Hello, readers of My Money Design! I am ARB, the Angry Retail Banker!

Over on my blog, I offer what I call “An Insider’s Take On Retail Banking”, which means that between bouts of raging out and threatening my entire customer base with physical harm, I talk about both life as a branch banker and ways for you to maximize your banking relationship.

I am here today to talk about absolutely none of that stuff.

Before you all hit the back button on your browser and type “funny cat videos” into a Google search, know that I’d like to discuss an awesome form of passive income that I think doesn’t get covered a whole lot.

I’m talking about Peer-to-Peer (or P2P) lending and I will be addressing some of the common arguments against it.

What Is P2P Lending?

I actually first heard of P2P lending right here on My Money Design and have been smitten with the concept ever since.

While I’m sure the veterans of the passive income community already know what P2P lending is, let me take a moment to explain the basics to the uninitiated.

P2P lending is a form of loaning money that bypasses the banks and other financial institutions almost entirely.

Instead, borrowers looking for loans are matched with individual investors looking to lend out their own money with interest. Essentially, individuals act as banks and make a profit in the same way that the banks typically do.

The two major P2P platforms in the United States are Prosper and Lending Club, the latter of which saw Google as a major investor before becoming a publicly traded company.

Both borrowers and investors (or lenders, I should say) would sign up for an account with either or both platforms.

Borrowers would then submit their loan applications while lenders would transfer funds to their accounts. Once the borrower is approved for the loan, it becomes visible on the site to the lenders.

Lenders go through the list of available loans and decide which loans they want to fund and how much of each loan they want to fund (as little as $25 per loan).

Once a loan is fully funded and distributed, the borrower repays the loan via monthly payments that cover both principal and interest. Those payments are distributed to the investors who funded the loan.

Pretty much it’s regular people lending money to other regular people. You can imagine it as yourself taking on the role of the bank, or as being a bond investor where the bonds represent real people rather than governments, municipalities, or businesses.

Either way, expect that at least one out of every three people you try to explain P2P lending to will look at you and un-ironically ask you if you are a loan shark.

![It's a stupid question. Prosper doesn't let you do this when someone defaults. [Photo courtesy of Treachery In Outer Space by Cary Rockwell, 1945. public-domain.zorger.com]](https://www.mymoneydesign.com/wp-content/uploads/2015/06/public-domain.zorger-carey-rockwell-1954.jpg)

Why Should I Be Interested In P2P Lending?

Is my word not good enough for you?

Alright, how about the fact that most experts believe you can earn a 5-12% return on your investment in P2P lending. Now understand that this is not a hard number or a guarantee; your results will depend on the loans you choose, your loan filters, your risk tolerance (you want the riskiest loans or the safest?), and the state of the general economy.

I’m not telling you what you will or won’t make. But it seems to be the average for many institutional investors and industry experts and it seems to be the average whenever I do loan back-testing (more on back-testing later).

Now, there will be a downward trend in the ROI (Return On Investment) of every portfolio. A new portfolio hasn’t had a chance to experience defaults yet. But even taking this into account, looking at all of Lending Club’s loans issued since 2009, we still see a ROI of 8.68%.

Not bad, huh?

Compare that to your savings account getting you 0.01%.

And P2P lending is gaining grounds amongst some personal finance bloggers who are letting the results speak for themselves. Mr. Money Mustache, for example, has seen returns so far of about 12.22% as of this writing. I credit the mustache for his success.

But Mr. Money Mustache isn’t the only wildly popular, immensely successful, and amazingly good looking blogger to enter the P2P sphere. I’m, of course, talking about me. I said “amazingly good looking”, right?

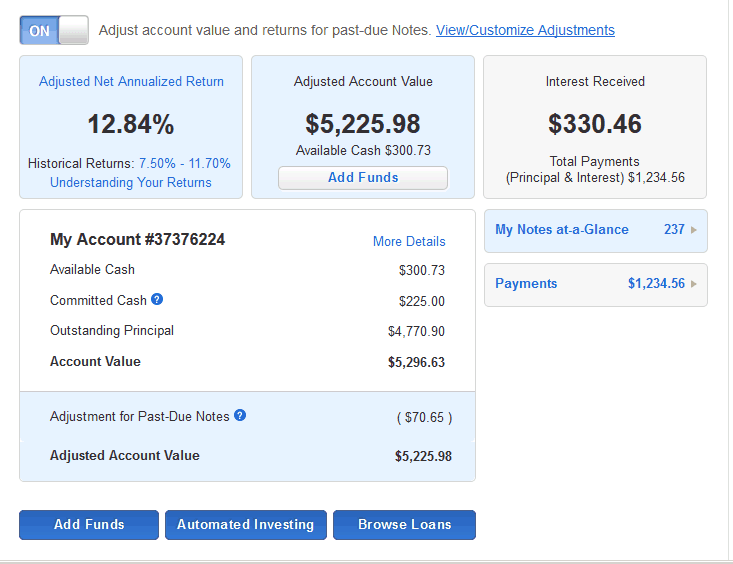

For those of you who must know how much I’m making, I started with Prosper a little over a year ago and Lending Club a few months after that. My Prosper account has returned me about 9.93% for all the notes that are over ten months old (thus properly weeding out the defaults from the ROI), while my younger Lending Club account (invested entirely in low grade, high yield loans) as a return of 12.84% after taking defaults into account.

