Did you know that you can use a 72t distribution to get early access to your 401(k) or most any other retirement account before age 59-1/2 … WITHOUT having to pay a penalty?

One of the biggest obstacles we face when we’re saving for retirement is the rule that we have to wait so long in order to finally use it.

For years, I had a goal to retire early (long before age 60).

But I was completely stumped by how I was actually going to be able to take money out of it.

I remember being in my young 20’s and thinking “what good is using a 401(k) if I have to wait almost 40 years to get my money back out”?

Fortunately, not only did I wise up and realize that saving your money in a 401(k) is a hell of deal (when you look at how much your saving in taxes and count in employer matching), but I also failed to understand:

You don’t necessarily have to wait until age 59-1/2! There is a way around this rule without having to pay the penalty, and it’s called a 72t distribution.

Here’s how it works and how you can use one safely in your plan to reach financial freedom … way, way, way before age 60!

What is a 72t Distribution?

A 72t distribution (or 72t for short) refers to a section of the IRS tax code that allows savers the privilege of accessing their money without penalty. Here’s a link to the official IRS FAQ.

You can do through taking what is called “substantially equal periodic payments” (also called SEPP). Here’s how they work.

You first choose from one of three distribution options:

- Required Minimum Distribution – Distribution is found by dividing the account balance by the life expectancy of the tax payer and beneficiary. The amount changes year to year.

- Fixed Amortization Method – Calculated as an annuity based on the tax-payer and beneficiary’s age versus a mortality table. The amount is the same each year.

- Fixed Annuitization Method – Calculated by dividing the account balance against the life expectancy of the tax-payer and beneficiary. The amount is the same each year.

As you can guess, each option will result in a different amount of distribution you can take.

Once they start, you have to keep taking the withdrawals until you turn age 59-1/2 or until 5 years have passed, whichever is longer.

Ordinary income taxes are paid on the distributions; just as they would be when you would withdraw them normally after age 59-1/2.

72t Distribution Example:

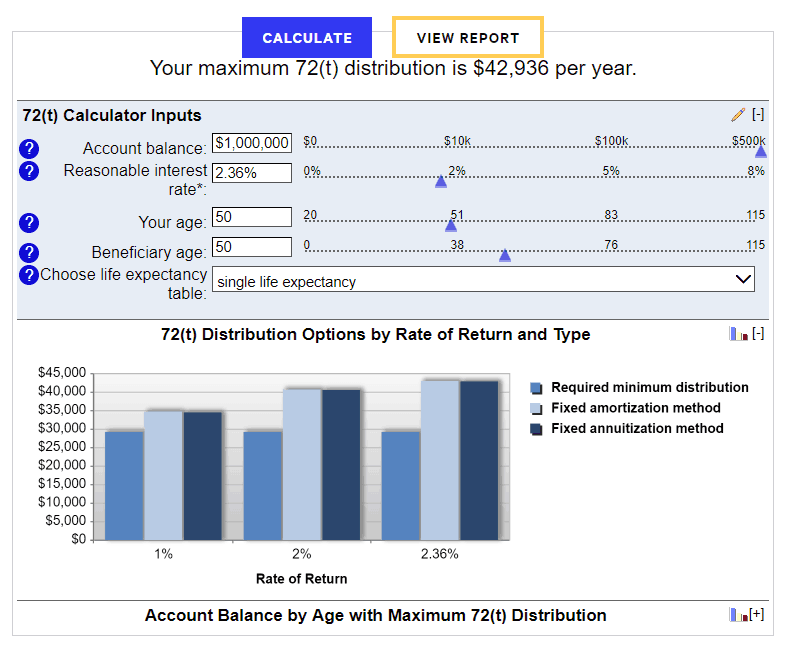

Let’s say you’re 50 years old and have a nest egg of $1,000,000 saved inside my 401(k). You’ve decided that you would like to retire early and need this money to start covering my living expenses.

With a 72t distribution, you could start making SEPP’s to accomplish this. Using this free online calculator, we can calculate that your maximum withdrawal per year from my 401(k) could be UP TO $42,936 per year for a minimum of the next 9-10 years (until age 59-1/2).

