k).

Both your personal contributions and your employer matching contributions will continue to grow in your traditional 401(k) plan as tax-deferred for years and years. During this time, you won’t pay any taxes on the earnings you make off your investments. When you finally decide to retire and start making withdrawals, this is when you will start paying taxes.

What If I Have a Roth 401(k)?

Because 401(k) employer matching contributions are always tax-deferred, they must be handled just like a traditional 401(k) plan. Therefore, if you’ve decided to contribute to a Roth 401(k), then your financial provider will effectively set you up with two 401(k) accounts. Your personal contributions will go into the Roth account after being taxed, and your employer contributions will go into the traditional account before taxes are taken.

Are 401(k) Employer Matches Required By Law?

No, 401(k) employer matching is not required by law. It is completely up to your employer to decide how much they would like to offer you (if anything at all).

401(k) Employer Matching Contribution Formulas

There are lots of different ways that employers can structure 401(k) matching contributions. Here are some of the most common employer matching formulas:

- Dollar for Dollar. For every $1 you contribute, your employer will also contribute $1.

- Partial. For every $1 you contribute, your employer may only wish to contribute a partial amount such as 50 or 25 cents.

- Something for Nothing. In rare instances, some employers may decide to contribute a percentage to your 401(k) regardless of what you contribute; even if it’s nothing at all.

- Combination. By far, this is the most typical method of 401(k) employer matching you will hear about. For example, at the company I work for, we’re offered a dollar for dollar match up to the first 3% of our pay and then another 50 cents for each dollar for the next 2% of our pay. Effectively, this works out to a 4% match overall, but the structure encourages the employees to contribute at least 5% of their paycheck.

Matching Caps

Again, please note that in almost all instances of 401(k) matching, your employer will place some “cap” or upper limit as to how much they will give you. This could be any number they choose.

Profit Sharing / Bonuses

If your employer has a profit-sharing program or gives out annual bonuses, they might also decide to make an additional contribution to your 401(k). Again, the amount of this additional contribution is up to the discretion of the employer. It may also vary from employee to employee.

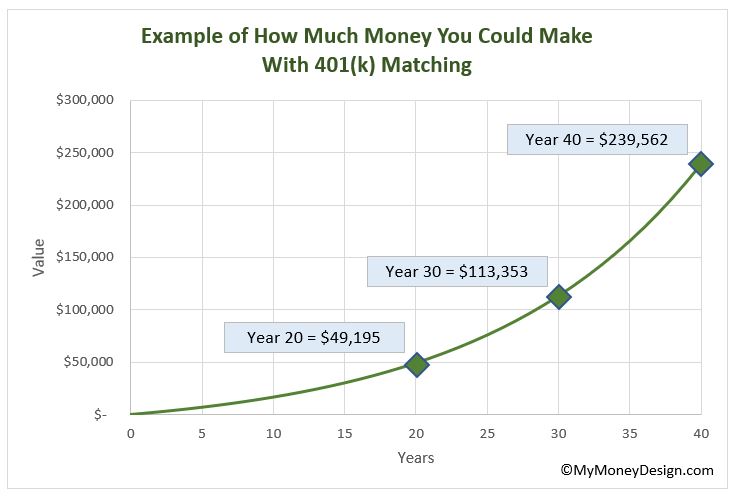

How Much Money You Could Make With 401(k) Matching

Let’s say you’re in a situation where you haven’t signed up for your employer’s 401(k) plan yet. How much money are you leaving on the table by passing up your full 401(k) match?

Let’s create an example using some modest assumptions:

- You earn a gross salary of $60,000 per year.

- Your employer will match you 25 cents for every dollar you contribute up to 8% of your salary.

Using these figures, your 401(k) employer match would be $1,200 per year.

Although that may not sound like a lot of money to some people, you have to remember that as time goes on, compounding returns will help to grow this money exponentially.

How much are we talking?

Assuming an average annualized return of 7% per year, you would potentially be missing out on:

- $49,195 after 20 years

- $113,353 after 30 years

- $239,562 after 40 years

Wow! You could have an extra six-figures in your nest egg from just the employer contributions alone. This calculation doesn’t even include your personal contributions.

Again: Definitely do NOT wait. Sign up for your 401(k) plan right away and start getting your employer matches immediately!

What is a Good 401(k) Match?

“Dollar for dollar” or “something for nothing” may seem like the best 401(k) matching plans. But if they have low cap limits, then this could be deceiving.

To really understand if you’re getting the best 401(k) match, calculate how much total money you stand to earn if you contribute the full amount up to your employer’s capped limit. You can then compare this to the industry average and decide for yourself if your company is being generous.

For example, which plan sounds better to you?

- A dollar for dollar match up to 4% of your salary.

