In our house, we have both. I work as an engineer and have a 401(k). My wife is a teacher and has a 403(b).

Early on when we first got our jobs, I honestly knew nothing about either plan. We each just simply filled out the forms and really thought nothing of it.

A few years later when I started taking more and more of an interest in personal finance, I became more curious about how each one of the plans works.

How are they the same? How are they different?

More importantly, as we started crafting our plans to retire in our 40’s, it became increasingly important to really understand the fine details behind each one.

How can I get my money back? How can I maximize its growth?

In this post, I’ll go through each aspect of a 403(b) and 401(k). Along the way I’ll tell you whether each part is the “same” or “different”, and why.

What are 403(b)’s and 401(k)’s? What do they do for me?

Same. Both are U.S. tax-advantaged savings plans intended to help working people save more money for retirement.

Each plan allows you to divert money from your paycheck into a special investment account BEFORE taxes are taken out. This is a really huge advantage because it results in you saving way more money than if you would have tried to do this with after-tax money from your paycheck; approximately 33% more!

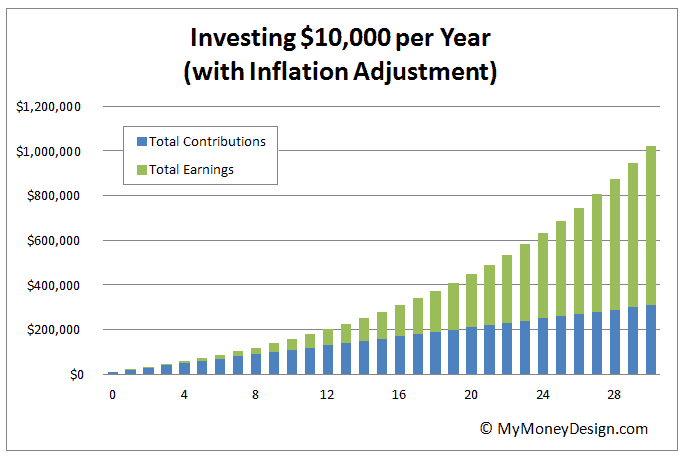

Once saved, the money is then invested and allowed to grow and compound tax-deferred until you’re old enough to withdraw it. The longer the money is invested, the better potential you have of reaping the benefits of compounding returns. This is when money grows on top of your money. At some point in the process, your earnings actually start to out-pace your contributions.

Just check out this compounding return example to see for yourself (green vs blue):

When your savings (also called your “nest egg”) reaches a high enough level, you can safely live off of some small fraction of it for decades to come. In other words, you’re ready to retire. For example: If you save up $1 million dollars, we know that you should statistically be able to withdraw $40,000 per year using a rule of thumb in financial planning called the 4 Percent Rule.

What does the name mean?

Same. For both retirement plan names, it refers to the section of IRS tax code from which the plan is written.

- 401(k) = For-profit / private companies

- 403(b) = Tax-exempt organizations like public schools, hospitals, churches, etc.

Are they the same thing as a “pension”?

Same. Nope. Not at all. A pension is something totally different.

Pensions are “older” style plans (also called defined benefit plans) where your employer pays you a pre-determined amount of money every month after you retire for the rest of your life (also called a defined benefit plan). 401(k)’s and 403(b)’s were each created with the intentions of helping workers save more money for retirement IN ADDITION to receiving a pension.

Unfortunately pensions have gone the way of typewriters and VHS tapes – towards extinction. To keep costs down, most organizations have shifted away from them. As a matter of fact, the EBRI reports that fewer than 2% of people in the private sector still participate in pension plans any more.

Basically, unless you happen to work someplace that still offers a pension, whatever you save for retirement yourself is all you will have.

Which plan was created first?

Different. Although you tend to hear about 401(k) plans more often, you may be surprised to learn that the 403(b) was established first back in 1958. The 401(k) was not created until 1978.

Who can contribute to each type of plan?

Different. Like we explained in the meaning behind the name, each plan is usually designated for one type of employee: Private or public. Since both types of plans are employee-sponsored, you have to work at a place that offers that type of plan in order to contribute. In other words, if they offer a 403(b), then you can participate in one. If they don’t, then you can’t contribute to one.

What are the contribution limits?

Again: Both plans are tax-deferred from Federal taxes. But remember that you still have to pay FICA (Social

Security and Medicare) taxes.

Is there employer matching?

Same, but tends to be more with the 401(k). Although both types of plans will allow employer matching to take place, the reality is that this tends to happen more frequently with the 401(k). The reason for this gets back to the nature of 401(k) plans being with “for-profit” companies where more money is available to be spread around. Generally speaking, non-profit companies usually don’t have enough discretionary income to make these sorts of matching contributions.

The typical 401(k) match for most U.S. companies is 50 cents to the dollar. This works out to roughly 2.7% of the employees pay.

When can I get access to my money?