Of my 164 Prosper loans, only 7 are late and 2 have been charged off (with 13 being paid in full already). On the Lending Club side of things, I’ve got 237 loans with 4 of them being late, 1 still in the grace period, and 1 charged off (14 of them have been fully paid). While I expect the default rate to increase as time goes on, that’s definitely not the risky “Vegas gambling” many people see P2P lending as.

Now the worst, most dishonest thing I can do is sit here and tell you that you will make a ton of money because I’m doing good so far, but I just want you all to get a feel for what the general returns have been since 2009. I truly doubt a mature portfolio will see consistent 15% annual returns, but I do believe that P2P lending can offer you better returns than even my beloved dividend stocks, though with much greater risk (so I do recommend keeping only a small portion of your greater investment portfolio in P2P loans). I have companies that pay 3% in dividends; I have loans with interest rates over 20%.

Taxes On P2P Lending:

For those of you who forgot, MMD wrote a nice little eBook recently called Save Better (which everyone should go and buy already) in which he taught you all the ways you can save money on your taxes. One of the ways to gain a tax advantage was by investing in stocks for the long term. Dividend and capital gains taxes are lower than the ordinary income tax rate that your paycheck is taxed at.

But what about your P2P lending returns? How are they taxed?

Unfortunately, your returns are taxed as normal income, and if you’ve ever found yourself complaining about how much the government takes out of each paycheck (like I do every two weeks), then you are going to find this to be a major downside to this form of investment.

Fortunately, both Prosper and Lending Club allow you to open up an IRA with them, greatly minimizing your tax burden. And like stocks, charged off loans in your taxable account can be written off as losses, according to this post on Lend Academy, a popular P2P lending blog.

P2P Lending In Your Area:

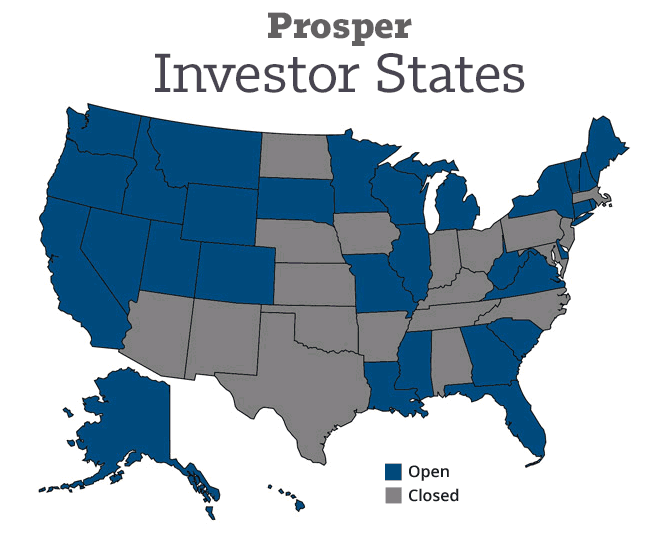

Funny thing about P2P lending. Not all states allow it.

I’m not going to go into why certain states have still not allowed P2P lending (why does any politician support or oppose anything? Votes and money), but some states allow you to enter the P2P lending world, and other states do not.

What’s crazier is how complicated these restrictions are. It’s not simply a matter of the whole asset class being allowed or blocked. Rather some states allow you to borrow but not lend, and some states allow you to do business with one company but not the other.

A potential investor may find themselves allowed to borrow from Lending Club and Prosper but not actually lend money out themselves. Another person may find themselves limited to doing business with Lending Club but not Prosper.

As far as investing goes, 28 states allow you to invest in Lending Club while 31 allow you to invest in Prosper. The breakdown for Lending Club is as follows:

If you live in a state that doesn’t allow P2P lending at all, then you’re pretty much out of luck.

But what about you non-’Muricans that don’t live here in ‘Murica? You might want to check out what P2P lending companies exist in your country.

Europe has a number of different P2P lending companies headquartered in the United Kingdom, France, Spain, and Germany, of which some of the best ones are listed in this Forbes article.

P2P lending has also broken through the Great Firewall of China. There the amount of money that has been issued in loans has increased by 300% since the same point in time in 2014.

The Asian Banker actually takes the time to list all P2P lending services by country. This asset class is not just limited to the Western world; these markets are also in Australia, Hong Kong, India, and South Korea. No word on when North Korea will be getting in on it (probably never).

The Arguments Against P2P Lending:

Now that I’ve educated you on a few aspects of P2P lending, I want to really get into the meat-and-potatoes of this article.

You see, every type of investment has its risks, and P2P lending is no exception.

The biggest risk of a P2P loan is that of a loan default. A person might lend money to a borrower only for that borrower to never repay the loan.

But you could say that about any type of investment. Stocks could go up and down, or the company can go bankrupt. Bonds can also default. Not all bonds are as safe as the U.S. Savings Bond. Real estate investment income can erode due to vacancies, maintenance, and deadbeat tenants.

I could literally go down a list of passive income ideas and come up with a reason to avoid every single one.

I’ve heard a lot of arguments over time about why “you shouldn’t be lending money to random strangers over the Internet”. Some arguments against P2P lending were very well crafted and thought out. Others, not so much.

