“.

The main theme of the book is that a stock’s dividend yield is the best indicator of its value and ultimately the right time to buy. Building upon “The Dividend-Yield Theory” presented in the first book, Kelley reviews and updates this theory using new and recent data. The book then goes on to explain how this theory can be applied by individual investors.

The Dividend-Yield Theory:

The Dividend-Yield Theory is very interesting. Rather than look at 100 different metrics, the theory follows one simple premise.

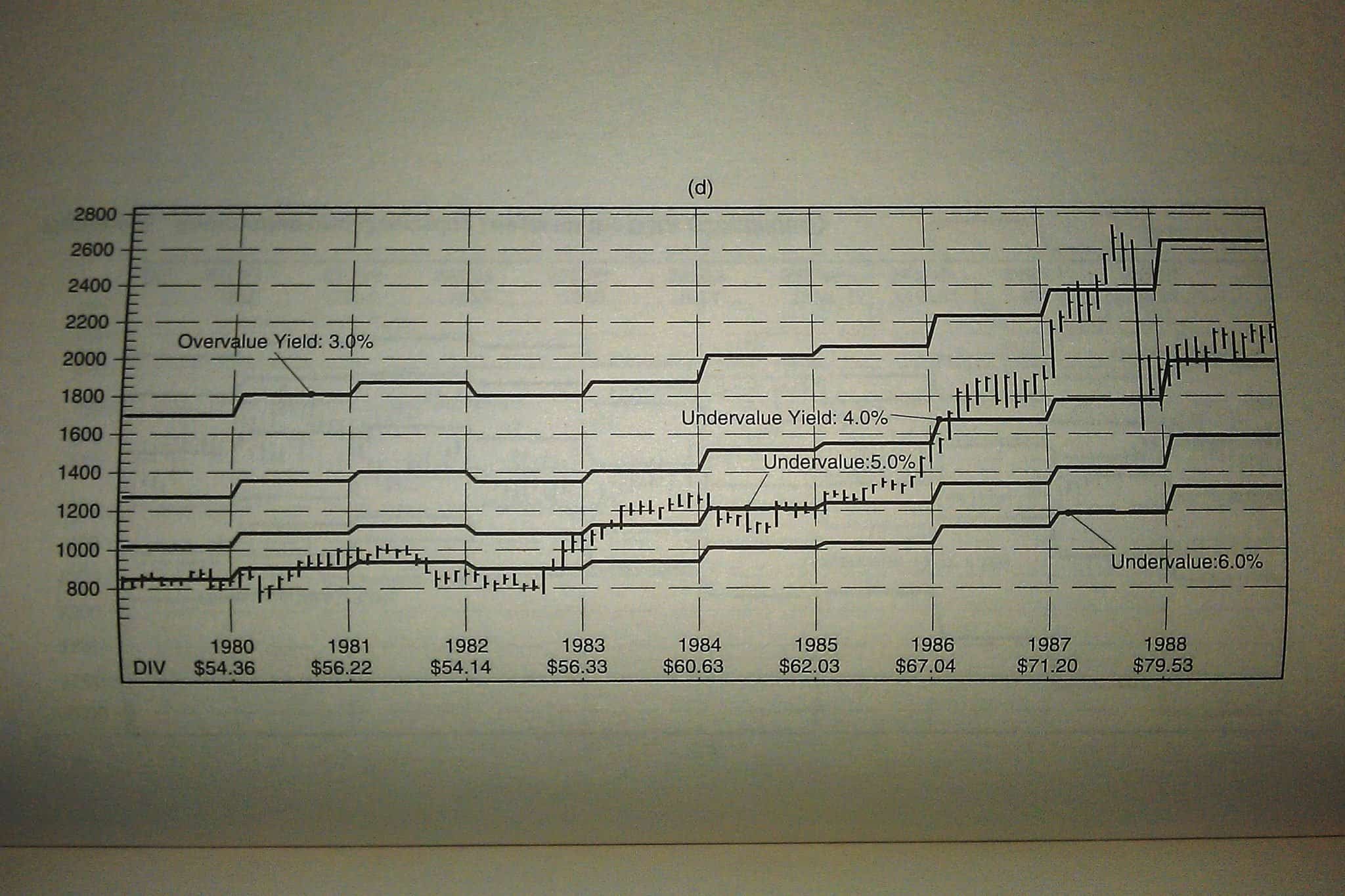

If you take any reputable, blue-chip stock and follow its dividend yield, you’ll notice it cycling up and down over time. It’s within these cycles that upper and lower-limit boundary lines can be established. As the stock’s dividend yield cycles up and down, this will reveal if it is either “over-priced” or “under-priced”. As you can probably guess, we want to buy when the stock is under-priced!

