The other problem is that once you do get on a roll and make your way towards that initial $15,000 emergency fun, your mind starts getting awfully creative. You start to think to yourself: What if I paid down some debt? What if I put it towards my Roth IRA? What if I invested it in something totally different? And then we’re right back where we started…

The Alternative Emergency Fund Strategy – Step 1:

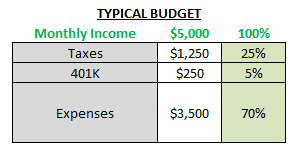

Consider that the average monthly budget probably looks like this:

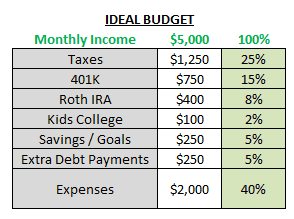

Let’s totally forget about our emergency fund situation for a minute and focus only on our budget. What if over the next few years, you were able to work towards some type of ideal budget similar to this:

That would be pretty great! But what in the world does focusing on my budget got to do with my Emergency Fund? The answer is more than you think!

1) By budgeting your money properly and diverting it to various savings goals, you’ll have more “streams” to grab from when you’re in trouble. What I’m calling streams are any of the important things you voluntarily put your money towards like your 401k, Roth IRA or any fixed rate savings account, etc.

2) You’ll learn to live with far less expenses. It’s a lot easy to cover your expenses when they’re 40% of your income versus 70%. In other words, you’ll need less money when you’re in trouble.

The Alternative Emergency Fund Strategy – Step 2:

You weren’t getting out of saving up for an actual emergency fund – you know that right? Should your finances ever hit DEFCON 1, you’re going to need some cushion to survive on.

The good news is that now that our budget is in order and we’re living off of less money, you’ll need to save less money. Think about it – if you lost your job, the only important thing you need to cover are your expenses (your savings and goals will simply have to wait). And again, it’s a lot easier to cover 40% versus 70% of your income. So if we base our emergency fund target on expenses only, that $15,000 to $60,000 goal can now be cut down to a “Reduced Emergency Fund” of $6,000 to $24,000.

Emergency Fund Scenarios:

Consider how this strategy would help you:

Emergency Fund Scenario 1 – Times Are A Little Tight:

No problem. Just borrow from that Reduced Emergency Fund. If that doesn’t cut it, you also have the option to divert one of your lesser priority streams such as the “Extra Debt Payments” or “Extra Savings” towards covering the expense. Of course focus on getting back on track as soon as possible so you can go back to your normal budget soon.

Emergency Fund Scenario 2 – Things Are Really Rough:

Uh, no! My car died and I need a new car NOW! Or my roof is leaking and I need a new one NOW! Again, use the tactics in Scenario 1. If that doesn’t cut it, then you may have to dig deep and raid some of your higher priority streams such as the “College Savings”, “Roth IRA”, and “401K”. Of course try reducing them rather than cutting them down completely. And get back on track as soon as possible!

Emergency Fund Scenario 3 – The Lost Job:

This is possibly the worst scenario of them all because if you lose your job, you lose your primary (or only) source of income. This is why saving that Minimum Emergency Fund and striving to keep your expenses low helps. While you may not be able to save for retirement, you certainly won’t starve and you’ll be able to keep up with your main expenses. It will sting to let your savings goals sit idle, but use that pain to find a new job and get your life back on track!

Although I don’t endorse this, in the most extreme of extreme situations you can:

1) Withdraw the principal (not the earnings) from your Roth IRA after five years

2) Borrow against your 401k with intentions to repay it in the future

I would make that the absolute last possible resort option. Be cautioned that taking money out of your retirement account early is sabotage against the power of compound interest.

One last note: Notice I called Scenario 3 the worst because a job loss usually means losing 100% of your income. So why not diversify your income by creating alternative streams of passive income in addition to your job? Consider that if you had other forms of passive income coming in and suddenly lost your job, then your needs for the emergency fund would be even further reduced. Plus who doesn’t want MORE money?

