This is not a retirement plan you will find anywhere else. How can I make such a bold claim? Because my plan for financial independence does what no other plan on the web does – use real numbers to show just exactly how much money I plan to generate and how I will get there!

So if you’re tired of people simply talking about early retirement and would like to see the brass-tacks of exactly how one regular guy and his family plan to pull this off, then read on. Even if you can’t use all the strategies that I plan to use, I’m hoping that you’ll still be able to pick up something useful that you can use for your own plan!

And as always, suggestions for improvement are always welcome!

Becoming Financially Independent = My Money Design:

It was November of last year when I first took a crack at this and published the initial draft of my complete plan to achieve financial freedom. The article was a highly detailed road-map of where I planned to put my money and what kind of effect that would have on my finances all the way up to death (or age 100). Even though this post is a big revision of that plan, I still highly encourage you to look through it if you haven’t already. Just like with this article, I spent quite a bit of time tweaking every detail I could think of.

I refer to this “grand-master” or “ultimate” plan for becoming financially independent as my “money design” (hence the name of my blog). One of the mantras I preach here on this site is that every person’s money design is unique to them. Mine may not agree with yours, and your plan might not be a fit for me. But we’d both be crazy not to at least hear each other’s plan out and see what we can gain from each other. Sometimes if when you’re smart enough to shut up and listen, you might just learn something useful.

The Fundamentals of Early Retirement:

Over the years as I’ve plotted and schemed at how a person actually pulls off financial independence, I’ve come to realize that the cornerstone of any viable plan almost always boils down funding to major buckets of money:

- Things that will give you income before age 59-1/2

- Things that will give you income after age 59-1/2

I’ve covered the mechanics of how this sort of thing works in this post here. But to give you a quick summary, it pretty much goes like this:

- If you plan to retire early, you need to have funds or ways of generating income from things where you won’t have to pay a penalty or excessive taxes because you aren’t age 59-1/2 yet (Remember that the IRS age where you get to touch your 401k, IRA, etc)

- Because most of us live on a (somewhat) fixed income, you need to be very strategic about what and where you put your money. Putting too much or too little in one bucket versus the other will greatly affect whether or not you will have enough money to retire early or possibly run out of money later on in life.

So keeping this thought mind, our financial independence plan will be broken up between pre and post age 59-1/2 accounts as well as how we can access them. TONS more on this below.

Timing Target:

Our money design is attempting to have my wife and I reach financial independence 12 years from now. At that time I will be 45 and she will be 48. Though we don’t necessarily have to retire right away, our goal here is to have the option to if we want to.

12 years is a pretty big milestone for my wife and I because that will be the year that she will be eligible to officially retire from her job and receive a full pension with benefits. Obviously this pension income is very important to our financial plan because it will reduce how much income we would need to generate ourselves.

Anticipated Expenses:

After a pretty thorough review of our current and anticipated living expenses, I’ve determined that my wife and I would need about $5,000 minimum per month net (after taxes).

This number is of course dependent on a wide variety of “what if’s”. For example, if we can figure out a way to pay the house off sooner, then we’ll need much less. If the price of oil or healthcare continues to rise about inflation, than we might have some trouble.

Overall I feel like $5K is probably right in the middle – enough to be comfortable but not too crazy.

My Money Design in Its Entirety:

