I first became somewhat curious about my own pace against those of other people after reading the book Your Money Ratios. The book offers you some suggested milestones for where you should be at with your savings given different age levels.

In case you want to know but are too scared to “look under the bed”, your 401k balance is probably doing a lot better this year than you think. Despite some of the choppy financial news for this month, 2013 has been a pretty favorable year overall for the market on average.

The Average Retirement Savings of 401k Plans:

To give you an idea of how your balance may compare to that of your peers, here are a few interesting figures I found in some recent articles. In my opinion I found them to be somewhat low and a little bit alarming.

Here are the average retirement savings for 401k plans as reported by Fidelity for the third quarter of 2013:

- Average balance = $80,600; up 10% from this time last year

- Workers who have had an account 10 years = $211,800; up 19% from this time last year

- Workers age 55 and over who have worked 10 or more years = $255,000

Interestingly enough in a related article on retirement savings, the following 401k balances were reported for employees at these major companies:

- Gap = $15,000

- Google = $70,000

- Southwest (pilots) = $300,000

(I’m going to go out on a limb here and guess that the age demographic probably has something to do with the slant observed in these findings. I would expect most people working at the Gap and Google to be much younger than pilots who have probably worked with Southwest for some time.)

Keep Your Goals In Perspective:

Even though it can be fun and even helpful to compare your 401k balance to the average retirement savings of the general public, I think it’s important to keep one thing in perspective:

How is MY plan going according to MY individual goals?

That is a very important difference.

So what if you have more than $255K like the average 55 year old. That’s not really going to get you very far when you consider that withdrawing 4 percent each year to live upon will only result in $10,200/year or $850/month BEFORE taxes. Does that sound like it’s going to be a very enjoyable retirement budget?

Let me give you a personal example.

At age 33, I too have already surpassed that $255K statistic by just a few thousand dollars. If I plug that number into my handy Excel worksheet and use some modest assumptions and continuing to keep up with my contributions plus my 401k employer match, I can estimate that in about 15 years (2028) my 401k retirement savings should be somewhere near $1,150,000.

You might think that’s a lot of money. And I do agree that sums over one million dollars certainly are. But to simply have a giant retirement savings is not my goal.

My goal is:

- Reach financial freedom as soon as possible.

Therefore the balance of my 401k account simply becomes one component of my overall financial freedom plan.

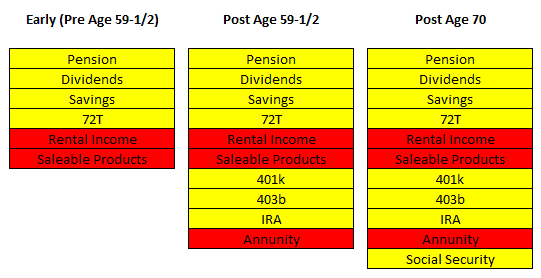

Because I intend to reach my goal long before age 59-1/2, I’ll need sizeable investments outside my normal retirement savings plans. Even though they may be taxable, the trade-off will be the ability to gain access to them whenever and wherever I want. Plus if you spend just a few minutes understand the basic tax rules, you might actually find some breaks within the system for capital gains and dividends that are pretty favorable as well.

Thankfully we also have more than just the 401k being put to work for us in the post age 59-1/2 years. We’ve also got our Roth IRA’s, a 403b plan, and a pension to look forward to.

Don’t Fall Under Market Skepticism:

Perhaps the reason that more Americans don’t save above 2% per year for retirement or put more into their 401k savings is because they are still skeptical about the stability and future of our economy.

As one of those people who saw their 401k balance get cut in half during the Recession, I can sympathize with those concerns. That whole experience really taught me some valuable lessons about what the word “risk” really means.

