Every year at least once, I take everything I’ve learned about money to date about money management, tax strategies, etc., and then I use that information to improve our financial freedom plan; a creation you will often hear me refer to as my “money design”.

Why do I do this? For both my benefit and yours, of course!

Obviously I want to achieve financial independence for myself and my family. By finding new strategies and changing up my plan every year, I can make it so that I’ll be able to get there sooner or have more money available to cover my living expenses.

My hope is that you’ll be able to learn something from everything I share here, and then apply it to your own personal financial freedom plan. Ultimately I’d like to help everyone benefit and improve their finances as much as possible.

A BIG Year of Changes:

SO what are the things that happened this year that will change my plan?

- I learned about the Backdoor Roth IRA Conversion; yet another powerful tool that will give us early access to our money before age 59-1/2!

- I changed jobs and rolled over my old 401(k) into a traditional IRA.

- We moved to a new house. In doing so, we had to drain our taxable investment account to come up with enough money to finance the down payment. Once our old house sells, I’ll then have the opportunity to move some of the proceeds back into our taxable savings.

And then there was the biggest change of all: Battling cancer for the first half of the year. Finding out you have a life threatening disease forces you to think about things a little bit differently. You can read more about my perspective in this post here.

A good example of this is my mention of us moving to our new house. While it may not make sense to some people for us to drain our taxable savings to make this happen, I can tell you that the qualitative benefit from us doing so is off the charts! We’re much happier in our new neighborhood living only mere minutes away from my wife’s work and the children’s schools, friends, etc. Remember: It’s not always about the money.

Different From Other Early Retirement Plans:

Before we get to my financial freedom plan, one thing I have to point out about our situation is that it’s a little different than ones you might find from other early retirement / financial independence bloggers.

Primarily, it’s this: Our plan is earmarked to a date; not a specific amount of money.

Let me explain …

Here’s how OTHER blogger’s plans usually go:

- Decide on some magic number they need to get to in order to retire (example: 25 times their anticipated income).

- Save up a bunch of money as quickly as possible to get there.

Here’s how our plan is different:

For those of you who don’t know, my wife will soon qualify for a pension! She is a public school teacher and qualifies for a handsome sum of money every month for the rest of her life after earning a minimum 30 years of service credits. Given how many years she already has in AND the fact that we prepaid 5 years, she’s on track to qualify as early as the year 2026!

(I’ll be age 46 and she’ll be age 48. That’s one more year than I predicted last year. I noticed I made a mistake last time. When I re-checked her account, I found out she wouldn’t have full credits until 2026.)

That means, to some degree, we have golden handcuffs on our wrists. Walk away early, and we give up a lifetime of payments that could value as much $4.7 million (using the assumptions below that we’ll get to in a minute)!

Definitely don’t want to do that!

So on that important point, my wife has a minimum of 10 years to go. I don’t really want to retire before she does, and so that gives the two us at least 10 more years to plan, save, and structure our savings in a way that will give us the most amount of passive income imaginable.

Another VERY important point to consider: Both of our children will be in college by 2026, and so retiring too early may not make the most sense if we want to help them pay for their education and avoid taking on massive amounts of debt.

So now that you understand all of that, let’s go over the latest version of our money design and see exactly how we’re going to pull this plan off!

Our Early Retirement / Financial Freedom Plan:

Here it is! Here are the details of exactly how we plan to be completely financial independent by 2026:

I. Work and save for the next 10 years.

During this time:

- My wife will build up her service credit to receive her full pension.

- We’ll be maxing out our 401k, 403b, and two Roth IRA’s every year.

- I’ll also be using any money I make from blogging to max out a SEP IRA.

