Have you ever wondered about the differences between a 403(b) vs 401(k)? In our house, we have both. I work as an engineer and have a 401(k). My wife is a teacher and has a 403(b). Early on when we first got our jobs, I honestly knew nothing about either plan. We each just simply filled out the forms and really thought nothing of it. A few years later when I started taking more and more of an interest in personal finance, I became more curious about how each one of the plans works. How are they the same? How are they different? More importantly, as we started crafting our plans to retire in our 40's, it became increasingly important to really understand the fine details behind each one. How can I get my money back? … [Read more...] about What’s the Difference Between a 403(b) vs 401(k)?

401K

The Pension vs 401k – The 401k Did Not Kill Retirement

Every now and again when I read through the headlines on my favorite money news sites, I see the same desperate-for-attention headlines proclaiming that “retirement is dead” and that we basically have no hope of ever saving enough money. How do they draw those conclusions? The usual suspects cited are the decline of pensions, the deflating of Social Security and the rise in costs as reasons why none of us can save and why we’ll all need to work until we are 80. And then there is my personal favorite: The 401k. They talk about the 401k like it’s a James Bond villain. When they compare the pension vs 401k, they describe it as a horrible and inefficient means for retirement. Basically, their message is that the 401k killed … [Read more...] about The Pension vs 401k – The 401k Did Not Kill Retirement

What is Financial Freedom – The Easy to Follow Explanation

The tagline to My Money Design has always been designing financial freedom. For as long as I’ve been into reading financial books and blogs about money, I’ve seen a lot of them try to answer the question of what is financial freedom. However, I feel as though the weight of this term often gets lost or trivialized. In this post, we’re going to layout a definition for financial freedom and explain where we need to focus in order to achieve it. … [Read more...] about What is Financial Freedom – The Easy to Follow Explanation

Our Long Term Financial Goals and How We’ll Meet Them in the New Year

Happy New Year everyone! I hope everyone is safe and having a smooth transition into this new start. It seems this event is always marked with a great deal of optimism because people feel like they have a symbolic marker from which they can wipe the slate clean and start out fresh. It might be eating habits; it might be quitting your bad vices. For me, it always marks a time to re-evaluate our long term financial goals and see if our actions will get us to where we want to be. … [Read more...] about Our Long Term Financial Goals and How We’ll Meet Them in the New Year

Why You Need to Get Your Full 401k Matching as Early as Possible

Not too long ago, I was trying to demonstrate how NOT taking full advantage of your 401k matching contributions offered by your employer was causing you to lose out on more money over the course of your career than you probably thought! While it’s never too late to get your personal finances in order, one simple mistake I see people making all the time that kills me is when they wait as late as 5 to 10 years before they finally get with the program and start contributing enough to their retirement plan to get the full 401k matching from their employer. I beg you - Please don’t waste another year! Remember time is one of your greatest assets as an investor, so don’t squander it! In this post, I’ll show you just how powerful taking … [Read more...] about Why You Need to Get Your Full 401k Matching as Early as Possible

Six Easy Steps for Figuring Out How to Save for Retirement

When I read that 49% of Americans are not contributing to any retirement plan at all, I was not surprised to find out that the biggest offender group were people between the ages of 18 to 34. My guess is that it's not that they don't want to do it, but rather that they don't know how to save for retirement. The last time there was a round of 401k sign-up at work, my younger colleagues seemed hopelessly lost. They were given a nice big folder of papers containing numbers of charts, and told the old “you should probably contribute 10% of your paycheck” advice. But when it came down to, they really just had had no idea how to save for retirement. When I'd ask them if they felt 10% would be enough, I was met with blank stares like … [Read more...] about Six Easy Steps for Figuring Out How to Save for Retirement

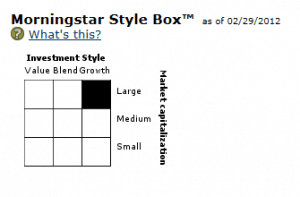

How to Pick Good Mutual Funds for Your 401k or Retirement Plan

Let me see if I can describe how your employer 401k or 403b retirement plan orientation went: • You all walked into a meeting. • An HR administrator handed you a folder chucked full of loose documents. • You were released with little direction and told to bring the papers back all filled in. Am I close? It’s pretty sad that something so important to our livelihoods later on in life is treated as another routine task. There are many things that should be explained to you when you sign up for your 401k (click here for my complete guide on this topic). But if there’s one thing where people REALLY need help, it’s deciding which mutual funds to pick for their plan. Past returns? Large cap / small cap? Expense ratios? What does all this … [Read more...] about How to Pick Good Mutual Funds for Your 401k or Retirement Plan

Will Dividend Stocks Help Me Retire Early?

If you have any hopes and dreams at all of retiring early, then you know that one of the biggest challenges you face is the fact that there are penalties for withdrawing your money too early from your retirement accounts. For most of them, this will be age 59 ½ (click here for a complete list). So one of the re-occurring questions that we keep asking on MyMoneyDesign is: • How do I bridge the gap between early retirement and age 59 ½? In previous posts, we’ve reviewed the following non-employment, investment-style options available: • File for a 72t or “SEPP - Substantially Equal Periodic Payments” to get penalty free portions of your nest egg money out. • Quit working at age 55 to get your 401k’s and 403b’s, but NOT earlier. • … [Read more...] about Will Dividend Stocks Help Me Retire Early?