• Start saving today!

Why?

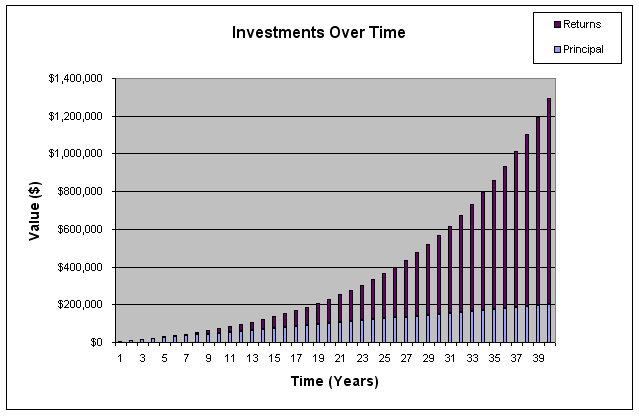

One simple reason: The effects of compound interest. Simply put, when you save your money, the effects of compound interest cause your money to grow far beyond anything you could have ever saved on your own. See for yourself:

In my simple example, the light purple is the money you saved and the dark purple is the money that grows on top of it through the process of compound interest. To get into the nitty-gritty of how that works, please read my post.

The most important element to the power of compound interest is “time”. The earlier you start, the more time you have to work with, and the more opportunity you have to really increase your potential reward.

Fighting Against Nature:

Would you like to know the biggest draw-back to a 401(k) retirement plan versus the classic pension retirement plans our parents had?

• It’s that a 401(k) is optional.

Unfortunately, given the choice to do something now or later, most of us will procrastinate and choose later. It’s programmed in our brains. It’s human nature to put off the things that hurt. But it’s not always what’s best for us.

To put it into words, what are we waiting for to start saving?

• To be rich of course!

Don’t Put It Off:

When we’re richer, we’ll naturally have more money to put away. Right?

Unfortunately, there’s a lot of flaws with this logic. Ask yourself if you’ll be richer when you have to deal with the following:

• What are your expenses now? A cell phone? Car insurance? Petty credit card purchases? What will your expenses be like when you’re buying food and clothing for a whole family?

• Do you still live with your parents? How “rich” do you think you’ll be when you have a mortgage and property taxes to start paying?

• How “rich” do think you’ll be when you have to start paying a utility bill, cable bill, and water bill?

• Do you have any children? How “rich” do you think you’ll be after you start having kids? Start paying for daycare? There were some months my daycare expenses exceeded my mortgage payment!

• How about home expenses? Do you have any idea how much a new roof costs?

• Someday, your family will need more than one car. My family had 4 cars growing up. Think you’ll be rich when you’ve got 4 cars to pay for, tires to change, insurance to pay, etc?

• Someday, your kids will want to go to college. Do you really want them to drown in student loans or are you going to pay for some of it?

• Someday, your kids will want to get married. Do you want to help them pay for some of it?

• One day you’ll have to pay for some big medical expenses, either for yourself or someone you love. How rich will you be then?

The Reason to Start Saving that No One Tells You About:

Besides the obvious benefits of having more money and taking advantage of the power of compound interest, there is another reason to start saving today:

• You’ll learn to live on less

That’s right. Going back to the “I’ll do it when I’m richer argument”, the problem is that as you make more money, you’ll want to spend more. And that will just make it harder to save than ever. The sooner you put together a budget and start putting the money away, the sooner you’ll start living like you never had that money in the first place. And that will make it easier to put more of it away in the future – little by little as your goals change over time.

Don’t underestimate how important this is for your lifestyle. It’s easier to start good habits from the beginning than to try to change them after the damage has already been done.

Remember: There will never be a magic sign or a tap on the shoulder where someone tells you to start saving. Once you have your goals in place, take advantage of the power of compound interest and start getting comfortable living without the money you’re putting away in savings. The “you” in the future will thank you.

Photo Credit: Clock Shadow by Duncan~, on Flickr

Related Posts:

1) How Your Retirement Income is Different from Now

2) Will You Have to Work Until Age 80?

3) Will Your Retirement Cost $2 Million?

Leave a Reply