Here are my experiences this week:

Local Mortgage Company:

The first place I called was a local mortgage company that was recommended to me by my neighbor. I have a very strategic reason for choosing this company:

• My neighbor and I have the same exact model house. Our neighborhood is a new-build subdivision built around 8 years ago. My neighbor is also getting a home appraisal right now and that will give me a very good idea about what my house is worth (say to +/- 10%).

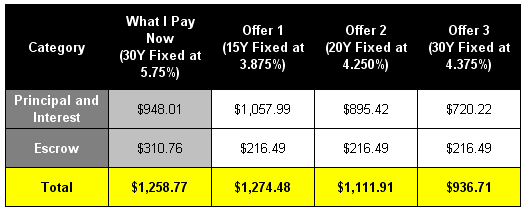

After answering some initial questions, the agent gave me three pretty-good sounding options:

Well, as life has taught me, you must scrutinize everything when it comes to your money!

Notice something peculiar about these offers? The escrow is different. Why? Because they did not include PMI (principal mortgage insurance). Currently I am paying about $90 per month in PMI.

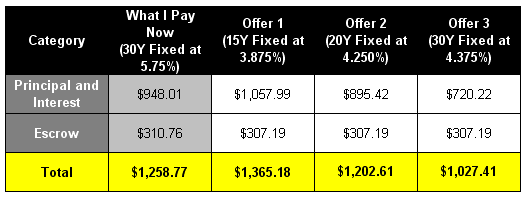

So after calling the rep back, he informed me that I would also need to add about the same amount of PMI to each of these estimates. Therefore, my payments would look a little more like this:

Although the monthly payment is still a little bit better (with the 20 year option), it’s not as appealing now. The plot thickens on the PMI issue below.

My Local Bank:

My dad and I belong to the same bank, and he just had a great experience with refinancing. Since he has much more equity in his house than I do, I had to speak to a mortgage specialist. What she had to tell me was quite surprising.

Since I am likely underwater (I owe more than what my house is worth), my refinance would likely have to go through the Home Affordable Refinance Program (HARP). This is a special government program setup by the Obama Administration where you can refinance your home even if your loan-to-value (LTV) ratio is as high as 125%. In my case, that means my home estimation could come in as low as $140,000 / 1.25 = $112,000. One requirement of this program is that your loan has to be backed by Fannie Mae or Freddie Mac (which I am). But here’s where it gets interesting:

• According to what I was told by the agent, if you pay PMI, you can not refinance your loan with anyone other than your current mortgage provider or the originator of your loan (if different). This is because a new PMI provider (which is different from your mortgage provider) will likely NOT approve you if you are underwater.

What?! Is that correct? I really have no idea, but now that its out there, I have look into it. Not to vent, but these types of contradictions between the information I receive frustrate me because now I will have to do my own research into the matter and become a semi-expert on the subject. Sorry, end of venting – thanks for listening.

I forwarded this information on to the first Mortgage company (since according to this rep, they can’t technically help me) and am awaiting a response. I will also be definitely checking the Internet for the facts on HARP and PMI.

Quicken Loans:

Since I like to have at least 3 quotes for just about everything, I also decided to give the Internet a try at this. Using Bills.com, I filled out some quick forms and was then aggressively perused by an agent from Quicken Loans.

My conversation with Quicken Loans went about how I expected it would. After answering some questions about my current loan and house, the agent looked up the approximate value of my house on the Internet and our conversation instantly hit a brick wall. Here is why:

• On such Internet sites such as Zillow, my house estimates for around $101K (even though my state taxes put it around $134K). This is because sites like this use the sales of other homes in your neighborhood to estimate the value of your house. Yes, there probably have been some houses in my neighborhood that have sold for around this price. But there is a big difference – my house has twice the square footage. The models that were available when my neighborhood was built ranged between +1200 and +2300 sqft. My house is one of the +2300 sqft ones. Home estimation sites like this usually cannot recognize these types of facts. So unfortunately, this is a major drawback to using them.

Regardless of who is right, the only way to know for sure is to get an estimation (for around +$300). Since the agent felt I was at high risk for not qualifying for anything, we said good-day and the call ended.

By the way: No hard feelings to Quicken Loans. I’m sure our conversation would have went a lot better if I was in a different position with my equity or if I had some concrete detail on my home value.

Next Steps:

1. As with Quicken Loans, it looks like I can’t do a whole of anything until I actually know what my house is worth. I have the State tax value as a general idea, but I need to know for sure. My best bet will be to check with my neighbor who also has my same model house and see what his appraises for. Worst case scenario is that I pay for an estimation myself.

2. I will need to check into the facts about what the mortgage agent from my Bank told me about PMI. I’m sure there are some missing details where both the agents from the Bank and the Mortgage Company are right (after all, this is their job). But as of right now, I’m not sure what the differences are and will need to investigate it for myself.

3. Until I know items 1 and 2, there is not a whole lot of value in pursuing anymore mortgage quotes or offers.

Check back for more updates to follow.

Table of Contents:

Chapter 1, Chapter 2, Chapter 3, Chapter 4, Chapter 5

Photo Credit: Microsoft Clip Art

Leave a Reply