Traditionally, I stick with mutual funds to stay diversified, keep my costs down, and avoid the turbulence of the market. However, last year I had a great time with Apple (AAPL) (up 26% from my initial purchase) and I’m hoping I can use the same care and attention to pick another winner.

Going After Dividends

As part of my ongoing initiative to add passive income streams, I’ve decided that my next set of stocks should be dividend stocks. There are a lot of reasons why to look at dividend stocks for my next purchase:

• They pay dividends! Although dividends are never guaranteed, there is the potential to earn a small amount of money just for holding the stock. So on top of the potential capital gains, I could easily earn another 2 to 4%.

• The fact that the company can even pay a dividend indicates some financial strength. Picking a healthy company is important!

• Dividend stocks generally outperform non-dividend stocks in the long run. For a long-term investor like me, this is a hard trend to ignore.

• Dividend income is generally taxed lower than standard income. As part of a tax-advantaged strategy, I would want to add as much dividend income as possible.

My Picking Strategy

1. Check BigSafeDividends. To begin, there is a great website that screens dividend stocks for free called bigsafedividends.com. It is ran by Charles B. Carlson and was mentioned in his book “The Little Book of Big Dividends” (click here to read my review of this book). On this site, he ranks and scores dividend stocks based on a number of factors. Whether or not you agree with his scoring method, the site serves as a great way to pre-screen potential dividend stock candidates.

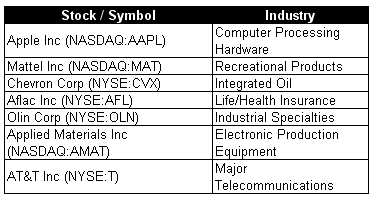

After browsing through the top performers, here is my list of potentials:

Yes, you got me. I slid Apple in there. I did it because I wanted to compare these stocks to some of the metrics of Apple. Plus, there are rumors that Apple may finally pay out dividends this year.

2. Pulling Metrics From CNN Money. CNN Money is my favorite for screening stocks and learning more about them. For each one you type in, they have all the stats you’d ever need, the company’s financial statements, and even a forecast from surveyed analysts.

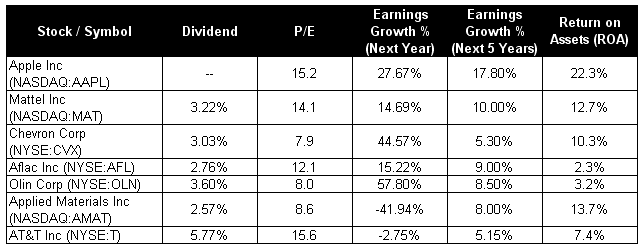

The metrics we’ll be considering will include dividend yield, PE ratio, and growth forecasts.

3. Using the “Big Secret” Strategy. In the book “The Big Secret for the Small Investor”, author Joel Greenblatt presents his case for picking stocks based on a metric called the “Value Weighted Index” which compares a company’s earnings to their assets (also called Return on Assets or ROA) (click here to read my review of this book). This figure demonstrates the company’s efficiency at generating income regardless of their size. It was one of the metrics that lead me to pick Apple.

The two pieces of information needed to calculate this can be found on CNN Money and are easily calculated.

Analysis

Putting it all together, here are the results:

• ROA: No one comes close to Apple. Mattel, Chevron, and Applied Materials are the runners up. Aflac and Olin Corp look pretty sad.

• Dividend Yield: Apple is the loser here because they do not have a dividend. AT&T looks the most attractive, but use caution. Sometimes a large dividend is used to attract investors where other metrics fail.

• PE Ratio: None of these companies are outrageous. 20 or less was a score I was expecting to see. Chevron looks to be a bargain.

• Growth: Both the short-term and long-term outlook is pretty good for Apple, Mattel, Chevron, Aflac, and Olin Corp. Applied Materials and AT&T may have some short-term issues. I’ve often hear the quote “If a company isn’t growing, it’s dying”.

Conclusions

My picks are Mattel, Chevron, and Apple. Mattel and Chevron are in the 3% dividend range that I am looking for and pass my other metric criteria. Even though Apple hasn’t paid dividends yet, it has the potential to start doing so in addition to being a great performing stock for another year.

Will you be purchasing any new stocks this year? What criteria do you judge them against? Please feel free to share.

Photo credit: Microsoft Clip Art

Related Posts:

1) Which is Better – Paying Off Your Mortgage or Investing the Money? – Part 2

2) Which is Better – Paying Off Your Mortgage or Investing the Money? – Part 1

3) Trying Out “The Big Secret” Stock Picking Strategy

Leave a Reply