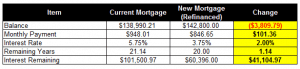

I’m very proud to announce that this chapter will end our story on getting a refinance. As of Monday, we finally closed on our new mortgage under the Home Affordable Refinance Program (HARP)! Here’s what has been going on since last time: Our Home Appraisal: So after the initial consultation and deposit, there was not a lot to do except wait until the estimator came back with his appraisal of our house. And so we waited, and waited, … And after 8 years of not “really” knowing how much our house was worth, we finally received an official home appraisal as part of the process. How did we do? Bum-badda-baaa (victorious trumpets sounding ….): … [Read more...] about Adventures in Refinancing, Chapter 5

HARP

Adventures in Refinancing, Chapter 4

We’ve got big news: We applied for a refinance! What’s New It’s been quite a while since I’ve updated this series. Since my last post in Chapter 3, a lot has happened - a lot of good things! … [Read more...] about Adventures in Refinancing, Chapter 4

Adventures in Refinancing, Chapter 3

Since my last post on refinancing, I have visited a great deal of posts and articles on the web and have learned that we have something is common: • Many of us have the same problem with trying to get a refinance. That problem is: 1) We are underwater (our house is worth less than what we still owe). In mortgage terms, our loan-to-value (LTV) ratio is above 100%. 2) We faithfully make our payments on time 3) We have no other home equity or liens against our property 4) We have private mortgage insurance (PMI) Number 4 is the real kicker. In most instances, this is where all the government help you see advertised all over hits a brick wall. … [Read more...] about Adventures in Refinancing, Chapter 3

Adventures in Refinancing, Chapter 2

My quest to get our mortgage refinanced started off with great promise – like a hot air balloon up and off into the sky. But … it didn’t take long for it to come crashing back down onto the ground. Here are my experiences this week: Local Mortgage Company: The first place I called was a local mortgage company that was recommended to me by my neighbor. I have a very strategic reason for choosing this company: • My neighbor and I have the same exact model house. Our neighborhood is a new-build subdivision built around 8 years ago. My neighbor is also getting a home appraisal right now and that will give me a very good idea about what my house is worth (say to +/- 10%). After answering some initial questions, the agent gave me three … [Read more...] about Adventures in Refinancing, Chapter 2