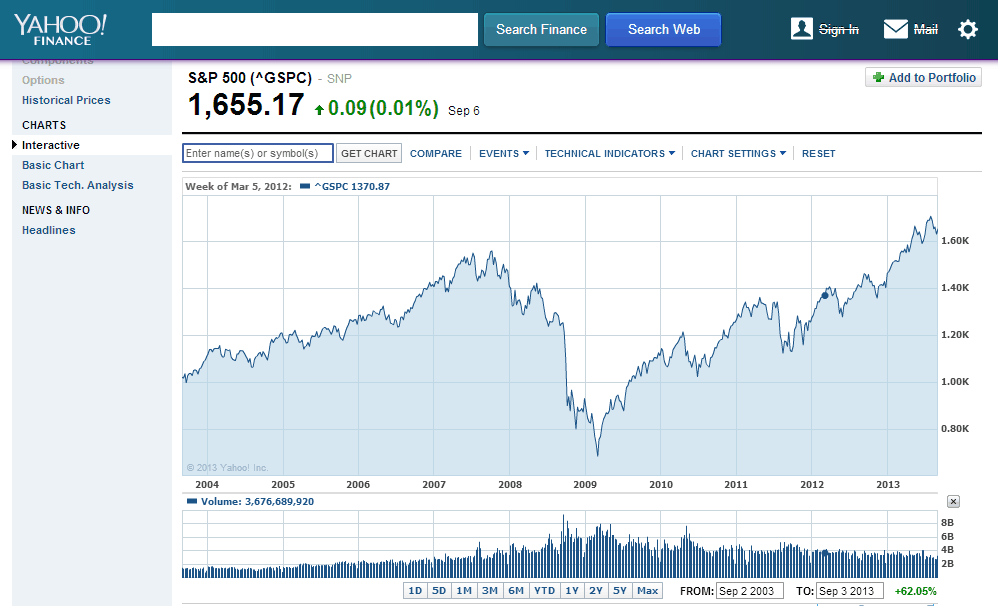

I remember all throughout 2009 every major news media was quick to point out that at its lowest point all the returns from the past 10 years had been wiped out. Their point was that we the investors had made nothing on our average retirement savings over the past decade. Even the book Aftershock painted a pretty gruesome portrait of the upcoming U.S. future.

But history has a way of being cyclical and allowing reversion to the mean to occur. And for that reason I am optimistic about the long term.

A quick check of the S&P 500 10 year history today shows that it is up 62%. Just as the protagonists of financial planning encourage, the average of our financial markets reverts back to a positive long term trend when you give your investments enough time to recover.

The important thing is to plan effectively, diversify your income sources, and build in lots of safety factors. Don’t go for the bare minimums as your target goals. Engineering encourages you to design safety factors into your creations to compensate for such unknowns. Your money design for retirement should follow the same since it will be impossible for you to predict all the uncertainties that could occur.

Your will reach your goals and be able to retire when you want if you allow yourself to and challenge yourself to follow a plan. Don’t join the average retirement savings of your peers. Excel beyond them!

Readers – How do your retirement savings compare to the figures listed above? Do your goals call for some alternative strategies?

Related Posts:

1) There Are No Shortcuts to Early Retirement Planning

2) Exploring My 401k Alternatives – Maybe More Dividend Stocks?

3) Is the Conventional System to Create Wealth Rigged?

Images courtesy of FreeDigitalPhotos.net and MMD

That 2% is not too shocking as I worked in banking and investments and saw it first hand how little people were saving. Google and Southwest have a large GAP(no pun intended) but I think that is like you said do to the age difference. By comparison I’m not where I should be but I am not too far behind. I do talk to a lot of people that just dont think they are ever going to retire. Then I ask way and it always seems to be the government’s fault. Mind you they are not even saving enough to make retirement an option.

It boggles my mind that some people don’t think they will EVER retire. Why is that? Is saving money really that much of a struggle? Even if you follow the most basic of retirement saving equations and stash away 10% for 40 years, you’ll still exceed these numbers no problem. It just seems like such an easy way to win!

Easy for some. Some people are living paycheck to paycheck, or worse, for most of their career.

Your point about comparing your progress to your own goals and not to the averages is a really important one. For one, those averages are on the whole far too low compared to what they should be. They really reflect the poor state of our retirement savings, not something you should be shooting for. And also, as you say, everyone’s needs are different. You could have less than the average and be fine or more than the average and be behind. It’s all about your own personal goals.

As for us, we’re well on track for a fairly traditional retirement, but will need to do some work if we’d like to push that time frame up.

I’m glad to hear that you’re at least on track enough to make traditional retirement. And I’m sure that with a little extra work you’ll have no problem beating that number by 5, 10, or even 15 years. My old goal used to be to retire by 55. Now it’s 45! That’s way I’m very big on promoting that your goals should work for you and not just exceed the average. It’s really not the hard to stay ahead of the curve. The real challenge is doing something extraordinary like creating a mass fortune and achieving financial freedom at such a young age.

I think lots of those over 55 probably started out at some sort of job with a pension and will be relying on social security more than younger people, so hopefully that’s why that number seems low. My actual retirement account is not quite as high as those numbers for how many years I’ve been working, but quite a bit of my income was put into buying my practice and real estate, so hopefully that makes up for lack of a huge IRA at this point. I agree that having several options for retirement income is the key. We’re hoping Jim’s pension and our rentals can support us for years before we have to use tax deferred accounts.

While most people talk about planning for retirement, I think you guys have the right idea by actually diversifying your income and making strides towards achieving it.

