In my last super entertaining post about Social Security benefits, I ended with a mention about how being married may not only entitle you to Social Security spousal benefits, but there’s a strategy that you could use to really maximize your benefits to full potential! Here I will present the rules on using Social Security spousal benefits and walk through an example of how this will apply to my wife and I. Hopefully you'll be able to go through the same exercise for you and your spouse! … [Read more...] about Social Security Spousal Benefits – Hook Me Up Elderly Sugar Momma!

Retirement

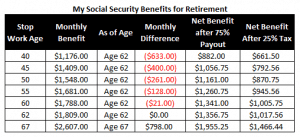

Social Security Benefits – The Kid Picked Last for Dodgeball

If there’s one lame duck that everyone ignores as part of their retirement planning, it’s Social Security. Over the years, Social Security benefits have been called too small, unfair, a Ponzi Scheme, and worst of all – dead! Yet for many Americans, their Social Security benefits are all that they have to live off of during retirement. And what’s even more frightening - if people continue to ignore retirement planning by sticking their heads in the sand, then Social Security benefits may be ALL they have to look forward to as well! So rather than sticking our noses up at it, let’s embrace our government hand-out (after all, we paid our money into it for so many years!). If you understand the basics of Social Security benefits, then you … [Read more...] about Social Security Benefits – The Kid Picked Last for Dodgeball

Retirement Income Planning with Author Daniel Solin

When you’re finally ready to retire and start accessing your money, mainstream advice says to follow the 4 percent rule. For anyone who doesn’t know, the 4 percent rule says you can start your retirement by withdrawing 4 percent of your total retirement portfolio to live on, and then doing the same each year thereafter with small adjustments for inflation. Research suggests that you’ll have a pretty good chance of success for about the next 30 years. Although this method is very popular for retirement income planning, there have been some studies to that show you can do better! … [Read more...] about Retirement Income Planning with Author Daniel Solin

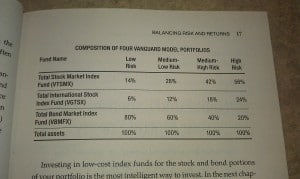

Asset Allocation Models from Author Daniel Solin

Do you really know how to split your retirement savings up in the best way? Chances are probably not. Trying to figure out the best asset allocation for your money design is something we refer to often here on my blog. Why? Because there of all the millions of combinations of investments we could put together, how do know which ones will work? What are the best asset allocation models for us to follow? I have been asking this question since I started investing and am still looking for the answer. We all know that in order to save up for a healthy retirement you’ve got to choose the right funds to stuff inside our investment portfolio. Choose poorly and your money will slip away from underneath your feet. Choose wisely and you’ll enjoy … [Read more...] about Asset Allocation Models from Author Daniel Solin

Tips for Achieving Early Financial Independence

The following post is a guest contribution from Early Financial Freedom. Giving the state of the economy, can you really achieve early financial independence? Is it a mirage that you can only imagine? My wife and I would like to assure you that it is real and attainable if you are serious about it. The bottom line is that you need to desire financial freedom in order to achieve it. The desire is the driving force for making early scarifies for later pleasures. How We Got There: Let me introduce myself. I am an engineer from New York and am happily married with a wonderful 7-year-old son. After working 10+ years as a hands-on engineer and later as a supervisor, I resigned in April 2012 to stop working for others and join forces with my … [Read more...] about Tips for Achieving Early Financial Independence

Six Easy Steps for Figuring Out How to Save for Retirement

When I read that 49% of Americans are not contributing to any retirement plan at all, I was not surprised to find out that the biggest offender group were people between the ages of 18 to 34. My guess is that it's not that they don't want to do it, but rather that they don't know how to save for retirement. The last time there was a round of 401k sign-up at work, my younger colleagues seemed hopelessly lost. They were given a nice big folder of papers containing numbers of charts, and told the old “you should probably contribute 10% of your paycheck” advice. But when it came down to, they really just had had no idea how to save for retirement. When I'd ask them if they felt 10% would be enough, I was met with blank stares like … [Read more...] about Six Easy Steps for Figuring Out How to Save for Retirement

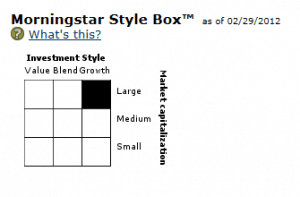

How to Pick Good Mutual Funds for Your 401k or Retirement Plan

Let me see if I can describe how your employer 401k or 403b retirement plan orientation went: • You all walked into a meeting. • An HR administrator handed you a folder chucked full of loose documents. • You were released with little direction and told to bring the papers back all filled in. Am I close? It’s pretty sad that something so important to our livelihoods later on in life is treated as another routine task. There are many things that should be explained to you when you sign up for your 401k (click here for my complete guide on this topic). But if there’s one thing where people REALLY need help, it’s deciding which mutual funds to pick for their plan. Past returns? Large cap / small cap? Expense ratios? What does all this … [Read more...] about How to Pick Good Mutual Funds for Your 401k or Retirement Plan

Before Retirement, Eliminate Your Biggest Expense

Frequently when you think of planning for retirement or becoming financially free in general, you think about how much money you’ll need to save in order to generate the kind of income that you’re use to. For example, how can I save $1,250,000 so that I can draw 4% and take out $50,000 each year? In this post, we’ll look at the other side of the coin. Instead, we’ll look for a way to reduce how much income you’ll actually need while on your own. And how will we do this? By focusing in on one of your largest expenses – your mortgage. … [Read more...] about Before Retirement, Eliminate Your Biggest Expense