It’s a BIG decision, and not one to be taken lightly! The answer could result in missed opportunity of hundreds of thousands of dollars later on down the road.

Or worse … make the wrong move and you could end up owing the IRS tens of thousands of dollars in taxes that you’re not prepared to pay for. Yikes!!!

I was recently faced with this decision now that I’ve made some new life changes and decided to switch jobs.

I’m not going to be shy – my 401(k) balance was pretty substantial! 12 years of saving and earning tons of employee matches results in a pretty healthy dose of 6-figures.

As I’ve emphasized before, with large amounts of capital like this, you don’t want to beat around the bush or procrastinate on this decision. Your money can be used to make you more money! That’s the beauty of compounding returns!

So when I weighed my options and asked myself if I should rollover my 401(k) into an IRA, all indicators came back a resounding green light YES!

In this post, I’ll explain why and how you can use this thought process to draw your own conclusions if you’re ever faced with a similar opportunity to do a 401(k) to IRA rollover.

Quick Review – What to Do With Your 401(k)?

Before we get into the nitty-gritty of why an IRA rollover is a good idea, let’s first review exactly what your options are for your 401(k) when you quit your job.

About a week after my last day at work, I received a letter explaining that I had the following options:

- Leave my money right where it is in the (old) company’s 401(k)

- Transfer my money out to the new company’s 401(k).

- Transfer my money out to another financial institution (this is a 401(k) to IRA rollover, and the option that I took!)

- Cash out your 401(k).

We’ll talk more about options 1-3 below.

Note if you’re under age 59-1/2 that you NEVER want to take option 4 unless you’ve fallen on really, really, really hard times financially. (And even then, there are better options you can take.)

Why is that a bad choice? Not only are you destroying your retirement nest egg, but you’ll also have to pay both taxes and a 10% penalty for the balance you withdraw. Think about it: For every $100,000, you’ll probably owe 25% in taxes ($25,000) and a 10% penalty ($10,000). That pretty much wipes out all your earnings!

Believe it or not, according to a report from the Transamerica Center for Retirement Studies, 25% of people took this route.

Short version – don’t do it!

Why You Should Rollover Your 401(k) Into an IRA:

As I mentioned, I choose option 3 (to rollover my 401(k) into an IRA with a private institution) over keeping it in the old plan or transferring it to my new company’s 401(k) plan for a number of good reasons.

Here are a few things to consider.

1. IRA Fees Are Less Than 401(k) Fees:

This one is the BIG one!

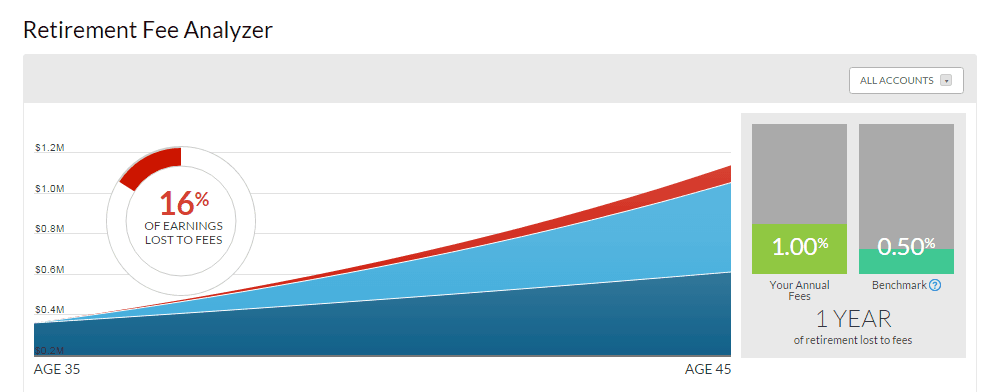

Most people know that when you pick your funds for your 401(k), they aren’t free. There are annual expenses that come along with owning them. Usually these costs are depicted as a percentage called an “expense ratio”. For example, an expense ratio of 0.5% means every year you’re paying $500 for every $10,000 you have invested into that fund. Those costs are paid to the mutual fund company that operates the fund, and they pay for stuff like the fund manager, transactions within the fund, etc.

