What’s New

It’s been quite a while since I’ve updated this series. Since my last post in Chapter 3, a lot has happened – a lot of good things!

• New HARP LTV Guidelines. As of December 2011, the rules of the Home Affordable Refinance Program (HARP) changed. Under the new updates, you could qualify for a HARP refinance all the way up to a loan-to-value (LTV) ratio of 125% of the current market value of your property. Keep in mind, however, that once you get near a LTV ratio of 100% or more, the interest rates the mortgage companies will offer will be not nearly as good as the “current market rates”.

• New HARP PMI Rules. In addition to the LTV changes, HARP also added a condition where if you have PMI (private mortgage insurance), you will need the same amount of insurance coverage for a refinance. Basically whatever you’re paying now will be the same thing you pay on your new refinance. In my case, this is about $90 per month. Although this sounds like a bad thing, it is actually good new. I was always afraid that if I got a refinance, my house would appraise for way less than what I originally bought it for, and I’d end up paying WAY more for PMI. Basically, the $90 I pay now is a worst case scenario.

• Appraisal Hope. My neighbors who have the same exact house as me got their appraisal back. Their house appraised at $160K. Hooray! That means there is hope that if I get an appraisal, my house will appraise for more than what I still owe (about $139K). Judging by the State Equalized Value of $134K and the appraisal of my neighbors’ house of $160K, I’m confident that my house should appraise for somewhere in between these two figures (hopefully on the higher end!).

• Mo Money! (Yes, that was an “In Living Color” reference). The profit-sharing gods at work were good to me this year. This check combined with my upcoming Federal tax refund and some savings we have should give me enough buffer to pay-down any difference I need to make up an LTV of 100% or less in order to guarantee that I get the best possible interest rate. After going through the math in my post “Which Is Better – Paying Down Your Auto Loan or Mortgage?”, I know that putting extra money towards my mortgage would be the smarter thing to do for my situation because it would eliminate several years worth interest and payments.

Taking a Leap of Faith

So enough talk! I decided it was time to take action!

On Friday, January 27, 2012, I had an appointment with a local private mortgage company and we filled out an application. This was the same company that my neighbors used, so hopefully my luck with the appraisal will be as good as what they had.

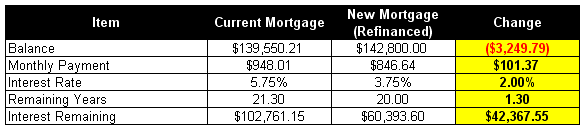

Here is the loan we were offered and ultimately will be applying for:

• A 20 year fixed rate at 3.75% with 0.375 discount points

Basically under this refinance, I’d save a boat-load of money. Here is a summary:

Not bad, right? Saving $100 per month, erasing 1.3 years of payments, and eliminating about $42K in overall interest seems worth the effort. As you can guess, I was pretty happy with these terms.

What Now?

So having signed the application, now comes the part where we wait … Everything is contingent upon what our home appraisal comes back as.

Once something new happens with the application or appraisal, we will continue our story.

Show Your Work

Want to calculate your own savings? Here is a link to the Microsoft Excel spreadsheet I created to make the results table above.

Adventures in Refinancing – Chapter 4.xls

Table of Contents:

Chapter 1, Chapter 2, Chapter 3, Chapter 4, Chapter 5

Photo Credit: Microsoft Clip Art

Leave a Reply