I was glad you mentioned we should compare ourselves to our goals rather than the poor performance of the general public. I am only in my mid twenties but I feel I am doing decent considering how much student loan debt we have paid off. We aren’t doing stellar, but I would say we are above average for our age.

With those student loans disappearing I’m sure you guys will be able to kick things into over-drive and really make some traction over the next five years.

You are considerably ahead of where I was when I was 33. I see no worries with the traditional retirement timeline for you. Of course, the more you bring your retirement date forward, the more you are going to need.

Thanks, but my plan is bring it very, very forward. By 12 years as a matter of fact. I know I’ve got a long ways to go if I’m going to accelerate my progress by then. That’s one of the reasons I’ve been so focused on trying to get my website projects to build up. Even if they can produce an extra $1,000 per month, that’s a lot more income I’ll have towards dividends and other investments that I would have never had before.

I’m always afraid to know how I stack up against everyone else. But it’s something I need to take more seriously as I had taken several years off any retirement savings because I was laid off then started freelancing. I’ll have to check that out!

I’m sure that you could always do a few stretch years of extreme saving and get your finances in prime shape. When you get older, its not that your chances of success go down, it just means a more focused and sometimes extreme plan than when you were age 22 and had 40 years to save.

My 401k balance is always low as I have moved to different companies pretty regularly over the past five years (and roll the 401k balance to a traditional IRA). When the studies show the average of 401k balances, I always wonder how representative my job hopping is and whether other people are rolling their balances to traditional IRAs, or letting them sit in a bunch of separate 401k accounts (& thus lowering the averages) etc.

As is usually the case, the data isn’t typically in the format I’d want it to be, but I’d love to get a better sense of total retirement savings rather than mere 401k balances.

That’s an interesting consideration, although I’m willing to bet that only a small fraction of the population has that problem and probably just looking at the 401k participation is good enough. I’d love to see what the actual participation rate is for having an IRA relative to a 401k. It’s probably lower than we think.

I agree that most people probably aren’t rolling to an IRA, but I do think that there are a lot who are simply letting their separate 401ks sit with whomever their prior employer’s servicer was, and never rolling over to their new 401k. For those people, each separate 401k balance would grossly under-report what their total retirement savings were. Even having just 3 jobs (& 3 separate 401ks) in one’s lifetime would under-report it by 67%. If you start thinking of having 6 or 7 employers, the figures could be way, way off.

Ah, I see your point now. I would imagine there is probably a fair amount of that going on, and its probably hard to really keep track of how many accounts really tie to the same person.

I am in awe of how things work in the US. We have no such thing (or anything similar) to a 401k in Romania and probably that is one of the reasons why our retired are doing so badly. Probably I won’t be doing much better from this point of view, but at least I do my best to save up and create my own 401k although obviously it’s not the same thing 🙂

No employer retirement plans in Romania? That’s too bad. That’s great of you to do something about your opportunities and change your own potential for the future.

Wow I am happy to be above average. Having $250K at age 55 would be stressful and prevent me from sleeping most nights.

Same here. I think I’d end up saving every penny I made so that I could get to retirement as soon as possible.

I’m curious, if you had $50,000 to invest right now, and could only invest it in one thing, what would you invest it in? Real Estate? 401k? Your stock of choice?

I’ve actually thought about this question on many occasions (have you ever asked yourself what if someone offered you $50K for your website today?) I can say without a doubt I’d invest in my taxable dividend stock portfolio. Why? Because it will help me to build that bridge from whatever age I retire to age 59-1/2. I’ve done calculations to see what would happen if I just let my 401k sit from now until 59-1/2 and it would be quite large despite making no further investments. Even though real estate or owning a business would be nice, I know myself enough to know that I don’t know enough those things and don’t really have any business dumping that much money into them. Hopefully within a year I can change all that by making some more traction with my website development and turning that into a legitimate business.

We have comparatively little in 401k accounts ~110k, but far more in taxable accounts (~$630k). The reason things are structured this way is we want to maximize our options for early retirement, and my 401k plan has fairly limited choice, so I am trying to just contribute to get full match.

Frankly, I’m still stunned that the average american is only saving 2% of their income per annum. How is this possible? It should be a no brainer to save at least 10% on even an average income.

Your 401k progress is great! Keep up the good work. You should be in position for a super comfortable retirement.

You and I have very similar strategies when it comes to structuring our taxable and tax deferred accounts for a shot at obtaining early retirement. I think that’s a unique situation where its okay to not have a huge 401k or be maxed out in the post age 59-1/2 savings area. Unfortunately I fear that the people that the article was referring to do not have an extra $630K in their brokerage account. You should be very proud of what you’ve accomplished!