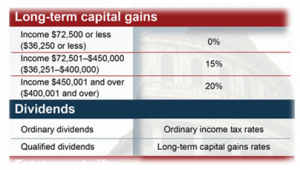

You know what I love about blogging? It’s that you learn about important things that you probably weren’t going to go searching for on your own. That’s exactly what Matt from Mom and Dad Money did for me when he wrote an epic guest post for My Money Design about two weeks ago. Even though there were a lot of great points buried within the text, one of the things I took away from it personally was the mention about how a long term capital gain (much like your dividend income) is taxed at a lower and more favorable rate than your ordinary income. Taxes? Time to Stop Reading This Post … Wait! Don’t leave. I promise not to bore you too much with a bunch of technical jargon. … [Read more...] about How the Lower Taxes From a Long Term Capital Gain Can Work Into Your Early Retirement Plan

dividends

Why Total Return Investing Is Better Than a Dividend Strategy

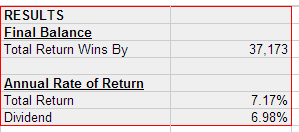

The following is a guest post from Matt Becker, founder of Mom and Dad Money. Matt is a proud father and husband, and his site is dedicated to helping new parents build financial security for their family. Although Matt and I have somewhat different personal opinions in regards to dividend strategies, I thought it might be fun to invite him to take the stage and share his perspective on why he thinks Total Return Investing would be better. I've always maintained the message on My Money Design that there is more than one way to reach financial freedom. If you can keep an open mind and not reject something just because it is different than what you use, then maybe you might just learn something. Go ahead Matt .... If you have … [Read more...] about Why Total Return Investing Is Better Than a Dividend Strategy

Exploring My 401k Alternatives – Maybe More Dividend Stocks?

So I’ve been thinking … Last year I wrote a post about how I was thinking about diverting some of the money we were contributing to our 403b retirement fund towards our dividend stocks instead. This was somewhat of a controversial move because traditional personal finance advice is to invest in your tax-sheltered accounts, not your taxable accounts! After all, why would you want to save your money in an account where you have to pay taxes? But it wasn’t that simple. There were several more alluring reasons why investing in dividend stocks would make more sense: … [Read more...] about Exploring My 401k Alternatives – Maybe More Dividend Stocks?

My Dividend Payment Income Report – September 2012

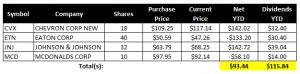

As many of you know, 2012 is the first year that I have really overhauled my stock investment strategy and changed my focus to simply collecting high-quality dividend paying stocks. Just like any dividend investor can tell you, dividend payment income is a pretty remarkable source of “truly” passive income. I prefix passive income with “truly” because the income they generate literally requires no effort on my part. I simply collect the payments each quarter! As of this month, I am happy to report the second installment of my quarterly dividend payments received. Please see the image on the left for the total. … [Read more...] about My Dividend Payment Income Report – September 2012

Protecting Yourself with Dividend Stocks

Darn! The year was off to such a great start for us investors! But then worries about Greece and the Euro spoiled the party. If you were following conventional wisdom and investing in Index Funds, then you’ve basically lost about 6% in May (following the S&P 500). Don’t worry – I’m not trying to bum you out. But it is times like this that you need to ask yourself “What am I doing to hedge myself? If buying stocks is offense, what am I doing to play defense?” … [Read more...] about Protecting Yourself with Dividend Stocks

Adding Your Children’s College Savings to the Budget

Please don’t hate me. I’m very proud that you’ve been following my advice (and the advice of my PF blog constituents) to start saving for retirement, etc. But now we’re going to talk about something that may require you to dig just a little deeper into those pockets of yours: • College “I Don’t Even Have Kids Yet!” Why Do I Care? I know some of you are pretty young and just graduating college yourself, while others of you may have recently got married and just had children. These are all great positions to be because, like most savings strategies, “more time” is our friend. However, this post is going to assume that someday when or if you already DO have kids, that you’ll want to send your little Princess or Jedi (… there’s a Star … [Read more...] about Adding Your Children’s College Savings to the Budget

Will Dividend Stocks Help Me Retire Early?

If you have any hopes and dreams at all of retiring early, then you know that one of the biggest challenges you face is the fact that there are penalties for withdrawing your money too early from your retirement accounts. For most of them, this will be age 59 ½ (click here for a complete list). So one of the re-occurring questions that we keep asking on MyMoneyDesign is: • How do I bridge the gap between early retirement and age 59 ½? In previous posts, we’ve reviewed the following non-employment, investment-style options available: • File for a 72t or “SEPP - Substantially Equal Periodic Payments” to get penalty free portions of your nest egg money out. • Quit working at age 55 to get your 401k’s and 403b’s, but NOT earlier. • … [Read more...] about Will Dividend Stocks Help Me Retire Early?

Browsing for Stocks – January 2012

It’s a new year and I’m optimistic that new opportunities are out there. In keeping with that enthusiasm, I’d like to add a few more individual stocks to my portfolio. Traditionally, I stick with mutual funds to stay diversified, keep my costs down, and avoid the turbulence of the market. However, last year I had a great time with Apple (AAPL) (up 26% from my initial purchase) and I’m hoping I can use the same care and attention to pick another winner. Going After Dividends As part of my ongoing initiative to add passive income streams, I’ve decided that my next set of stocks should be dividend stocks. There are a lot of reasons why to look at dividend stocks for my next purchase: … [Read more...] about Browsing for Stocks – January 2012