My wife has an interesting theory about the people on the show Extreme Couponing: They are really just organized hoarders!

How can you not come to such a conclusion? As seen on the show, they turn their entire garage into store-like aisles full of goodies they got for “free”. They have rows upon rows of frivolous items such as +800 toothbrushes or +500 sticks of deodorant. How about the sacred 6-inch thick binder that is packed full of coupons but is still somehow categorized? My personal favorite: When they go dumpster diving looking for newspaper circulars! Heck, in one episode I saw, they even bring along their kids and friends! Yes, people do some pretty crazy things to save a buck.

Before I upset any couponers, I want you to know that this post is not about you. I applaud any and all attempts to try to responsibly save money. If couponing has made a dent in your budget, then good for you!

No, what worries me is the false prescient that this show about extreme couponing will give to the general public: That spending all your time couponing is the best return on your effort.

Fan of the Show:

Don’t get me wrong, I love the show (… in the same way that I love the one about hoarders)! Who doesn’t like watching people in extreme situations? You’d think that a show about coupons would be pretty lame, but TLC has managed to write a climax into every show:

1. The person spends every waking moment tracking down coupons, researching sales, and meticulously planning their shopping trip.

2. The person goes to the store and buys anywhere from $400 to +$1,000 worth of stuff (just admit it, it’s more entertaining the more they spend!).

3. The person gets to the counter and starts to check-out when all of the sudden (gasp!) something is wrong! They calculated they would only spend $8 and the total is still $50! What did we do wrong!

4. The person realizes they forgot one last coupon in their pocket. The price falls down to something ridiculous like 15 cents and the mission is accomplished! That’s quality TV!

And honestly, nice work to these couponers for figuring out the system!

But Is It Worth It?

So let’s ask the fundamental question: Is it worth it for you to start couponing? I think the answer is as simple as any other good business decision – it depends. Who won’t see these people on TV saving +$1,000 and think to themselves, “I could do that”! And yes you could.

To start, there is one consistent thing I’ve noticed on almost every episode: The comment that these people spend ALL of their (extra) time couponing; close to 40 hours a week. You might think to yourself: Even if I did that, I won’t spend that much time on it. Okay, let’s assume you spend only 20 hours a week devoted to couponing.

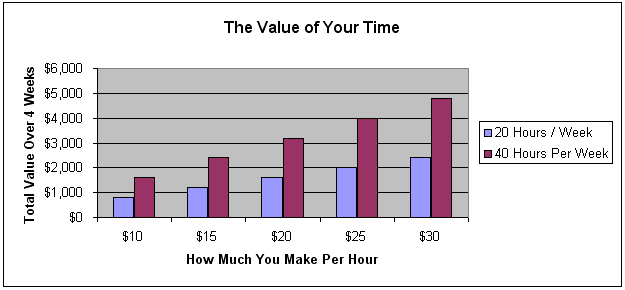

Next, how much do you make per hour at your job (before taxes)? $10? $20? $30? If you are salary, a quick trick is to take the first two numbers and divide it in half (Example: A person with a $30,000 salary makes close to $15 per hour). Now, using however many hours a week you spend couponing, do the following:

• (Your hourly wage) x (hours a week) x (4 weeks per month)

There you go! That’s the value of your time. Now:

• Are you going to save that much this month on groceries if you start couponing?

The answer may be “yes” or “no”. Surely, if you are a stay-at-home mom, your wages are lower, or you buy a lot of groceries, then this may be a good deal for you.

However, if the answer is “no”, then couponing is simply not worth your time. Even some of the most “extreme” couponers on the show have only really saved between $500 and $1,000. But this is usually because they bought a whole bunch of stuff they didn’t need like 1,000 bars of soap or 100 cans of corn. For a regular shopper like you and I with a regular agenda of purchases, I can only image that the best we could haul in a months worth of shopping would be between $250 and $500.

But I Don’t Work All the Time:

You say “But wait! Even if I’m not couponing, it’s not like I’m not going to work an extra 20 or 40 hours every week. What does it matter what I do in my spare time?”

The answer: A lot. The exercise above is just a common method for putting a number to your time. But time can be much more than just that. Not to get too philosophical or preachy, but you only have 168 hours of time every week to make the best of your efforts. Perhaps saving a few hundred dollars every month is a good use of that effort, but I have my doubts. If you have any entrepreneurial aspirations at all, put them to work making yourself $1,000’s of extra dollars (rather than $100’s) each month by being a land-lord, running a small business, doing consulting, etc. Between your normal work, the family, the cooking, the cleaning, and everything else you can think of, how do you really want to spend your “extra time”?

Will I use coupons the next time I go to the grocery store? Absolutely. Will I go dumpster diving for more coupons? Probably not.

Leave a Reply