If you’re looking to retire in your mid 50’s and want to be able access your retirement nest egg, then I’ve got some good news for you: The 401(k) Age 55 Rule might allow you to accomplish your goal of early retirement!

As most people in the U.S. know, when it comes to retirement planning, the IRS says you have to wait until at least age 59-1/2 to start withdrawing funds from any tax-deferred retirement accounts such as your 401(k) or IRA.

Otherwise, you’ll have to pay a pesky 10% penalty along with any applicable taxes.

If you’re an early retirement seeker like, then this creates a big problem.

How are you supposed to be able to access all the money you’ve saved for decades to be able to start your retirement and finally enjoy the fruits of your labor?

Fortunately, there is one small, little-known exception in the rules for 401(k) plans. It’s called the 401(k) Age 55 Rule, and it basically allows you to start making penalty-free withdraws from your retirement nest egg as soon as the year you turn age 55.

Here’s everything you need to know.

Disclaimer: Some of the links in this post to useful tools we recommend are affiliate partners. This is at no additional cost or risk to you. To learn more, check out our Privacy Policy.

How the 401(k) Age 55 Rule Works

The 401(k) Age 55 Rule comes from IRS Publication 575, and it says the following:

The following additional exceptions apply only to distributions from a qualified retirement plan other than an IRA: Distributions made to you after you separated from service with your employer if the separation occurred in or after the year you reached age 55.

In other words, under normal conditions, you don’t have to pay the 10% penalty as long as you leave your job on or after the year you turn 55. Not before.

The other major component is actually separating from your job. This rule does not work if you’re still employed. The term “separation” can mean many things. You could leave by your own will (retire), be laid off, or fired.

Example 1: You leave your job at age 56. Under the Age 55 Rule, you can start withdrawing from your 401(k) plan without fear of the 10% penalty.

Example 2: You get laid off from your job at age 54 and don’t turn 55 until next year. Under the Age 55 Rule, you are too young to qualify. Therefore, you’d have to pay the 10% penalty.

Example 3: You get fired from your job at age 54 but turn 55 in just a few months. Under the Age 55 Rule, you can start withdrawing from your 401(k) plan without fear of the 10% penalty.

Which Retirement Plans Apply?

Although this rule is often most associated with 401(k) plans, we should clarify that it actually applies to all “qualified retirement plans”. In general, this would be either a 401(k) or 403(b) employer sponsored plan.

Also keep in mind that this rule only applies to traditional-style retirement plans (no taxes now, pay taxes at retirement). For those people who love Roth-style plans (pay taxes now, no taxes at retirement), these ones do not qualify because the rules associated with Roth’s are different. With a Roth, contributions are available anytime for withdrawal. Only the earnings have to wait until age 59-1/2.

If you happen to work in a government institution that offers a 457 plan, these plans don’t qualify either. But there’s a good reason why. 457 plans aren’t subject to the additional 10% penalty tax to begin with. Participants of this type of retirement plan can start taking withdrawals anytime they wish, and only need to pay the taxes associated with those withdrawals.

Unfortunately this rule does not extend to IRA’s. When it comes to an IRA, you simply have to wait until age 59-1/2 unless you meet one of the other special requirements. OR you could use one of the other special early withdrawal techniques like a 72(t) rule / SEPP or a Roth IRA Conversion Ladder.

Check Your Employer’s Rules

Unfortunately, even though the IRS may allow you to start receiving benefits by age 55, your employer might not. This could even be the case after you’ve separated from service.

One very important caveat about employer sponsored plans such as 401(k)’s is that the rules are dictated by your employer. Yes, the money is yours. But the specific rules for how and when you can access it is not always the same. Since your employer dictates the plan, they can often place their own rules on top of the IRS rules. The only way to know for sure is to read your provider’s Summary Plan Description or have a nice talk with your Human Resources department at work.