Same. The IRS allows you to make withdrawals from both 401(k) and 403(b) accounts under the same conditions:

- You reach age 59-1/2

- Separate from employment (and retire) in the year turning age 55

- Apply for Substantially Equal Periodic Payments (SEPP) 72(t)

- Becomes disabled as per section 72(m)(7) of the Internal Revenue Code

- Through a loan (if allowed by the investment company)

- Death

Traditionally, if you want your money before age 59-1/2 and make withdrawals outside of these conditions, you will owe taxes and a hefty 10% penalty on the amount withdrawn. However, there are lots of ways to get your money without having to pay this penalty.

How much should I contribute?

Same. Good question! The answer will depend on you, your specific retirement goals, and what your financial situation looks like now.

Not sure about what your retirement goals are yet? A lot of people aren’t. That’s why I spent some time researching retirement planning and put together this book “Early Retirement Solutions: How Much Money Do I Really Need to Retire & Achieve Financial Independence?” It’s a guide that will help you explore what your needs are, how much you will need to save up, and how to optimize this plan even further.

Another angle I often take on retirement contributions: Contribute as much as possible!

Why?

First, let me ask you question. Do you like sales? Do you like to buy things when they are 25% or 33% off?

That’s basically what a tax-deferred retirement plan is doing for you – giving you a “sale” (so to speak) when you save your money.

Normally when a person saves money from their paycheck post-tax, they really only save about $0.75 for every $1 they earned because of the taxes. But with tax-deferred savings, you get to keep the whole $1. That’s an instant 33% increase!

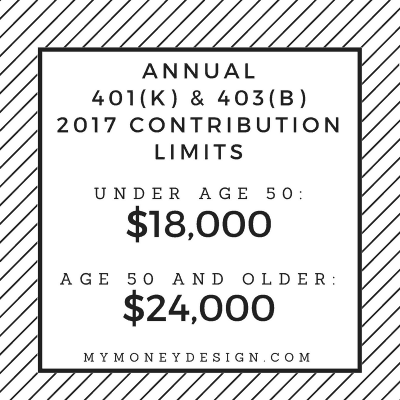

That may not sound like much now. But consider what happens when you get all the way up to the IRS limit of $18,000 per year. That’s $4,500 that you DON’T pay in taxes and keep for yourself. Smart!

Do I have to contribute to a 401(k) or 403(b)?

Same. No, not at all. Both plans are voluntary. But unless you’ve got gold bricks hiding somewhere, you’d be foolish not to.

Again: Remember that whatever you save for retirement is likely all you’ll ever have. Taking advantage of tax-deferred retirement savings plans like this give you a big break by not charging you taxes on your savings. In addition, the earlier you start, the more they help you take advantage of the power of compounding returns over time.

What are my investment choices?

Same/Different. 401(k) plans generally offer an assortment of mutual funds. In recent years, its far more common to also see these types of plans offering other products such as ETF’s and individual stocks.

Usually your options with a 403(b) are more limited and will depend upon how it is setup. 403(b)’s were originally introduced as tax-sheltered annuities (TSA). In the days of pensions, 403(b) participants would contribute to these annuities and get similar fixed-income payments later on in retirement. Because of the rise in popularity of 401(k) plans, many 403(b) plans have now changed their format to be more competitive with 401(k) plans by now offering low cost mutual-funds.

In both cases, the selection of investments is determined by your plan administrator (i.e. your employer). It is up to them whether your plan offers 5 choices or 500 choices.

A very simple way to keep track of all of your investments is to sign up for a free account with someone like Personal Capital. You can easily link your 403(b), 401(k), or any other investment account you have and get day-to-day updates on how your portfolio is doing.

Can I setup Roth-style accounts?

Same. If you prefer Roth-style retirement accounts (where you pay your taxes now rather than later), then you’ll be happy to know that both types of accounts exist in Roth form. However, Roth 403(b)’s are far less common than Roth 401(k)’s.

Can you also make IRA contributions?

Same. In most cases, employees with either 401(k) or 403(b) plans can contribute to an IRA too. But take note that the IRS a number of special rules when it comes to who can contribute based on whether you participate in a retirement plan at work and what your income level is.

For example: If you contribute to both a 401(k) plan and an IRA, your ability to deduct this amount on your tax-return may be limited.

Roth IRA contributions are usually less restrictive since they are mainly restricted by how much you earn. If you’re in doubt, check the official IRS rules or call a tax professional to know for sure.

How much do these plans cost?

Same (mostly). Both 401(k) plans and 403(b)’s have costs associated with the financial products as well as administrative costs for the plan itself. Again: Depending on what types of funds are offered and how much your company wants to pay for these costs will determine how much of the final cost gets passed on to you.

Because of the nature of 403(b) plans being classically based in annuities, they tend to be more expensive than 401(k)’s. Although 401(k) plan costs can vary considerably, many now offer low-cost mutual funds or ETF’s.