I’m not going to sit here and try to convince everybody that P2P lending is the best investment or form of passive income for you. Nor am I going to analyze whether P2P is a viable threat to the banking industry or compare them to traditional bank products like I did awhile back with prepaid debit cards. That is all outside the scope of this article.

Instead, I will opportunistically and shamelessly promote my blog using someone else’s resources in order to drive … I mean … address some of the arguments that I have heard against P2P lending and offer my counterarguments.

Argument #1: “What happens to you if the borrower defaults!? These loans don’t have any collateral!”

Do you know how many times I’ve seen this excuse presented as “The Big Secret The P2P Lending Platforms Don’t Want You To Know” or something like that? The notion that these loans are backed only by the good faith and credit of the borrowers?

This message is presented in this hushed whisper of a tone, like a crazy living-off-the-grid survivalist who is trying to tell everyone that bank tellers are calling the police on their customers without Obama overhearing and personally ordering a hit squad to cover his tracks.

It’s absolutely true what they say. These loans are backed by absolutely zero in collateral!

There is no home, car, or any other hard assets to recover in case the borrower doesn’t pay back the loan. And if the borrower defaults, you lose the money you lent that person.

But that’s just like a regular credit card or bank loan!

The fact that you don’t lose your home if you default on a bank loan doesn’t deter Bank of America from offering them, does it?

The fact that the bank can’t debit your bank account to pay unpaid credit card bills doesn’t stop Chase from getting you to apply for them, right?

And the banks seem to be making quite a bit of money off unsecured loans. They are certainly making record profits, according to this Wall Street Journal article from late 2014 which also pointed out that banks’ outstanding loans have topped $8 trillion (yes, I know much of this is mortgage lending) since research firm SNL Financial first started tracking them in 1991.

Banks are able to withstand loan defaults of tens of thousands of dollars per borrower not just because they already have billions of dollars in assets, but because each loan is such a tiny part of their overall loan portfolio that the loss of the entire principle of one loan is completely covered by the interest payments on the rest and then some.

You should do the same! Don’t loan $15,000 to one borrower. Loan the minimum of $25 to as many different borrowers as possible.

In the end, the cost of a borrower default will be greatly minimized and your losses will be nearly non-existent.

Even the lending platforms themselves recommend this tactic. And make no mistake; it is the single most important thing you can do to protect yourself.

Prosper’s website even states that since 2009, every investor who has purchased at least 100 notes (loans) has had a positive return on their investment.

Using the website Nickel Steamroller, which allows us to see the actual results (including ROI and default rating) of past loans, we can see that even a portfolio with only the riskiest loans gives us a positive ROI.

More than “positive”, if you had started in 2009 blindly throwing your money Prosper’s riskiest loans with no regard for the purpose of the loan, the borrower’s credit score, income, number of recent credit inquiries, etc., you would have had a staggering 12.61% return on your investment (with at least one year in there passing the 17% mark)!

More importantly (with the exception of 2010 and 2011), the rate of defaults has steadily decreased since 2009.

Now this doesn’t mean that you should go out and pour all of your money into the riskiest loans than P2P lending has to offer. I am simply showing you the numbers (actual real-world results, not just theoretical models or future predictions) that show the power of diversification, which in turn shows that the risk of borrower default is not something that should scare anyone away from this form of investing.

Even if 20% of our hypothetically lazy and careless lender’s loans had defaulted because he was targeting “the riskiest of the risky”, he still would have made $12.61 for every $100 invested as long as he simply diversified and invested only the minimum amount spread out across the maximum number of loans.

Argument #2: “You’re not investing! You’re just gambling! You have no way of knowing if these random people will pay you back!”

It’s true that past performance is no guarantee of future success, and that even with the numbers I quoted for you, it’s still possible for any individual loan to default.

You don’t see past the numbers on the screen. You don’t see the borrower behind it. Who knows if “bob_almighty111” is going to pay back that $25,000 loan?

Lots of things can happen. What if Bob loses his job? What if Bob is a deadbeat? Are you a deadbeat, Bob?

First, Prosper and Lending Club are major companies that deal in consumer lending. Don’t you think that they have strict underwriting guidelines that they follow?

Lending Club goes over their basic requirements here, and it’s pretty much the same criteria that the banks use.

Peter Renton, a respected member of the P2P community and the owner of the popular P2P lending blog Lend Academy which I mentioned earlier in this article, detailed in 2013 some of the changes in Lending Club’s underwriting requirements.

While these changes make it easier for borrowers to get approved for loans, it does so in a way that doesn’t increase the lenders’ risk, showing the care and effort Lending Club puts in their analysis of both individual loan applications and historic trends.

Prosper had a more storied history.

Remember how I wrote before that all their lenders since 2009 made a positive ROI if they diversified? Well, Prosper was around before 2009. The Prosper of old was a wildly differently run business than the Prosper of today. We are better off for it. The old Prosper, or “Prosper 1.0” as it’s commonly called, pretty much handed out loans to anybody who asked nicely, which is what my customers seem to think my bank is obligated to do (pro-tip: Having a checking account with over $1,000 does not guarantee you a loan).