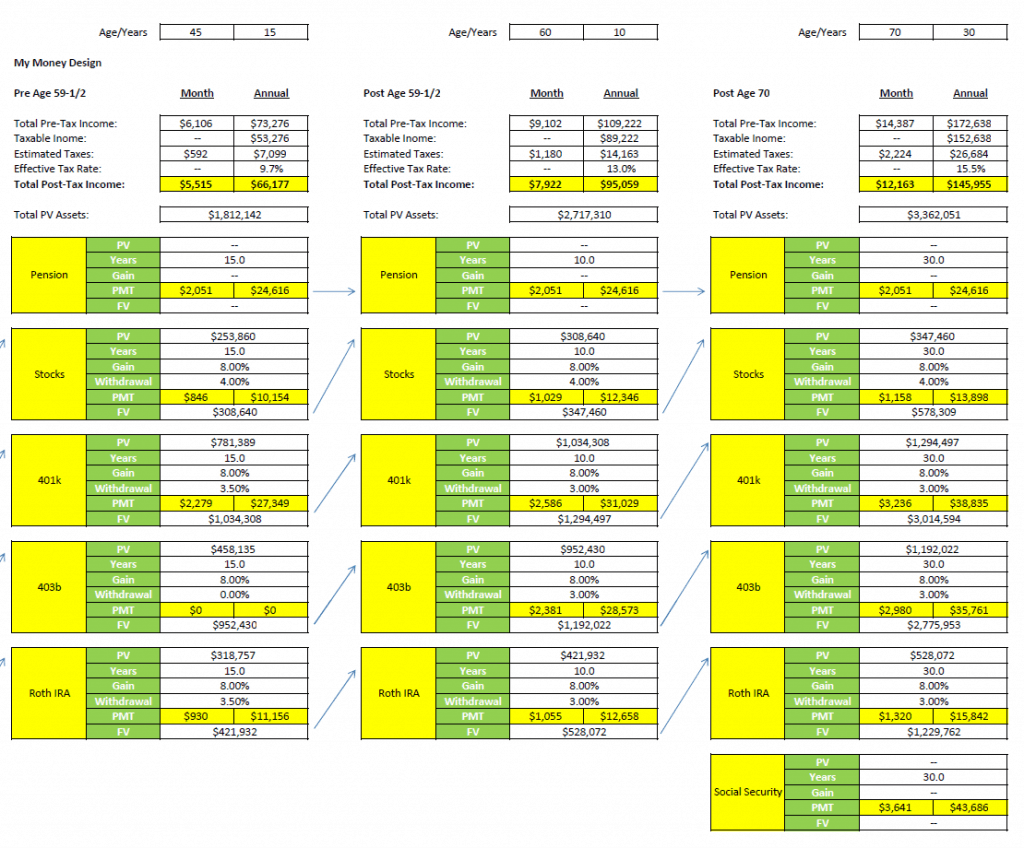

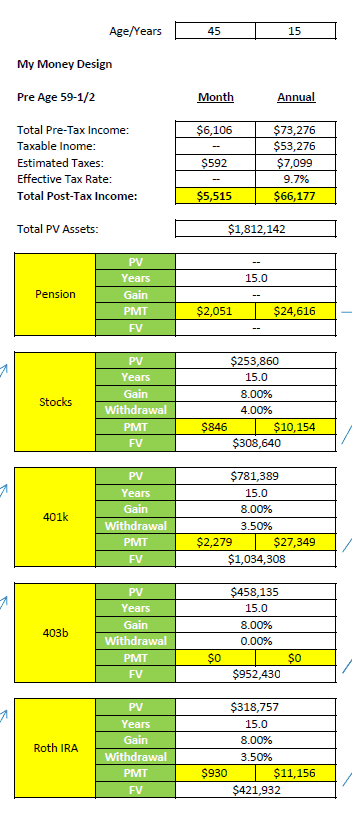

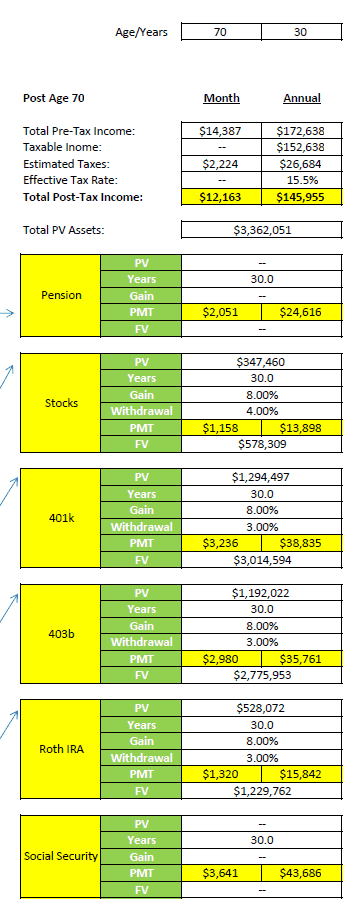

Using the same Excel file I created last year and making a few updates, here is my complete updated plan. I will go through each of those updates in more detail below.