If HR does deny you early access to your 401(k) at age 55, you could always gain that control back by rolling over your savings to an IRA. From there, you’d want to use the 72(t) rule / SEPP or a Roth IRA Conversion Ladder like we mentioned above. Although you wouldn’t have the ability to withdraw the money as freely as you could with the 401(k) at age 55, it does at least let you gain some access to your nest egg.

Other Ways to Access Your 401(k) Early

The Age 55 Rule is helpful if you’re only a few years away from the IRS age 59-1/2 restriction. But what if you want to retire even earlier, like in your early 50’s or even 40’s?

Luckily, there are lots of ways to accomplish this and use the money to enjoy your retirement according to your terms. To find out more about how you can make early withdrawals from your 401(k), IRA, or any other retirement fund, click here.

Are You Ready for Retirement?

The thought of retiring at age 55 can seem exciting! But cashing in your nest egg a few years earlier than everyone else could mean that you might need a little more savings than your peers.

Do you know if you’re truly ready?

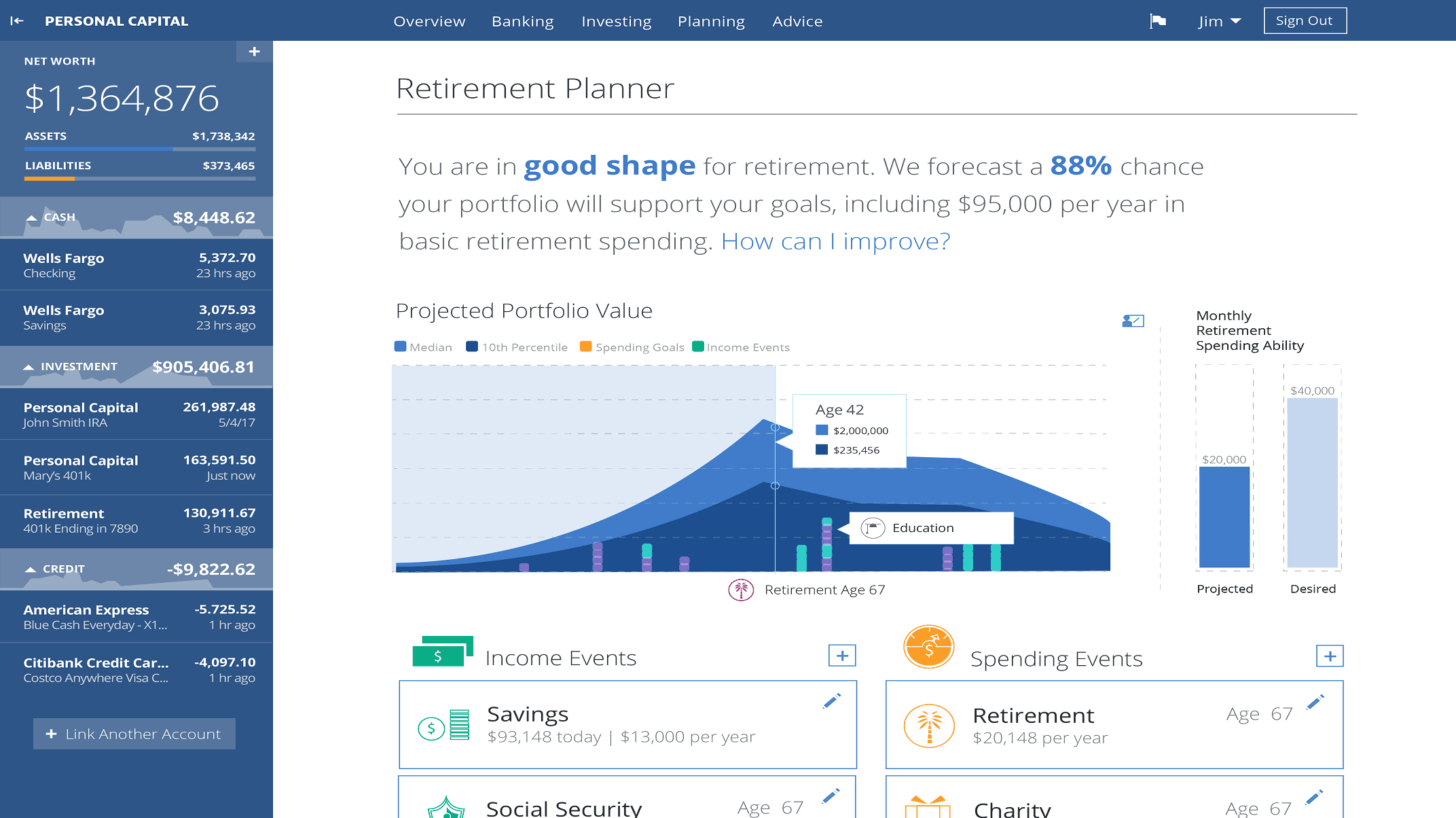

If you haven’t already, take some time to add up all of your retirement accounts and estimate how long your money will last. An easy (and fun) way to do this is with the free Retirement Planner from Personal Capital.

How does it work? You simply enter in some basic information about when you’d like to retire and how much money you’d like to withdraw each year, and then the planner shows you best and worst case scenarios for how many years until you will run out of money. To use the Retirement Planner, simply create a free account, link to each of your retirement accounts, and then like magic you can see a daily snapshot of all of your funds at once. By using your actual retirement account balances, this will help to provide you with the most accurate and tailored-for-you results.

Again, this retirement planner is completely free to use. So I would definitely recommend giving it a try!

Featured image courtesy of Unsplash

Huh. That age 55 penalty kinda sucks if you get laid off at age 54. It’s nice to know for early retirement planning, though.

Yeah, that would be really unfortunate timing to be laid off at age 54. But you still have 72t / SEPP’s you could take. They’re not as user friendly, but they are a possible way to get penalty-free access.

