Did you know that you can use a 72t distribution to get early access to your 401(k) or most any other retirement account before age 59-1/2 ... WITHOUT having to pay a penalty? One of the biggest obstacles we face when we're saving for retirement is the rule that we have to wait so long in order to finally use it. For years, I had a goal to retire early (long before age 60). But I was completely stumped by how I was actually going to be able to take money out of it. I remember being in my young 20's and thinking "what good is using a 401(k) if I have to wait almost 40 years to get my money back out"? Fortunately, not only did I wise up and realize that saving your money in a 401(k) is a hell of deal (when you look at how … [Read more...] about How to Use a 72t Distribution to Get Money Out of Your 401(k) and Retire Early!

early retirement

How to Retire By 55 (or Sooner) on a Salary of $50,000 or Less

If you’ve got dreams of retiring early by age 55 or sooner, then you’ll be very delighted to know: This is a goal that is definitely well within your reach! Believe it or not, our ability to reach financial independence is something that is completely dependent upon our own decisions. It doesn't matter if you're in your 30's, 40's, or any age. If you want to make working optional and retire by age 55, then you just have to be willing to stick to a strategy that will get you there. Forget about the things you think are holding you back. In no place do we see this more than in one of the most popular money-excuses "I don't make enough money to ever retire". You might think that the dream of financial freedom is … [Read more...] about How to Retire By 55 (or Sooner) on a Salary of $50,000 or Less

Our Plan for How to Achieve Financial Freedom – January 2016

Welcome to the first new blog post of the 2016 year – the annual edition of our plan for how to achieve financial independence and retire early (aka F.I.R.E.)! Every year at least once, I take everything I’ve learned about money to date about money management, tax strategies, etc., and then I use that information to improve our financial freedom plan; a creation you will often hear me refer to as my “money design”. Why do I do this? For both my benefit and yours, of course! Obviously I want to achieve financial independence for myself and my family. By finding new strategies and changing up my plan every year, I can make it so that I’ll be able to get there sooner or have more money available to cover my living expenses. My … [Read more...] about Our Plan for How to Achieve Financial Freedom – January 2016

Should I Rollover My 401(k) Into an IRA? – Absolutely!

One of the biggest financial questions working people like you and I face when we change jobs is the question of should I rollover my 401(k) into an IRA or not? It’s a BIG decision, and not one to be taken lightly! The answer could result in missed opportunity of hundreds of thousands of dollars later on down the road. Or worse … make the wrong move and you could end up owing the IRS tens of thousands of dollars in taxes that you’re not prepared to pay for. Yikes!!! I was recently faced with this decision now that I’ve made some new life changes and decided to switch jobs. I’m not going to be shy – my 401(k) balance was pretty substantial! 12 years of saving and earning tons of employee matches results in a pretty healthy … [Read more...] about Should I Rollover My 401(k) Into an IRA? – Absolutely!

Even Though I Want Financial Freedom, I’ve Still Got a Long Ways to Go

Recently when I was asked to do an interview with the Mint website, it got me thinking a lot about how much I want financial freedom and where I’m at so far with my own savings goals. So I decided to try this fun game - You can try it too. Pretend you decided to stop working tomorrow and were going to live off of absolutely nothing else other than your financial assets (and good looks) for the rest of your life. Call it an early retirement. Call it what you will. The magic question would then be: How much money would you be able to pay yourself each month? How Much Money Would You Need? In the past I’ve determined that my magic number to reach financial freedom was somewhere around $5,000 per month. In other words, if … [Read more...] about Even Though I Want Financial Freedom, I’ve Still Got a Long Ways to Go

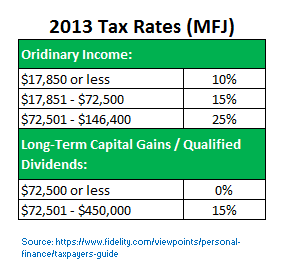

My ULTIMATE Plan for Becoming Financially Independent – December 2013 Update

For weeks I’ve been hinting at it, and at last I’ve finally put it all together! The end of the year and the beginning of the new one is the perfect time to sit down and revise your goals. So what better time than now to publish the latest edition of my ultimate plan for becoming financially independent! This is not a retirement plan you will find anywhere else. How can I make such a bold claim? Because my plan for financial independence does what no other plan on the web does – use real numbers to show just exactly how much money I plan to generate and how I will get there! … [Read more...] about My ULTIMATE Plan for Becoming Financially Independent – December 2013 Update

Tax Deferred vs Taxable Retirement Income Strategies, Take 2 – A Much More Substantial Difference!

One of the great things about running a personal finance blog like mine is that sometimes you think you’re right about something. So you publish it. And then you find out very quickly from your audience that you could have done a much better job! Just before Halloween, I published what started out as my valiant attempt to challenge the belief that investing in a 401k plan is the better of the retirement income strategies when you compare it to a regular taxable stock-based account. In case you haven’t read it yet, please feel free to check it out here. While I thought I had put forth a good effort, I was humbly delighted to receive a number of comments that pointed out several flaws with several of the assumptions I used to reach … [Read more...] about Tax Deferred vs Taxable Retirement Income Strategies, Take 2 – A Much More Substantial Difference!

Tax Deferred vs Taxable Retirement Income Strategies – How Big Are the Differences Really?

Pop quiz: If you could choose to save $10,000 using one of two retirement income strategies, either a 401k or a regular taxable stock brokerage account, which one would you choose? If you said “401k” (or really any other tax deferred savings account), then that’s what I would have expected you to say. Why? Because that’s what conventional financial planning advice teaches us. We all know that if we want to have a solid retirement income, then we need to max out our tax-deferred savings, let it grow, and then worry about paying the taxes later. And why not? Things like 401k’s and IRA’s are perfectly valid strategies for saving as much as you can and building up your nest egg. So you can imagine my hesitation and apprehension as … [Read more...] about Tax Deferred vs Taxable Retirement Income Strategies – How Big Are the Differences Really?