- Anything extra we have to save will go into our taxable investment account. It’s important to note here that I plan to give priority to our tax-sheltered accounts over our taxable investment accounts. I know a significant number of other early retirement bloggers like to build up their taxable savings to help bridge the years leading up to age 59-1/2. BUT as you’ll see, I have other systems in place to take care of this. My aversion to over-using taxable accounts is that at this time my wife and I are in the 28% tax bracket, meaning that all the money we’d potentially save in there would first be subject to 28% taxes before we could even save it. In the strategy to follow, I’ll be paying a lot less than that in taxes!

II. In ten years when I’m 46 years old, my wife and I can finally retire (if we want)!

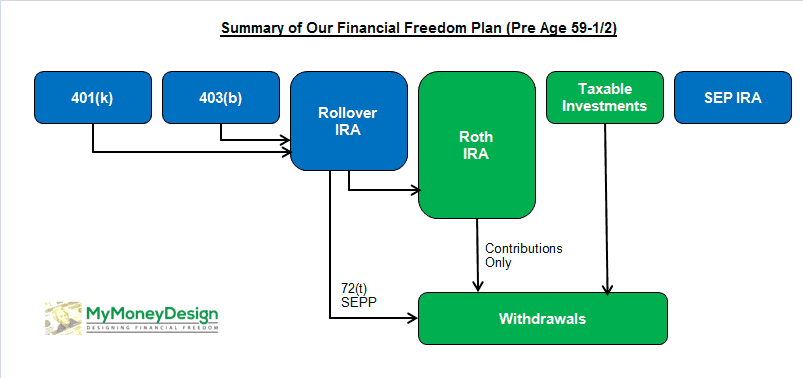

When we do, we’ll rollover our whole 401(k) and 403(b) balances into our Rollover (traditional) IRA. That way, the money will be in accounts that WE control (not our employers). Plus, our fees should be a whole lot less.

III. Early Retirement Years 1-5:

In the beginning, our target net inflation adjusted income will be approximately $72,000. That’s $6,000 per month; a pretty generous amount to enjoy!

To fund this, we will:

- Start collecting my wife’s pension ($24,616). This income will be taxable.

- Start a 72t taking out a small amount from our Rollover IRA ($20,000). Per the 72t rules, I’ll have to continue taking out this same exact amount for the next 15 years until I turn age 59-1/2. This income will also be taxable.

- Withdraw a small amount of the principal contributions from our Roth IRA’s ($26,000). Remember that withdrawing the contributions, NOT the earnings, are penalty-free / tax-free before age 59-1/2. Now you see why I’m contributing and converting my money over to that Roth IRA!

- Also use our taxable investments / savings to bring up the difference (~$12,000). Remember that if this comes from capital gains and dividends at or below the 15% tax bracket, you pay $0 in taxes!

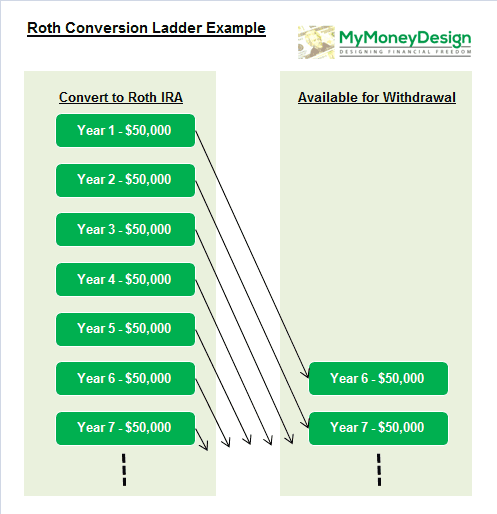

- Planning ahead for retirement Year 6 and beyond, I will start at Year 1 converting a decent chunk (~$50,000) of my Rollover IRA to a Roth IRA using the Backdoor Roth IRA strategy. These conversions are also taxable.

- Important notes:

- If I’ve done my math correctly, after a standard deduction ($12,600) and two personal exemptions ($4,000 each), all of these taxable withdrawals should in no way exceed the (inflation adjusted) 15% tax bracket (less than $74,900). That means I’m paying WAY LESS in taxes on all of this money than I would be right now!

