The 4 Percent Rule has arguably become one of the best known and somewhat controversial strategies in retirement planning when it comes to safe withdrawal rates.

Yet, despite how often we refer to it on this blog, it occurred to me that I’ve never actually written an article that talks about it comprehensively.

While doing the research for my ebook “How Much Money Do I Really Need to Retire & Achieve Financial Independence?”, I got the opportunity to dive pretty deep into the publications that made the 4 Percent Rule famous and the studies where it originated.

That ended up becoming a very interesting task because it helped me to understand this topic at a much deeper level.

As it turns out, there is actually a lot of misinformation out there about this technique and why it was suggested.

More importantly, I also learned that there were a lot of other useful details contained within these articles that could better help us prepare for retirement.

So with that said, here’s everything you’ve ever wanted to know about the 4 Percent Rule. Enjoy!

Disclaimer: Some of the links in this post to useful tools we recommend are affiliate partners. This is at no additional cost or risk to you. To learn more, check out our Privacy Policy.

What is the 4 Percent Rule? How Does it Work?

The 4 Percent Rule is a concept in retirement planning that says you should be able to safely and consistently withdraw a portion of your retirement savings equal to 4 percent of your starting nest egg balance year over year with inflation adjustments for the next 30 years; regardless of whatever happens in the markets.

Here’s a simple example of how this works. Let’s say you retired with a portfolio of $1 million dollars.

- In the first year, you could withdraw 4 percent of your portfolio for living expenses: $1,000,000 x 0.04 = $40,000.

- In the second year, you would take out the same amount as the year before and adjust for inflation (example 3 percent): $40,000 x 1.03 = $41,200.

- In the third year, you would again take out the same amount as the previous year and adjust for inflation again (example 3 percent): $41,200 x 1.03 = $42,436.

- And so on for at least the next 30 years.

Where Does the 4 Percent Rule Come From?

The 4 Percent Rule first came from an article that first appeared in the Journal of Financial Planning back in October of 1994. It was written by a financial planner from California named William (Bill) Bengen, a former aeronautical engineer.

Why Did Bengen Propose the 4 Percent Rule?

This is very interesting …

Up until this article, it was said that financial planners were commonly misusing an “average” anticipated growth rate to estimate how much money a retiree could comfortably withdraw from their retirement savings. Think of it like a reverse mortgage where the average market returns were the interest rate and the mortgage payments were your nest egg withdraws.

There was just one HUGE problem: The markets don’t actually return average rates! They fluctuate … and by quite a bit! This is a phenomenon called “Sequence of Returns Risk”, and Bengen spent the first 2 pages of his article talking about what profound consequences it can have on the survival and longevity of your portfolio.

One vivid example of this was a magazine article from Worth with investment guru Peter Lynch. In this article, Lynch made the claim that a retiree could safely withdraw a ridiculously high 7 percent per year from their retirement portfolios if they were invested in mostly stocks because stocks were returning an average of 11 percent per year. This, of course, is not at all correct.

Bengen knew advice in the popular media such as this was not only false, but it was also downright harmful! Therefore, he decided to perform his own study to see what a “true”, reasonable safe withdrawal rate should be.

How Did Bengen Figure This Out?

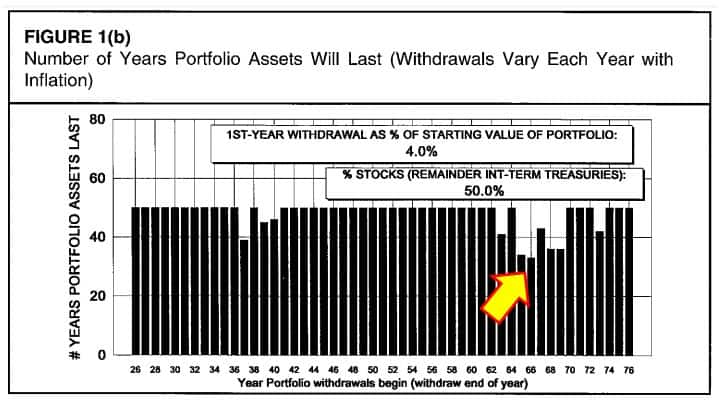

As a former engineer, Bengen took a very data-driven approach. He decided he would back-test various “rolling periods” of actual market data going all the way back to 1926. For example, if the rolling period was 30 years, think of this as asking the question “how would my portfolio have performed if I retired from 1926-1956, 1927-1957, 1928-1958, …” and so on.

