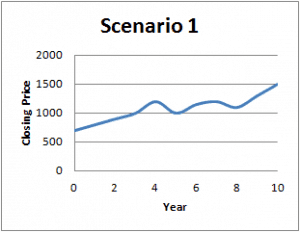

Pop quiz: Pretend your investment portfolio looked like one of these three graphs. Which of these represents an 8% average annualized return each year? The answer: … [Read more...] about What Does “Stocks Return 8 Percent Each Year” Actually Mean?

Personal Finance

Six Beginner Strategies for 529 Savings Plans

The following post is from guest author Ryan Jones. Ryan is a contributory writer associated with Debt Consolidation Care and has written several articles for various financial websites. He holds his expertise in the Debt industry and has made significant contribution through his various articles. A 529 plan is a kind of savings plan which is especially designed so as to encourage savings for the future college or any other mode of higher education. These savings plans have some tax advantages and are also legally known as the “qualified tuition plans”. The 529 savings plans are named so because they follow Section 529 of the Internal Revenue Code and are mainly administered by the different state agencies and the organizations. Six … [Read more...] about Six Beginner Strategies for 529 Savings Plans

Protecting Yourself with Dividend Stocks

Darn! The year was off to such a great start for us investors! But then worries about Greece and the Euro spoiled the party. If you were following conventional wisdom and investing in Index Funds, then you’ve basically lost about 6% in May (following the S&P 500). Don’t worry – I’m not trying to bum you out. But it is times like this that you need to ask yourself “What am I doing to hedge myself? If buying stocks is offense, what am I doing to play defense?” … [Read more...] about Protecting Yourself with Dividend Stocks

Six Easy Steps for Figuring Out How to Save for Retirement

When I read that 49% of Americans are not contributing to any retirement plan at all, I was not surprised to find out that the biggest offender group were people between the ages of 18 to 34. My guess is that it's not that they don't want to do it, but rather that they don't know how to save for retirement. The last time there was a round of 401k sign-up at work, my younger colleagues seemed hopelessly lost. They were given a nice big folder of papers containing numbers of charts, and told the old “you should probably contribute 10% of your paycheck” advice. But when it came down to, they really just had had no idea how to save for retirement. When I'd ask them if they felt 10% would be enough, I was met with blank stares like … [Read more...] about Six Easy Steps for Figuring Out How to Save for Retirement

Adding Your Children’s College Savings to the Budget

Please don’t hate me. I’m very proud that you’ve been following my advice (and the advice of my PF blog constituents) to start saving for retirement, etc. But now we’re going to talk about something that may require you to dig just a little deeper into those pockets of yours: • College “I Don’t Even Have Kids Yet!” Why Do I Care? I know some of you are pretty young and just graduating college yourself, while others of you may have recently got married and just had children. These are all great positions to be because, like most savings strategies, “more time” is our friend. However, this post is going to assume that someday when or if you already DO have kids, that you’ll want to send your little Princess or Jedi (… there’s a Star … [Read more...] about Adding Your Children’s College Savings to the Budget

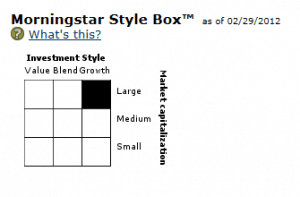

How to Pick Good Mutual Funds for Your 401k or Retirement Plan

Let me see if I can describe how your employer 401k or 403b retirement plan orientation went: • You all walked into a meeting. • An HR administrator handed you a folder chucked full of loose documents. • You were released with little direction and told to bring the papers back all filled in. Am I close? It’s pretty sad that something so important to our livelihoods later on in life is treated as another routine task. There are many things that should be explained to you when you sign up for your 401k (click here for my complete guide on this topic). But if there’s one thing where people REALLY need help, it’s deciding which mutual funds to pick for their plan. Past returns? Large cap / small cap? Expense ratios? What does all this … [Read more...] about How to Pick Good Mutual Funds for Your 401k or Retirement Plan

Before Retirement, Eliminate Your Biggest Expense

Frequently when you think of planning for retirement or becoming financially free in general, you think about how much money you’ll need to save in order to generate the kind of income that you’re use to. For example, how can I save $1,250,000 so that I can draw 4% and take out $50,000 each year? In this post, we’ll look at the other side of the coin. Instead, we’ll look for a way to reduce how much income you’ll actually need while on your own. And how will we do this? By focusing in on one of your largest expenses – your mortgage. … [Read more...] about Before Retirement, Eliminate Your Biggest Expense

How to Buy a Stock Market Index Fund

If you're wondering how you can buy an index fund, then you're in the right place! Index funds have become a favorite investment choice for people from all walks of life. Thanks to their simplicity and performance, you could easily grow all the money you'll ever need by consistently investing in an index fund. Even legendary investment guru Warren Buffett famously bet (for charity) a group of hedge fund managers that they could not outperform a simple index fund. And you know what? He was right! Even though these guys were supposed to have all the right connections and information to beat the market, they still managed to lose to an index fund. 10 years later, the index fund gained a 94% return while the hedge fund only … [Read more...] about How to Buy a Stock Market Index Fund