• How do I bridge the gap between early retirement and age 59 ½?

In previous posts, we’ve reviewed the following non-employment, investment-style options available:

• File for a 72t or “SEPP – Substantially Equal Periodic Payments” to get penalty free portions of your nest egg money out.

• Quit working at age 55 to get your 401k’s and 403b’s, but NOT earlier.

• Withdraw the principal (not the earnings) from your Roth IRA.

Although each of these options is a possibility, they’re not really outstanding because each one involves withdrawing from your retirement accounts sooner than later. As you can guess, the sooner you dip into your accounts, the higher your potential is for running out of money during retirement!

So what else can we do to try to add some low-cost income during early retirement?

Adding a New Alternative – Dividend Stocks:

About a year ago, I read a book called the “The Little Book of Big Dividends” by Charles B. Carlson which sparked an interest in dividend investing. For anyone who doesn’t know: A dividend stock is just a normal stock that happens to pay you money (a dividend) every quarter (every 3 months). How much money? It varies – but the average is usually about 3% per year. The dividend is actually just a cut of the earnings that the company is making.

Once I started getting into blogging, I began to notice that some people REALLY get excited about dividends stocks. Guys, gals, young, old, and even a Ninja!

All-in-all, they were all promoting a lot of the benefits that I believe would be very helpful in our options for early retirement.

Why I Think Dividend Income Would Help You Retire Early:

Here are some of the reasons dividend stock investing might be a useful part of your early retirement strategy:

• You don’t have to be a certain age to start collecting dividend income.

• Dividend income is truly passive – you don’t have to do anything to receive it except hold the stock!

• Dividend income gets taxed at a lower rate than normal; about 15% if you are in the 25% tax bracket.

• There is a great deal of evidence to support that dividend stocks generally do a lot better in the long run than non-dividend stocks (probably because you need earnings to pay dividends).

• Even if the stock price goes down (and it will sometimes), you still get your dividend income.

• Possible inflation protection! If you pick a really good company, they’ll likely increase their dividend payout each year.

The Cons:

• A stock is still a stock. There is never a guarantee that you won’t completely lose all your money.

• Companies can decrease or stop paying dividends anytime they want for any reason.

• Just because a stock pays a dividend doesn’t make it awesome. In fact, some scrupulous stocks issue a really high dividend to bait greedy investors.

How Much Money Will I Need?

Have you ever heard someone say “It takes money to make money”? This is literally true with dividend stocks.

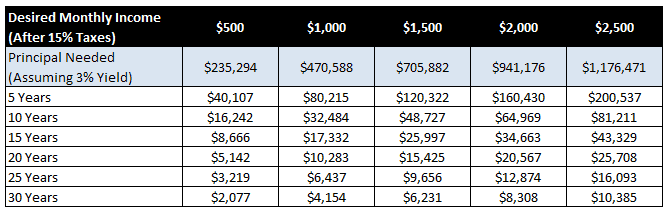

Below is a chart that shows how much money (principal) you’d need to have in your account to deliver the desired after-tax dividend income you’re looking to receive (assuming a 3% dividend yield). To give you an idea of how long it would take to accumulate that much cash, I have also included an estimation of how much you’d need to save each year (assuming an 8% compound return) based on the number of years you’ve got until you wish to retire. (Read vertically down each column).

… Record Screech!!!

“I need to save how much money??? MMD, have you lost your mind? There is no way I can save up that much cash!”

True, the numbers don’t lie. For example, if I’ve got 20 years until I’d like to take an early retirement and I wish to receive $2,000 per month after taxes, then I’d need to save $20,567 per year for the next 20 years. I don’t know about you guys, but I really don’t have that kind of money!!! Especially not when I’m already stretching to max out my 401k and Roth IRA.

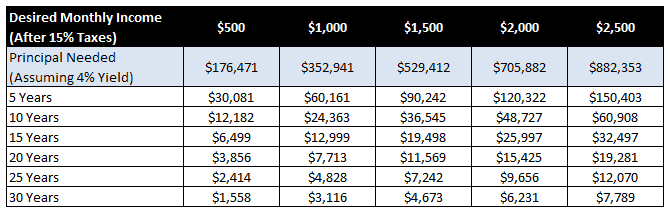

Even with a 4% dividend yield, the estimations slightly improve, but are still quite substantial:

Conclusions:

While dividend income can be a slightly tax favored and a truly passive way to obtain some pre-retirement (or even post-retirement) cash flow, it may require substantially high levels of principal to make it work. Therefore, in my money design, dividend income won’t completely replace my income, but it will play a part as a compliment. For example: I may seek to only receive $500 or $1000 per month in post-tax income even though I really need more than this. Clearly I will need to use dividend income in combination with a few other tricks to maximize my pre 59 ½ income.

Looking at the big picture, I would not suggest that you sacrifice your contributions to your employer retirement plan or IRA for reasons we have discussed in previous posts. However, should you come into a surplus of savings, profit sharing, tax refunds, or happen to be an extremely diligent saver, than perhaps dividend stocks may be your next best alternative – especially if you plan to retire sooner than later!

Readers: What tricks will you use to retire early? Do you have a place for dividend stocks in your retirement plan – whether early or not?

Related Posts:

1) Why I Finally Sold My Apple Stock

2) Is 2 Percent the New Safe Retirement Withdrawal Rate?