Bengen’s goal was to find a withdrawal rate that worked for EVERY rolling period. Success was defined as NOT running out of money by the end of each rolling period.

Bengen’s market data consisted of 50 percent stocks (Standard & Poor’s 500 index) and 50 percent intermediate treasury bonds. He also considered inflation in addition to these market returns since this element had just as much of an influence on the real value of the portfolio over time.

How Did Bengen Conclude “4 Percent” Was the Best?

In the 1994 article, Bengen’s first conclusion was that a safe withdrawal rate of 3.0 percent worked 100% of the time for every 50-year rolling period. He also said that a rate of 3.5 percent worked with nearly the same success.

Rationalizing that most retirees don’t need their money for 50 years, he decided to redo the calculations with 30-year rolling periods instead. Here is where he discovered that a rate of 4.0 worked for every 30-year rolling period. Rates of 5.0 and higher had some rolling periods where the retiree ran out of money, and so they were dismissed as being too risky.

Thus, Bengen concluded 4.0 percent was the optimal safe withdrawal rate. Here is an exert from his original article:

Taking a Closer Look

In addition to naming 4 percent as the winner, there were several other highlights we can take away from this article:

- Note that in this study, the 4 percent rule actually worked 100% of the time for each 30-year rolling period. In fact, the lowest number of years that it worked was 33 years. There were many rolling periods in history where your money lasted for 50+ years!

- Asset allocation also played a role. If you increased your stocks to 75% and decreased bonds to 25%, then this increased the number of rolling periods that worked for 50+ years. But your lowest period of success dropped by one year to 32 years.

- Portfolios with stocks below 50% or above 75% were counter-productive. They caused retirees to run out of money sooner than 30 years.

- If you wanted to leave money to your heirs and end your retirement with greatest amount of money possible, the higher stock allocation of 75% was the most beneficial.

And then there’s the most important statement that Bengen makes in this article: He reminds the reader that this 4 Percent Rule is just a suggestion to help you with planning. He makes it very clear that you may need to make your own adjustments along the way.

The Trinity Study

In February of 1998, the AAII (American Association of Individual Investors) Journal published another important milestone for the 4 Percent Rule.

Three professors of finance form the Department of Business Administration, Trinity University, San Antonio, Texas, Philip L. Cooley, Carl M. Hubbard and Daniel T. Walz, had decided to conduct their own study of safe withdrawal rates.

Their article became known as “The Trinity Study”.

What Did the Trinity Study Do?

The Trinity Study more or less back-tested market data in much the same way as Bengen did. However, their approach was just a little different.

Whereas Bengen was looking for how many years your money would last based on a fixed withdrawal rate, the Trinity Study was calculating the statistical odds of how long your money would last for a fixed term of years.

This is a very important distinction. Bengen was looking for a rate that worked with 100% success. The Trinity Study, on the other hand, sought to quantify the probability for success.

