That might sound crazy, but you have to remember: All large companies were just small stocks at one time or another. At some point they experienced a period of explosive growth, and someone became rich as a result! Why can’t that someone be you?

This subject is exactly the premise of a book I recently finished reading called Big Profits from Small Stocks by Hilary Kramer. (Actually the full name of the book was “The Little Book of Big Profits from Small Stocks + Website: Why You’ll Never Buy a Stock Over $10 Again”). Kramer’s main punch-line to the book: It will be much easier to multiply your earnings when your cheap $10 stock goes up in value to $20 as opposed to when a $100 stock goes up to $110.

In the next few sections I’m going capture what her proposed strategy for this and what my feelings are on it.

Why Did I Pick This Book?

Why not? Even though I’m big on value investing with large companies, I’m never opposed to hearing other theories or success stories on how to pick stocks. And besides – I always like to have a good easy read book when I’m on vacation. Magazines get really old really fast, so I stopped by the library and found this book based on title alone.

Why We Want to Find Cheap Stocks to Invest In:

The book starts off with Kramer making her fundamental claim for this strategy:

It takes less to make a $5 stock go to $10 than it does to make a $100 stock go to $200.

As a former Wall Street employee, she feels this statement is true mainly because Institutional investors (those with mutual funds, hedge funds, etc) will often not touch a stock if it is below $10. Therefore, because Wall Street hasn’t quite yet had a chance to flood the stock with their enormous volume of capital and disrupt its supply and demand relationship, you, the small investor, still have a chance to pick it up before the big-boys do (p. 19).

Why Are These Stocks So Cheap To Begin With?

Chapter 3 opens with a discussion of the “fallen angels”. Fallen angels are stocks of companies that used to be revered and loved, but have now fallen on hard times. One example of a former fallen angel was the Ford Motor Company. During the Great Recession when GM and Chrysler filed for bankruptcy, the entire economy was down on the automotive industry and Ford’s price was down. But Ford was still fundamentally strong, and thus a good cheap stock to buy.

The questions you have to ask yourself for stocks that are fallen angels:

- What went wrong?

- Can it be fixed?

Kramer explains that the S&P 500 is a good place to start looking for the fallen angels. Look for ones with a market capitalization under $1 billion and a share price below $10 (p. 34).

Chapter 4 explores another type of low cost stock: The undiscovered growth stock, or “darling” stock. These are the smaller companies that no one has noticed yet and are poised to be picked up by the Wall Street big-boys at any given time.

To find these types of cheap stocks to invest in, you need to:

- Look for stocks below $10 per share that have been growing earnings and revenue for at least 5 years (p.47). Debt to equity ratio should be a maximum of 0.3 (70% equity and 30% debt) (p.48). This follows legendary investor Benjamin Graham’s advice of owning at least twice what you owe.

- Then look for companies who have products or services that have a strong potential to grow in today’s markets.

- Insider ownership of 10% or more is also a good indicator of vesting.

Other metrics for finding cheap stocks to invest in:

- Look for companies with 100% earnings growth (revenue growth is not critical) (p. 49). The debt to equity ratio maximum should be 50% and the share price must be $10 or less. (p. 50)

- Look for “Bargain Bin” stocks (Chapter 5) by examining the ones that are currently worth less than tangible book value. You can find this out by subtracting intangible assets (like goodwill) and then dividing tangible assets by the number of outstanding shares. (p.55) Set your stock screener to look for stocks with a price to book ratio of less than one. Then set debt to equity ratio to a maximum of 0.3 and share price of less than $10. Pick only the profitable companies by finding those that have a P/E ratio of 1 or greater (p. 62).

- In general you can ignore the actual numbers of the P/E and PEG ratios because our growth stocks will have little earnings when they are about to explode (p. 92). We just want them to actually have earnings (PE ratio of 1 or greater). Instead what you want to pay attention to is the direction of ROE, not the actual number itself. (p. 94)

Criticisms of Big Profits from Small Stocks:

Despite some of the practical advice that Kramer offers to pick these stocks, I found a lot of her evidence to be very lofty. For example, she makes several claims about finding low cost stocks during the Great Recession of 2008 and then making a killing when the stock price rose a few years later. Correct me if I’m wrong, but isn’t it common sense to pick up stocks when they are on sale during a financial recession? For the non-obvious companies, I would have preferred some deeper or more technical analysis of why certain stocks were selected.

I also found Kramer’s enthusiastic promotion of the biotech and pharmaceutical industry stocks in Chapter 6 to be somewhat irresponsible. For a book geared towards introducing readers to evaluating cheap stocks to invest in, I didn’t feel as though these two industries were really at the right level of complication.

And then just like any book these days, much of the content starts to feel like a giant advertisement to get the reader to author’s website and subscribe to one of the three publications she manages. Then again, isn’t that what most books are these days?

My Stock Picking Experience:

I’ve been both burned and had some great success with being speculative about stocks. In general I believe that if you’re willing to put the time and energy into really researching and understanding a company, then there are probably some good opportunities to be had. Just look at the history of Warren Buffett’s stock picks.

However, I’m not one of those people with that kind of time. I subscribe more to a John Bogle style of investing where I’d rather either invest in the stock market average or go for only large-cap companies that pay handsome dividends.