This led to default rates reaching obscene levels of roughly 35%. Eventually they got busted in 2008 for selling unregistered securities and had to be reorganized into what is now informally called “Prosper 2.0”, complete with SEC regulation and everything.

So now operating within a proper regulatory environment and maintaining an underwriting process that doesn’t involve the words “yes to all”, Prosper’s ability to filter out the bad loans from the good has been almost immediately visible.

Their investors are earning positive returns and they have an A+ rating from the Better Business Bureau.

But why take anyone else’s word for it when you could be your own underwriter? … Sort of.

I mentioned a couple paragraphs back a site called Nickel Steamroller, right? Right.

And as I very briefly mentioned, that site lets you back test actual loan results, complete with filters. This means that you can actually apply certain sets of criteria, plug in the data, and see how well real loans that fit that description did in earning their investors a return during a certain time period.

For example, you want to know if lending to the state of California would increase your loan defaults. Or perhaps you are looking to see which loan purpose will net you the highest return.

You can apply filters such as credit score, home ownership, open credit lines, loan grade, literally anything. You can search for how loans that fit that criteria did during a time period of your choosing.

This isn’t how some analysts or a computer program think such loans might do. These are actual results of real loans and what they made for real investors.

Gambling is throwing your money on red and hoping for the best.

Gambling is putting all your money into one or two loans and hoping that you see that money again. But with the ability to back test loans—to look at loans of different criteria and see their real world results—you can effectively do your own “underwriting”, formulate your own strategy, and know what loans are more likely to be paid back and what loans are more likely to fail.

Again, you have no way of knowing if any individual loan will be paid back, and it is true that defaults are just part of the game.

But knowing that certain types of loans in certain areas for people underneath a certain credit score have historically had high rates of default allows you to lower your own default rate by avoiding those loans.

You’re not just closing your eyes and throwing your money at random people when you have real world data that tells you which groups of borrowers have paid back loans in the past and which ones have a history of taking lenders’ money and running.

Argument #3: “Has this asset class been stress tested? Who knows what will happen if another financial crisis strikes!?”

Oh yes, P2P has been stress tested.

This has been stress tested through more financial crises than you think. And it has survived the worst of the worst. Forget the Great Recession, this asset class has survived the Great Depression!

How is this possible, you ask? Are all bankers mighty and omnipotent time lords?

Yes, yes we are, but that has nothing to do with P2P lending. Again, I point you right back to my first counterargument as we look at the borrower’s side of the equation.

Before, we looked at one aspect of P2P loans that were similar to bank loans; the lack of collateral. Not all bank loans involve collateral such as your home and car.

Credit cards are a prime example of unsecured debt, or debt backed by nothing but a borrower’s credit history and promise to repay.

But let’s take a closer look at the actual loans offered by Prosper and Lending Club and see what else is similar.

Let’s see: P2P loans are fixed rate, unsecured loans offered with three to five year terms. The loan amounts range from a couple thousand dollars to $35,000 and are paid back in monthly installments with principal and interest being applied to every payment.

Hmm … these don’t sound similar at all to bank loans. No, instead they sound exactly the same!

Literally, the only differences between a basic personal loan from a bank and a P2P loan is that the bank directly profits in the former while individual investors directly profit in the latter, and I have to deal with angry customers wondering why they haven’t been given a closing date yet in the former while I don’t have to deal with the general public at all in the latter.

… Wait, I think I figured out why I like P2P lending so much.

The banks are still here, still offering these loans, and still making money on them.

In my eyes, P2P lending isn’t really a new asset class at all.

It’s not some exotic new thing that even the most seasoned financial advisers have trouble understanding. They aren’t mortgage backed securities or anything like that.

They are the same simple, easy to understand fixed rate bank loans that people have been dealing with for decade upon decade upon decade upon decade. They have been stress tested to Hell and back and they have passed.

The only thing new is that you have a chance to earn money from these loans rather than Jamie Dimon (Chase’s CEO).

Argument #4: “The people applying for these loans must be some serious deadbeats! If they had good credit, then why wouldn’t they just go to the bank like everyone else?”

P2P lending is just starting to dip its toes into the world of mainstream finance, but it’s not there yet. It’s still a brand new asset class as far as your average investor is concerned.

Most people have never heard on it and have to have it explained to them, while everyone knows about the stock market or buying rental property. And when the average person needs a loan, the first thing they do is go to their bank. Or their parents.

I have seen many people imply P2P loans to be “the back channels of lending”, as if the borrowers were dealing with shady loan sharks in the basement of a Mafia-owned bar. They ask why would someone go out of their way to borrow money at ridiculously high interest rates (Lending Club’s highest APR is over 26%, while Prosper loans can hit the 35% mark) from a lender that no one’s ever heard of when there is a reputable bank on every street corner that they can deal with (and speak to a lending professional as well).

The thing is that many of those reputable banks have very strict underwriting criteria. While they have been loosening their requirements, those underwriting requirements became much stricter in the years immediately following the financial crisis and still have not returned to those levels.

I fully support the tightening of lending standards since banks can only afford so much risk on their primary method of making money (sorry, increasing the amount of deposits is worthless as far as increasing revenue goes since banks don’t make money that way), but that means that it is really hard for Bob the Borrower to get a loan.