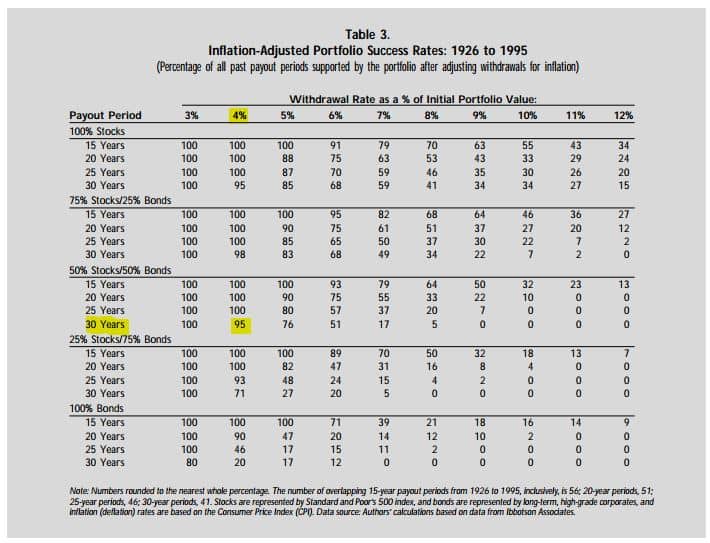

This is where we get the infamous “95 percent” success statistic that is so often mis-attributed to Bengen. It was actually the Trinity Study found that a retiree with a portfolio of 50% stocks and 50% bonds will have a 95% chance of success of not running out of money for at least 30 years if they start making withdrawals at a rate of 4.0 percent and increase those withdraws with inflation every year thereafter.

Here is an exert from the original article:

Why Did Bengen and Trinity Study Results Differ?

The difference is in which indices were used. Both Bengen and the Trinity Study used the Standard & Poor’s 500 index for stocks. But when it came to bonds, Bengen used intermediate treasury bonds while the Trinity Study used long-term, high-grade corporate bonds.

More From the Trinity Study

Just like Bengen’s article, there’s some more valuable information that often goes unnoticed.

- The analysis was conducted with both inflation adjusted and non-inflation adjusted returns. Believe it or not, if you do NOT adjust for inflation, a withdrawal rate as high as 6.0 percent had a 95% chance of success for 30 years. Even though we all know that adjusting for inflation is very important, this information could be useful for someone who is hoping to use a higher withdrawal rate and make sacrifices.

- Increasing your stock ratio up to 75% actually raised your chances of success from 95% to 98%.

- Just as Bengen concluded, don’t use portfolios with stocks below 50% or above 75%. They are counter-productive.

- Also similar to Bengen’s article, the authors concluded that a portfolio of stocks closer to 75% would leave you with more money at the end of retirement.

It was also mentioned: This study is just to help with planning. You may need to make your adjustments from time to time.

Why Is the 4 Percent Rule So Controversial?

There are basically two camps for why so many people debate the 4 Percent Rule:

On one hand, there is the possibility that you will run out of money. For some people, the Trinity Study success rate of 95% is not high enough. Even a 1% chance of failure scares them to death. They want an absolute, ironclad guarantee that their hard-earned savings will never run dry.

Along those same lines, skeptics also like to make the case that:

- Stocks are not going to return the same high average annualized rates that they have in the past. Even the famous John Bogle was quoted as saying we should only expect 6% nominal growth from stocks over the next decade.

- Because bond yields have been so low, we are entering into uncharted territory for bond performance.

The other angle that critics take comes from the opposite extreme: The possibility that the 4 Percent Rule tricks us into being too conservative when a higher withdrawal rate could have been used.

Remember back to Bengen’s data and the fact that many rolling periods in history went 50+ years without running out of money. This begs the question: Could we have been enjoyed more of our money instead of living in fear that we would prematurely spend it?

As you’ll find out in the next section, there may be some truth to this …

That Was Then … What About Now?

Okay, so the 4 Percent Rule worked back in the 1990’s. Since then, we’ve had the Dot-Com bust in 2001 and the Great Recession of 2008. So how has this strategy held up over the years?

In short: Very good!

In 2010, financial researcher Dr Wade Pfau re-created the Trinity Study and found that a 4.0 percent withdrawal rate had increased to a 96% success rate.

Not long after that, in 2011, the original Trinity Study group got back together and revised their study. Like Pfau, they too found that 4.0 percent worked safely for 30 years on a 50/50 stocks and bonds portfolio with an increased success rate of 96%. Miraculously, the 75/25 stocks and bonds portfolio had increased to a whopping 100% chance of success for 30 years.

I should also mention that for the non-inflation adjusted portfolio with 75/25 stocks and bonds, you could now use a withdrawal rate as high as 7.0 percent for 30 years with a 91% success rate. Your chances for success increased to 98% if you used a 6.0 percent withdrawal rate and had a 50/50 stocks and bonds portfolio.

