The below article was composed by contributor Elaine McPartland. If you are interested in writing for My Money Design, please feel free to contact me. Debt, in general, can be extremely difficult to get a handle on. Between the misleading terms and harassing creditors, you may feel lost in a sea of uncertainty. Fortunately, there are ten easy ways for how to pay off debt fast that you can tackle and attain financial liberation once and for all. … [Read more...] about How to Pay Off Debt Fast in 10 Easy Ways

Personal Finance

The Conventional Home Loan – Don’t Mess It Up This Time Around

Another one bites the dust …. It’s getting to be a sad site walking around our little neighborhood. All around us there are houses that have slipped into foreclosure. It’s obvious when it happens. First the house gets really quiet. Then the yard starts turning brown and overgrown. And then it becomes official - the bank comes along and posts a legal notice in the window letting everyone know that the people who used to live their let their conventional home loan slip into default. … [Read more...] about The Conventional Home Loan – Don’t Mess It Up This Time Around

It’s Time to Get Real About Our Household Expenses

Stop lying to yourself. … About your expenses that is. If you are constantly finding yourself short on funds every other month, or if you have to keep dipping into your life savings just to keep the checkbook healthy, then something is wrong. That was a harsh realization I had recently. Even after all the budgets and spreadsheets I’ve made, we were forecasting a huge deficit for the year. The only solution? It was time to get real about our household expenses. … [Read more...] about It’s Time to Get Real About Our Household Expenses

8 Quick Money Making Ideas For An Extra $100 to Invest

The following contribution is by Pauline Paquin from the blog Reach Financial Independence. Pauline has just launched a new site called Make Money Your Way to help readers diversify their sources of income with real estate, investing, entrepreneurship and online endeavors. Born and raised in Paris, Pauline writes about how she has been traveling the world for the past 10 years, while trying to build wealth and achieve financial independence, and how you can follow your dreams and reach your goals too. You can follow Pauline on Twitter @MoneyYourWay. If you are a regular reader of My Money Design, you know by now that the best way to build wealth is to make your money work for you, and not the other way around. How does one do that? By … [Read more...] about 8 Quick Money Making Ideas For An Extra $100 to Invest

Steps to Building a House You Can Love

The following post is a guest contribution. If you’d like to write for My Money Design, please feel free to contact me. So you've finally made it! You've worked and sweat, and you and your family are finally ready to purchase the house of your dreams. Building a new home can be a fun and exhilarating experience! But all the steps to building a house can also be a stressful process if they are done incorrectly. … [Read more...] about Steps to Building a House You Can Love

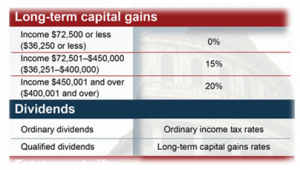

How the Lower Taxes From a Long Term Capital Gain Can Work Into Your Early Retirement Plan

You know what I love about blogging? It’s that you learn about important things that you probably weren’t going to go searching for on your own. That’s exactly what Matt from Mom and Dad Money did for me when he wrote an epic guest post for My Money Design about two weeks ago. Even though there were a lot of great points buried within the text, one of the things I took away from it personally was the mention about how a long term capital gain (much like your dividend income) is taxed at a lower and more favorable rate than your ordinary income. Taxes? Time to Stop Reading This Post … Wait! Don’t leave. I promise not to bore you too much with a bunch of technical jargon. … [Read more...] about How the Lower Taxes From a Long Term Capital Gain Can Work Into Your Early Retirement Plan

Understanding the PE Ratio Formula and Why It’s Such a Popular Stock Metric

If there’s one stock evaluation metric that people love to throw around, it’s definitely the old staple: the PE ratio. Just open up any money magazine or financial article, and this will usually be one of the first values that they highlight. But even though there’s really not much to the PE ratio formula, its importance is warranted because it can reveal a lot about the company and investors belief about its future. … [Read more...] about Understanding the PE Ratio Formula and Why It’s Such a Popular Stock Metric

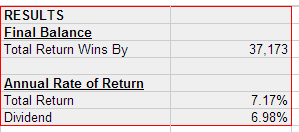

Why Total Return Investing Is Better Than a Dividend Strategy

The following is a guest post from Matt Becker, founder of Mom and Dad Money. Matt is a proud father and husband, and his site is dedicated to helping new parents build financial security for their family. Although Matt and I have somewhat different personal opinions in regards to dividend strategies, I thought it might be fun to invite him to take the stage and share his perspective on why he thinks Total Return Investing would be better. I've always maintained the message on My Money Design that there is more than one way to reach financial freedom. If you can keep an open mind and not reject something just because it is different than what you use, then maybe you might just learn something. Go ahead Matt .... If you have … [Read more...] about Why Total Return Investing Is Better Than a Dividend Strategy