(..Click on the image to see it full size..)

Glossary:

For those of you who are seeing this plan for the first time, allow me to run you through what each of these terms means:

- PV = Present value. This is how much money is in the account at the start of the term.

- Years = The number of years that the account will grow for this segment.

- Gain = Estimated annualized (i.e. compounded) growth rate each year.

- Withdrawal = This is how much we plan to withdraw from the account each year (expressed as a percentage).

- PMT = This is how much money was either put into or out of the account. A negative number means money was added or invested into this account. A positive number means money was paid out or withdrawn for living expenses. The number on the left is the monthly figure and the number on the right is the annual figure.

- FV = Future value. This is how much money is in the account at the end of the term.

Other Important Assumptions:

Just a few other things to point out:

- Yes, this model IS inflation adjusted. For the entire model we have used an average 3% which will simply be subtracted off of each segments earnings.

- We’ll use an average annualized gain of 8% per year for all investments across the board.

- Employer contributions to my 401k will NOT be included since in my case they are susceptible to fluctuate. Besides, by not counting it, those extra earnings will make a nice safety buffer as the years pass on. Look at it as icing on the cake!

- Taxes will be calculated at the end of each segment once the total income from all the individual accounts has been added together. This is because the marginal tax rate will be highly dependent upon how much income we are actually producing. For lack of any better information, we’ll continue to use the marginal 2013 tax system taking into account a standard deduction, personal exemptions, etc.

So now that you’ve seen the whole thing, let’s break it down column by column into bite-size chunks, and look a closer look at the what and why as it applies towards the overall financial strategy.

The Pre-Age 59-1/2 Column:

In terms of early retirement, focusing on this area is one of the most important things you can do. Why? Because under normal conditions you won’t be able to access your traditional retirement accounts (401k, IRA, etc) until after age 59-1/2. Therefore, you will need to carefully craft how and where your financially independent income will come from.

So will we be able to pull it off? Let’s take a closer look at this first column:

PASS! We’re making more than $5,000 per month after taxes, with just a little room to cushion.

So where is that money going to come from? Mainly from 4 sources:

Our pension. As I’ve mentioned once my wife completes a certain minimum number of service credits with her employer, we’ll be eligible to retirement with a full pension. The amount shown in my plan is actually reduced from the full eligible amount based on a “spouse survivor rider” that we would sign up for. In case you don’t know what that it is, it means that if she were to pass away I’d still receive a large portion of that pension for as long as I live.

Our stock funds. Because this account is just a normal taxable brokerage account, I can dip into it all I want whenever I want! My plan here would only be to withdraw a small portion of it (probably just the dividends) for income. Another nice part to including this in my overall strategy is that capital gains and dividends are taxed lower than normal ordinary income, so I could look forward to even lower overall taxes!

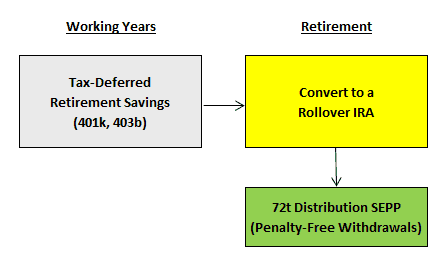

Our 401k using a 72t Distribution. In case you’ve never heard of a 72t distribution, check out my post on it. Basically a 72t distribution allows you to set up a series of substantially equal periodic payments (SEPP’s) that bypass the whole 10% tax penalty for early withdraws. Of course it does involve a little maneuvering first. I’d have to rollover my 401k balance first into a Rollover IRA, and then make the SEPP’s from there.