Probably the most recent update came in 2015 from financial researcher Michael Kitces. He also recreated the rolling period experiment using a 60/40 stocks and bonds portfolio going all the way back to 1870. Kitces concluded that:

- Two-thirds of the time, the retiree finishes with two times their original starting balance! The median value was 2.8 times the original balance.

- Less than 10% of the time does the retiree EVER finish with less than the starting principal.

Thus, even in our modern times, the 4 Percent Rule still has a very high chance of success.

What’s Bengen Up to These Days?

These days, Bengen is retired and (you’re going to love this) uses two financial planners to help manage his assets. You can also find the occasional article interview or podcast where he’s a guest.

You may be interested to know that in 2001, Bengen offered a new twist to the 4 Percent Rule proposing an updated strategy called the “Floor and Ceiling” method.

Here’s how it works: Much like the 4 Percent Rule, the retiree would start off their retirement using some “safe” percentage of the initial nest egg balance as the baseline. Then in the following year, depending on whether the markets were up or down, the retiree would adjust from this starting value either up or down staying within some artificial boundaries. Generally, this was a ceiling of 20% above the real value of the initial withdrawal and a floor of 15% below that same.

This technique was designed to ease both camps of critics: Those who felt like the 4 Percent Rule did not provide enough protection in bad times, and those who felt it was too conservative during the good times. By allowing the withdrawals to be more responsive to what was happening, Bengen felt this was a more dynamic approach.

More About Retirement Withdrawal Strategies

Of course the story doesn’t end there. I’ve collected a ton of information about retirement withdrawal strategies over the years. Particularly, I’ve strived to find methods where we could maximize our withdrawals but yet not put ourselves in jeopardy of running out of funds.

If you’d like to learn more, please enjoy the following:

- What is the Best Safe Withdrawal Rate for Retirement?

- Could This Be a New Safe Way to Use 4 Percent Rule?

- Is There Merit to a “Percentage of Remaining Portfolio” Retirement Withdrawal Strategy?

- Is a Safe Withdrawal Rate of 7.0 Percent Acceptable? The Trinity Study Thought So!

- How Does Social Security Factor Into Your Retirement Safe Withdrawal Rate?

Try Out Your Own Retirement Savings Withdrawal Rate!

Not sure if the 4 percent rule is for you? Would you like to experiment with other withdrawal rates and see what your odds of success would be?

I know I would! Retirement planning is just that – a “plan”! And plans should be tailored to your specific needs (and not to what everyone else is doing).