Well, in case you didn’t know, the fun doesn’t end there. There’s a whole second group of more elusive costs you pay for when you have a 401(k) called “administrative expenses”. This is an entirely separate group of costs for things like operating the 401(k) fund, book-keeping, etc. According to Bankrate, these administrative fees can sometimes range up from 0.36 percent to 1.71 percent.

As you can guess, once you’re up there in the six-digital balances, these cumulative “extra fees” of 1 and 2% can really start to add up. This will seriously erode the money that should be going into your pocket!

To give you an idea, Personal Capital’s free account has a tool that estimates how much money you’ll lose over time as a result of these 401(k) fees over the next few decades. In just 10 years it estimates that I’ll lose as much as $85,384! OUCH!

So how can we avoid these stupid costs? Simple … don’t keep your money in a 401(k). Take your retirement savings and roll it over into an IRA.

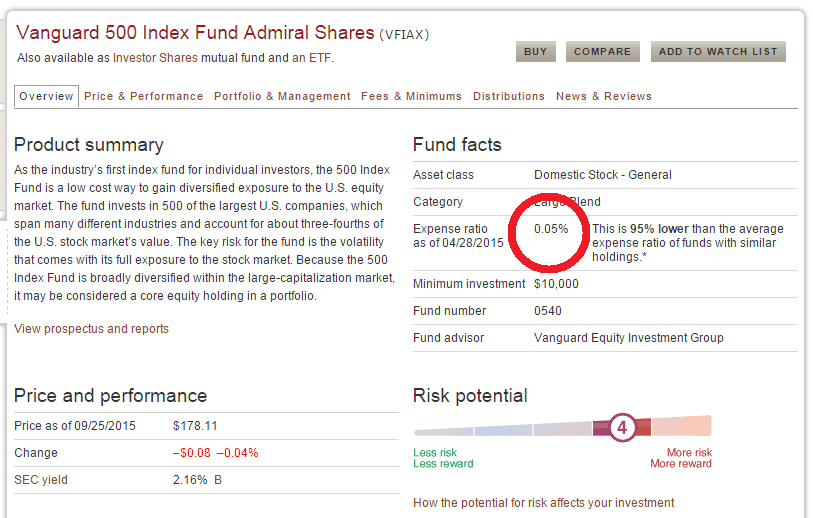

Check this out. Vanguard charges an expense ratio of 0.17% for a simple stock market index fund. If you’re moving over more than $10,000, then you qualify for their special “Admiral Shares” and the cost drops down ever lower to 0.05%. That’s a measly $50 for every $100,000 you’ve got invested.

And how much are the administrative fees? – NOTHING! There are no administrative fees with an IRA!

All this just equals more money in your pocket!

2. IRA’s Give You More Fund Choices:

If your 401(k) was anything like my old plan, then it probably only gave you about 20 or so somewhat –blah- choices to invest in.

I say –blah- because often you hear the complaint that the funds they offer 1) don’t perform that well and 2) have excessively high expense ratios.

While most of the time I’d recommend just going for the stock market index fund and calling it a day, for more advanced investors, there can be some great benefit to paying attention to diversifying your asset allocation. Check out this post we did here showing how a good asset allocation could have helped stabilize your loses during the whole 2008 Great Recession.

By doing a 401(k) to IRA rollover, you open the door to virtually every asset available to purchase from that financial institution. In my case, pretty much anything Vanguard has to offer, I could invest in.

That means if I’d like to get fancy with more sector specific stocks like health care or technology, I can!

3. IRA’s Have More Accessibility for Early Retirement:

This last point is particularly important for me.

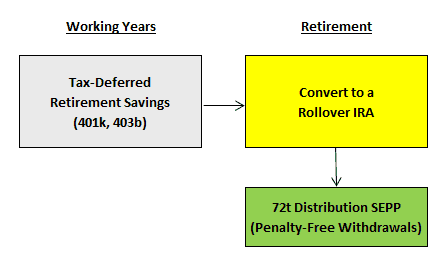

If you’ve ever followed my plan to retire by age 45, then you’d know that an IRA rollover was in the works all along.

Why? Because in order to retire early I will be using either a 72t or Backdoor Roth IRA Ladder to gain early access to my money. Both strategies will allow me to start taking early withdraws from my retirement savings before age 59-1/2 without having to pay any penalties.

