It’s arguably one of the most highly debated figures in retirement planning.

Since its inception in 1994 by Bill Bengen, it seems as though you can find just as many people who love it as those who hate it.

Why so much fuss over one tiny, little number?

Because of what it stands for! Planning your nest egg size using the right safe withdrawal rate figure can mean the difference between playing with fire during retirement or having 100% confidence that you’ll never run out of money.

But if you pick a number that is too conservative, it can also mean the difference between trying to save up for a $2 million dollar nest egg instead of a $1 million dollar one. Obviously it would be great if we didn’t have to stress ourselves out by saving two or three times more money than we need for retirement.

So what if the critics are right? What if some other figure than 4% (maybe lower or even higher) could give you that confidence you need without having to drastically over-save your money?

In this post we’re going to take a hard look at a number of safe withdrawal rates and see if there really is some optimal number we can count on when we’re planning for retirement.

How Can We Find the Perfect Safe Withdrawal Rate?

To properly explore this subject, let’s first ask ourselves:

What do we want from this little exercise?

Since I plan to retire early (and you can see my whole plan here), I want:

- The highest, reasonable level of confidence that we’ll never run out of money.

- A rate that will last us longer than 30 years.

That’s good! But how do we figure that out?

Well … usually when someone wants to see how their investments would have performed, they simply take the annualized average of the stock market over the last 50 or so years and crunch some numbers as if each and every year the stock market returned a fixed rate of return.

Though that makes for a nice back-of-the-envelope style of estimation, it fails to reproduce what actually happens in real life.

In reality, the markets go up and down all the time. Never do they produce the same perfectly linear return each and every year.

So a better way to prove to yourself how long your money “would have lasted” would be to use real stock market data – as if you had actually retired during specific 30 year time frames. For example:

- If I had retired in 1985, I would have X1 amount of dollars left to my name today in 2015.

Now as you can guess, retiring at different years throughout history would have made significant differences on where or not your nest egg savings would have lasted. For time periods it would have been successful (positive balance) and in other instances you might have ran out of money (negative balance).

So a far more thorough way to approach whether or not your savings would have lasted would be to repeat the same analysis for various periods in history straight down the line:

- If I had retired from 1984 to 2014, I’d have X2 amount of dollars left.

- If I had retired from 1983 to 2013, I’d have X3 amount of dollars left.

- If I had retired from 1982 to 2012, I’d have X4 amount of dollars left.

- … and so on.

Doing things this way would give you far more confidence that no matter what happened in history; whether it be bad economic conditions, war, natural disaster, or whatever, that your retirement nest egg would have made it and you would have never ran out of money!

Wouldn’t it be great if there was something out there that could take those stock market returns and do all of these simulations for us?

Guess what … there is!

It’s called FIRECalc.

The Power of FIRECalc:

FIRECalc is a wonderfully useful free website that can essentially be used to do everything I just said above.

The way it works is you simply go to the homepage and enter in:

- How much you’d like to take out of your nest egg every year in retirement

- What size nest egg you plan to save up (start with)

- How long you’d like to see your savings last.

Then … Presto! FIRECalc crunches your numbers through every economic condition since 1871 and lets you know how exactly many times your portfolio would have succeed or failed. They also provide a “success rate” number letting you know the percentage of how many of those conditions had positive results.

Imagine that for one minute …

Finding a safe withdrawal rate with a success rate of 100% means you would have out-lasted every single thing that happened in the world since 1871!

How’s that for confidence?

So for this experiment, I’m going to use FIRECalc as a sort of “safe withdrawal rate calculator” to see just how many scenarios would have actually returned a 100% success rate (or close to it).

The Results:

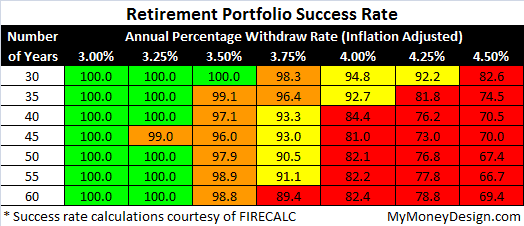

After running dozens of retirement scenarios through FIRECalc, here are the success rate results it returned:

I figured the most effective way to share this with you was in the form of a heat map.

My own personal preference for this heat map was:

- Green = 100% success!

- Orange = 95 to 99% – Still really good odds of success.

- Yellow = 90 to 94% – Getting a little risky.

- Red = 89% and below – Too risky. Forget it!

The Winner?

So looking at this table, what would I declare the most optimal safe withdrawal rate to be?