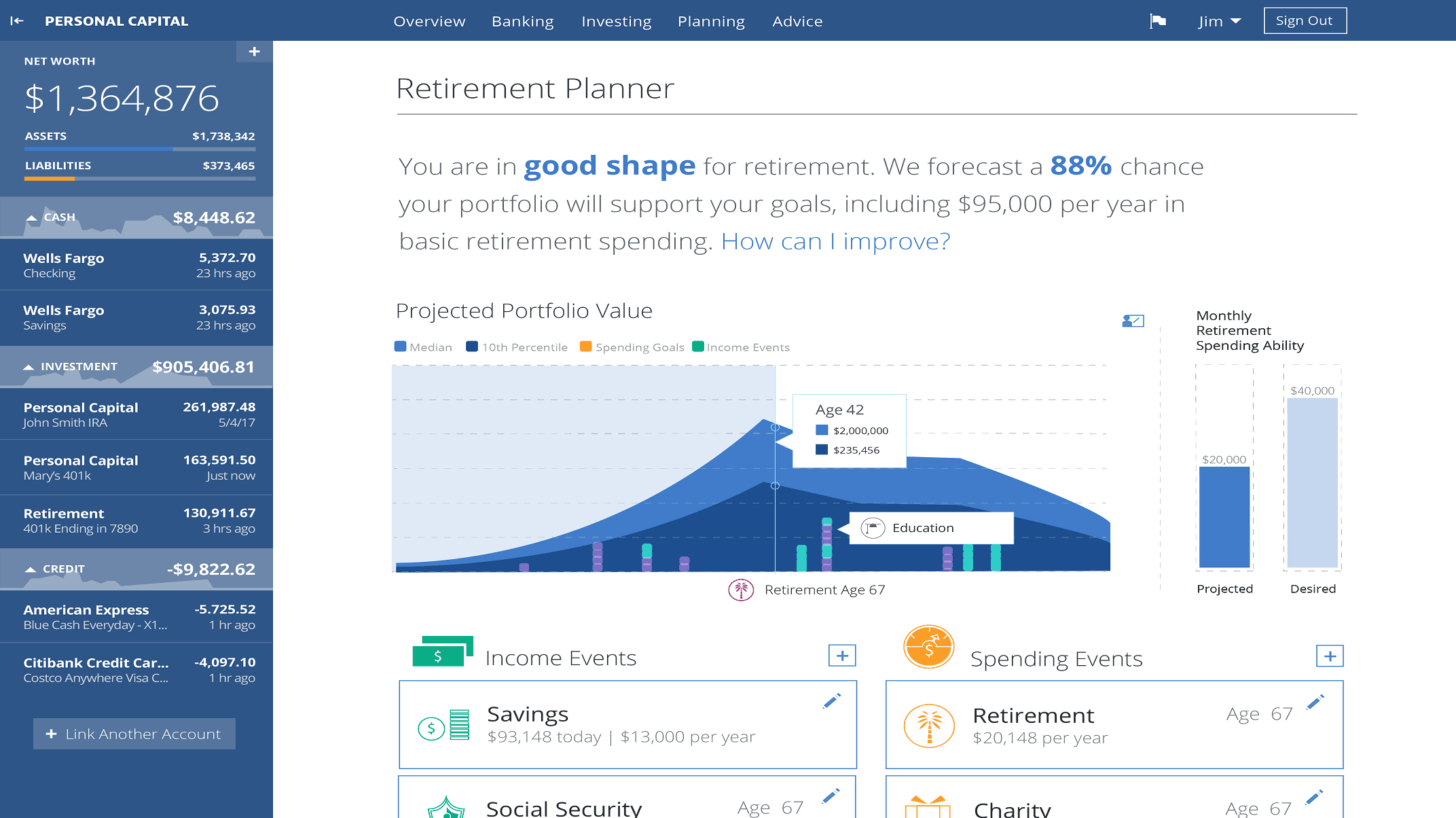

That’s why I’d like to recommend you try a free retirement planning tool such as this one from Personal Capital.

The Personal Capital Retirement Planner goes beyond most free calculators you’ll find online. You can set your parameters, add in specific goals, and then see a projection of how long your money will last (based on 5,000 Monte Carlo simulations). Plus, since you link outward to your nest egg accounts, the numbers you’re working with are always real and up-to-date. That’s why I recommend giving it a try. It’s definitely one of the best free resources you’re going to find!

Readers – What is your take on the 4 Percent Rule and all of this background history? Do you feel that it’s still a safe strategy to use? What retirement withdrawal method do you prefer to use and why?

Featured image courtesy of Flickr

Thanks for the interesting post. I’ve always wondered who came up with the 4% rule and how they determined that 4% was indeed the best percentage to use.

You’re very welcome. I used to wonder the same thing too. When you really look at the method and statistics behind how it was developed, it makes a lot more sense. Plus it gives me a lot more confidence that the odds of it not working are very slim.

Always a hot topic. The latest update I’ve seen, which is done very, very well, is work in an excellent 7 part series on Early Retirement Now (https://earlyretirementnow.com/2017/01/25/the-ultimate-guide-to-safe-withdrawal-rates-part-7-toolbox/).

Definately worth checking out. As a result of “ERN’S” work, I’m using a 3.5% withdrawal rate for our retirement planning.

For anyone planning an early retirement, 3.5% is a pretty optimal safe withdrawal rate. For just a little bit of extra saving, it gives you a world of confidence and security. I came up with the same result about 2 years ago after spending an afternoon playing with FIRECalc and documenting the results. I was glad later to learn that it agrees with both Bengen as well as ERN’s recent series.