But while the big banks are only dealing with borrowers that have perfect or near perfect credit, Prosper and Lending Club will deal with people that aren’t quite at that level but can demonstrate that they will be able to pay back a loan.

Someone who has been successful at making timely credit card payments at 30% interest should be able to pay back a debt consolidation loan at 15%, even if they don’t have the best credit or income. The P2P platforms have their underwriting guidelines, but they are less strict than the banks and will lend to people with subpar credit if those people demonstrate the ability to pay back their debt. They will deal with Bob when the big banks won’t.

But okay, so P2P platforms are geared towards riskier borrowers then? That sounds, well, risky.

Sure they can justify charging these people higher rates, but it sounds like an investor is playing with fire by de facto dealing with only subprime borrowers.

And if P2P lending is going to become mainstream in the investing world, it has to become mainstream in the lending world as well. It has to do that first. Which means attracting prime borrowers.

Why would someone with perfect credit go out of his way to learn about Lending Club when they probably have a Chase right around the corner?

This is where a personal banker is best suited to answer that question. The answer is the interest rates.

If you were to walk into my bank with your perfect credit score and apply for a loan, you will probably be offered a rate somewhere in the 9-10% range.

But look on the websites for the P2P companies. While they are known for exorbitantly high interest rates, those are only for their riskiest borrowers.

Borrowers with good enough credit to qualify for the highest rated loans (A-rated loans) earn the lowest interest rates, around 6.5%.

So imagine someone with perfect credit and a very high income is being offered two loans, one from Lending Club and the other from Chase.

They are both unsecured fixed rate loans with a 3 year term. The person can even apply online for each without leaving their home.

The two otherwise identical loans, however, come with different rates.

Lending Club’s is 6.5% while Chase’s is 9.5%.

Which do you think our hypothetical borrower will choose?

Exactly!

When you loan money to people, you aren’t just giving your money to deadbeats who survive off payday loans and minimum wage.

These aren’t the bottom of the barrel borrowers who were laughed out of the banks. These are prime borrowers who shunned the banks because they wanted a better deal.

Many of the borrowers are the sort of borrowers that the banks look for, that the banks make money off of.

But these borrowers have gone to P2P companies instead, where you make the money.

As a side note, we’d never laugh you out of the bank. We usually wait until you’re gone.

Final Thoughts:

……….Take care of yourself and each other?

I’m not expressly making the case for P2P lending here. Even though I am a lender, I am not arguing that it is awesome and everybody should do it.

There are pros and cons for all asset classes, P2P lending included. But these are arguments against P2P lending that I’ve heard here and there that I had to address because I honestly feel they don’t hold any water.

- We know the loans don’t have any collateral; they are the same unsecured loans that a bank offers.

- It’s not gambling; we can back test these loans to see how they’ve performed historically and only invest in the types that give us the most likely returns.

- It’s been stress tested; these are basic consumer loans that have been around for ages.

- And these aren’t deadbeats who can’t pay their debts coming for more money; many of them are prime borrowers who rejected the high interest rates of the major banks.

I’d like to thank MMD for giving me a chance to voice my opinions on P2P lending. I will now repay him by attempting to steal his readership using this picture of an adorable puppy.

Featured image courtesy of Pixabay.com. See captions for all other image sources.

![As part of their Weekend Update. [Photo courtesy of Wikimedia Commons]](https://www.mymoneydesign.com/wp-content/uploads/2015/06/wikimedia-commons-snl.png)

![My Money Design never--AWWWW!!!! [Photo courtesy of Witthaya Phonsawat at FreeDigitalPhotos.net]](https://www.mymoneydesign.com/wp-content/uploads/2015/06/freedigitalphotos.net-witthaya-phonsawat-puppy-dog.jpg)

I considered peer 2 peer lending until I found that people in my state could only buy investment’s on their secondary market. That killed the dream for me. I think it’s a solid investment idea for those who are able to invest directly!

Holly,

It stinks that so many states still block people from can be a very lucrative investment opportunity. I don’t really touch the secondary markets, but I know some people who will sell noted on it that have entered the payment grace period. I personally prefer to keep my P2P lending a simple as possible.

Thanks for commenting!

Sincerely,

ARB–Angry Retail Banker

Excellent post ARB! I’d love to do some investing with P2P but am in a secondary only state. I love the idea, especially for those that can directly invest and think it’s a great way to add some diversity to your investing as a whole.

John,

I’m glad you enjoyed it! Not so glad that you are also in a state that won’t let you invest properly. Seems to be a thing around here.

It’s great for diversity into fixed income debt assets. If you’re looking for bonds, but you want a better yield than US Savings Bonds but better diversity than putting your money in a handful of third world countries’ bonds, then this a perfect alternative.

I still believe it should a small portion of your overall portfolio, but if done right then it can be a powerful place to grow wealth as you eventually move funds over to a dividend stock portfolio or something.

Thanks for commenting! I’ll likely be covering P2P lending on my own blog from time to time.

Sincerely,

ARB–Angry Retail Banker

Very nice overview of P2P lending. I’ve considered it but never pulled the trigger. I guess there are too many choices in the investment world. Our latest focus has been on real estate, but maybe down the road. I think P2P is a great way to add diversity.