Unlike many books on this subject, the text gets pretty graph and chart heavy towards the middle to support this theory. You can see the cycle in both the Dow Index as well as a few individual stocks.

So how can we find out just what these boundaries are? By subscribing to Kelley’s publication of course! His newsletter “Investment Quality Trends” (to which Kelley is the Editor of) does just that – reviews and analyzes stocks for these types of occurrences. And he makes sure to mention this every couple of pages …

Making a Strong Case for Stocks:

Even if you don’t believe this theory, the book is packed with a lot of great reasons why stock investing is one of your best strategies for the long-term.

For example, Chapter 2 (p. 17) proclaims that between 1926 and 2008 that the average annualized returns for the following investment types were:

• S&P 500: 9.60% (or 7.10% after inflation)

• 20-Year Government Bonds: 5.70% (or 2.20% after inflation)

• 30-Day Treasury Bills 3.70% (or 0.50% after inflation)

Obviously there are going to be periods where bonds do better than stocks. So Kelley tests that theory by comparing the “rolling averages” against each other over certain lengths of time (20 years, 10 years, etc). What did he find?

• 20-Year Holding Period: Stocks outperformed fixed income 98.43% of the time (p. 22)

• 10-Year Holding Period: Stocks outperformed fixed income 85% of the time (p. 25).

• 5-Year Holding Period: Stocks outperformed fixed income 73.41% of the time (p. 25).

Focusing on Blue Chips:

In the value-investing mentality of this book, it really focuses a lot on blue chip companies that issue dividends. Not only is there a lot of argument for blue-chips and the Dow Jones, but it also gives some good rule-of-thumbs to follow:

• Stay away from dividends that have a payout ratio (dividend divided by the 12-month earnings) that are higher than 50% (or 75% for utility companies) (p. 178).

• A stock is likely to increase its dividend when the payout ratio is 30% or less (p. 178).

Not Necessarily for Beginners:

As I’ve already mentioned, this book is very chart and graph heavy. The text basically already assumes you know something about stocks and investing. It does not get into what a dividend stock is, using them for retirement, DRIP’s, or any other 101 lesson such as that. If you’re just starting out, you may want to consider reading “The Little Book of Big Dividends: A Safe Formula for Guaranteed Returns” by Charles Carlson first.

Related Posts:

1) Book Review: “The Little Book of Big Dividends” by Charles B. Carlson

2) Protecting Yourself with Dividend Stocks

3) Will Dividend Stocks Help Me Retire Early?

Photo Credits: Amazon, Dividends Still Don’t Lie

This book looks great, but as you said — I think I’d need to read a few beginner books to get my feet wet before I dive into this one. Great writeup!

Thanks Nell and welcome to the site! Yes, try the “Little Book of Big Dividends” first. It is much more introductory in nature. I’ve spent most of this year and last learning about dividends and how people use them as part of their passive income strategy. It’s a very intriguing concept that requires a lot of wealth generation over time, but could have great pay-off.

Does the book do a good job explaining the theory or would I have to subscribe to the newsletter to follow through on the info? It sounds interesting but I don’t want to read something that’s just hocking a newsletter….

Yes, the book does a good job of describing the theory and arguing for the dividend metric. However, the bulk of the text is more suited to support the theory. To some degree Wright basically assumes you’ve read the first book from the 80’s and then builds upon the theory by presenting data that takes us all the way up to the present. Although he describes what the “under-value” or “over-value” lines are, he does not reveal the equations for technically determining them. I guess you can’t reveal the magic behind all your tricks.

I know what you mean about reading books and having them be giant infomercials. That seems to be more and more common place in some of the newer books.

Thanks for the tip MMD! I haven’t gotten into dividend paying stocks but it will be something I consider as we start to invest more heavily in the coming years.

I would add this book to my list now but I have like 30 already on there. I think I will just have to take a mental note and check this out when the time is right (for me).

I’ll make dividend investing easy on you Jason – Just keep checking back here! That was one of my major initiatives for the year. And as you can tell, I’m making sure to share my lessons with everyone as I keep learning more about them.

I like this approach especially with blue chips. I think that having a portfolio of blue chip, high yield dividend stock is must for your safe retirement. I’d even mix this with the Down theory. Find high quality, blue chip stock that is undervalued. Let it go up before you sell and reinvest into another undervalued blue chip. You make money by the stock price gain and the dividend while you are waiting for stock to go up!

Again, you have read my mind! I’m working on a post now about the Dogs of the Dow that I will publish in about two weeks. The Dogs theory intrigues me! It seems more and more that dividends reveal a great deal more about investing security than most of us realize.