What if you were age 57 and started your 72t distribution? Now you’d have to continue your periodic withdrawals until age 62 to meet the 5-year minimum requirement (even though you’re over the age of 59-1/2).

Watch-Out!

Because of this 5-year or age 59-1/2 requirement, you have to be careful when using a 72t distribution to retire early. Once you start, you can’t stop before meeting the requirement, or the penalty will apply. Therefore, you need to be clever in choosing an amount that will not allow you to drain your retirement nest egg savings too quickly too early.

Two possible ways to handle this:

- You don’t have to choose the maximum interest rate allowed in the SEPP calculation. You can choose a lesser value which will result in lower payments and less drain on your nest egg over time.

- You also don’t need to take distributions from your entire nest egg. You could roll it over and divide it up into two IRA’s and then only start taking SEPP’s from one of the accounts. This would again preserve some of your savings for longer.

Another 401(k) Withdrawal Challenge (and Solution)

One of the BIG challenges about 401(k) plans that a lot of people don’t realize (sometimes until the last minute) is that even though the IRS says its okay to make 72t distributions, the plan itself may still not allow it.

I found this out myself with my old 401(k) plan. After learning about 72t distributions, I called the financial institution to see if it would be a possibility and the answer was “no”.

How can that be? Remember that when it comes to a 401(k) plan, much like in the U.S. how we have Federal and State laws, a 401(k) plan is made up of IRS and plan adminstrator rules.

Your plan administrator is generally your employer and they can rules for how the plan is handled. If for whatever reason they say “no” to early distributions, loans, etc., then those are the terms.

Related reading: What Are the 401(k) Withdrawal Rules for Early, Penalty-Free Access?

Do that mean you’re stuck without any options? Of course not!

A simple way around this challenge is to rollover your 401(k) balance to an IRA, and then proceed with the 72t distribution. This works because it changes all the control of the money from your employer to you!

A Helpful Phone Call with Vanguard

Years ago when I first heard about a 72t, I wanted to know more about them from the people who deal with them on a regular basis. So I decided to call Vanguard (where I have my IRA’s) and see what they had to say about the possibility of taking a 72t distribution. Here is what they had to say:

Let’s say in 10 years I decide to leave my job. If I want to rollover my 401(k) into my Vanguard IRA account, is there a fee for that?

No, there are no fees. You’d just fill out a form and convert it to a Traditional or Roth rollover IRA. If you pick the traditional, than there won’t be any taxes. If you pick the Roth, then there would be taxes owed on the balance, and you’d have to pay them out of pocket for that year on your income taxes.

(Just to be sure, I also called my 401(k) provider and checked to see if they had any outgoing fees for moving my savings. It turns out they do: a onetime of $40. I also found out that if I were to keep the money in my 401(k) but separate from my employer that a $25/year service fee would apply. Good to know.)

Suppose I do the traditional IRA rollover and wanted to access a portion of this money using a 72t to receive SEPP’s. How would I go about this?

I’d strongly urge you to talk to a tax professional about calculating one of the 3 payment options under a 72t distribution. They will also be able to help you code your withdrawals when you file them on your income taxes.

You don’t have to fill out anything or notify Vanguard. Vanguard doesn’t keep track of any of this for you. You simply make an early withdrawal and then make sure you code it on your taxes correctly.

If I were to file for an SEPP, do you separate or partition a portion of my savings to cover these payments?

No. There’s no setting aside money or locking it away someplace safe. Your distributions simply come out of your normal investment account.

You and your accountant need to keep exact records of your withdrawals so that this money can be tracked and reported properly to the IRS. Failure to comply or meet the minimum could result in having to pay the penalty.

I currently have a Roth IRA with you guys. Suppose in 10 years I wanted to make some early withdrawals. Would I have to pay taxes and penalties?

With a Roth IRA, you can withdraw the contributions anytime without penalty or taxes (since you’ve already paid taxes on this money when you invested it).

The earnings are different. If you just plan to use the money for regular expenses, then you will have to pay ordinary income taxes and the 10% penalty.

When you make your withdraws, your contributions come out first. Then come the earnings.