Kim,

I consider the swath of investment opportunities out there to be a good thing. But sometimes you need to hang back and choose which investments you are going to master and which ones you are going to ignore. Like anything else, we can’t be good at EVERYTHING investing, and it’s better to truly master a handful of passive income techniques than to try (and fail) to manage every type of income source under the sun. “Jack of all trades, master of none” isn’t the best way to go with investing, in my opinion.

You have to find the investments that are right for you. For you, that might be real estate. P2P lending might not be for you. I’m the opposite. As a banker, I feel comfortable with the risks that come with these loans. But I’m also a very Lazy Retail Banker, not just anAngry Retail Banker. As such, I like my passive income to be truly passive. The idea of dealing with maintenance issues and unruly tenants turns me off to the idea just as quickly as the idea of lending money to strangers over the Internet may turn others away from P2P lending.

I wish you luck on your real estate investments. And maybe once you become a major real estate tycoon, you’ll dabble in P2P and become a fellow lender.

Oh, I just checked out your recent article about how to pay for emergencies without going into debt. We as a country really don’t learn, do we? People with six figure incomes can’t afford to pay $400 for when something goes wrong? You know what, if you work in a bank and see how some of these people handle their money, you wouldn’t be surprised.

Thanks for reading!

Sincerely,

ARB–Angry Retail Banker

I am a Lending Club investor as well and so far am really happy with the returns (~10.9% currently, but i am expecting it to fall to 7-8% in the long term). It is nearly impossible to cover all possible reasons people have against P2P loans in one post, but you did a really good job. Thanks for taking the time to get these out there!

I had a couple thoughts to add that have influenced my reasons for using P2P lending as part of my portfolio.

1) A lot of people have a fear of non liquidity of P2P investments. While i would argue that Lending club and Prosper could do a better job encouraging the secondary market, there is actually a decent amount of liquidity here. I actually started investing with Lending club a couple years ago, then changed my mind and wanted to pull my money out to pay off my house. It took me a bit of work, as listing and pricing loans isn’t as automated as it could be, but i was able to unwind my entire portfolio in a month and only took about a 1% hit on total value (this is about a one month penalty on interest which is very similar or better than most CDs). When i started investing again a year or so later i knew i could get my money out if i needed to.

2) In addition to the liquidity that is there, the cash flow aspect of P2P loans actually make it a very attractive emergency fund or 5 year gap fund (if you are planning on doing a rolling roth conversion ladder). There are a couple articles that do a better job explaining this than i can here (https://www.1500days.com/guest-post-using-p2p-lending-as-a/ , https://peersociallending.com/investing/cash-flow-king-peer-peer-lending-investments/ ). but basically in addition to the interest payments you receive you get almost 2.5x that amount in principal payments each month so your entire position will unwind in 3-5 years if you don’t reinvest. I have enough investments in Lending club right now to generate a $800/month cash flow for 4-5 years. This is huge! My personal goal is to get this up to $2000/month that would completely cover my basic expense needs in case i say lost my job, wanted to change professions, or retired early and worked on rolling IRA contributions over to my ROTH.

3) last point i wanted to squeeze in is that yes there is a risk of loss of capital if say the economy tanked, job market crashed, and people started defaulting like crazy. But guess what – the stock market is going to get crushed in that scenario as well. So even if i loose 10% of my investments (which seems incredibly unlikely), while stocks drop 20-30% (which seems pretty likely at the moment), i will still have made out like a bandit compared to everyone else 🙂

Lucas,

Man, how did I miss your comment? That’s what happens when you mainly use an iPhone with a cracked screen.

I’m glad you enjoyed the article. Certainly there are reasons to stay away from P2P lending and reasons to dive right in. I will never say that it’s for everybody or that there are no arguments against it (I have a friend who’s skeptical of P2P lending and has used mathematics to prove that you really need a big investment in there in order to be fully protected). But these are the most common arguments that I hear, and like I said, these specific arguments I don’t think hold water.

I also agree with you that with the secondary markets, there’s more liquidity than people think in P2P. That said, I don’t really bother with them. Maybe I’m just lazy, but I don’t really feel like listing my loans on the secondary just so they can be sold at a much lower price than what I bought them at. If it gets to the point where I’m selling a loan, then that means that the loan is likely a toxic asset at that point. Might as well keep it; either it’s unsellable at a good price (or at all), or the borrower will find a way to start making payments again.

I never really thought of P2P loans as an emergency fund. Personally, I prefer to have a high yield online savings account or short term CD as an emergency fund (since I may have to access that money QUICK). But depending on the size of your portfolio, it can provide short term monthly cash flow to tide you over until it’s time to start drawing from your 401k, Social Security, etc. It can be a great tool for early retirement if you’re looking to just retire a few years early (or a few years earlier from when your main early retirement income source is ready to kick in). All you have to do is simply stop reinvesting the loan payments you receive and start withdrawing them instead. Honestly, though, a dividend stock portfolio is ideal for cash flow and superior to P2P lending as the dividends should be growing and your companies don’t have a mere 3-5 year lifespan (the cash flow from a P2P portfolio is finite; once that last borrower pays off that last loan, your cash flow is gone unless you start investing again). Still, if you are nearing early retirement and want to get out of the 9-5 a couple years early, tapping your P2P lending portfolio for cash flow can definitely help you bridge that gap.