3) A Better Way to See If You’ll Run Out of Money During Retirement

Photo Credit: Microsoft Clip Art

I don’t have much experience with dividend stocks, but from what I have seen, the dividends themselves are a nice bonus, but will never make you rich. I think the real value in dividend stocks is that the companies that offer dividends are typically really strong companies and the stocks themselves are very good/valuable. I think I read somewhere that Apple recently offered a dividend of 1% or there about, which came to about $6 per share. Okay sure, if you had 1,000 shares in Apple, that would be $6,000, but if you compare that to the $600,000 or so that you have invested in the company, the dividend is kind of petty.

Definitely the true benefit comes from owning companies that are financially strong! While dividend income will never replace my normal cash flow, I wouldn’t mind getting an extra $500 of truly passive income each month!

Stocks are a nice way to diversify your portfolio. They give dividends as a return, whose purpose is to beat inflation. The purpose of any investment is to beat inflation.

To retire early you have to save more,earn more and invest more. Dividends alone will not be enough to retire early, except you already have lot of money to invest(as you mentioned).

Dividends will be helpful against inflation! There are other tax-advantaged accounts to use first, but I believe this will make a nice alternative to plain old saving and paying full taxes!

The reality of how much you NEED to retire independently (without Soc Sec) is staggering for many people. It’s one of the primary reasons our country is going to be in a serious bind when social security runs out (2037).

At this point, I’m just looking at Social Security as “my allowance” when I retire and leaving the serious income generation to my personal accounts. It is very disappointing how few people think about these matters or have any plan what-so-ever.

I LOVE the charts. The big numbers are really just motivation to save more… I’ve been focusing on cash flow a bit lately… Which do you prefer between rental real estate and dividend stock investing?

I’m leaning towards the dividend investing.

I have yet to try rental real estate. However, there is a lot of good, bad, and ugly out there about it (for example – my father-in-law had a house burn down!). I’m sure with the right tenants it can be a good money maker.

I ran some hypothetical numbers for a house in my neighborhood that was for sale and was unsure how I’d make over $100 per month after all was said and done. That’s a pretty low return considering the risk with the tenants, mortgage, decrease in home value, etc. To contrast, I should within a handful of years be able to generate the same $100 return with some level of guarantee using high-quality, large company dividend stocks. Plus I have more confidence that the principal will increase relative to other stock alternatives.

Ultimately, I have not ruled out rental properties just yet. I’m taking each “revenue stream” one at a time.

Wow – burned down. That’s crazy. There’s something about the liquidity and passivity of dividend stocks that I like too. Since I’m not a big “debt” guy, the OPM factor of the real estate isn’t that big of a deal for me, especially because it lowers the cash flow to near (or below) zero often – and with stress. Good stuff.

Don’t forget, the less you make, the less taxes you need to pay. For instance, in 2012, if you only needed $2500/month then you wouldn’t pay any tax on LTCG or dividends. In future years, it is only 10% if you are in the 15% tax bracket.

Good point! Not only does that further support the use of dividends and capital gains as income during the “bridge period” of early retirement, but it also reduces my projections I provided for principal needed to produce that level of income (I had already factored in the 15% tax as a worst case figure).

It’s crazy to see the amount of money that you need to save to retire comfortably. I don’t see myself being able to save $20,000 a year anytime in the near future. I need to use those numbers as motivation to get on the ball and save more.

Isn’t it? And this is just the money I’d need BEFORE retirement – before I start dipping into my real retirement funds! Ha – looks like I’ll need some more income tricks in addition to dividends if I’m going to be successful at early retirement!

It can be overwhelming thinking how much you’ll need, but when you have motivating factors like your grandparents, it helps you to set your priorities set. Don’t get too caught up in the large number because remember you have other vehicles you can use for saving like IRA’s, Social Security, and dividend stocks. Since you are getting a 403b, does this also mean you will be given a pension? My wife is a teacher and has a 403b and pension. There is a great deal I still have to learn about 403b’s. Hers is setup as an annuity which means she will one day receive fixed amounts of income for the rest of her life. However the fees are likely higher than some of my other investment funds. Do you know how yours will be setup?

I have only recently begun to think about what happens between retiring early and retirement at the normal age (for those who wish to retire early). I think it’s because I have just assumed I will most likely work in some capacity my entire life! I enjoy it. Perhaps that will change as I progress:).

Once you get saving and actively planning your retirement, you start to realize that early retirement may not be entirely out of the realm of possibility. It comes back to how you value your priorities. For me, to work until age 59 and ½ is not part of the plan. But admittedly, it will be more challenging to create a strategy for early retirement.

Wow, I didn’t realize that you needed that much money to make money. Your post was very sobering

Ha! It is very staggering to look at those charts. I’m shooting for about $500 in income, but I’m going to need a lot of side cash! The nice thing to remember is that your principal is still yours to withdraw as well. For example, if your principal is making an 8% return in capital gains, you could take out 2-3% in addition to the dividend income. There’s a lot of ways to make some monthly cash flow!

Investing for cash flow or dividend investing is superior than investing for capital gains because you get actual cash flow in addition to capital gain. However, you need a solid foundation of financial security from fixed income investments to act as a buffer incase the dividends don’t come through as expected, track record notwithstanding…

Thanks Usiere, and welcome to the site! You are right; you don’t want to lose your principal even though it may only be 5 to 15 years in-between your “early retirement” and your 59 and ½ date. Because of this, I have also considered what result bonds may play in achieving the same sort of income.