It’s not too complicated, but it can result in tax penalties if done incorrectly. Again, I’d be sure to only set myself up with something small like 3.5% (less than the recommended 4% rule) so that I don’t exhaust the account too early before the rest of my age 59-1/2 funds kick in.

Our Roth IRA’s. Because the principal contributions can be removed without penalty, this would be another safe place to receive income from as long as I keep the withdraws small (around 3.5% of the whole account balance).

In terms of the 403b account, that one we wouldn’t touch and just allow it to grow without any further contributions (since we’re no longer working).

How Do We Get There?

This is the tricky part.

In order to hit the magnitude of money I’m showing here, we’d have to:

- Max out our 401k ($17,500)

- Max out our 403b ($17,500)

- Max out both of our Roth IRA’s ($11,000 combined)

- Invest heavily in our stock account ($12,000 per year / $1,000 per month)

WOW! That’s A LOT of money! $58K each year?? Where am I going to get all that?

Commit to maxing out our tax-sheltered accounts:

As we proved in this post here comparing taxable and tax-deferred retirement income strategies, you’d have to be a fool to pass up all the potential thousands (perhaps millions) of dollars you could earn just by using your tax-sheltered accounts to their fullest extent.

So with that thought in mind, contributing as much as possible to our 401k, 403b, and Roth IRA’s is a top priority. Even if it involves re-arranging our budget so that we are capable of doing so.

Remember too that I am NOT counting my employer’s contributions to this balance. So in reality as I update this file every year, I should be coming up with even more than what I’m anticipating.

More blog income:

As I talk about often on this site, I’ve been actively working hard to develop an online business of niche money making sites that will result in $1,000 per month or more of income each month. This is something that I plan to hit even harder in 2014, and can hopefully make $1,000 a minimum threshold!

With any of the profits that I generate from those sites as well as this one, my initial plan is to fund my stock brokerage account. Beyond that if I need to use this money to supplement some of our living expenses since we are saving such a high percentage of our income in the tax-sheltered area, then we can pull from this area too.

Because blogging / internet income is so turbulent, I don’t want to make it an official part of my retirement plan. I’d hate to say that I’m going to count on $1,000 per month when suddenly Google rolls out a new algorithm change and all my sites are wiped out. For now I’d rather just funnel the money into something more stable like one of my investment accounts, and then rely on the dividends or capitals gains from them.

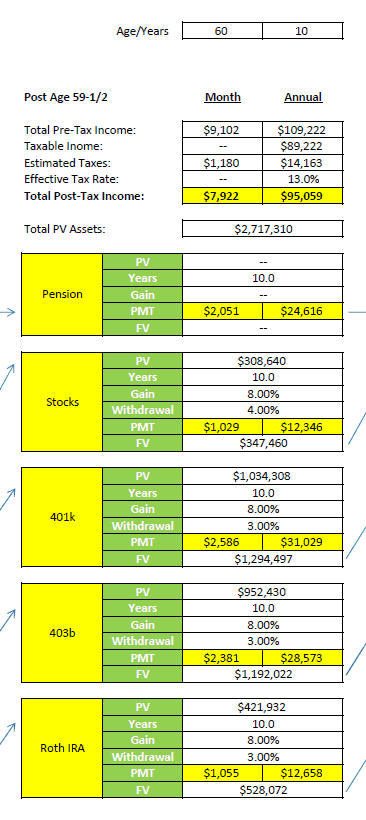

Post-Age 59-1/2 Column:

So now here’s where things change – and for the better.

The IRS defines age 59-1/2 as the age when you can officially start to take withdraws from any of your retirement accounts. So now that we can do this without penalty, does this give us enough retirement income to continue our streak of financial freedom?

PASS! We’re making way more than $5,000 per month.

So how are we doing it?

- Because we didn’t take out too much during the pre-age 59-1/2 years, we’ve given ourselves a good chance to let each of our accounts flourish and grow.