if you get laid off at 54 and you turn 55 the same year all is well…..that’ s my understanding.

OK but how much can i set up to withdraw from the 401k at 55 what the max amount i can withdraw year from the 401k until i am 59 1/2

Under the 55 rule, do the distributions each year have to be equal and is there a minimum or maximum amount allowed?

Not that I’m aware of. But to be sure, consult your tax professional.

Just an update – I took your advice and spoke with a tax professional….he advised me to get a copy of the plan rules and regs (which I did from HR) – it’s the plan itself that dictates min/max and when you can take the money. (in my case – you can only withdraw once every CALENDAR year and the maximum is anything up to the available balance at the time of withdrawal) He did tell me that of course the tax consequences would apply but the penalty for early withdrawal would not. He also said that there are some 401k plans that do not have the 55 provision available and that there are other restrictions placed on other plans. He, like you, suggested that people bring their plan rules/restrictions to a tax professional to get an accurate answer for their own situation.

Thanks for all your help, I now have a better planned retirement strategy than before.

Under the rule of 55, I realize the 401k may have it’s own limitations, but does the IRS limit how much and how often I can take distributions from a 401k plan?

I’m not ready to retire yet however this was still a really interesting read.

Cheers!

I don’t understand why people prefer traditional IRA’s over Roth IRA’s. You are leaving money on the table when you choose a traditional IRA because if you pay your taxes now instead of retirement you don’t have to worry about inflation.

Can you roll a 401k from another company into your new employer plan and still qualify for the 55 year rule for all of your funds?

Yes

I got laid off from my job 1 month before the year I turn 55. (laid off Dec 1st 2018 and I turn 55 in Oct 2019). I still had pay coming to me from my company in 2019 and therefore I have a 2019 W-2 from them. Is this sufficient to use the 55 rule for my 2019 taxes? I had to pull my money from my 401k in order to live due to no job so I am looking to avoid having tp pay the 10% penalty.