Readers – What do you think of saving for an emergency fund? Do you have alternative strategies for dealing with extreme situations or possible job loss?

Related Posts:

1) How to Budget – Introduction

2) What Should Be in Your Safety Net?

3) What Would You Do With An Extra $1,000?

Photo Credits: Microsoft Clip Art, MMD

I am a big believer in having a big emergency fund with 6-12 months expenses, BUT that is just what helps me sleep at night. Everyone is different! Really, having any emergency fund is better than none!

I’d love to have that much stashed away, but like I said – I start getting creative once I get above $10K. You’re totally right. Even having $1K is better than nothing at all!

Very timely as I am just starting our journey towards 3-6 months of expenses. I’m going to save every penny I can for the rest of the year now that we have no more consumer debts to pay off. Until then, I guess the credit card and pension funds are my big e-fund.

Interesting choice on the pension funds. I didn’t think you could take those out until it was time to retire. Of course, each pension works a little different, so you probably know your rules better than I do.

I’m personally not a believer in a big emergency fund for myself. Part of that is the last point you made about diversified income sources. If I were to lose my job I do have my blog and other websites to fall upon. In that case I’d suddenly have far more hours to dedicate to them. So I could probably increase those income levels pretty easily. Plus I have some other sources of money to tap before having to hit up my retirement account.

Of course you’re not a big supporter – Your article was one of the ones that inspired this post! Obviously I think they’re important as a general blanket statement for most of the public. But I strongly agree with you that having other income sources would solve this problem completely. I’m hoping in one to two years I can follow-up this post with a completely different view and account of how I was greatly able to diversify my income streams.

Well for me it’s essential as a freelancer…and not one who makes a ton of money either. The problem I’m having is making enough to cover my expenses AND save some each month for an emergency. My last stop is not living by myself and finding a roommate. It’s the only way I’m going to get ahead…well that and land a full time job, which I’m really hoping for. If I do, I will for sure continue to save an emergency fund, because you never know…

I don’t think any of us can top your situation! Free lancing is very unique and can be very unstable for most us – me included. I really hope you can land a few jobs and save up a stash.

I have a six plus months emergency fund in terms of expenses, not income, and there is a big difference in that for me. I will be keeping it in cash and am lucky to have been able to save one up from the beginning. I think people should strive to keep a few months of expenses only in cash and if something pops up cut back to the minimum as far as expenses go. Just my two cents.

Agreed! I think it should have more to do with expenses rather than income, because your goals can go on hold, but your expenses will remain what they are. It would be nice to have that much in cash set aside. Your account would be far more safer.

We have a small emergency fund now but over time we’ll continue to build it up. In addition to our emergency fund we also have other streams we could tap into if we absolutely had to: 401k and a targeted savings account. I’d never want to dip into the retirement funds but sometimes you have to do what you have to do.

I hear that! I would never think to dip into my retirement accounts because of the devastation it would cause. BUT if times were ever REALLY bad and it came down to staving with no house, then I’d have to use my A-Bomb and tap the 401k. Fortunately I’m conscious of this fact and will try to build a few onion layers around it so this never happens.

I created a savings fund versus “an emergency fund” where anything comes and goes out of this one fund. Travel, emergencies, unexpected expenditures – all come out of here. It’s worked for quite some time and I plan on putting more into this fund. Seems to avoid the hassle of managing multiple accounts.

That’s not a bad suggestion either! Its like another layer to the “emergency fund” onion as we’ll call it. I love all these systems people keep coming up with!

I think my “system” just came out of laziness lol

I like this — it’s a good and different way of thinking. I think sometimes we can get bogged down into having a finite amount of money and an infinite number of buckets to put it in!

Thanks Kathleen! I’m hoping I can experience success with a few side income projects and diversify this strategy even more. There’s definitively more than one way to be safe than saving a billion dollars unnecessarily.

We hear time and time again how important it is to have an emergency fund. While most people prefer having one, others view it as a waste of time and resources. I like that you’ve provided some great alternatives to actually having an emergency fund.