- We’re now drawing from each of our retirement accounts: Pension, 401k, 403b, IRA’s, and stocks. But do we necessarily need to? Read on why to the Post-Age 70 years.

- Again, we’re going to only make very small and conservative withdraws (less than 4%) for our living income.

Will I be happy with an inflation adjusted income of almost $8K after taxes? I’d say so!

Not only should our house be paid off well before then, we should plan to have plenty of other living expenses reduced. That just leaves more money for travel, pursing my interests, and having fun!

Post-Age 70 Column:

Now we should be well into retirement. So what’s our financial independence status look like? Did we run out of money?

PASS! Now we’re making over $12,000 per month!

How are we doing so well? First of all we were very smart and kept our withdraws extremely low. By doing so this allowed the balance of each of our retirement funds the potential to pick up momentum and really grow to new heights.

Realistically this column is not much different than the Post Age 59-1/2 column except that now we are also eligible to start collecting Social Security – yet another income source!

Now before you get all fired up with your opinions about Social Security, let’s review the facts:

- Social Security is not dead yet. It’s still going and probably will until the government decides to make some big sweeping yet-to-be-determined change to it.

- Yes – Social Security at the moment is underfunded at the moment and admits that they will only be able to pay out 75% of what they owe. To me, receiving 75% of what I’m owed is a lot better than 0% (nothing at all).

If you’re interested in seeing how much you and your spouse will be eligible to collect from Social Security some day, the Social Security website has a pretty good resource for figuring this out.

Strategic Tip: Wait as long as possible to start taking out the money! The maximum age you can start making withdraws is age 70. I explored this topic pretty thoroughly in a post I wrote here about how you can use this maximum age and spousal benefits to really max out your Social Security benefits.

What’s Your Money Design?

Hopefully as you read this article you didn’t say to yourself “This plan won’t work for me! I’ll never be able to save up that much money!”

If you did, then you missed the point.

The point of this article wasn’t to tell you exactly how much money you need to save.

The point was to show you that if you also want to become financially independent, then you need A PLAN!

Financial independence isn’t going to happen on its own. If you truly want to be ahead of the curve and control your own destiny, then:

- Draft a plan

- Actually commit to it

- Keep on challenging and improving that plan

It doesn’t matter how or where you start. I don’t care if you try to model my entire plan or take away just one tiny section. My intention with sharing this with you was to show you what I’m going to do in hopes that you can use whatever parts will fit you. These strategies are not mine alone to take to my grave or horde all to myself. Use them as you please to make your life and well-being better off.

Remember that no one is going to be looking out for your money quite like you will.

Readers – So what do think my overall money design? Any areas of concern or improvement? What about you – what are your plans for becoming financially independent? Anyone else planning for an early retirement? What specific actions or strategies will you be using to get there?

Related Posts:

1) Could Early Retirement Planning Be Ruining Me?

2) How Do You Compare to the Average Retirement Savings of Other Americans?

3) There Are No Shortcuts to Early Retirement Planning

Image courtesy of FreeDigitalPhotos.net

Wow, thanks for sharing! I really love the way you’ve thought this out and it really provides an awesome starting point for anyone who likes the idea of early retirement but doesn’t really know how to go about it. The only tiny little nitpick I’d have is the assumed 8% return. Have you tested it with lower returns as well? If so, are you comfortable with those results? I only ask because I think 8% is on the higher end of what we might expect for returns, especially if you include anything other than stocks in your portfolio.

On a side note, I’m probably late on this but I like the new site design. Very clean looking.

Thanks for the compliment on the site redesign! It was time and far overdue …

I had considered using a lower rate of return. In fact in my post from last year I used 6% instead of 8%. BUT I also DIDN’T adjust for inflation in last year’s model. I think that was the big eye opener for me this year. That’s why I decided to roll with 8% this time around. Obviously the situation gets quite a bit less rosy the lower you go, but there are options. For example I could risk a higher withdrawal rate all throughout retirement and I’d likely still come out just fine. The other thing that kind of “pads” this model is the fact that I don’t include my employer 401k contributions as part of the future model. This is actually quite a bit of money and should help to soften any lower than expected return years.