3.5%

That’s the equivalent to an inflation adjusted withdrawal of $35,000 every year for a starting nest egg balance of $1 million.

Why Did I Pick That Rate?

Statistics!

Notice how in that column every single success rate was above 95%. Even for retirement periods lasting as long as 60 years!

I don’t know if I’m going to be retired for 60 years. But that sure would be nice to know that my money is going to last that long if I need it to!

Now if I really wanted to be conservative, then I could have instead opted for a 3.0% or 3.25% withdrawal rate. After all – those two rates had almost unanimous 100% success rates for every given time period.

But understand what that means. Using our example above, a 3.0 percent withdrawal rate would only give you $30,000 for your $1 million dollar nest egg. That’s $417 less per month you get to enjoy in retirement.

On the flip-side, too conservative of a withdrawal rate could also mean saving up a whole lot more for retirement; perhaps unnecessarily. Let’s say you wanted that $35,000/year retirement income. That would mean having a nest egg of:

- 3.5% withdrawal rate = $1,000,000 nest egg

- 3.0% withdrawal rate = $1,166,666 nest egg. That’s $166,666 more dollars you need to save! Ouch!

So is the risk of a 3.5% rate worth the return?

For me, I think so.

What About the 4 Percent Rule?

To give credit to the number that started it all, notice that the results from FIRECalc do in fact validate the 4 percent rule.

At 4%, you have a 94.8% chance your money will last you for 30 years. To my surprise it also revealed that you would have 92.7% chance that your money will last you 35 years. That’s not too bad.

If all you plan on needing your nest egg is for 30-35 years, then these are pretty reasonable success rates for you to base your retirement planning needs upon.

It’s when you get into 40 years and beyond that you see how a 4 percent withdrawal rate starts to unravel. Notice how at those years the results start to get very unfavorable.

The same could be said about a 4.25% withdrawal rate. If you only need your money to last 30 years or less, then you could get away with using this rate. Plus it would give you more money to enjoy at retirement!

But anything higher than 30 years and your chances of success again quickly tank.

Forget about using a 4.5% rate or more. You’re simply just playing Russian Roulette with your retirement savings at that point.

FIRECalc Technical Notes:

A few details I wanted to point out about FIRECalc and the calculations it produced here:

- The success rate is based only on the three numbers you enter into the program (as we talked about above). It’s ignoring any Social Security, pensions, dividend income, etc.

- It’s assumed that the money you withdraw for your retirement expenses is inflation adjusted at 3%. In other words if you start with $40,000 your first year, you’ll take out $41,200 your second year, $42,436 your second year, and so. I’m glad the creator of FIRECalc did this because that’s right in line with how the original 4 percent rule publication of 1994 approached this.

- All the market phases are based on years going back as far as 1871.

- It’s assumed your portfolio is 75% stock (index) and 25% bond funds. Obviously if your asset allocation was different, then this would affect the results.

- It automatically subtracts an annual fee of 0.18% to cover the funds.

One of the cool things about FIRECalc is that you can alter any of these “default” settings to make the simulations as close to your personal financial situation as you’d like it to be.

I highly encourage you to check it out and give it a try for yourself!

Readers – What are your safe portfolio withdrawal rates? Do you agree that 3.5% is a better compromise between confidence and return? After looking at this data, what number do you feel comfortable with for your own retirement planning needs?

Featured image courtesy of Pexels

MMD, that column/spreadsheet is indeed helpful. And, I think the 3.5% is fair enough for everyone. Having this rate would really get me motivated to save for my retirement years/fund.

It is definitely helpful to see that even after 60 years of stock market data at that rate that your money would be so secure. The 3.0 and 3.25% would be a little better, but I think I could take the risk.

3.5%, 4%, I’m not really thinking too much about it now. I know that every retirement scenario I run gives us a 100% chance of retiring completely on our “goal date” with a withdrawal rate of 4%. If we get to that point and find that it’s pushing it, I feel confident that we could learn to live on less. Right now our goal is just saving as much as we can.

If you’re saving that high, then chances are you’ll probably be able to use a more conservative withdrawal rate and guarantee that your money will last forever.

Great breakdown MMD! I’ve done some playing around with FIRECalc myself though not this in depth yet. Like Holly, we’re basically focusing on accumulating as much assets as we can and diversifying as much as we can. I don’t know that ER is necessarily the route we’ll go as it’ll depend on the growth of our business.

Even if you don’t go for early retirement, understanding the viability of these withdrawal rates can still be helpful – no matter when you start dipping into your retirement savings.

