If you said “401k” (or really any other tax deferred savings account), then that’s what I would have expected you to say. Why? Because that’s what conventional financial planning advice teaches us. We all know that if we want to have a solid retirement income, then we need to max out our tax-deferred savings, let it grow, and then worry about paying the taxes later. And why not? Things like 401k’s and IRA’s are perfectly valid strategies for saving as much as you can and building up your nest egg.

So you can imagine my hesitation and apprehension as I’m about to do the opposite with some of my money.

Funding My Early Retirement Ambitions With Taxable Savings:

Because early retirement is a strong goal of mine, I’ve been seriously contemplating changing my money design by moving some of the funds I normally invest in my 401k or 403b into my taxable brokerage account. My intention would be to buy relatively safe dividend paying stocks.

Don’t worry. I wouldn’t move all of it. Just a little bit. I still consider my tax deferred savings to be a major player among my retirement income strategies later on down the line.

So why even consider this? Well, as I’ve discussed before in my plan for how to become financially independent, your taxable savings could play a HUGE part in accomplishing the dream of an early retirement. Remember that your taxable accounts are accessible before age 59-1/2 whereas your tax-deferred accounts are not (unless you’re willing to take a devastating penalty).

But that move would pose a MAJOR concern:

- If I choose to save even just a portion of my money in my taxable investment account over my 401k or other tax deferred account, would that hurt me in the long run? Would I be doing something I regret years later and sabotaging my own financial efforts?

That’s no joke.

The last thing I personally want to do (or inadvertently encourage any of you to do) is adhere to a plan for decades only to find out that you should have been doing something totally differently that would have yielded you a lot more money.

This has become one of my biggest challenges to planning and executing an early retirement. Surely I do not want to shoot myself in the foot by diverting perfectly good money from my tax deferred accounts to my taxable accounts.

But at the same time, the writing is on the wall when it comes to early retirement. If all you’ve ever done is save your money in a 401k or IRA, then you have NO early retirement income strategy. It would be nearly impossible to access any of my fortune unless I want to file a 72T or pay the devastating 10% penalty.

So then it’s a question of opportunity. How much potential investment or income potential am I willing to give up in order to satisfy this goal?

The answer may surprise you …

Re-Evaluating My Retirement Income Strategies:

Like anything in personal finance, there is only one thing I can do when you want to compare multiple strategies:

- Collect the facts.

- Build a model.

- Run the numbers and see what you get.

The Facts:

What do we know about investments using both types of accounts?

For the tax-deferred savings, let’s assume we’ll use a 401k plan.

- Contributions go in tax-free (before income taxes are taken out of your paycheck)

- Contributions grow tax-free

- Once you retire, you pay ordinary income taxes on whatever amount you withdrawal each year. Typically that would be about 25% for most people.

- Taxes are paid on both the principal and gains withdrawn.

For the taxable investment account, let’s assume a brokerage stock full of regular common stocks.

- Contributions go in with after-tax money (after ordinary income taxes have been taken out of your paycheck)

- Contributions grow tax free until the stocks are sold. In other words, if you buy a stock and hold it for 10 years, then you will not have to owe any taxes on it until the day you sell those shares 10 years later and receive proceeds of those gains.

- Capital gains and dividends are taxed at lower rates than ordinary income taxes (up to 15% for most people, 20% in high income situations) as long as they are held more than one year and are qualified by IRS standards.

- Taxes are paid on just the gains (and dividends). You get to subtract your cost basis (what you paid).

The Model:

So now that we know how it all works, let’s create our hypothetical situation:

Suppose I have $10,000 per year I could contribute to a 401k. But I’m considering alternative retirement income strategies and might just put it into a taxable investment account instead.

- That means I’d either contribute $10,000 each year to a 401k or $7,500 ($10,000 – 25% for ordinary income taxes) to my brokerage account.

- We’re going to contribute and invest over a period of 30 years.

- For each portfolio, we’ll purchase Dow Jones Industrial Average investments earning an average annualized rate of 8% per year.

- In both cases our money will grow tax free until we decide to finally start making withdraws in 30 years.

- At the 30 year mark we’ll start making withdrawals of $60,000 per year. (With the 401k, we’ll assume that we’re of legal age and will not owe any penalties.)

- Once withdrawn, we’ll pay the ordinary rate of 25% for everything we withdraw from the 401k account. For the stock account we’ll pay the lesser tax rate of 15% on just the gains using either FIFO or the Specific ID method for cost basis. (Note: In this example it will actually be a mute point. After 30 years of savings your gains would be substantially higher than your initial contributions. SO you’d end up paying taxes on almost everything you withdraw.)