“The point was to show you that if you also want to become financially independent, then you need A PLAN!” I could not agree more MMD! I think that with finances in general you need a plan, but even more so when you’re looking at something like early retirement/financial independence. I love the thoroughness of the plan, though I do have the same question as Matt does in regards to testing it out with a bit lower returns. I believe the 8% increase is likely a good one, but you never know. 🙂

I think I’m late on noticing it as well – love the new design!

You guys are both actually right on time with site redesign. It took place right around Christmas, so you’re probably some of the first regular readers to see it.

I remember reading books and websites about people who had quit their day-job and making money on their own, and it used to get me so excited. But then one day I realized that I wasn’t them. They had a plan and had done a great job executing it. I on the other hand was day-dreaming. I had no plan. And so I changed that …

You see how I responded to Matt, but in general I don’t think 8% is that crazy to still believe in. Some websites are still promoting 10% as the expected average, and that sounds high to me. What gives me some confidence in this figure is to take a look through Vanguard’s fund options, look at the older funds (the ones that have been around longer than 30 years) and see that despite all the big crash of 2008, some ups, and some other notable downs in the economy, a lot of them are still ranking around an 8% return.

WOW! I’m blown away here. This is the most detailed plan I have ever seen. I haven’t even started to save for retirement yet…..One of my goals for the year though is to start investing. I’ve actually been reading a lot of investing books lately trying to self educate myself. I’ve never had a job with a retirement plan (or any benefits) so I’m trying to map out a plan for myself.

This is really awesome though. Congrats to you for being so on top of things!

Thanks Alexa. Now I’m hoping that you’ll be able to take some of this and use it for your own strategy!

My sister is also a freelancer and I was looking into some retirement savings options for her. Have you thought about opening a SEP IRA?

Nice job by the way getting a few books and trying to teach yourself more about investing. That’s exactly where I started. There’s a certain level of confidence and authority that comes with reading a book on any topic, and I think this is a good place to start for anyone who wants to build that foundation of knowledge.

My plan is pretty simple. At the rate that I’m making money from my trading, I figure I’ll have $10 million by the time I’m 40 (12 years). That should be enough for me to do whatever I want.

I’m amazed at how much time and energy you’ve put into this!!! I really hope you can achieve it too! I know for me early retirement will not be an option and I’m OK with that. I mean I’m almost at the age that you guys plan on retiring! And for me I have a long way to go. But like you said every plan/goal is different. Mine is to retire at a comfortable age and still have plenty each month to live a fun life…if that makes any sense. Basically the tried and true, typical retirement.

What’s ironic (as I sit here in the cold bleakness of winter) is that my vision of retirement has warm sunny days spent on the beach. To some degree you’re already living that lifestyle, so you should be proud!

Add me to the list of those who are blown away with how thorough you are here, MMD. That spreadsheet is one of the seven wonders of the world.

I can’t say that I have “designed” exactly where my finances will be many years down the road.. For me, it’s still a stretch to even visualize where I will be 1 year down the road.

Thanks Jeff. That Excel sheet took forever to put together! But I will say it was pretty eye-opening when I linked everything together and saw where the money will go. In past I’d always do simple FV calculations for just my 401k or just my IRA, etc. But never did I combine them together. And I knew that wasn’t accurate. I knew that taking out early withdrawals would have future effects on the same account or other accounts, and I wanted to figure out a way to model all of that.

I’m sure that when you guys really want to be done working or even ease up on saving, you’ll put together some sort of plan. Hopefully you can use some of this in your own plan to gain a few years or a few thousand dollars!

Great post MMD. Have you thought of real estate in your plans? Real estate is a big part of my financial plan.