How long does vesting take?

Different. Vesting is how long it takes for you to become the owner of the employer contributions you receive into your retirement funds. This is usually decided by your plan administrator and can take anywhere from 0 to several years.

Typically participants of 403(b) plans are vested instantly. For 401(k) plans, it takes much longer to become fully vested because the private companies have more control over the rules and may want to leverage them to discourage employees from job-hopping too soon.

Can I just keep my money in the 403(b) or 401(k) forever?

Same. No. The IRS has something called Required Minimum Distributions (RMDs) for both plans starting with the year that he or she reaches 70 ½ years of age or, if later, the year in which he or she retires. Basically this means that you are required to take out a certain minimum percentage of your money each year, or you you’ll face a hefty 50% penalty!

Can I take a loan if necessary?

Same. Loans are possible from both 401(k)’s and 403(b)’s.

Per the IRS: The maximum amount that the plan can permit as a loan is (1) the greater of $10,000 or 50% of your vested account balance, or (2) $50,000, whichever is less. A plan that provides for loans must specify the procedures for applying for a loan and the repayment terms for the loan. Repayment of the loan must occur within 5 years, and payments must be made in substantially equal payments that include principal and interest and that are paid at least quarterly.

Can I convert or rollover these plans to an IRA?

Same. After leaving your employer, you can roll over some or all of your 401(k) or 403(b) plan to a traditional IRA. In some cases, depending on your costs and any plan restrictions in place from your administrator, transferring your money into an IRA might actually be better.

If your 401(k) or 403(b) is a traditional “tax-deferred” style setup, avoid converting or rolling it over to a Roth IRA. If you do, you’ll owe taxes on the entire amount that was converted. What’s worse, depending on how much money we’re talking, it could push you into one of the highest tax-brackets; meaning that you would owe far more in taxes than you’d ever otherwise owe. Avoid this option unless you absolutely know what you’re doing.

Readers – Who else also has one or both of these types of retirement plans? What the advantages and disadvantages that you have noticed between a 403(b) vs 401(k)?

Image Credit: Pexels

That’s funny the 403b started 20 years prior to the 401k, I did not know that. I had a 403b a number of years ago as I worked for a non-profit. Thankfully it was like your typical 401k and had numerous mutual funds to pick through.

Yeah, that was a fun factoid to find out! I didn’t know it either. My wife’s 403b is also more mutual fund based, but the fees are more excessive than I’d like to see (which was one of my reasons for lowering our contribution to it).

I had never heard “The 403b is usually an annuity contract offered through an insurance company, but as of recently mutual funds have become a choice as well.”

Mine has always had a full set of options. Maybe back in 1978 this was true?

I know from a personal level that my wife’s options are all either mutual fund (classic cash / bond / stock based) or annuity based. I have also read this fact on several other sites. I’m sure there will be those lucky outliers that have more options than the average, and perhaps your plan is one of them.

My husband’s 401K only has one sucky option. Perhaps this is a small firm/non-profit vs. large firm/government organization distinction.

Only one option? That’s really lame. Even a minimal 401k plan should have at least one stock and one bond option – just for simple diversification.

My husband is a teacher and he has PERA 401K, which has several funds to choose from, and they also offer a 403b,which has annuity funds. I’m not sure whey the offer both. On $33K a year, there is no way to max them out. We stopped the 403b because of the annuity and high fees. They don’t match either one, but he will still get a pension if he puts in the time. The investment options are if you want to save more than the pension.

That story sounds very similar to my own situation with my wife! A pension is nice, but why can’t they do a match or incentive for the 403b also?

Good info! We have never been offered a 403b before.

Unless you work for the government, its one of those things you’d never have to deal with. But the term gets thrown around a lot, so I wanted to layout what makes them different.

I literally had never heard of 403b’s. Thanks for educating me. Unfortunately my current employer (a private school) doesn’t have retirement benefits. But this is something I’ll have to ask about the next time I’m interviewing.

If you work for a private school, they may have a 401k instead. And that’s okay because it may work out better for you if they give you a wider range of options. To not be offered any retirement benefits at all is alarming. I consider that to be a very important part of my compensation. Good luck when you interview!

Nice comparison, MMD! I didn’t know that 403b was created way back in 1958.

You’re welcome Shilpan. Funny I didn’t know that either until I looked it up. But I guess it makes sense!

That is interesting I would not have thought that the 403b was created earlier than. Thanks for summing up the differences I had not known them.

You’re welcome Shane. Who knew? 🙂

I would appreciate an up-date on the maximum contribution rules.

That can certainly be arranged! I will schedule this post for a revision.

Can a 401K be rolled into a 403b?

Yes. Similar to an IRA rollover, you can move your money out of the 401k and then into the 403b without any issues as long as its within the normal 60 window. Or depending on the financial institution that hosts your 403b plan, you might be able to make it even simpler and make a direct transfer.