- In total, all of these withdrawals that I will be using for living expenses will not exceed 3.5% of our total savings. According to FireCALC, this is an extremely safe withdrawal rate.

- After a quick check with Vanguard, you are allowed to do both a 72t and Roth IRA conversion within the same year.

IV. Early Retirement Years 6-15:

I will continue to target an inflation adjusted net income of ~$72,000 using the following:

- Continue to collect my wife’s pension ($24,616 taxable).

- Continue making the same 72t withdrawals from our Rollover IRA per the 72t rules ($20,000 taxable).

- Using a Backdoor Roth IRA Ladder strategy, NOW each of those funds I converted in Year 1+ from my Rollover IRA to a Roth IRA will be treated like a contribution, and becomes eligible for a tax free withdraw! The new plan will be to take out $38,000 tax-free.

- Since I can now take out more money from my Roth, there will be no need to dip into my taxable savings. So I’ll stop making withdrawals.

- Planning ahead for retirement years 15+, I will continue to convert more of my tax-sheltered accounts (Rollover IRA, SEP IRA) to a Roth IRA using the Backdoor Roth IRA strategy (~$70,000 each year). Again, the exact amount that I convert plus all of my other taxable income shall not exceed the 15% tax bracket.

V. After Age 59-1/2:

At retirement year 15, I’ll be age 60. That’s when all of my retirement accounts will suddenly unlock and become penalty-free for withdrawals. So when this happens, in the years to follow, we’ll:

- Continue receiving our pension.

- Stop taking my 72t distribution – because I won’t need them any more! (And after age 59-1/2 I won’t have to.)

- Increase my tax-free Roth withdrawals.

- Continue to convert our tax-sheltered accounts over to our Roth IRA up to the 15% tax bracket. Doing this not only help provide us with tax-free income in the future, but it will also help decrease our RMD’s and make estate planning much easier for our heirs.

VI. Social Security:

Around age 62, my wife and I finally qualify for Social Security distributions. Depending on where we’re at financially, we may start receiving those distributions OR wait delay them so we maximize the returns. There are different schools of thought on which technique is better, and honestly because of the uncertainty of Social Security as a whole, I don’t put too much stock in trying to figure out which one is the better route.

One thing I do know: Whether or not I receive Social Security isn’t going to be a make-it-or-break-it case for our early retirement plan. Right now we’re treating it as “extra” money – financial icing on the cake!

Summary:

Putting all of this together, I’ve got a MONSTER Excel spreadsheet that calculates each year of each type of account. It’s far too massive and cumbersome to show you here.

So to illustrate our plan better, here’s a summary of what our withdrawals (red line) and net assets (blue line) should look like over time. Year 1 = our first year of early retirement.

Assumptions:

For the technically inclined, here are the assumptions that are being built into our model:

- As I mentioned above, this plan is inflation adjusted at a rate of 3% per year.

- Our anticipated annual growth rate for our investments is 7% nominal (that’s a real rate of 4% after inflation). Even though according to NYU the average annualized rate of return is really closer to 10% for the S&P 500, I like to use lower returns in my model as a “safety buffer”.

- Employer contributions are NOT included in our model. I do this on purpose as another safety buffer.

- Our model goes until we are 100 years old.

What Will We Do When We Retire?

Ironically, … probably work!

… Wait, what??? Isn’t this supposed to be a post about early retirement??? What’s going on?

You have to understand … all along this whole money design plan has never really been about the actual act of being “retired”. In fact, I sometimes cringe to use the word in my writing.

This plan is all about choices. It’s about finding financial freedom. Once you have enough money to do whatever you want, then you really can DO WHATEVER YOU WANT!

- I could continue to work at the same job if I wanted.

- I could take a different job.

- I could start my own company.

- I could spend all day with my family.

- I could travel.

