Who’s ready for some financial smack-down? If there’s any two groups of investors I can think of that are more divided, it’s those who invest in real estate and those who invest in stocks - like a North and the South of financial planning if you will. So the question here is this: Which one actually has a better chance of making you more money in the long run? This may be a controversial debate, but we’re going to settle this argument the MyMoneyDesign way – by running the numbers! So let's see what we come up with ... … [Read more...] about Which Is Better – Rental Income or a Stock Market Index Fund?

Mortgage & Refinance

How Much Money Would I Make If I Rented Out A House?

When it comes to buying stocks, the old rule of thumb is to “buy low and sell high”. If you’re fortunate enough to understand this saying, then you’ll know that it doesn’t just apply to stocks. It’s meant to teach you to look for opportunities. So even though the value of my home seems to go down, down, down every year, perhaps therein lies an opportunity. As I walk the dog through my neighborhood, there is an abundance of houses for sale. And what’s more is that I KNOW they are selling for FAR less than what I paid for mine. So this gets me thinking: • If I have any aspirations to buy a house and rent it out, is now the time? … [Read more...] about How Much Money Would I Make If I Rented Out A House?

Dos and Don’ts in Mortgage

Are you looking to buy a house? The purchase of your home may be the largest expenditure you will have in your life. Therefore, applying for a home loan is a process that you should not take lightly. The cost of a house is just your beginning expense. Points and the interest you must pay for a mortgage during the term of your loan will be much more than the price of the house. That’s why paying attention to the details of your home loan may turn out to be more important than the sale price of the home. To get the most out of your mortgage, consider the following: … [Read more...] about Dos and Don’ts in Mortgage

Before Retirement, Eliminate Your Biggest Expense

Frequently when you think of planning for retirement or becoming financially free in general, you think about how much money you’ll need to save in order to generate the kind of income that you’re use to. For example, how can I save $1,250,000 so that I can draw 4% and take out $50,000 each year? In this post, we’ll look at the other side of the coin. Instead, we’ll look for a way to reduce how much income you’ll actually need while on your own. And how will we do this? By focusing in on one of your largest expenses – your mortgage. … [Read more...] about Before Retirement, Eliminate Your Biggest Expense

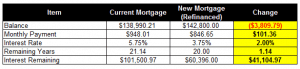

Adventures in Refinancing, Chapter 5

I’m very proud to announce that this chapter will end our story on getting a refinance. As of Monday, we finally closed on our new mortgage under the Home Affordable Refinance Program (HARP)! Here’s what has been going on since last time: Our Home Appraisal: So after the initial consultation and deposit, there was not a lot to do except wait until the estimator came back with his appraisal of our house. And so we waited, and waited, … And after 8 years of not “really” knowing how much our house was worth, we finally received an official home appraisal as part of the process. How did we do? Bum-badda-baaa (victorious trumpets sounding ….): … [Read more...] about Adventures in Refinancing, Chapter 5

Which is Better – Points or No Points on Your Mortgage?

As if understanding all the basics of a mortgage like interest rates, amortization, escrow, and PMI weren’t complex enough, there comes one more product that really convolutes the entire process even further: points. Like all of the items mentioned above, knowing whether or not to purchase points can have significant long-term implications on how much money you may actually save or lose throughout the life of the mortgage. This post is going to explain how all that works and I’ll even give you a Microsoft Excel worksheet to try it out yourself. … [Read more...] about Which is Better – Points or No Points on Your Mortgage?

Adventures in Refinancing, Chapter 4

We’ve got big news: We applied for a refinance! What’s New It’s been quite a while since I’ve updated this series. Since my last post in Chapter 3, a lot has happened - a lot of good things! … [Read more...] about Adventures in Refinancing, Chapter 4

Adventures in Refinancing, Chapter 3

Since my last post on refinancing, I have visited a great deal of posts and articles on the web and have learned that we have something is common: • Many of us have the same problem with trying to get a refinance. That problem is: 1) We are underwater (our house is worth less than what we still owe). In mortgage terms, our loan-to-value (LTV) ratio is above 100%. 2) We faithfully make our payments on time 3) We have no other home equity or liens against our property 4) We have private mortgage insurance (PMI) Number 4 is the real kicker. In most instances, this is where all the government help you see advertised all over hits a brick wall. … [Read more...] about Adventures in Refinancing, Chapter 3