Unfortunately with a 401(k), you can’t use these strategies. This is because when you have your money in a 401(k), your plan administrator (i.e. your employer) has to grant you access to these types of withdraws. So if they deny you, you’re out of luck.

Though you may not think that’s the case at your work, you should definitely find out. I was very surprised at my last job when I found out they did not allow early withdraws or loans from your 401(k).

By rolling over the balance to an IRA, YOU hold all the power (as you should)! You can then grant yourself the ability to use one of these early access strategies if you so wish.

For early retirement seekers, that’s a huge advantage.

A Warning About Rollovers Into a ROTH:

Before we wrap things up, I just wanted to make one last point about 401(k) to IRA rollovers and something to watch out for.

When rolling over your retirement savings, the financial institution will ask you if you’d like to rollover to a Roth IRA instead of a traditional IRA. DO NOT do this unless you fully understand what you’re about to get yourself into.

When you convert from a traditional 401(k) to a Roth IRA, you move from a pre-tax to a post-tax type of account. Translation: You’ll owe a ton of money in taxes!

How much? Potentially $25,000 for every $100,000 in savings you roll over. YIKES!!!

So unless you are prepared to cover that enormous tax bill, make sure you go from a traditional 401(k) to a traditional IRA. When you do that, no taxes whatsoever are due.

Take Control of Your Money:

In summary, if you’re asking should I rollover my 401(k) to an IRA, for me the answer is absolutely yes!

Control over your life savings is an absolute must in my book. This is one thing you seriously don’t want to procrastinate on or leave in the hands of someone else. Put your money to work in the most efficient way! Even though it may seem like a chore to make the 401(k) to IRA rollover happen, its really a lot more simple than you think. Just pick up the phone or hop on the computer, and make it happen.

As we saw above, those 10 minutes or so it might take you could be worth tens or even hundreds of thousands of compounded dollars for retirement later on in the years to come.

That’s quite a nice return on investment if I ever saw one, and definitely worth your time!

Readers – How many of you have done a 401(k) to IRA rollover? What were the reasons that made you do it (or not do it)?

Featured image courtesy of zack Mccarthy | Flickr

MMD, my mother is 56 years old, not yet 59 1/2, she wish to leave the money in the 401(k). I think if I am in this age window and tap an IRA, I would be subject to penalty in addition to income taxes on the withdrawal unless I submit to a Substantially Equal Periodic Payment arrangement, in which it dictates how much I can take each year and forces me to take it for a minimum of five years.

For some folks, it may be easier to just leave the 401k alone and let it be. The losses in administrative fees may not be enough to really make a difference.

That is true that there would be some cons to using a 72t/SEPP or Backdoor Roth IRA Ladder. But it’s a small price to pay for all those years of tax-free saving you got to take advantage of.

I’m not surprised that a quarter of people cash out when leaving a job. I’m sure it seems like a windfall but that actually is your money that’s being thrown away. We’ve never had to roll over a 401K but I’d put it all with Vanguard if we ever have that choice.

Unfortunately that figure doesn’t really surprise me either. Too often people think too short-sided when it comes to large sums of money.

Amen to Vanguard! That’s exactly where it all went.

Two words: Yes – Vanguard. I have not done a 401k to IRA rollover. Luckily my 401k is currently with Vanguard, but when I eventually leave this job I definitely will roll over to an IRA.

That must be pretty cool having your 401k with Vanguard. Your money is literally in the best possible place it can be 🙂

One aspect you miss — if you rollover a traditional 401k into a traditional IRA, it makes backdoor Roth IRAs while you’re still working more difficult, if not impossible. And not all 401ks have bad expenses….mine is all Vanguard funds with low expense ratios.

I don’t quite follow – what about rolling over from a 401k to a traditional IRA while you work makes it impossible? You are allowed to convert your money from a traditional IRA to Roth IRA as you wish as long as you can handle the taxes. Can you explain your scenario?

I agree that not all 401k plans have bad expenses; Vanguard being an exception to the rule. But I’m afraid if you look around on the Internet you’ll find that a lot of people are unsatisfied with their plans and the administrative fees.