- A match of 50 cents to a dollar up to 9% of your salary.

Doing the math:

- 1 x 4% = 4%

- 0.5 x 9% = 4.5%

Since plan 2 is greater than plan 1, plan 2 is the better deal and will ultimately result in more money. Just be sure to contribute the max amount needed to get the full amount every year.

What is the 401(k) Matching Average?

According to Fidelity, the average 401(k) employer match is approximately 4.7% of your gross pay. For example, if you earn $60,000 per year, then the average 401(k) employer match for the year would be $2,820.

Because there are so many different combinations of ways employers structure their 401(k) matching contributions, it’s often helpful to express this number as a percentage of your overall salary. That way, you can easily make comparisons from company to company.

How Do I Qualify for 401(k) Employer Matching?

Generally, all you have to do to take advantage of your company’s 401(k) employer matching program is to start contributing to your 401(k)! It’s really that simple.

To know for sure, go to your company’s human resources (HR) department and ask them if they offer 401(k) matching contributions. Ask about their rules for the program and get them in writing (preferably). Be sure you’re clear on their rules and ask questions if you need further clarification. Again, don’t let the embarrassment of asking a question hold you back from potentially earning thousands of extra dollars over time!

Spread Out Your 401(k) Contributions for Maximum Benefit

Remember that in order for you to get your full 401(k) employer match, you need to be sure to always be contributing at or above your employer’s matching contribution limit for each and every paycheck.

For example, if you run into some trouble financially and need to turn off your 401(k) contributions, understand that you will also be forfeiting your employer matches.

There is also some caution that needs to be taken if you are at the other end of this extreme. Let’s say you are an employee who maxes out their 401(k) contributions every year. Beware that some personal finance blogs out there will recommend that you “front load” your 401(k) contributions for the year; meaning you contribute a substantially large amount to your 401(k) for the first few months until you reach the IRS limit. An example of this would be:

- You earn $60,000 per year and are paid bi-weekly. That means you earn $2,307.69 gross every two weeks.

- You set your contribution rate to a high rate of 50% and contribute $1,153.85 per paycheck.

- After just 17 paychecks for the year, you’d already reach the IRS maximum contribution for the year.

The problem with this is that since you are paid 26 times for the year, for at least 9 more paychecks your contribution would be 0. Therefore, you’d miss out on the 401(k) employer match for these remaining paychecks.

To be sure, again, make sure you ask your company’s HR department and fully understand how they structure their 401(k) matching payments.

How Vesting Affects Your 401(k) Match Ownership

While your contributions to your 401(k) always 100% belong to you, remember that there may be some “time” qualifications for the contributions from employer before this money belongs to you. This is a process known as “vesting”.

A typical example of the vesting process may be that for every year the employee works for a company, they become 25% more vested in their 401(k). This would mean:

- If the employee leaves the company after 0.5 years, they would be entitled to keep 0% of their 401(k) employer contributions.

- If the employee leaves the company after 1 year, they would be entitled to keep 25% of their 401(k) employer contributions.

- If the employee leaves the company after 2 years, they would be entitled to keep 50% of their 401(k) employer contributions.

- If the employee leaves the company after 3 years, they would be entitled to keep 75% of their 401(k) employer contributions.

- If the employee leaves the company after 4 years, they would be entitled to keep 100% of their 401(k) employer contributions.

Why do employers do this? Vesting is generally used to motivate employees to stay loyal to the company and work with them for the long-term.

Again, this is just one example. By contrast, my current employer offers a vesting schedule where you qualify for 100% of the contributions at the time of hire. This means all your 401(k) matching contributions are yours starting from day 1!

Just like the 401(k) matching contributions themselves, it is up to the discretion of the employer to decide how they would like to structure their vesting process.

To find out more about 401(k) vesting works, click here.

Employer 401(k) Contribution Limits

There are some limitations as to how much your employer can contribute to your 401(k).

According to the IRS, employers are not allowed to contribute up to the lesser of $56,000 or the employees annual compensation to any employee’s 401(k)

Again, remember that this limit is the combination of both matching contributions and any profit sharing / bonus payments. For most employees, the 401(k) matches they receive from their employers will never exceed this IRS limit. But if your company offers profit sharing or annual bonuses, it is possible they could make additional contributions to some employees that would exceed this limit.

Highly Compensated Employees

To help protect against employers unfairly giving select employees substantially more 401(k) contributions than others, there is another test that employers must pass known as “highly compensated employees”. According to this test, highly compensated employees cannot contribute more than 2% above the average contributions made by non-highly compensated employees. Otherwise the company would be found to be discriminating in favor of their highest earners.

For more information about highly compensated employees, check out this article here.

Photo credits: Pexels, Unsplash

Leave a Reply