In past on My Money Design, we’ve covered a number of different techniques and metrics you can use to help figure out whether a company will be any good or not. These are things such as:

- Basic metrics (that you’d find on Yahoo Finance, CNN Money, etc)

- Dividend Yield

- Dividend Payout Ratio

- The PE Ratio

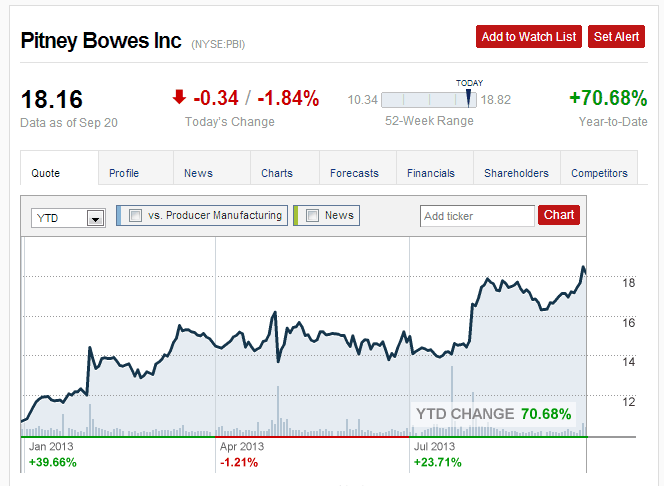

Despite my beliefs though, I do include at least one speculative purchase each year just to keep things fresh. This year’s gamble was on manufacturer Pitney Bowes (PBI). Though the shares weren’t below $10 like the book encourages, I did pick them up for around $12 per share back in February. Here is how the shares are doing today:

(You can see a complete list of all the stocks I bought this year and why in this post here.)

So while I’m not going to encourage anyone to rush out and make a bunch of risky stock purchases, I’m also not going to dismiss the fact that opportunities are out there for cheap stocks. I think you’ve just got to be willing to put the time and energy into it to make a truly informed decision.

Readers – How many of you have ever found good cheap stocks to invest in and have a success story to share? In general do you stay away from cheap stocks or flock to them looking for opportunities? What do you think of Kramer’s advice on fundamentals to look for?

Related Posts:

1) Why Total Return Investing Is Better Than a Dividend Strategy

2) My Broker Lets Me DRIP Stocks – Why That’s Great

3) One Man’s Success With Borrowing Against 401k Funds for a Comeback

4) Reader Debate – Would You Borrow Money to Invest in Stocks?

Images courtesy of FreeDigitalPhotos.net, Amazon, and CNN Money

This isn’t something I pursue so I don’t have much to add in terms of advice or experience. But I’d be interested to hear why she focuses on the absolute price of the stock as opposed to P/E or something to that effect.

Her point is that these types of stocks are extremely under-valued and that the traditional metrics like PE and others won’t really add up. So instead she just wants you to focus on the direction of earnings rather than the actual numbers.

I just finished reading A Random Walk Down Wall Street, and I have to say I agree with that book. In the long run (30-40 years) it is nearly impossible to beat the market average (S&P-500). It is much more likely that you’ll do worse and use up countless hours of your time trying. I’m a proponent of buying and holding market index funds for these reasons 🙂

I tend to agree. The vast majority of my funds are either in large index type funds or in stocks that are part of an index fund (and relatively safe). But it is fun to buy at least one stock here and there to see what you get. Everyone loves a good ten-bagger story to brag about!

MMD,

Yes, as long as we can keep the percent we spend on speculating regulated to ~5%, it’s fun. If things totally tank, we’ll still be fine. And, if you get that ten bagger you’ll be able to brag about it for years to come! 🙂

Definitely! As long as the core of your funds is safe and stable, then go ahead and have fun with a very small portion of your investments!

I think this idea would be fine in small quantities if you have some higher risk money to play with, but I would not put the majority of my investments in something with that much risk.

Agreed, and in no way do I think anyone should commit their savings to a plan like this. But if you’ve got a little bit of money to go crazy with and the ambition to put it to the test, then knock yourself out, right?

Price is irrelevant, you need to look at market cap. Look at Netflix its $310 but a $12 billion dollar company, but Microsoft is $34 and $200 billon. Easier for a $12 billion company to gain than a $200 billion one.

Good point about market cap, but I don’t think we can disregard price so easily. The idea here is to find stocks that are “on sale” relative to price rather than good long term prospects.

Interesting idea. I’ve been relatively more active in looking at early stage companies (which by extension tend to have smaller stock prices). To date, I’ve contented myself by picking those early stage companies that still pay dividends (few and far between, but they can be found).

I’ve become more open to the idea of looking at those same small companies that are at an even earlier stage, not paying a dividend, but still exhibit strong growth, and have first mover advantage or barriers to entry. The bulk of my portfolio will always remain in larger, steadier assets of established companies, but I do acknowledge considerable opportunities at earlier stages of investing, and I am steadily devoting a small amount of my portfolio to surfacing these.

After having been burnt by a few fleeting picks, I don’t think I’ll ever be able to part with having a majority of my portfolio in large stock companies. That is still my core as well. But I love the prospect of potentially getting that 10-bagger! I was pretty happy when my Apple stock doubled a few years back.

Really appreciate you sharing this blog post.Really thank you! Really Cool.

You’re welcome.

Here in the Uk – the average growth rate of listed North American Mutual funds has been 8.9%pa over the last 5 years and 6.2%pa over the last 10 years.

In contrast the average growth that of listed North American Smaller Companies Mutual Funds has been 12.7%pa and 9.6%pa respectively

Certainly makes a valid point for smaller company investing.

As long as you’re able to stomach the risk that comes along with investing in smaller, growth companies, historical financial data does support that there is opportunity with those companies.

I’ve pretty much only been burned doing this. That said, I’m still OK with a little bit of speculation if it’s money you can afford to lose. Just know it’s really just gambling so don’t go risking your pretirement funds with this kind of investing.

Completely agreed. You should limit your “fun money” to only a very small percentage of your investments and stick to your core, stable plan for retirement.