This Bogleheads wiki link explains it best: https://www.bogleheads.org/wiki/Backdoor_Roth_IRA

“If you have any other (non-Roth) IRAs, the taxable portion of any conversion you make is prorated over all your IRAs; you cannot convert just the non-deductible amount. In order to benefit from the backdoor, you must either convert your other IRAs as well (which may not be a good idea, as you are usually in a high tax bracket if you need to use the backdoor), or else transfer your deductible IRA contributions to an employer plan such as a 401(k) (which may cost you if the 401(k) has poor investment options).

For example, suppose you have just created a new traditional IRA, and you add $5,000 of non-deductible contributions to it. You’d like to convert this IRA to a Roth IRA via the backdoor.

Suppose you also have another traditional IRA with $15,000 in deductible pre-tax contributions. These contributions may have come from a 401(k) rollover, or from standard deductible traditional IRA contributions from earlier years when you were eligible to make deductible contributions to a traditional IRA.

To compute the tax due, you would need to take $5,000 and divide it by $20,000 (the total value of all your traditional IRAs), to get the percentage of the conversion that will be tax-free. In this case, it is 25%. Therefore, the other 75% of your conversion–in this case, $3,750–would be taxable.

This can be viewed with the following formula:

Variables:

C = Amount to Convert to Roth

B = Balances of all pre-tax IRAs

TF = The percentage of the amount you’re computing this would be tax-free

TF = 100 * [ C / (C + B)]

Using the numbers from the case study above results in:

100 * [ 5,000 / (5,000 + 15,000) ]

which is 25%.

If the $15,000 traditional IRA could be transferred into a 401(k), then the formula becomes:

100 * [ 5,000 / (5,000 + 0) ]

which is 100%, meaning that 100% of the conversion amount ($5,000) is tax-free.”

In short, having all your money in a 401k makes the backdoor Roth IRA (if you are currently in the accumulation phase and earning so much that you can’t do a Roth IRA contribution) a lot easier/more advantageous.

Thank you for sharing this. I understand and follow the logic. However, isn’t the goal of a Backdoor Roth IRA ladder to access your retirement savings early before the age 59-1/2 penalty? That’s why I plan to use it.

Getting a higher percentage of your balance to be tax free is somewhat of a moot point. If you were to alternatively put all your money into a 401k account to try to take advantage of this, then 100% of your withdraw from the 401k would be taxable as opposed to whatever % (< 100%) that will be tax free from the Roth conversion. Factor in the higher and lower tax brackets during your working and non-working years, and the two options may end up being a wash.

One thing about rolling everything over into an IRA though: No employer match in an IRA! It all really depends on those fees vs the employer match. You may save money on fees, but you may be leaving even MORE money on the table (or in your employer’s pocket). And I plan on taking every last cent from my employer that I can.

Sincerely,

ARB–Angry Retail Banker

I don’t believe employer matches would apply in this situation. I’ve only ever heard of earning employer matches on a portion of new income that you’ve saved. When you quit your job, your old employer stops paying you matches, so there is no benefit there. When you start a new job, you don’t get a match from your new employer on the old balance you roll forward into the new 401k plan; you only get matches on any new contributions you make.

I thought you meant contributing to an IRA instead of a 401k going forward.

I did a roll over when I left my 1st job right after college. I worked for a local bank for about a year, I rolled it over to vanguard. It was one of the best things I did with my money. Good Luck in your roll over. Will you stick with 1 fund or spread it around in various vanguard funds.

I diversified over about 6 different funds covering stocks, bonds, international, and healthcare. Fortunately I had enough to qualify for all Admiral shares! Fancy … 🙂

Good move and nicely explained. I rolled over all of my retirement money into Vanguard as well. I was fortunate enough to put them in the Admiral shares. It is a nice cut on the expense ratio. My wife’s 403b is in Fidelity. They offer the Spartan funds, that have a similar expense ratio to the Vanguard Admiral shares (actually I think they are a tad lower). Keeping your expenses low should be apart of anyone’s investment strategy. I will have to explore your IRA backdoor plan. I plan on using my dividend portfolio and wife pension to enter early retirement and then use our 403b and IRA’s to kick in later. Thanks for the good info!

Thanks for the tip on the Spartan funds. My new 401k is through Fidelity, so I should look that up.

Sounds like we have very similar early retirement plans with the pension, dividends, 403b, and IRA’s.