I’m pretty far out (~10 years) from FI, but I would be fairly confident with 4%. Mainly because I don’t think I will never earn income again. I’m sure I’ll find something I like that will at least cover a portion of my expenses every year, and therefore drop my withdrawal rate lower than 4%.

Having a part time job or making some income on the side will definitely drop how much you need to withdraw from your savings. It’s a smart way to offset your expenses and use a lower withdrawal rate without having to skimp by with too little.

My approach to retirement planning is to construct a portfolio of dividend growth stocks, and then live off that dividend income. My portfolio could yield somewhere between 3% – 3.50% on average, and grow that dividend income above the rate of inflation.

One interesting piece of information behind the 4% rule is that between 1926 – 1994, the average yield on US stocks was approximately 4%. Plus, if you look at historical trends, you will see that dividends are always positive and much more stable than capital gains.

Good luck in your retirement planning!

DGI

Thanks for those investment tid-bits. You don’t have to sell me on dividends. I love those things! I plan to have a decent portion of my early retirement income come from dividends.

I’m with many of the others. At this point, I’m not too worried about my safe withdraw rate. I am more focused on saving as much as possible every month. Right now, my wife and I are working on saving 40% of our income.

No worries. The idea behind the article was to give people the right tools for planning out how much their nest egg needs to be. Depending on whether you use 3.0% or 4.0% or whatever, it can make a pretty big difference in how big your nest egg ultimately must be.

Hi,

I think there’s an error in the article. You list 3.5% withdrawal rate needs a million. 3.0% needs 1.6 million. Do you mean 4% needs 1.6 million? A smaller withdrawal rate wouldn’t need a larger nest egg.

Thanks, but where in the article does it say you need 1.6 million?

Are you referring to the part that says:

The math behind those figures is:

$35,000 / 0.035 = $1,000,000

$35,000 / 0.030 = $1,166,666

In order to maintain the same retirement income level but use a more conservative withdrawal rate, you’d have to start off with a larger nest egg amount.

I haven’t used FIRECalc, but it’s always interesting to run the numbers. We are also trying to save as much as possible and develop other streams of income just in case. I am pretty confident that between all of our investments we”ll be in good shape when the time comes.

Yes the ideal withdrawal rate for me will be 3.3% because I will leave the spread between this and the portfolio returns to help provide a buffer for growth. I estimate my portfolio to return around 4-8% in dividends every year. So with a 3.3% withdrawal rate, SS, website income, and other misc. income, I should be able to retire OK.

I think a 4% withdrawal rate is VERY safe if you ignore entirely Social Security — in other words, if you need $40k a year, $1 million is plenty to retire, because at some point (and certainly by 70) you will be collecting Social Security in some amount/.form to reduce the amount you’re taking out.

Now, you’d need the discipline to merely reduce your withdrawal amount by the amount Social Security is paying you or some large percentage of the amount you’re getting from Social Security (i.e. not treating Social Security as a windfall bonus and just maintaining the 4% rate of withdrawal from your portfolio), but if you calculate your needs without Social Security, you’ll be pleasantly surprised how well you’ll do WITH Social Security at the 4% rate.

Great info in this post. So often people focus on “the number” to retire and forget about the fact that it all comes down to cash flow. A safe and calculated withdrawal rate will dictate your income. It comes down to planning your retirement expenses and lifestyle in accordance with that cash flow.

Like many others here, I’m not too worried about my SWR, but for a different reason. As I’ve mentioned in the past, I plan to live off my dividend income rather than a traditional nest egg. This way, rather than selling assets and drawing from a finite pool of money, my retirement income will replenish itself automatically. I’ll never have to sell which means I’ll theoretically never run out of money.

That said, I will be using my 401k as part of my early retirement strategy with that backdoor Roth conversion tactic you talked about. That I may need to calculate my SWR for, but that is only going to supplement my retirement rather than being the main source of funds.

Sincerely,

ARB–Angry Retail Banker

That sounds really neat – I will definitely check this out. Although, the 75% stocks sounds a bit high as a default…

I think the 3.5% withdrawal rate would work out if one wants to have an inflexible withdrawal pattern. Even though the 3% rate has been advocated for by many financial analysts, it means one have to save more and thus not the best. However, for some of us who want to be spontaneous in how we withdraw, would the 3.5% rate be appropriate?

It all depends on your retirement time horizon. If you’ve got 35 years or less, then you could be a little more flexible with your withdrawals. But if you want a high level of confidence of success, stick to 3.5% or less.