To avoid that 10% penalty, you could also use the 72t distribution to access your Roth earnings penalty free as well.

Other Ways to Withdraw From Your Retirement Accounts.

72t distributions aren’t the only way to gain early access to your retirement savings. Lots of early retirees have figured out several creative ways to make withdrawals from their funds penalty-free well before the age 59-1/2 rule. To learn more about how you can make early withdrawals from your 401(k), IRA, and other retirement accounts, check out this post here.

Readers – Who has used a 72t distribution to take money out of their 401(k) or another retirement account? Did you find the process complicated, or is it easier than it sounds?

Image courtesy of Pexels

I have heard of a 72t distribution before. It sounds like you’ve got it all worked out and Vanguard is so easy to work with anyways. I’m not close enough to retirement (or early retirement) to worry about it! =)

Let’s hope our online efforts keep us from having to ever use this strategy to hit the panic button on our retirement savings.

Good summary and good idea with giving Vanguard a call on this one 🙂

Yeah, i haven’t gotten a firm answer on the 401k SEPP question either. Several sources have stated that 72T withdraws can’t occur for QRP (qualified retirement plans) which include 401ks unless you are separated from service (https://www.rollover.net/401k-Rollover/72T-Rule.htm). Your 401k provider might have to “support” them as well, but it seems like there would be little incentive for them to do that. If you are separated from service you might as well roll over to a IRA anyway to get full selection of funds.

There looks like there is an additional exception for money out of a 401k between 55-59 1/2 if you “retire”

https://www.401khelpcenter.com/401k_education/Early_Dist_Options.html#.UqXYEcTku5I

So maybe this would be one reason to leave it in a 401k if you are over 55.

Most of the SEPP calculations pretty much guarantee that you won’t run out of money in your accounts as they are life expectancy based. However if you are drawing down your IRA to quickly or want to reduce your SEPP payments you can do so one time (https://www.irs.gov/Retirement-Plans/Retirement-Plans-FAQs-regarding-Substantially-Equal-Periodic-Payments#8) by switching to the RMD calculation method (which is usually about 50% less then the other two). From what i have seen on the calculations you can get about 3.8% of total funds out a year with the Amortization method (around age 40), where as the RMD method would take around 2.2%

Thanks again for renewing my interest in this method. I’m glad to see how viable this option is as part of my overall strategy. I’m actually satisfied with how low the effective withdrawal rates are across the 3 SEPP methods. I’d rather have some limit on how much you can withdraw as opposed to pulling out too much and sabotaging my life savings too quickly.

FYI – I also just saw a convincing argument for a ROTH conversion ladder (https://jlcollinsnh.com/2013/12/05/stocks-part-xx-early-retirement-withdrawal-strategies-and-roth-conversion-ladders-from-a-mad-fientist/) that would also work if you have all your savings in a tax deferred account. Basically you can roll over any amount of money to a ROTH and if you keep this amount low each year you get the same almost 0% tax treatment.

Couple advantages of this method:

1) you have more control of the amount you “convert” each year

2) if you convert but don’t use the money it is already in your ROTH

3) if you don’t want to convert you don’t have to (SEPP forces the withdraw – but you can re-contribute back in if needed).

Couple disadvantages

1) The major disadvantage with this method is that converted funds to ROTH are subject to a 10% withdraw penalty if withdrawn within 5 years of the conversion. This means that you need 5 years of ROTH contributions (which would get withdrawn first) or taxable funds to hold you over while you build up the ROTH converted funds, or you need to start withdraws 5 years early (paying higher taxes at that point while you were still earning money).

Either way it is great to have 2 options as it reduces risk of someone changing the tax code, and provides some additional flexibility depending on your exact situation when you get to that point.

Very interesting! Thanks for that share. I will have to check this out in further detail. I love how creative some people get with these strategies.

We haven’t used it, but this is basically our plan. Luckily we have two 401K accounts, so we can do one and hold off on the other if we still have enough income coming in from other sources that makes it not needed.

