Have you ever wondered when to drop collision and comprehensive coverage from your auto insurance policy?

Without a doubt, auto insurance is a must-have when your vehicle is relatively new, higher in value, and you need the financial protection.

But what happens as time goes on and our vehicles begin to decrease in value? What about when you’ve racked up hundreds of thousands of miles, and you know the trade-in value of your car will be next to nothing? Is there a point where full coverage simply doesn’t make good financial sense any longer?

This is a question I struggle with every time I have to renew my auto insurance policy. I commute every day over 60 miles each way to and from work. Traditionally, to get the most bang for my buck, I purchase relatively inexpensive used cars and drive them until my millage is well into six digits.

Conventional wisdom says to drop full coverage if it exceeds 10% of the replacement value of your car. For example, if you stand to receive $5,000 if you’re in an accident, then your insurance shouldn’t cost more than $500 per year.

But does this 10% rule of thumb really always hold true? What if you drop your coverage and get in an accident right away? Honestly, how much savings are you really going to get and how long would you have to go without an accident for it to be financially better?

More so, is there a break-even point where paying for comprehensive and collision coverage would barely cover your car if you were in an accident (if at all)? Or could I be passing up better financial opportunities such as paying off some debt, adding it to my retirement savings, or simply building up my rainy day fund?

In this post, I’d like to explore my options and crunch the numbers. Most importantly, I’d like to see if the benefits really do out-weigh the risks, or if it simply makes more sense to keep comprehensive and collision and simply adjust the deducible (more on that below). But first: What is comprehensive and collision coverage?

What is Comprehensive and Collision Coverage?

What does it mean to have comprehensive and collision? Why is it important to even have this type of coverage on your auto insurance in the first place?

Collision insurance covers the damage to your vehicle in the event that you are in an accident with another vehicle. An example of this would be a typical car-crash scenario where one car hits another.

Comprehensive insurance pays for non-collision related damage. An example of this would be a broken windshield due to a flying rock or hail.

Are comprehensive and collision insurance required by law?

Generally, no. State laws don’t require you to have coverage that protects the physical appearance of your car. However, keep in mind that if you have an auto loan, they might require you to keep full coverage (to protect their asset, of course).

What does the law require? That you are financially responsible for any injuries or damage you cause as a result of your driving. Hence, why you have Bodily Injury Liability and Property Damage Liability. The minimum amounts will vary from state to state.

Then why even buy comprehensive and collision ?

Like all insurance policies, your goal is to minimize your financial risk and protect your asset from unfortunate events.

Imagine you just bought a brand-new $40,000 SUV and get into an accident one mile from the dealership. Even though no one is hurt, without insurance, you would be on the hook for tens of thousands of dollars associated with repairing your vehicle. So by having insurance, you mitigate that risk by paying a relatively small sum of money for the insurance provider to pay those expenses should anything accidental occur.

Deductibles

Keep in mind that collision and comprehensive coverage costs will vary depending on your deductible. Your deductible is the amount of money you must pay first when a claim is made before the insurance company will pay any benefits.

Example: You are in an accident and have $5,000 of damages. Your deductible is $500. Therefore, you pay the first $500 while the insurance company covers the remaining $4,500 for the repair.

Typically most people select deductibles between $500 and $1,000 depending on a great deal of factors like price, comfort level, accident history, etc.

Depending on your type of policy, you might not have to pay the deductible yourself. If you have what’s called “broad from” insurance and you are determined to be less than 50 percent at fault for the accident, then the other party (or rather their insurance company) will pay for your deductible.

