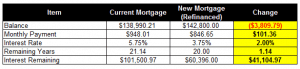

I’m very proud to announce that this chapter will end our story on getting a refinance. As of Monday, we finally closed on our new mortgage under the Home Affordable Refinance Program (HARP)! Here’s what has been going on since last time: Our Home Appraisal: So after the initial consultation and deposit, there was not a lot to do except wait until the estimator came back with his appraisal of our house. And so we waited, and waited, … And after 8 years of not “really” knowing how much our house was worth, we finally received an official home appraisal as part of the process. How did we do? Bum-badda-baaa (victorious trumpets sounding ….): … [Read more...] about Adventures in Refinancing, Chapter 5

equity

Adventures in Refinancing, Chapter 4

We’ve got big news: We applied for a refinance! What’s New It’s been quite a while since I’ve updated this series. Since my last post in Chapter 3, a lot has happened - a lot of good things! … [Read more...] about Adventures in Refinancing, Chapter 4

Adventures in Refinancing, Chapter 3

Since my last post on refinancing, I have visited a great deal of posts and articles on the web and have learned that we have something is common: • Many of us have the same problem with trying to get a refinance. That problem is: 1) We are underwater (our house is worth less than what we still owe). In mortgage terms, our loan-to-value (LTV) ratio is above 100%. 2) We faithfully make our payments on time 3) We have no other home equity or liens against our property 4) We have private mortgage insurance (PMI) Number 4 is the real kicker. In most instances, this is where all the government help you see advertised all over hits a brick wall. … [Read more...] about Adventures in Refinancing, Chapter 3

Adventures in Refinancing, Chapter 2

My quest to get our mortgage refinanced started off with great promise – like a hot air balloon up and off into the sky. But … it didn’t take long for it to come crashing back down onto the ground. Here are my experiences this week: Local Mortgage Company: The first place I called was a local mortgage company that was recommended to me by my neighbor. I have a very strategic reason for choosing this company: • My neighbor and I have the same exact model house. Our neighborhood is a new-build subdivision built around 8 years ago. My neighbor is also getting a home appraisal right now and that will give me a very good idea about what my house is worth (say to +/- 10%). After answering some initial questions, the agent gave me three … [Read more...] about Adventures in Refinancing, Chapter 2

Adventures in Refinancing, Chapter 1

I’ve recently decided that I should take a hard look into getting a home refinance loan. Home interest rates are the lowest they have ever been in history and I need to take advantage of this opportunity before it is too late. However, the road may not be easy given how much I still owe on my house and what I think it is worth. I feel a lot of people are probably in this situation and curious about what options they may have. With that said, hopefully you find this series of posts useful towards your own efforts. … [Read more...] about Adventures in Refinancing, Chapter 1