Thanks for commenting and giving your thoughts, Lucas. I’m glad you enjoyed this article. I put a lot of time and effort into creating this content, so I hope that this content provides value for MMD’s readers.

Sincerely,

ARB–Angry Retail Banker

Great writeup!

I get tired of winding where and when the other financial shoe will drop every time I make my IRA contribution and try to decide where to invest it.

Next year I’m opening an IRA account with Lending Club, at least I’ll have more fun picking the investments.

Jack,

An IRA is probably the best way to go with P2P lending. I wish I had thought of that sooner (I was trying it out and didn’t want to potentially tie up the money until 59 and 1/2). Unlike dividend stocks, you can’t just sell off your loans (well, you can in the secondary markets) and it takes 3-5 years for them to be paid off, so it takes time for you to have access to all that cash you’ve invested once you decide that it’s time to stop accumulating assets and start living off them. If one is going to have to wait anyway, an IRA simply makes sense. Plus it helps save money since P2P lending is taxed as ordinary income, unlike dividends from stocks.

It’s good that you are going to open an IRA with Lending Club next year. Learn about P2P in the interim. Learn about what type of people are more likely to pay/default on loans, which types of loans have a higher rate of default, and even what areas of the country are more likely to default. Use Nickel Steamroller, the back testing site I mentioned in the article, to see what results you can reasonably expect based on the outcomes of past loans.

Sincerely,

ARB–Angry Retail Banker

I’ve been doing very small-scale P2P lending for a long time and haven’t seen returns that high!

My returns have been in the 1-2% range, but I will say this — I’ve been a member of Prosper for a long time. I started in 2007 with $100 and 2008 came and took a big chunk out of that. I’m almost back to $100 in this account without adding in any additional money, but it just goes to show what a down market can do. But that’s the risk you take in any of these scenarios. I guess my point is that, wherever there is the chance to gain big, risk is going to follow as well.

All that being said, I could see myself starting to invest a small portion into Prosper on an automated basis as an investment vehicle. That kind of dollar cost averaging might help to alleviate some of the pain caused during economic downturns.

FM

FI Monkey,

Yikes! I was going to ask how your returns were that low until I saw the dates, The pre-2009 Prosper and the post-2009 Prosper are like two different companies now, and the difference between them is like night and day. Their underwriting policies back then were very loose and irresponsible, and a person was more likely to lose money with them than to gain.

Today, it’s different. I pointed it out in the article. They have a very favorable rating with the Better Business Bureau. They are definitely worth investing in. Just remember that, with P2P lending, your initial returns will be much higher than what they will be after a couple years. When you first start, all your loans will be new and you won’t have had a chance to experience defaults. After a year or so, your returns will come down to more realistic levels once things normalize and the losses from defaults are factored in.

I wouldn’t really do much dollar cost averaging with P2P, unless it’s for the purposes of keeping it at a fixed percentage of an overall growing portfolio (complete with stocks, bonds, real estate, precious metals, or whatever else). There’s not much to dollar cost average anyway. It’s not like the P2P market, or the loans within, go “up” or “down” like stocks. You can dollar cost average your way into Apple or Coca Cola as the stock price goes down. But some guy’s $15,000 debt consolidation loan is just that, and once it’s funded, then it’s funded. I say take a small but fixed amount, invest in both Prosper and Lending Club loans, and then slowly add to it as time goes on while making sure to keep it at only a certain percentage of your greater portfolio (well less than 10% for me).

Sincerely,

ARB–Angry Retail Banker

ARB,

Again – thanks for the great guest post!

I’ve 2 questions to ask:

1) What sort of a strategy for P2P Investing do you feel as got you to the returns you’re seeing so far? Do you think you’ll continue down the same path for the foreseeable future?

2) Do you have anything specific you look for to screen out a borrower before you invest in it? What sorts of things draw you in or send up red flags? For example: Do you only invest in borrowers who plan to use the money to start their own business?

MMD,

Thanks for having me! And for putting up with posting my gigantic article with about a hundred thousand pictures and links. I’m sure there was that one moment where you had to be wondering “Why the hell am I allowing this individual to guest post here!?”.

I’ll answer both your questions in one fell swoop. Screening the borrowers is everything. It’s the basic underwriting. Sure the companies themselves will underwrite the loans before they hit their sites, but like a bank, you’ve got to do your due diligence and thus your own underwriting.

The thing is, there are a LOT of loans to go through. You’ve pretty much got to underwrite them in one fell swoop. And that means coming up with a set of criteria that maximizes your returns, minimizes your defaults, and to set your account to automatically invest in loans that fall under that criteria.

I mentioned Nickel Steamroller because that site allows you to back test loans and see what worked and what didn’t. What criteria (loan grade, employment history, purpose of the loan, credit score, number of recent inquiries, home ownership, number of bankruptcies, state of residence, so on and so forth) have historically made people money and what criteria have lost people money. Obviously that’s only past results, but they are REAL past results and that gives us the best possible information we can get. You have to choose the settings and criteria that are right for you, that give you the highest returns and the lowest default (and overall, the most comfort), and then import those settings over to your P2P portfolio and set it to automatically invest those loans.

