Who’s ready for some financial smack-down? If there’s any two groups of investors I can think of that are more divided, it’s those who invest in real estate and those who invest in stocks - like a North and the South of financial planning if you will. So the question here is this: Which one actually has a better chance of making you more money in the long run? This may be a controversial debate, but we’re going to settle this argument the MyMoneyDesign way – by running the numbers! So let's see what we come up with ... … [Read more...] about Which Is Better – Rental Income or a Stock Market Index Fund?

S&P 500

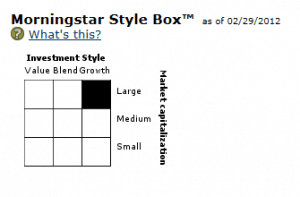

How to Pick Good Mutual Funds for Your 401k or Retirement Plan

Let me see if I can describe how your employer 401k or 403b retirement plan orientation went: • You all walked into a meeting. • An HR administrator handed you a folder chucked full of loose documents. • You were released with little direction and told to bring the papers back all filled in. Am I close? It’s pretty sad that something so important to our livelihoods later on in life is treated as another routine task. There are many things that should be explained to you when you sign up for your 401k (click here for my complete guide on this topic). But if there’s one thing where people REALLY need help, it’s deciding which mutual funds to pick for their plan. Past returns? Large cap / small cap? Expense ratios? What does all this … [Read more...] about How to Pick Good Mutual Funds for Your 401k or Retirement Plan

How to Buy a Stock Market Index Fund

If you're wondering how you can buy an index fund, then you're in the right place! Index funds have become a favorite investment choice for people from all walks of life. Thanks to their simplicity and performance, you could easily grow all the money you'll ever need by consistently investing in an index fund. Even legendary investment guru Warren Buffett famously bet (for charity) a group of hedge fund managers that they could not outperform a simple index fund. And you know what? He was right! Even though these guys were supposed to have all the right connections and information to beat the market, they still managed to lose to an index fund. 10 years later, the index fund gained a 94% return while the hedge fund only … [Read more...] about How to Buy a Stock Market Index Fund

Would Dollar Cost Averaging and Bonds Have Saved You From “The Lost Decade”?

In the first part of this series, I wanted to test the claim that dollar cost averaging (DCA) was an effective strategy for protecting your investments. Too often I’ve heard claims against investing within the media saying that if you had bought stocks (particularly) during “The Lost Decade” between 2000 and 2010, then you would have had a -23% return on your money. After crunching the numbers, we determined that dollar cost averaging would have beat a static investment in the S&P 500 and returned a -6.8% return instead of a -23%. That’s great, but who wants a negative return?! Why didn’t we just hide our money under the mattress and do nothing? Unfortunately, that may be true. But remember that when it comes to investing: Defense … [Read more...] about Would Dollar Cost Averaging and Bonds Have Saved You From “The Lost Decade”?

Would Dollar Cost Averaging Have Saved You From “The Lost Decade”?

From time to time when I get my 401k statement, there is a small newsletter mixed in with my financial statement. It usually presents some very introductory information about retirement, investments, etc. In this issue one of the topics was dollar-cost averaging. For those of you who don’t know, dollar cost averaging (DCA) is a strategy where you invest the same amount time after time. During the good times when shares are higher, you buy fewer shares. During the rough times when shares are lower, you buy more shares. This strategy prevents you from buying at the wrong time and over-spending or under-spending on your investments by “averaging” your price over time among these periodic investments. Sound familiar? That’s exactly what … [Read more...] about Would Dollar Cost Averaging Have Saved You From “The Lost Decade”?