Like many of you, I knew the path to create wealth would be lined with hard work, lots of saving, and choosing the right investments. I took the conventional financial advice and began with a modest 10% savings rate. It wasn’t until the last few years that I’ve tried to accelerate my results by bumping my savings rate to extremely high amounts.

So is it any wonder that when I look at my 401k balance and see how long I have to go that I feel I’m playing a rigged game? Sure if I stay the course I might have a decent nest egg in 20 to 30 years? But what about NOW? What if I’d like to experience financial freedom sooner rather than later? Isn’t there a better way to build your wealth beyond simply saving for the next +30 years?

Questioning Our Ability to Create Wealth:

Believe me – this post is NOT meant to discourage you from saving your money. In no way shape or form! Saving for retirement is still VERY much an extremely important part of my money design for one day achieving financial freedom.

Nor am I slighting the fact that it takes time to become wealthy. I still believe wealth is something best earned. Most of us will never have the metaphorical “keys to the kingdom” simply handed over to us. To create wealth will take a lot of hard work, risk management, and creativity.

That last word … creativity …

As we often do here on My Money Design, I have to stop and ask – is there a better and more creative way to grow my fortune? Am I really getting the maximum return for all my efforts?

Exposing the Flaws of the System:

Like I said, this is in no way meant to put down savers. But at the same time, let’s examine the system and see if you can identify with where I’m coming from.

Conventional financial wisdom says to save about 10% of your gross annual income. You can find this mantra (and other variations) repeated over and over again in lots of financial literature.

Let me ask: Will this help you to create enough wealth to achieve financial freedom?

Last week in my post What is Financial Freedom, I asked the readers how they would define financial freedom. The majority of the comments answered with things like “being able to quit my job” or “having enough money to cover my expenses”. All of these statements are true.

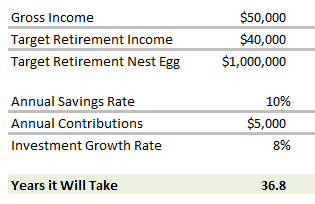

So using the conventional route, let’s do the math and figure out how long it will take to save for retirement. Here are our variables:

• Whatever our gross income is now, we’ll target needing 80% of it for retirement.

• To fund our retirement income, we’ll assume that we’re going to draw 4% out of our nest egg each year. That means we’ll need our nest egg to be 20 times the amount of our retirement income (1 / 0.04 = 20).

• To eliminate variability, we’ll assume that all our investments are in a stock market index fund producing an annualized average return of 8% per year.

So let’s say I make $50,000 per year. If we use that conventional 10% savings rate, then how long is it going to take me to create the wealth I need to retire and experience financial freedom?

Wow, 37 years? That’s pretty lame. If I start a job at age 24, then I’ve got to wait until age 61 to finally be rich …

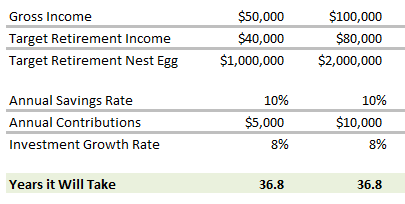

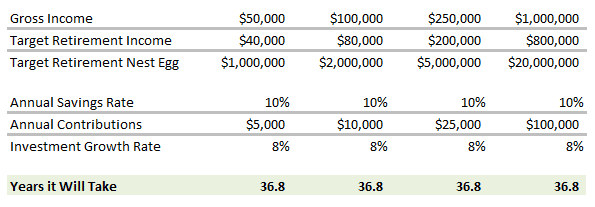

Does my situation change if I’m a higher income earner and made $100,000 per year? Now how long will it take?

… Wait, it’s the same thing? Why is that?

Consider that your standard of living is naturally dependent upon your income level. We all want to enjoy the fruits of our labor and our expenses tend to gravitate towards whatever the number may be – meaning that you’ll have to save that much more for your nest egg.

Can’t I Just Save More of My Paycheck?

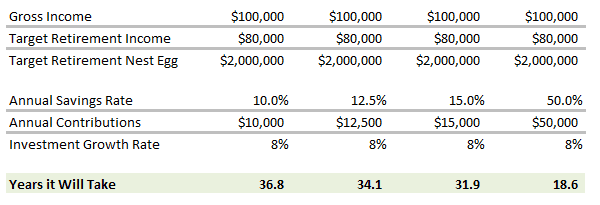

You might just think that the way to create wealth quicker would be to save more of your paycheck, right?

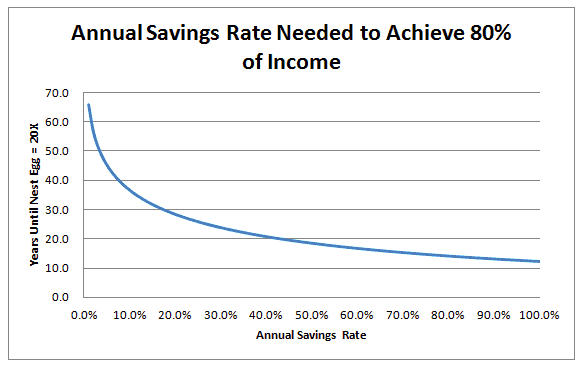

You’re correct. That helps. But guess what – you’re still going to be working for THE MAN for a very long time. Check out these examples:

Even the ultra popular bloggers who advocate saving EXTREME levels of income (50% and beyond) are still not cutting it. The path to creating wealth still takes almost 20 years!