- For simplicity, we will not adjust our figures for inflation. That just makes everything more complicated …

Run the Numbers, See What You Get:

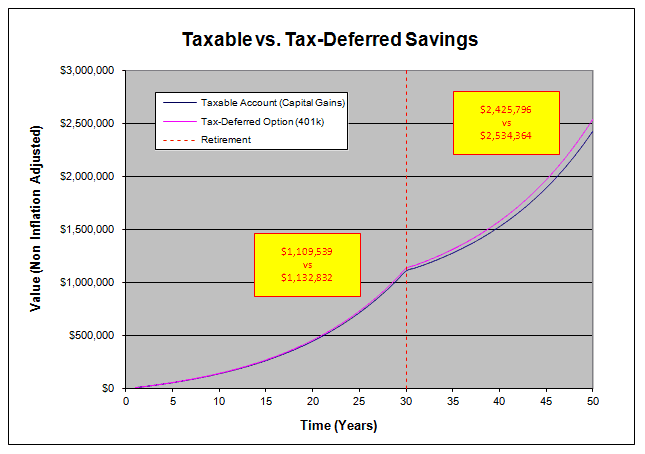

So even though we initially said the 401k was the better option, the question is: By HOW MUCH is one of our retirement income strategies better than the other? A lot? A little? Is there even a noticeable difference?

You be the judge. Here are the results:

What Does This Tell Us?

As suspected, by the time you decide to retire, you will have more money with the tax-deferred savings account (the 401k). But not by much. The difference will only be by about $23K (for our example).

But then fast forward 20 years into retirement. Not only will you have more money (in theory), but potentially a LOT more! In our demonstration, you’d have approximately $108K more! Is that pretty significant? I know I’d feel a lot better right now with an extra $108K in my pocket …

So perhaps we could stop right here and say that our opportunity cost for a chance at an early retirement is $108K less than what our total fortune could be.

But is that really a fair summary?

Consider the following: Do you plan to spend every last cent you own during retirement? I’m guessing the answer is probably not.

In fact if you plan to use 4% withdrawal rule of thumb for retirement income, than you fundamentally don’t plan to ever run out of money. Otherwise you’d have nothing to withdraw from.

So when you put it in that context, $108K x 4% is only $4,000 less per year in retirement income from your savings. Now your opportunity cost of going down the taxable path vs the tax-deferred one just dropped to a sacrifice of $4,000 per year. Does that make it worth it now? To me that seems fair. But I think that is personal question that will vary from person to person.

Honestly – this post is now really to sell you on one or the other of the retirement income strategies that are out there. This post was an exercise. A chance to think. No matter what your retirement goals look like or what you want to achieve, I believe its very important to objectively collect the facts and then see for yourself how your two options would differ. We could have very well found out they were drastically different. Or perhaps they ended up the same. You never really know until you work it out and see what you get. And in this scenario, I learned what I wanted to about the opportunity cost of using one option versus the other.

Related Posts:

- There Are No Shortcuts to Early Retirement Planning

- When Can I Retire – It All Depends On How Badly You Want To!

- My Money Design for How to Achieve Financial Freedom – November 2012 Update

Images courtesy of FreeDigitalPhotos.net

Hey MMD,

Did you factor in the 15% dividend taxes you’re gonna pay annually which will reduce your returns. If you’re in dividend stocks every year you’re going to have to pay that.

No, and good point. I didn’t really specify whether the taxable account would be all capital gains or more dividend heavy. Regardless, I should probably redo the numbers and see how much that impacts the amount you’d get each month in the end.

I like the thought process here and I agree that there’s value to putting money into a taxable account with your goals. But there are a couple of reasons why you’re overstating things here.

First, your taxable account does not grow tax-free. Your dividends are taxed annually. So especially if you’re pursuing a dividend-focused approach, you will face a regular tax drag on those funds.

Second, it’s extremely unlikely that you won’t make taxable trades during the accumulation years. Whether it’s rebalancing or a change in strategy, you’ll likely face taxes at some point.

Third, you’re likely overstating the taxes you’d pay on the 401(k) in retirement. Much of that $60k would either be tax-free or taxed in the 10% and 15% brackets. Your effective tax rate would actually be MUCH lower than 25%. Now to be fair, the taxes are also overstated for the taxable account, as LTCG would be 0% for everything in the 15% bracket and lower. But the net effect of the analysis here is disproportionately favoring the taxable account.

You took the words out of my mouth, Matt. Even tax efficient strategies still likely end up with several taxable events (though with the right taxable income, you might not be subject to taxable gains at all).

Still, it’s a great exercise that had results much closer than I thought they would. Maybe taxes aren’t quite the boogey man I think they are.

I’ve got a feeling that if I re-ran the numbers with different considerations for tax brackets and some taxes paid for trades and dividends, I’d bet they end up pretty close again in terms of monthly income.

Good points. I could back and try a few different tax scenarios paying more attention to brackets.

I love that you are thinking outside the box as far as early retirement. I completely agree that you need to have some income in non retirement accounts to get you to 59.5 or beyond. We are choosing to do that with rental property, but are putting some aside in non-retirement accounts as well.

Thanks Kim. I know that my tax-sheltered accounts will be okay, so I find it absolutely imperative that I find one or more alternate ways to make an early retirement happen.

Of course all kind of advisers will tell you to use 401k or IRA accounts. It is a big business and how would you dare managing your finances yourself without paying them fat fees? I use 401k for only one reason – employer’s match, otherwise I wouldn’t have that account at all. From other accounts I use ROTH IRA and taxable accounts. From the long run, it makes no difference as your chart is proving. The biggest advantage then is you can take the money from the taxable account whenever you want.