- I could strum my guitar all day if that’s what pleased me …

Just imagine all the things you could do if money was not an issue!

That’s really what this plan is all about. It’s about giving yourself the opportunities you never thought you had.

It’s about removing the fear of losing a job and having stay handcuffed to it until the day you die.

It’s about giving yourself the upper hand.

Money really does provide an element of power. But unlike what most people would have you believe, it’s not all evil. That “power” can actually be used for many good things.

It can be put to work for you. It can afford you the chance to do things you never would have done before. It can buy back your time.

That’s what this plan is really all about.

Readers – What do you think of this year’s edition of our early retirement, financial freedom plan? Is there anything you’d change? Is there anything in this plan that you think you might use or integrate into your own plan? Please share!

Featured image courtesy of Pictures of Money | Flickr

Solid plan, MMD. You’ve really got everything covered from all angles. I myself am planning to make use of the Backdoor Roth Conversion strategy to help supplement my main plan of attack, a monster divided stock portfolio which I plan to live off of!

Best to you and your wife, and Happy New Year!

Sincerely,

ARB–Angry Retail Banker

Thanks ARB. Yes, I hope that backdoor Roth strategy sticks around for a long time. I keep hearing every now and again about laws that might possibly close the loop on it. Let’s hope none of them ever come to fruition.

Wow – very in depth. I didn’t see you discuss mandatory withdrawals at 70.5. Looks like you’ll have some large ones, right? Which would trigger big taxes. I’m not an expert on it, but have started looking into for older relatives.

Good point. I did not address RMD’s at all. Though, with enough conversions to a Roth through the backdoor strategy, there may not be hardly anything left in my “traditional” accounts to make much of a difference. With a Roth, I won’t have to make RMD’s.

I like that saving and income chart over then next 10+ years! Where there’s a plan, there’s a way right?

I also believe one should shoot to retire by a certain AGE, not by a certain financial figure since there’s always one more dollar to make, but not one minute to create.

I’m glad you survived your cancer!!!!

Best and HNY!

Sam

Thanks Sam! I agree. Earmarking our plan for the year we become eligible for my wife’s pension is very significant. Even though we might have enough money to retire before then, it makes more sense to take advantage of this benefit and then just try to build it up as much as possible in the meantime.

Well thought out and definitely doable. My plan involves building a passive income stream to replace my job’s income by investing in income producing assets today. I am well on my way and I plan on beating my goal by 1 year. It will be a huge day when I finally declare financial freedom. Good luck on your strategy and plans.

Regards,

Deets

Thanks Deets, and congrats on moving things up by 1 year.

This seems like a spot on plan and you could even get by with less if you manage to pay off the house early. The only concern I see for the future is if prices go up too much and wages stay stagnant. Also if for some reason the investments don’t pay dividends it could change things for my plan to FIRE. Good luck

Thanks EL. Fortunately this plan should provide much more money than we actually need, and that should help act as yet another safety buffer.

That is a solid plan, MMD. I just hope that you have FIRE! And I know that you can because you are financially responsible and very committed to any plan. Happy New Year!

Thanks Cody. I’m looking forward to it by 2026!

I am amazed with your plan MMD. Knowing that you can retire at the age of 46 years is really unbelievably great! You still plan to work. That is really being financially responsible and having financial freedom. Good luck!

Thanks Jamie. Hopefully I will still learn some more tricks yet, and can make this plan even better in the years to come.

Will bookmark this. This could come in handy later when i couldn’t sleep. At least it could get me into planning several things before I sleep.

Thanks Randolph. Hopefully this post does something more for you than put you to sleep. 🙂

Amazing and detailed plan. I don’t think I’ve ever seen more thought put into a retirement plan laid out on a blog like this before. Pretty cool!