My 3 Possible Auto Insurance Options to Consider

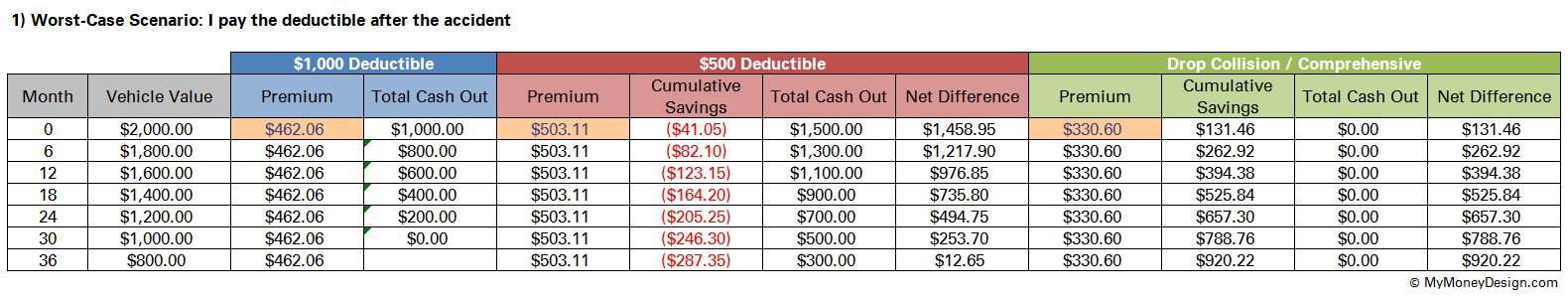

To really determine if keeping collision and comprehensive coverage makes sense, I decided to call my insurance provider to get figures on a few different options. (Yes, these are REAL numbers!)

Basically I see three main options we could choose from:

- Keep the coverage with a $1,000 Deductible. Right now my auto insurance policy carries a $1,000 deductible for collision and comprehensive. If I stay this route, I can change nothing and continue to pay the same rate I’ve always paid.

- Keep the coverage with a lower $500 Deductible. I could reduce my deductible to $500 and pay a higher price of $41.05 more every 6 months ($82.10 per year). If I get into an accident, then we can assume I’d have less to pay out of my own pocket (assuming I have to pay the deductible at all).

- No Coverage. I could drop collision and comprehensive from my policy altogether and save $131.46 every 6 months ($262.92 per year). However, if I get into an accident, then it’s game over! I would have to pay for all the damages myself (or more than likely start looking for another used car).

Worst-Case Scenario: I Pay the Deductible After the Accident

To really appreciate a good analysis, I find its best to start extreme and compare all three options assuming the worst-case scenario.

In this model, what circumstances would make it worst-case?

- First of all, let’s perform the calculation assuming I was in a car accident and my vehicle was completely totaled at the end of each 6 month period (starting from 0 to 30 months). As time builds on, we’ll see the cumulative effect of the savings versus the depreciating effect of the vehicle (resulting in the net amount of money I will be entitled to receive).

- Let’s also assume that I have to pay the deductible, not the other party. How likely is that? Unfortunately, more than you think. The last accident I was in included someone who claimed to have insurance but turned out to have none. My insurance company sent her legal notices, but there was never any response. So I was on the hook for paying for the entire deducible. Again, we want to assume worst-case.

- Finally, we’ll need to estimate the depreciation of my vehicle. For your information, I drive a 2011 Chrysler 200 (that I picked up for a steal!). It currently has over 150,000 miles (I told you I commute a lot!) and has an estimated value of roughly $2,000. Since my car is at the tail end of its life-cycle value, I think we could reasonably assume a decrease of $200 of Blue-Book value with every 6-month insurance period.