Looks like we’ve started from different positions, but will have a mix of both tax and non tax effective strategies. I must say I really do like the 401k tax benefit though. It’s tax effective arbitrage if you can defer tax at 30% today and pay the same obligation 20-30 years later at 10-15%. My mistake was not thinking of the 401k as a tax arbitrage play but as an investment play. I think you may be able to do a Roth conversion of 401k funds at effectively zero rates of tax.

At current tax rates, you’d have to withdraw about $230,000 to pay a 25% effective federal tax rate.

Why not do the calculations with actual current tax rates? Right now a single person will pay 14% tax on $60,000. A married couple withdrawing $60,000 would pay 8.5%.

I think you are spot on with the thinking behind getting a plan in place to reach financial independence. The only way is to fund taxable accounts now, unless you predict you will have another source of income. Some folks are going the Real Estate route or the business route, but that involves more hard work than a sizeable taxable dividend stock portfolio.

@Martin, @Kyle, @Integrator, and @EL

Thanks for you input. Lots of good advice here that I did not previously consider in my first draft of this post. I would like you to know that I have done some additional research on some of these other topics and revised my calculations model. I plan to either update this post or run a new one with these new findings. Stay tuned …

Always challenge the status quo. Any taxable vs tax-free model is going to be simpler than reality, but I like the process you went through to make up your own mind.

Currently, I hedge my bets. Looking at the current dismal state of the world economy, the US spending money like a drunk Navy sailor in Manila, and Cyprus stealing money from bank depositors earlier this year, I can almost hear the government salivating at all the money currently sitting in tax sheltered retirement accounts. A stroke of the pen created them, and another stroke can force them into government “investments” for the “greater benefit of all.”

These days I’m diversifying into individual DRIP stocks for my market investments, and looking more business opportunities to get a better balance of investments outside the investment markets.

Thanks Jack. Although if the government ever raided our tax-sheltered accounts, I think you’d see a lot of wealthy professionals fleeing the country in droves.

You have fallen pray to one of the classic blunders that i see almost everyone making (when comparing taxable to tax deferred or roth to tax deferred)

You save taxes at your marginal rate by contributing to a 401k, however you pay taxes at your average rate (because you start from 0 you have a lot of money tax free then the lower tax brackets, then the higher tax brackets). Assuming 25% taxes on 401k withdraws is ridiculously high . A better assumption would be to use your current marginal rate as a savings and average tax rate applied to income coming out. better yet, project your expected income and figure out the rates that way. I can live quite comfortably on 30k a year, on which i would pay 0% federal taxes! But even if i use my current income and marginal rates they are way different. My marginal rate is 25%, but my average tax rate is <10%. What do you think the changes are that major tax policy changes will be enacted to significantly target the 47% of people who pay $0 federal taxes??? Even if some changes get enacted it is unlikely to materially change this numbers.

Thanks for the insight Lucas. I’m actually working on a “re-do” of this post where we’re going to pay more attention to the marginal tax rates. Here’s a few of the things I’ve picked up that I believe line up with your comment. Let me know if this is your understanding as well:

During the saving years, assuming I’m in the 25% tax bracket, if I save $10,000 each year, then my delta between a taxable vs tax-sheltered account would be $2,500 because with a 401k you’re saving at your top marginal tax rate.

During the retirement years, assume I was using the 401k savings strategy and am going to withdraw $60K. That would mean I would pay ($17850*10%)+(($60,000-$17,850)*15%) = $8,108 in ordinary income tax. For the taxable account, since a withdraw of $60K is under the $72,500 15% step, I would owe nothing in capital gains tax.

You are correct on the savings year side, but not quite right on the retirement side. This calculation depends highly on your filing status but lets assume you are married as that is the tax bracket you are using. If you are married you get 20k income tax free (12200 standard deduction, 7800 personal exemption), so your taxable income is immediately only 40k. so you then do 17850*10% + (40000-17850)*.15 = $5107 for a tax rate of 8.5% (far less then 25%). If you are married and have 3 kids like i do, you effectively get $57500 in income before you pay any taxes (once you add the additional personal exemptions and convert child tax credits to a deduction using the IRS income table (https://www.irs.gov/pub/irs-pdf/i1040tt.pdf)

This also doesn’t include using an HSA as part of your plan as well where you can reduce your taxable income even further ($6500) even if you don’t have earned income. The HSA funds can be immediately turned around and used tax free on any medical expenses or long term care insurance premiums. After 65 they also can be used on anything (like an IRA), but under that use they count as income.

Awesome! Thanks for clarifying that Lucas. Those are all the deductions I always seem to graze over and take for granted when I’m using TAXAct to file my income taxes. I just looked up both topics and understand them much more clearly now.

https://taxes.about.com/od/deductionscredits/qt/standard.htm

https://taxes.about.com/od/preparingyourtaxes/a/personal_exempt.htm

The strategy of using an HSA to offset your taxable income seems like icing on the cake. In my re-do I’ll mention this as an advanced technique. Thanks!