I plan to use a very low percentage in the first few years like somewhere between 3 and 3.3%. This way I can play it safe to take more later on. As you age, I’m sure anyone can find more ways to increase frugality. Entertainment expenses usually tend to go down the older you get. Also you can get a cool little part time job to cover any shortfalls in income.

A safe withdrawal rate of 3 – 3.3% should put you the in range to almost guarantee never running out of money! If you can swing it, go for it.

Thank you for outlining the history and research behind the 4% rule.

In my analysis, I have identified that dividend payments are generally more stable and reliable than capital gains in the short term ( 1 -5- 10 years). This makes them an ideal source of income in retirement ( and a great gauge to check how much I can safely “spend” in retirement without running out of money). Stock prices gyrate up and down, but dividends have usually been more stable, and with some hiccups have otherwise maintained a stable and upward trajectory over time .

When I reviewed the information on 4% rule, I found that the average dividend yield from the 1920s to early 1990s was.. surprise surprise 4%.. While I may be biased, I am claiming that the success of the 4% rule was due to dividends. In essence, the strategy was spending dividends and interest, and letting the principle grow over time.

In my personal retirement strategy, I expect to be living off dividends. I estimate a 3% yield today to be sustainable ( either through a DIY diversified portfolio of dividend stocks or an ETF like VYM or SCHD)

I’m sure dividend payments played a huge role in the underlying stability of safe withdrawal rates over the years. But capital gains can account for much of it as well; especially during the good years. I’m sure this is why for some rolling periods the 4% rule actually worked for 50+ years. With the S&P 500 dividend yield closer to 2% these days, does this affect your strategy in any way?

The 2% yield on S&P is not very comparable to say the 4% average yield from prior to 1990s due to buybacks and due to the fact that the number of non-dividend paying companies has been higher than average over the past 20 – 25 years. I just view buybacks are more fleeting and temporary than dividend policies. I am relatively certain that S&P 500 companies will pay around $45 or so in annual dividend income in 2017, but I have no idea how much stock they will buyback. Nor do I know if S&P 500 will be at 2,500. by year end or at 1,500 ( ironically these short-term movements would matter to you in the retirement phase if you are selling stock to fund expenses in retirement)

But not a lot of changes really for me- just starting with list of dividend champions (25+ years of annual dividend increases), screening for valuation, trends in operating performance etc. Yield is the last factor I look at usually. I think that an average yield of around 3% can be expected with a portfolio build over time. I mean i you bought the VYM for example you can achieve just that.

Actually, ever since finding out your site and a few other sites, I am more focused on tax minimization and deferral. For example, if I bought VYM with a 3% yield, I am essentially earning a 2.40% net yield after taxes (fed and state). If I put the same amount of money in 401 (k), I can buy S&P 500 and earn a 2% net yield but I can also use tax savings to fund a Roth IRA and earn a 2% – 3% yield on that. So my net yields are roughly comparable ( and I do assume roth conversion ladders will be the fate of my pre-tax 401 (k) balances)

I do hold the dividend champions in high regard. And getting a semi-automatic 3% yield without ever touching your principal doesn’t sound too bad either. That could do a lot for ensuring your longevity.

Interesting. I knew about the origin of the 4% rule but hadn’t heard about the Trinity study before.

Like DGI, my goals is to be able to retire and live off my dividend and other cash flow streams, effectively living off the interest rather than the principal.

Whether that works or not, I’ll let you know in 50 years…

According to some of those studies, most of us who use a reasonable safe withdrawal rate will have a great chance of never touching our principal and living off of whatever fruits they bear (dividends, interest, capital gains, …) I’m with you on the 50 year thing. Maybe this will all work, maybe it won’t. But if history is an indication, I’d say the odds are in our favor.

Excellent article; very thoroughly researched. My question is about RMDs. Since many of us have the bulk of our retirement assets in IRA and 401k plans, won’t the government’s required minimum distribution (RMD) rates dictate how we withdraw money from our accounts? It would be hard to follow the 4% Rule, or similar plans, because we must instead follow the 4% Rule. I realize in the early years of retirement the RMD is less than 4%, so we’d be safe to follow it, but what about later? Thank you.