Recently my wife and I just renewed our medical flexible spending account. As silly as it may sound, we’re pretty happy to see that extra $50 to $100 in our checking account every two weeks. Even though we’ve always used one of these plans through her employer, I’m always surprised when I talk to other couples and find out just how many people DON’T use them. Or even know they exist! Most married couples or families can attest to the fact that there never seems to be any shortage of medical or daycare bills to pay! This is why taking advantage of a flexible spending account can help you and your money design. So read on and find out how an FSA works and how it can put a little extra money in your pockets on these types of … [Read more...] about Using a Flexible Spending Account to Get Another Tax Break in Your Paycheck

Personal Finance

My Money Design – October 2012 Update

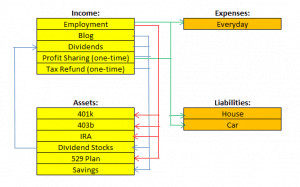

The website isn’t called My Money Design for nothing! It’s been almost 10 months since my last Money Design update and a lot has changed. Not only have I learned a ton of new tricks from my fellow personal finance bloggers on making and investing money, I have also taken a number of important steps at home and at work that I believe will further benefit my family's efforts to reach financial freedom. So with that in mind and in anticipation of my usual Money Design update, I have decided to get to work early with the revisions to my plan. … [Read more...] about My Money Design – October 2012 Update

My Cash Flow Plan – September 2012 Update

The end of Summer and back to school time are a period of change for our household finances. This is generally when my wife and I get our raises, her contract gets negotiated, and a lot of other expenses or credits get mixed into our budget. So for us, this is a great time to take another look at our cash flow plan and see if any revisions are necessary. … [Read more...] about My Cash Flow Plan – September 2012 Update

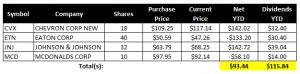

My Dividend Payment Income Report – September 2012

As many of you know, 2012 is the first year that I have really overhauled my stock investment strategy and changed my focus to simply collecting high-quality dividend paying stocks. Just like any dividend investor can tell you, dividend payment income is a pretty remarkable source of “truly” passive income. I prefix passive income with “truly” because the income they generate literally requires no effort on my part. I simply collect the payments each quarter! As of this month, I am happy to report the second installment of my quarterly dividend payments received. Please see the image on the left for the total. … [Read more...] about My Dividend Payment Income Report – September 2012

Social Security Spousal Benefits – Hook Me Up Elderly Sugar Momma!

In my last super entertaining post about Social Security benefits, I ended with a mention about how being married may not only entitle you to Social Security spousal benefits, but there’s a strategy that you could use to really maximize your benefits to full potential! Here I will present the rules on using Social Security spousal benefits and walk through an example of how this will apply to my wife and I. Hopefully you'll be able to go through the same exercise for you and your spouse! … [Read more...] about Social Security Spousal Benefits – Hook Me Up Elderly Sugar Momma!

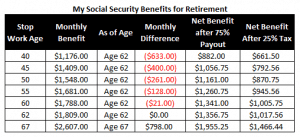

Social Security Benefits – The Kid Picked Last for Dodgeball

If there’s one lame duck that everyone ignores as part of their retirement planning, it’s Social Security. Over the years, Social Security benefits have been called too small, unfair, a Ponzi Scheme, and worst of all – dead! Yet for many Americans, their Social Security benefits are all that they have to live off of during retirement. And what’s even more frightening - if people continue to ignore retirement planning by sticking their heads in the sand, then Social Security benefits may be ALL they have to look forward to as well! So rather than sticking our noses up at it, let’s embrace our government hand-out (after all, we paid our money into it for so many years!). If you understand the basics of Social Security benefits, then you … [Read more...] about Social Security Benefits – The Kid Picked Last for Dodgeball

Retirement Income Planning with Author Daniel Solin

When you’re finally ready to retire and start accessing your money, mainstream advice says to follow the 4 percent rule. For anyone who doesn’t know, the 4 percent rule says you can start your retirement by withdrawing 4 percent of your total retirement portfolio to live on, and then doing the same each year thereafter with small adjustments for inflation. Research suggests that you’ll have a pretty good chance of success for about the next 30 years. Although this method is very popular for retirement income planning, there have been some studies to that show you can do better! … [Read more...] about Retirement Income Planning with Author Daniel Solin

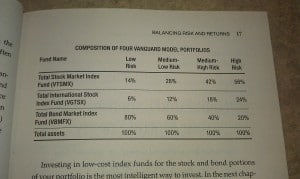

Asset Allocation Models from Author Daniel Solin

Do you really know how to split your retirement savings up in the best way? Chances are probably not. Trying to figure out the best asset allocation for your money design is something we refer to often here on my blog. Why? Because there of all the millions of combinations of investments we could put together, how do know which ones will work? What are the best asset allocation models for us to follow? I have been asking this question since I started investing and am still looking for the answer. We all know that in order to save up for a healthy retirement you’ve got to choose the right funds to stuff inside our investment portfolio. Choose poorly and your money will slip away from underneath your feet. Choose wisely and you’ll enjoy … [Read more...] about Asset Allocation Models from Author Daniel Solin