When it comes to planning for retirement and diversifying your investments, these days your choices pretty much fall between one of two major options – the ETF vs mutual fund. Recently while rolling over my old 401(k) to an IRA with Vanguard, I had to make a very big decision as to which way I wanted to go. I could stick with their low cost mutual funds which I was very familiar with. Or I had the option to pick commission free ETF’s. Having six figures of retirement savings, this was in no way a decision to be taken lightly! Choosing the right type of funds could mean saving myself thousands and thousands of dollars in unwanted expenses or trouble later on when I’m ready to start making withdraws from my funds. I’ve been an … [Read more...] about ETF vs Mutual Fund – Why My Money is with Mutual Funds

Vanguard

Should I Rollover My 401(k) Into an IRA? – Absolutely!

One of the biggest financial questions working people like you and I face when we change jobs is the question of should I rollover my 401(k) into an IRA or not? It’s a BIG decision, and not one to be taken lightly! The answer could result in missed opportunity of hundreds of thousands of dollars later on down the road. Or worse … make the wrong move and you could end up owing the IRS tens of thousands of dollars in taxes that you’re not prepared to pay for. Yikes!!! I was recently faced with this decision now that I’ve made some new life changes and decided to switch jobs. I’m not going to be shy – my 401(k) balance was pretty substantial! 12 years of saving and earning tons of employee matches results in a pretty healthy … [Read more...] about Should I Rollover My 401(k) Into an IRA? – Absolutely!

Who is the Best IRA Provider When You Don’t Have Much Money to Open an Account?

This post was a great suggestion from Alexa over at Single Moms Income. If you have a topic you’d like me to write about on My Money Design, please feel free to comment or send me an email. Read any article about money and what will it tell you? Start an IRA! You know the benefits. You know it’s good for your finances. But what if you don’t have a lot of money to put in one? Where can you find the best IRA provider without having to open an account with thousands of dollars? Never fear! You’ve got options. In this age of online accounts and competition, more and more IRA providers are willing to accept less money to get started. This just translates into more opportunities and options for you to choose from. In this … [Read more...] about Who is the Best IRA Provider When You Don’t Have Much Money to Open an Account?

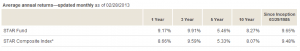

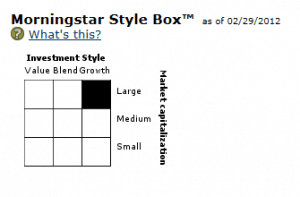

How to Pick Good Mutual Funds for Your 401k or Retirement Plan

Let me see if I can describe how your employer 401k or 403b retirement plan orientation went: • You all walked into a meeting. • An HR administrator handed you a folder chucked full of loose documents. • You were released with little direction and told to bring the papers back all filled in. Am I close? It’s pretty sad that something so important to our livelihoods later on in life is treated as another routine task. There are many things that should be explained to you when you sign up for your 401k (click here for my complete guide on this topic). But if there’s one thing where people REALLY need help, it’s deciding which mutual funds to pick for their plan. Past returns? Large cap / small cap? Expense ratios? What does all this … [Read more...] about How to Pick Good Mutual Funds for Your 401k or Retirement Plan

How to Buy a Stock Market Index Fund

If you're wondering how you can buy an index fund, then you're in the right place! Index funds have become a favorite investment choice for people from all walks of life. Thanks to their simplicity and performance, you could easily grow all the money you'll ever need by consistently investing in an index fund. Even legendary investment guru Warren Buffett famously bet (for charity) a group of hedge fund managers that they could not outperform a simple index fund. And you know what? He was right! Even though these guys were supposed to have all the right connections and information to beat the market, they still managed to lose to an index fund. 10 years later, the index fund gained a 94% return while the hedge fund only … [Read more...] about How to Buy a Stock Market Index Fund

Let Curiosity Guide You, But Common Sense Protect You

One of the biggest challenges to being new to investing is that you simply don’t know where to start. Sure you may start by reading a few magazine articles. But it can be overwhelming when they start talking about things like asset allocation, Index funds, P/E ratios, Large cap, Growth sectors, Valuations, etc. What does all this stuff even mean? The truth is that you don’t need to know everything about everything to get rich. In fact, I would venture to say that most people don’t. In reality, you really only need two things to get started on your investment journey: Curiosity and Common Sense. We All Start Somewhere: No one comes into this world being a financial genius. It is something we learn along the way. And if you feel left … [Read more...] about Let Curiosity Guide You, But Common Sense Protect You