Results

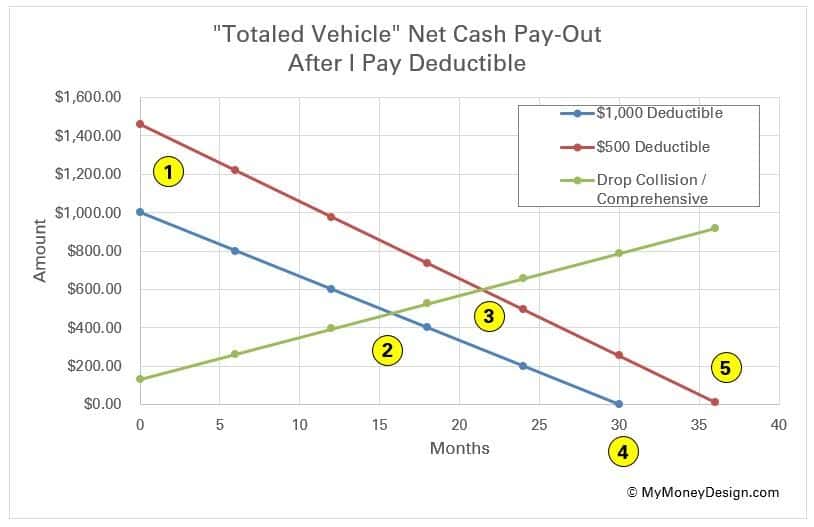

Observations

1. If I totaled my car tomorrow, clearly switching to the $500 would yield the greatest value whereas dropping collision and comprehensive would result in the least value.

2. If I can manage to stay accident free for at least 16 months, then dropping collision and comprehensive would begin to yield a greater net return relative to having a $1,000 deductible.

3. If I can manage to stay accident free for at least 22 months, then dropping collision and comprehensive would begin to yield a greater net return relative to having a $500 deductible.

4. After 30 months, having a $1,000 deducible would reach a break-even point ($0 value). Going forward, it would make sense to drop collision and comprehensive since there would effectively be no benefit.

5. After 36 months, having a $500 deducible would reach a break-even point ($0 value). Again, going forward, it would make sense to drop collision and comprehensive since there would be no benefit.

Consensus

Though I could accumulate some savings over time, the benefit would not outweigh the risk until several months down the road. Clearly paying for a lower deducible would put me in a better position financially, but this is only if I am unlucky and get into an accident. Hence, the higher deductible option seems to fit right into the middle of the road.

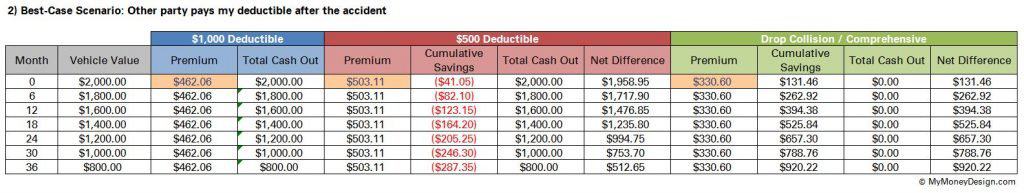

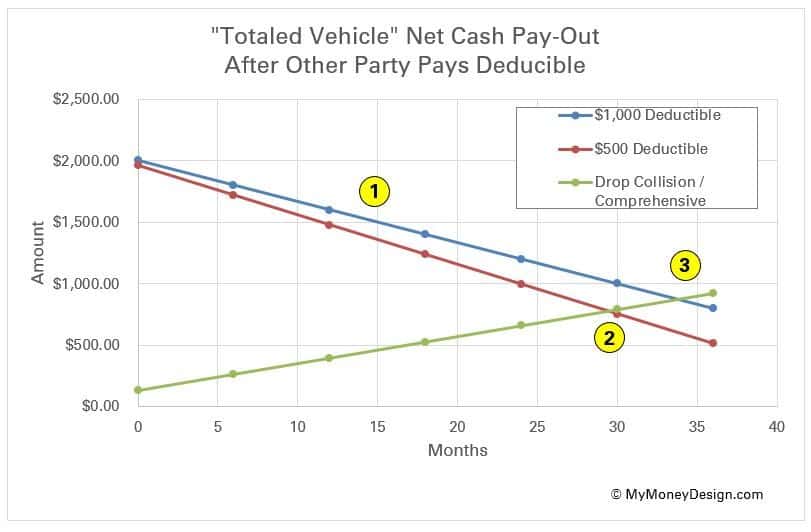

Next Worst-Case Scenario: The Other Party Pays the Deductible

Okay, so maybe the situation I painted above isn’t necessarily “typical”. People get into accidents all the time and both parties have insurance. And when they do, that means they also cover your deductible. So is it really fair to base our decision assuming that we’d have so much to lose?