In fact, just for fun, we can even show that even if we save 100% of our income, it would still take 12.4 years to reach our goal!

So What Options Do We Have for Building Our Wealth?

What if I put my money into riskier but potentially higher return investments? You could try this out and might even have a few good years here and there.

But dozens of studies are out there to show that over the long-term you can’t beat the average annualized return of a stock market index fund. So in reality this isn’t really a very good option.

What if I just decide I’m going live ULTRA frugally? Going back to the first chart, if I make $50,000, what if I drop my Target Retirement Income to $20,000? Then I wouldn’t need to save so much for retirement!

Again that’s true. But why sell yourself short? Who really wants to live on LESS money than they have now? I don’t know about you, but my mental picture of financial freedom is worry-free and full of possibilities. Not penny-pinching and scrapping to get by. Why not set your sights higher?

So while this may work for some people, again, this option is again out for me.

Utilizing Our Entrepreneurial Creativity:

That brings us to the only option we have left: To conclude that the only real way to create wealth is to start our own business or at a minimum leverage our entrepreneurial tendencies through some type of side-income.

Think about all the truly wealthy people you know or have read about it, and you will find this to be a universal trend among them.

This blog has been a tremendous amount of inspiration in this area. It took me a year, but the income it generates now is worth the effort. And the best part – I keep it separate from our regular income so that it can go towards other investment endeavors.

Of course this isn’t enough substance to quit my job or do anything rash. But I can quickly see how the only logical alternative to truly create wealth is to go into business for yourself. Creating income that is sustainable and beyond the scope of your employer is the only way to accomplish this in the shortest amount of time possible.

Over the next year, this is a topic that I’d really explore in further detail. Like I said – there are no plans to quit my job or anything like that. But what about gaining more Internet properties? What about holding more dividend stocks? What about making the leap of faith on a rental property? The MMD portfolio is only a seedling with room to sprout branches that reach high in the sky. I’m looking to 2013 and beyond with great optimism!

Readers – What do you think about the conventional system to create wealth? Is taking 37 years to build a nest egg really the best method, or have you found a better way?

Related Posts:

1) Retirement Income Strategies for My Money Design – November 2012 Update

2) P2P Investing Denied! What Should be My Next Passive Income Ambition?

Image courtesy of Teerapun / FreeDigitalPhotos.net

Good post MMD! 37 years is a lot of time, and if you can make it work then great. This, however, is one of the main reasons why my wife and I started our own business. After much thought we determined it was the one true way we could have unlimited income. Sure, there is risk…but I’d much rather work for myself and have unlimited income then continue with the same thing for years and making little headway.

John, I feel like what you and your wife started my illustrate my point completely. Why build a fortune for someone else working 35-40 years when you could be doing something for yourself!

I think this is a great post. My personal strategy is to become debt free as soon as possible as I build my nest egg. Also keeping living expenses down is important. My hope is to have extremely low living expenses so that my nest egg doesn’t have to stretch quite as far.

Thanks Holly. Keeping those expenses down will be a key ingredient to this whole equation!

The answer is yes and no. The system is in some ways rigged against you, but in other ways it does work for you.

The “rigging” part is the law that requires your 401k investment to only go into mutual funds. By far the majority of mutual funds underperform the market. The good news, however, is most offer index funds which give you the return of the market average with minimal fees taking away from that. More good news is most 401k plans also offer money market funds, and the option to use when the economy begins to overheat and the pressure begins to build up for another recession.

T

here are ways and means to do better than the market. If you’re serious about that, you’ll want as much as possible under your direct control. That means your IRA funds. That gives you more control, but it also puts the burden on you to do some homework to make sure you know what you’re doing. The good news it doesn’t take all that much, but the bad news is if you don’t do it, you’ll not do better than the index funds.

Thanks William, and welcome to the site. I agree that 401k funds aren’t perfect, and they’re a heck of a lot more expensive than what I pay Vanguard (which is where I keep our IRA’s). I was thinking of the “rigging” as being more-so led to believe that this is the only way or best way to accomplish your retirement goal.

37 years is too long for me, that’s for sure! But 10% in savings is quite low, a reasonable rate can be 20-25% if you are motivated and don’t want to reduce too much your lifestyle. I read recently that the average savings rate in Europe was 10-15%, but you have to be above average if you plan on retiring early. 25% savings allows you to retire at age 45-50, that’s much better. And it is desperately slow at the beginning but once compound interest snowballs it’s not too bad. And safe. I prefer to take more risk but it would be plain depressing to have worked for 10 years for nothing and start a traditional retirement fund at age 40.

That European number beats the 3% savings rate I read about here in the USA!

I feel I’m experiencing the drag of the slow build up. But even if I were to retire at 45 to 50, that’s still not half bad (keeping it in perspective to my peers).