Actually I have given real estate a great deal of consideration. In many ways I acknowledge that there are probably better opportunities and possibilities for ROI with real estate than you could find with stocks, mutual funds, etc. However the biggest lesson in personal finance is always to only invest in what you understand. And I know that right now I don’t consider myself ready or confident enough to put money into real estate. But I certainly am not going to write it off. I may one day make it a priority to learn more about it.

Wow….congrats on your awesome plan! It looks like you took a lot of time to think things out…..and that’s awesome!

I haven’t taken (or had) the time to write up anything quite like that. Maybe one day. Right now we’re just saving/investing as much as we can and seeing where it takes us!

I’m sure that if you’re saving and investing as much as you can, then you’re light-years ahead of the curve. And that’s a good place to be! Maybe for a post some time you two could quantify where you think all that saving will get you. For example: Will you have enough to consider yourself retired or financially free by age 55? 45? 35? It might be fun and interesting for you guys to see!

It’s great that your wife will qualify for full benefits. That is so helpful and not something freelancers trying to retire early get.

It was a great benefit when we finally logged into her pension plan website and actually read the rules! I suppose if we didn’t have that coming our way, we would just end up either changing our strategy by saving more, going more aggressive after other sources of income, cutting our anticipated expenses, or possibly working longer.

Great plan for FI, I think maxing out all those accounts will be a challenge but that is the fun part about the process. THe spreasheets are simple enough to follow and detailed at the same time.

You seemed to catch what I was going for – simplicity in a plan that most people would think is complicated! Glad to hear I was able to convey this.

This feels so tangible I love it. We like to put charts together regarding our financial outlook and while we’re not as finance savvy regarding retirement this is giving me all kinds of ideas on how to start! Thank you.

Tangible is good! That means its believable and therefore achievable.

Please do take away as much as you can from this plan. The exchange of ideas is what sharing this plan was all about.

Wow! What a plan. I hope I can be that detailed with my own money design. Having the option to retire in your mid to late 40’s is awesome! Good luck!

Thanks! We’ve got our fingers crossed that everything goes according to plan.

Wow, I took a few days off and you have a whole new design for the site. Love it!

I almost got a little teary eyed in a good way from reading your plan. I used to see things like this and think it was impossible, but now I am convinced that anyone can reach financial independence, especially if you avoid stupid debt. I am not this detailed, but I have run many scenarios of how our financial independence will look. We also will be able to take my husband’s pension in about 12 years. With that plus our rental income, we should be in good shape until 59.5.

Love the new site design!

Your thought process around your overall financial plan is in great shape. We are also planning to use mainly dividends to get there, but we’ll be adding a condo rental sometime this year also. Effectively, that will mean I’ve hit my passive income target of about $50k/yr for the year, but now we’ll have more debt given the upcoming purchase of the house. I figure in about 7-8 years, the total debt should be paid off, the passive income would have grown to close to $75k/yr and we’ll manage on that till withdrawal from retirement accounts kick it. In the meantime, I’ll be maxing out 401k’s.

This retirement planning/fi thing is so much fun!

Thanks Integrator. I’d say the Genesis theme was a good choice!

That’s exciting to hear that you’ll be exercising the rental income as well as the dividend payments for your early retirement. You’ll be dipping into two very powerful income streams!

I hope those are tears of joy when you read through the plan!

I’ve got to agree. What used to seem like an impossible task of retiring before 59-1/2 now seems so 100% possible! It all just comes back to how bad you want it and what you’re willing to do to get there. I agree that rental income will make a fine supplement to your income throughout your pre-retired years.

This is a very well though out plan. I am constantly impressed with how thorough, organized and intuitive your blog posts are. I might need to start including some charts and graphs on some of my future blog posts. 🙂

Thank you for the compliment! Hopefully there are elements to this plan that you can use to your benefit. What sort of strategies do you have for your own retirement plan?

Graphs and pictures are very nice for breaking up long text heavy blog posts. I think the trick is just not to go too overboard!