Of course we can take this point into consideration. So let’s re-do our model with one big change: If I’m in an accident, the other party has insurance and ends up paying my full deductible.

With this in mind, how does it change our calculations?

Results

Observations

1. For the entire life remaining life of my vehicle, at no point would the net payout with the $500 deductible ever provide a greater benefit than the $1,000 deductible option.

2. I would need to stay accident free for at least 30 months for the “dropping collision and comprehensive” option to yield a greater amount of savings than the $500 deductible option.

3. I would need to stay accident free for at least 34 months for the “dropping collision and comprehensive” option to yield a greater amount of savings than the $1,000 deductible option.

Consensus

Clearly when there is the assumption that I would not have to pay the deductible, it would take much longer for the savings of having no coverage to out-weigh the risk. Also when the deductible is no longer a financial threat, the lower cost, higher deductible choice becomes the better option.

Conclusions

So is it really financially better to drop collision and comprehensive coverage from your auto insurance?

This question really boils down to one thing: Do you believe you’re going to get in an accident or not?

Remember: Insurance is never an investment. Inherenitly, it’s a payment for protection from an unwanted risk.

So on that note, be honest with yourself: What’s the likelihood of this risk? How likely are you to get into accident, either by your own fault or by that of someone else.

Unfortunately, this is probably one of those things where we all tend to feel a somewhat false sense of confidence. Hey, I get it! You’re a safe driver. You could never be the one who gets into the accident, right?

But that’s exactly the problem. An accident doesn’t always have to be “your” fault in order for you to become involved. Accidents sometimes just happen. (That’s why they’re called accidents.)

Just like I mentioned already, my last accident was when someone with no insurance hit my car due to some icy weather. Even though I had her information, since she had no insurance, there was really no way to get her to ever pay for my deducible.

Two years before that, I was in another icy road accident where the car next to me started spinning out of control and hit my car. Again, not my fault. But the next thing I knew I had well over $5,000 in damage to my vehicle.

Every day, I commute to work a long, long ways. I deal with rain, snow, and everything in-between. So like it or not, when I have to really consider how likely I’m ever to be in accident again, the answer is probably “yes”.

Therefore, for me, it would make sense to keep collision and comprehensive coverage, and stick with the lower cost, higher deductible option. In other words, no change from the policy I have currently.

But again: Ask yourself the same question. If you don’t commute or drive in normaly stable weather conditions, then perhaps for you it does make sense to drop collision and compreshieve coverage from your auto policy.

Remember: When it comes to insurance, it’s a gamble. But it’s a high stakes game, so in my opinion, play it safe and choose the conservative option.

Readers – What do you think? When you do think its the right time to drop collision and comprehensive coverage from your auto insurance policy? What factors did you consider, or when do think it makes financial sense?

Photo credits: Unsplash, Pexels

I am seriously considering dropping collision and comprehensive coverage. One of the things I did not see mentioned this artical is coverage for uninsured and under insured motorists. That coverage is included in my liability coverage, separate from collision and comprehensive.

Upon renewal, my premium will exceed 10% of the car’s value. I can find cheaper insurance with the same coverage, but then it substantially increases deductibles on my home insurance. So that is the decision I have to make.

I like that you state that it’s important to have the financial protection of auto insurance while your car is new and worth a lot of money. My brother is looking for the best way to cover his new Tesla. I will send him this information so he can make sure to find the best automobile policy available to protect such a valuable car.