Another thing to keep in mind is that you don’t necessarily have to take the 72t distribution on your full balance. You could split your assets among different IRA’s and take the SEPP on just what you need. Read more here:

https://www.oppenheimerfunds.com/digitalAssets/72tDistributionsConsumerGuide-bc444b381cc1c010VgnVCM100000e82311ac____.pdf

Hey MMD, great info here. I don’t personally have any experience with 72t distribution…I think I might be a bit too young for all of that. Anyway, it was cool to read and learn something new! Thanks!

It’s never too soon to start planning your early retirement strategy. 🙂

You know, I just wrote a post about when it’s the right time to invest. I do invest, but just to invest. I need to start creating goals to really get my retirement going!

That’s interesting that you invest to invest money but not with a long term goal in mind. Obviously most people invest their money to get rich or build wealth into their older age.

The interesting thing is that when planning for retirement, there are many tax advantages you will learn about that can save you significant sums of money – more than if you just tried to make all that money by picking the right stocks, etc. It’s definitely worth investing time into learning.

I’m sure it’s easy to take out money. That never seems to be a problem. The harder part would be making sure you report everything correctly to the IRS. I wonder how many people take out money and spend it without realizing the tax burden? I don’t plan on needing any retirement accounts before 59.5, but this is good information just in case.

The IRS reporting did seem like the complicated part. Vanguard was very clear that they don’t report any of this, so you are basically on your own (or with the help of an outside professional) to make sure you get it right, or else you’ll get in trouble with the Tax Man! I’m sure a lot of people make this mistake, and that’s probably why it’s not such a popular or well-known method.

You’re very wise to set up your finances so that you don’t even need to worry about it.

Wonderful post — really nicely explained!

Another alternative would be a Roth IRA conversion ladder as described here:

https://jlcollinsnh.com/2013/12/05/stocks-part-xx-early-retirement-withdrawal-strategies-and-roth-conversion-ladders-from-a-mad-fientist/

The only negative is that you have to wait 5 years, so you’d have to have significant assets in your taxable accounts, but if you can pull it off it’s really great!

Thanks Brad. That’s 2 people now in the comments to reference the jlcollinsnh article. Now my curiosity is really peaked!

Great, you’ll definitely enjoy that entire Stock Series.

The Mad Fientist site is a must-read too…

Looks like you are on the right path to successfully withdrawing your retirement savings before the traditional 59.5 years of age.

And very smart to plan on transferring your expensive 401k to Vanguard. You’ll avoid annual account maintenance fees and slash your expenses.

I just transferred $60,000 from my 401k to my IRA at Vanguard and went from a 0.21% expense ratio (my 401k’s cheapest option) to a similar large cap index fund at Vanguard at 0.05% expense ratio. I just saved $100 per year (0.16% of $60,000) in exchange for a 9 minute phone call to my old 401k sponsor. That’s a little higher than my hourly rate while working! 😉

Nice work! Vanguard’s prices are so low. I don’t think people really understand how large an impact those expense ratios can make; especially when you get up into the serious money range of six-figure balances.

Nice tip there! BTW, when you rollover 401K to an IRA, most 401K providers will charge you a fee. There is no fee from the newly created IRA account and some firms even will reimburse your fee if you ask.

The process has to be done carefully to avoid penalties- it is called a custodian to custodian transfer – you shouldn’t get a check.

Good thing to point that out. I did look into that and they charge $40 on the 401k side.

The 72T program is a great way to get funds from your 401K early without the penalty. I will be 52 this year and I am thinking of retiring early at the end of this year. I will transfer my 401K with the US Government to a IRA at Vanguard. I will be able to pull out enough to pay my mortgage while my pension will pay the rest of my expenses. Then I will work part time doing stuff I want to do. Just so you know, they base the interest rate for the 72T by 120% of the Federal Mid-Term rate. This rule is pretty much set in concrete set by the IRS since 2003. The current rate (March 2014)is 2.21%. There are calculators to get a decent estimate based on your figures. Good luck to all who can do this. Life is too short to work a lifetime!!!!

Don’t you love it when a plan comes together? I’m glad to hear you’ll be exercising this little-known option. I certainly plan to do the same thing as well and enjoy my time in the sun!