Having spent 16 years in the system, I’ll say this….the big firms aren’t about creating wealth. They’re about avoiding heavy losses. So, most savings strategies (diversification, adding bonds, etc.) all revolve around reducing risk, not improving performance.

Sadly, I got to see it firsthand. When you got a little creative (because someone wanted to go fast and understood the downside….supposely…..) they went apes$%t when it didn’t work out BUT if you had a positive 5%? Crickets…..

They’re certainly not about our interests, are they … I’m afraid that is also part of the “rigging” that is going on. There’s really no one looking out for your money and cash flow like you do.

Agreed. Such is the nature of capitalism, though…

I think a key to saving more for retirement means you’re spending less money. Unless you’re just skipping out on a ton of expenses you plan to have in retirement, you’d also be reducing the amount of money you are used to living off of. So if you save 50% of your $100,000 salary and want to have $80,000 in retirement you get a HUGE step up in standard of living when you retire. Just a thought.

To some degree that is the game I’m playing for my own retirement. I’m still shooting for an 80% replacement, but we live off of much, much less than that.

This is eye opening. I am glad I am working toward making side income so I can fund my retirement. I don’t like status quo so I need to work hard.

Smart move! I’ve never been one for status quo either. I prefer to stay ahead of the curve as much as possible!

I personally wouldn’t use the word “rigged”, as that seems to imply that a few people in a room somewhere set up some unfair system for everyone. But at any rate, your conclusions are correct. It takes a very long time to accumulate wealth through normal hard work. This is just the nature of living on Planet Earth.

Since the dawn of time, the average person just gets by, and even the average diligent worker needs to spend most of their life working in order to have a few years off at the end. It was that way when people were hunters and farmers, and I don’t expect that to change just because we have specialization of labor and a medium of exchange.

So the much discussed question on blogs is whether it’s better to shorten this timeline through increasing income or decreasing spending. While in balance both are important, I’m definitely leaning on the income increases more. To each his own, but extreme frugality is not for me. I dislike going to my job each day, but I would dislike it a lot more if I had to ride my bicycle everywhere, cook every meal, fix everything that went wrong with my house, and stay at home for vacation. Hence, I’ve got a bias to keep spending levels “reasonable” and concentrate on income.

Thanks for calling me out on the “rigged” part. That was just me using my marketing skills to get your attention. It certainly was a catchy title, huh?

I couldn’t agree more that this is just the way it is for some people (the “status quo” group that Grayson mentioned above). I think where my mind was at with the “rigged” part was the way in which people blindly follow the “put 10% away for retirement and you’ll be fine” advice. If they looked a little closer at it, I don’t think they’d be happy knowing they’ve got a long 37 years in front of them. Furthermore the people that try to one-up the system and save more than 10% still can’t seem to break 30 years unless they start saving at crazy-extreme rates. This again adds to the rigged theme.

I’m completely with you on increasing income (while keeping my spending the same) in order to combat this. The whole extreme frugality thing is just not for me. It really sounds like a downer.

I like using the using your entrepreneurial spirit to create some side income strategy. I still like doing my full time job working for the man, but I’m now making thousands of dollars a year from my investments and part-time job. This should cut down my 37 years to retirement to less than 20 :0) Apparently some people are so good at this, like Michelle from Making Sense of Cents that her side income is even more than her 9 to 5 job lol.

Michelle is doing an outstanding job making CRAZY side income! Every time I read one of her updates, it kind of kicks me in the butt and makes me rethink how I could be doing things better.

I’m with you that I’m still working a full time job and trying to greatly accelerate this process. My original goal was to retire by 50. But now I’m hoping I can wrap things up in record time here (perhaps by 40?)

Excellent post, sir! It’s kind of depressing when you take these things into consideration; furthermore, I don’t think inflation was factored into this equation so I’m guessing the numbers are going to look a lot worse than taking 37 years.

Saying all of that, it’s one of the reasons I think real estate is one of the best ways to build an income stream in retirement. Instead of needing $2M to produce $80k/year you’d need 8 investment properties yielding $800/month in net profit. While it varies by market, I could probably have a $1M real estate portfolio to yield that sort of return which therefore cuts the amount I need in half.

Besides that, I totally agree that you need some sort of entrepreneurial endeavor. As we all know though, that’s much easier said than done and it doesn’t fit for a lot of our lifestyles/personalities.

True being an entrepreneur will not be for everyone. But to the victor go the spoils!

Interesting strategy with real estate. There certainly are a great number of books / blogs that show examples of people doing this and making it work. In fact that was the basis for most of Rich Dad Poor Dad. You could always accelerate your strategy by purchasing an apartment complex in a college town. You’d fill those 8 “investment units” with prospective (and parent co-signing) occupants year after year!

I think small business is the best way to create wealth. It takes all of your time, though. I was only able to do it for ten years, but when I sell, it will set me on the right path. I can’t quit yet, but I have high hopes that the proceeds from my sale will work well toward investments that create passive income. We’ll see.

I think it will. The value of your business was likely more than any of us could have built up on our own. By the time you finish selling, you’ll probably be able to live off the proceeds for a great time to come.