Every person is going to evaluate risk and reward differently, but I’ll tell you the criteria that I use: Over on Prosper, I invest in notes from grades C-HR (excluding the safer A’s and B’s), with 0-1 inquiries in the last 6 months (I’m okay with one inquiry because most people who need a loan don’t run to P2P lending first), no bankruptcies or anything on public record in the last 12 months, and an income of at least $50,000/year. On Lending Club, I invest in 50% C grade loans, 35% D, 10% E, and 5% G.

That’s my criteria. I actually don’t go too heavily on the underwriting. For me, it’s been working out. Nickel Steamroller results seem to back this. Other people might find this too aggressive/conservative. To each his own. I’m no P2P success story, just someone who’s good at countering arguments. My returns are what seem to be average. So I wouldn’t advocate just piggybacking whatever I do. But that’s been how I invest and it has been working for me so far. I will likely revisit Lending Club and start putting on more filters (I didn’t really filter out the loans there as it would have ended up with me not being able to invest in ANYTHING at the time. There simply weren’t enough loans out there), but outside of those few tweaks, setting those criteria and automating the whole thing is going to be my strategy for the foreseeable future.

I hope that answered your question, MMD. But like I said, everyone’s different. What works for one person might not work for someone else (a friend of mine thinks debt consolidation loans are a step away from bankruptcy while I think they are a pretty safe loan to go for). And I’m sure anyone can find faults with my filters, or lack thereof.

Thanks again for having me here, MMD! I hope your readers find some value in this post.

Sincerely,

ARB–Angry Retail Banker

I haven’t tried it because of the tax consequences (taxed at ordinary income), where as my capital gains are never taxed if I don’t sell and my dividends are taxed at a reduced rate. I just think investing in my plain Jane index funds is easier, and will have a better return for my investments over the next 30 years.

Fervent Finance,

The tax situation definitely stinks when it comes to P2P lending. But you can actually open up IRA accounts. Perhaps combining P2P lending with the backdoor Roth IRA conversion strategy MMD discovered recently could make for a decent early retirement strategy (or at least part of one).

Do those index funds pay a dividend? For me, investing is all about the cash flow. Your paper wealth may increase faster with index funds, but what’s the point if it’s just paper? Paper wealth doesn’t fund early retirement, or pay your bills. Personally, I prefer dividend stocks. I might have written about P2P lending, but dividend growth investing is my main investment strategy and I love it.

Sincerely,

ARB–Angry Retail Banker

I have heard of P2P for so many times. Thanks for being transparent about this and balancing the pros and cons. That being said, I’d like to try this out if there’s a chance. And, I know I am more secured after reading your post.

Thanks, Jayson! I do recommend trying it out. Just keep it a relatively small part of your overall portfolio, as they still carry a relatively high risk compared to stocks and mutual funds. It’s a good way to get into fixed income without the ridiculously low yields of US Savings Bonds or the ridiculously high risk of Zimbabwe (or whatever third world country’s) government bonds. Plus you get to be secured in the knowledge that you helped fund someone else’s wedding, vacation, business, or debt consolidation. Gives you that warm and fuzzy feeling inside (maybe).

Use Nickle Steamroller to back test different loan criteria. There’s dozens of ways to filter out loans. See which loans have historically done the best and use the ones that are right for you.

Good luck and thanks for reading and commenting!

Sincerely,

ARB–Angry Retail Banker

AS of right now, I cant invest in P2P my state is one of those states. But it seems many people are making a killing with over 10% returns. When I retire and move to a tax free state that allows P2P, ill use the interest to fund my wine & beer budget.

El,

Geez, another one that can’t invest in P2P! It’s really a shame that the state governments don’t do anything to protect the people, instead regulating and controlling them. They’ll tax your hard earned money to the point where most of the grueling labor you do goes right to them, and they’re alright with you being able to buy piles of electronics by charging it on a credit card and paying 35%. But a legitimate investment opportunity that can provide outsized returns (on the lenders’ side) or an opportunity to get a loan at a more reasonable rate and avoid a debt that spirals out of control? Oh no, they can’t have THAT.

Sorry, it’s just something that irks me. Anyway, thanks for commenting. Hopefully, that wine and beer budget skyrockets pretty soon.

Sincerely,

ARB–Angry Retail Banker

Aw, man. Apparently Arizona isn’t big on the P2P thing. I had actually planned to look into it in 2016. That said, yes I think the arguments against P2P lending are based on a lot more fear than anything else. Don’t want to lose big? Don’t put much money into a given loan. And/or choose low-risk ones.

It’s the same as putting your money in the stock market, really. You never know what companies are going to do to upset the public and cause stock prices to plummet. At least with P2P lending, your return isn’t in danger of other lenders’ panic.

Abigail,

Exactly. I think people are afraid of P2P lending because you are combining a new financial/investment concept with the still relatively new Internet. New technology especially scares people. You put that together into a package that can be summarized as “lending money to strangers over the Internet” and I’m not surprised that there’s resistance to this.

Can you imagine what an elderly person clinging to her passbook and saying that CDs, gold, and your home are the safest and best financial investments is going to think about P2P lending?

Sorry that you, too, live in a state that doesn’t allow P2P lending. But you have plenty of other ways to make passive income, so no biggie. MMD’s grand list of passive income ideas pretty much give every alternative you could think of.

Sincerely,

ARB–Angry Retail Banker