Even though it is a slim chance, I fear what would happen to those people if they ever lost their job or were without income for an extended amount of time. I just wanted to think outside the box and show there was more than one way to build protection.

I think you’ve articulate my viewpoint well with different scenarios. I believe that, besides having 5-10k set aside, you can prudently invest in different instruments to generate higher income than losing face value by keeping money in the savings account. By keeping in these safe instruments, you have access to capital if needed or borrow against it as a collateral.

I agree! You only need a portion of your account in cash, not all of it! You can still even invest your money in relatively safe investments. Of course there is a little more risk, but the chances are still very slim given the risk / reward.

I think it depends on what you do and how old you are. If you work in a field where jobs are easier to get, like a nurse, you might not need as much in an emergency fund. If you are 62 and work in publishing, you might have a harder time finding a job that would match your salary. Basically it is whatever lets you sleep at night.

You bring up an interesting point! If you work in an industry that is volatile versus a job where you have tenure or are protected by a Union, then your needs are very different.

You are right it is hard to save and even more correct about how creative we get when we have the extra money just sitting there.

Even though it would nice and safe to have the money in cash, you’re doing yourself a big dis-service by doing nothing with it. Even just a little bit in semi-modest investing is better than 1% interest in a bank account.

I used to treat my tax refund as an emergency fund. Or it’s what I put into my emergency fund. This year I didn’t. And it bit me in the butt when our car all but died. I’ll be returning to that strategy again this year!

It always happens when you’re not prepared! We kinda extended ourselves with a few home projects, then … wham! The washing machine has something wrong with it! Go figure!!!

I can’t think of any financial guru or the CFP that have used “gross monthly income.” It’s always been net expenses.

Really? I am very surprised! I usually see the two terms interchanged on popular media sites like MSN, Yahoo, CNN, etc. I feel like this is because they assume that most people income and expenses are the same thing (because they live check to check).

I’ve been steadily working on replacement income since I do not believe in depending 100% on a job for your entire income. My a portion of that is going directly towards my emergency fund. It’s not much now, but there’s more there than I had a year ago!

I’d love to get as far away from 100% job income as possible. I think little by little is the way to go on diverting to your emergency fund. Every little bit helps!

MMD,

We have levels of Emergencies similar to what you described, but the second source of income outside our jobs is something that really helps us sleep better at night.

The wife’s job is more secure, but mine is in the tech field with a Fortune 10 company that is really struggling right now. Our rentals are really our security blanket.

Our last line of defense in a really dire situation is to list several of our properties and liquidate the one that gets the first offer. We have other emergency funds, but it’s nice to know we have several options if things really got tough.

Exactly – the extra income only lessens how much you would actually need because you could still likely count on it during a job loss. Although it would probably be difficult to liquidate, it is great to know that you at least have that option. I think being aware of your layers of protection and the hierarchy of how you would liquidate them is a very important part of the strategy that everyone should give some serious thought to.

I love the idea of reducing the expenses while increasing the savings over multiple areas. 🙂

We have an emergency fund and other savings accounts for certain things, like: car expenses, health and dental, puppy expenses, etc. to cover things that might come up.

I think there isn’t 1 solution for everybody, so this post is a great resource for those who don’t do well with the traditional emergency funds.

Thanks Jen! I’m glad to hear you have several funds already setup. It sounds like you’re on top of things! I do hope people can use this strategy if they struggle (like I do) to simply save up a ton of cash.

Great post! Thank you for sharing how you structure your emergency fund with us, month after month I always try to create an e-fund but it just seems to always end up getting spent. I shall definitely refer back to this and try breaking it down the same as you have. Thanks!

Thanks and welcome to the site! I hope you are able to put this strategy to use and build a layer of protection around your finances.

If you have an outstanding 401k loan when you leave your employer, you’re required to pay the remaining balance back in full within 30 days or pay the 10% penalty plus any taxes due. I highly doubt that you can borrow against a 401k AFTER you’ve left your employer. Nice try though…

Not necessarily. 401k hardship withdrawal proceeds are not subject to the 10% penalty.