Glad to hear your kicked your cancer’s butt!!! I didn’t see it mentioned here, but I think in your specific situation I would give good consideration to life insurance and the proper amount to cover yourself with so that the plan can work even if things take a turn for the worse. This goes double since you mentioned college 🙂

We are in very similar situations in terms of age, net assets (per your graphs), etc. I am planning to get off the train a bit earlier than you and likely drop back to part-time work maybe in < 5 years time. I think I have our expenses adjusted where we can live on ~$36,000 or less a year (just about half of your $72K income). This will give me more time to spend with the kids before they are off to college or wherever their lives take them. Once they are out of the house, then I can look at maybe picking up additional work if I'm so inclined.

Good luck with the plan – it should really work well for you especially if you revisit it every year or two and update it according to how things in your life unfold.

Thanks Derek! Wow, your plan sounds pretty incredible as well. It’s pretty amazing how many different ways there are to approach this situation and win!

Oof, dizzying! At least you’ve worked out all of your options, and it sounds like you have a lot of them!

I recently found out we’re not quite as bad off as I thought we were, assuming I go for retirement at 67. We’re still far from where I’d want, but if we can get serious starting next year — or sooner if we can get Tim’s disability appeal squared away — we should be able to retire somewhat comfortably. Especially if we can get a couple of rental properties squared away in the next couple of decades.

Congrats on finding out you can get there sooner than you originally figured; especially considering the situation. Good luck working on those rentals!

I have been taking care of my retirement savings by investing and increase any means just like maximizing mg contribution to any government-related social security. Based on my calculation, I can retire by the age of 50 years with the right amount of savings. But, I’d totally would go for another 5 years more to have a better retirement life.

And if that was your choice, that would be fine. I don’t think anyone should be concerned about retiring as soon as possible. Though it would be nice to say you retired in your 40’s (or whatever), the real reward is when you retire and can really enjoy your fortune. And if that means another 5 years, then go for it.

I see you want to take 72t withdrawals of a specified amount ($20,000). The withdrawals rate is calculated based on account value and a distribution factor (using one of three IRS methods). You can’t just say “I want to take 20k per year.” You would have to use a calculator to back into the amount you want annually and siphon the starting value into a separate IRA to be used for the 72t plan only. Otherwise your full balance is used in the calculation and could end up being more than you anticipated and cost more in taxes than you want.

Good point. But the other way (and what I had intended on using) was adjusting the interest rate used for the calculation. As you probably already know, you’re allowed to use any reasonable rate up to 120% of the Federal Mid Term rate. https://www.bankrate.com/calculators/retirement/72-t-distribution-calculator.aspx

Backdoor Roths are a blessing. I’ve been using these for my wife and I the past few years. I’m glad you found out about them and that you will be using them.

Thanks. I’m just hoping they don’t change the laws in the upcoming future, and the opportunity gets away.

I love your plan and will probably refer back to this post as we get nearer to retirement! Jim is also in education and will get a pension in about 9 more years. Yes, it is golden handcuffs, but he enjoys his job so it’s not a sacrifice to put in the time for a lifetime of monthly income. I also will probably work until he is done as well. You guys are younger than us but it looks like we are on a pretty similar exit strategy.

Thanks Kim. Yes, those teacher pensions certainly are golden handcuffs. But like your husband, my wife is pretty content with her job and not completely in a rush to leave it. I don’t really see a lot of point to exiting before she does, and so I’m happy to continue working, earning, and saving more money to make FIRE day even sweeter!

Late blummer and new comer. Just read your book “Save Better”. It was very inspiring and relevant. I’m 49 y/o and I have only had a TSP account since 2010. I work at the VA and they match up to 5% , which I have taken advantage of but I need to step it up.

Hi Calvin, welcome to the site! I’m very glad to hear you enjoyed my book! I’m working on a new one right now, and it should be out soon.

Hopefully you’re taking full advantage of that 5% match. That’s not too bad!

WOW Such a Awesome Article thanks for sharing Amigo ! Keep it Up 🙂