Whenever I first get talking to someone about personal finances, one of the first questions they have is: How much do I need to save for retirement?

It’s a heavy question, I know!

Save too little and you might end up having to go back to work when you don’t want to. But set your target too high, and you might end up working harder and saving longer than you really need to.

Believe it or not, the math behind figuring out how much you need to save to retire is actually amazing simple!

… As in just one calculation …

That’s right. You can go online and find some complex calculator with one hundred different inputs if you’d like. But more than likely whatever that fancy gadget tells you will be no more accurate than if you were to use this simple rule of thumb.

What’s more important: Knowing the reasons and logic behind the numbers you choose to make this calculation. And that’s exactly what I’d like to go through with you in this post.

Disclaimer: Some of the links in this post to useful tools we recommend are affiliate partners. This is at no additional cost or risk to you. To learn more, check out our Privacy Policy.

How to Use the Rule of 25 for Retirement

I remember in my early 20’s, I was reading a magazine which featured an article with a quote from a financial adviser.

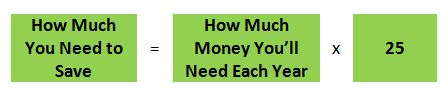

He suggested that if you wanted to know how much money you’d need to save up for retirement that all you had to do was the following:

Yup. That’s it …

Just figure out how much money you think you’re going to need each year, and then multiply it by 25.

Let’s try it for ourselves.

Example: If you’d like to spend $40,000 per year, then your retirement savings target will be 40,000 x 25 = $1,000,000.

(You can even shortcut this calculation even further and say for every $10,000 you think you’ll need in retirement, add another $250,000 to your savings target.)

… So, why 25?

The Logic Behind the Rule of 25

What’s crazy is that after all these years of blogging about money, reading personal finance books, writing my own books, and really digging deep into different strategies for retirement planning, the Rule of 25 still works!

Here’s the reason why.

The Rule of 25 is just a convenient way to perform a calculation using something called the 4 Percent Rule.

What’s the 4 Percent Rule, you ask?

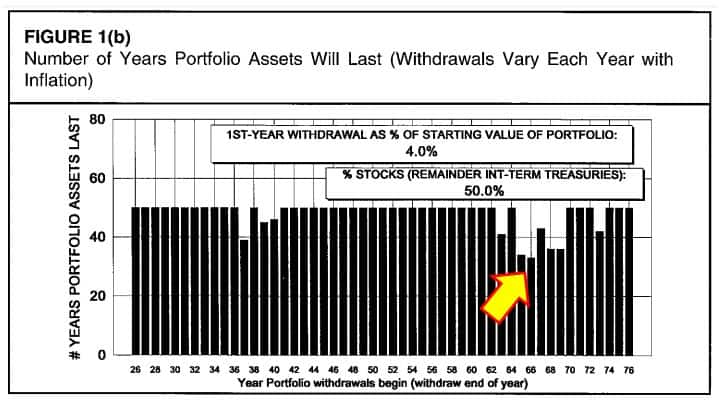

The 4 Percent Rule is a statistical study that says that the average retiree can safely withdraw up to 4 percent of their initial nest egg balance every year (with inflation adjustments) for at least the next 30 years.

It’s based on real market data going all the way back to to 1926. In other words, you could have retired at any point in time over almost the past 90 years, and you would have not ran out of money for a minimum of 30 years.

Hence, this is why you will often here it referred to as the “safe withdrawal rate”.

Here’s an example of how the 4 Percent Rule works.

- Let’s say you save up a nest egg of $1 million dollars.

- In your first year, you could withdraw 4% from your savings for $40,000.

- You could then continue to withdraw $40,000 each additional year making adjustments for inflation along the way. For example, if inflation is 3 percent, then we could take $41,200 the second year, $42,436 the third year, and so on.

No matter if the market is up or down, you can keep on withdrawing this same amount, and you should not run out of money for at least 30 years. In fact, during many periods throughout history, making withdrawals based on an initial amount of 4 percent actually worked for 50 years or more!

So what’s the relationship between 25X and the 4 Percent Rule?

Mathematically, multiplying your expenses by 25 or dividing them by 0.04 (4 percent) are the same exact thing.

Since its inception in 1994, the 4 Percent Rule has become a staple of retirement planning.

Thanks in part to its simplicity and practically, you can easily see why its become so popular.

But does it actually work?

Examples of 25X Retirement Success

Many of the big-name personal finance bloggers who have famously retired early did so by using nothing more than spending less, saving more, and using the 4 Percent Rule.

Here are a few examples.

Jacob Fisker and Early Retirement Extreme

Early Retirement Extreme is one of the first early retirement blogs (and books) to really gain a lot of popularity – mostly because of the author’s unusual retirement style.

The site’s creator Jacob Fisker graduated with a PhD in theoretical physics and worked for just five years as a research associate. During that time, he saved a whopping 75% of his income (after tax). By keeping his annual expenses under $10,000 and using the 4 Percent Rule, he knew that he would only need a nest egg of less than $250,000. Thus, Fisker was able to reach financial independence before the age of 30!

Though his approach is certainly not for everyone, it illustrates how powerful this relationship between spending and saving be, and how you can leverage it to your advantage.

Mr Money Mustache

Another good and extreme example of the 25X relationship is the blogger Mr. Money Mustache.

MMM, as he’s called (real name Peter Adeney) was an engineer who lives a pretty frugal life with annual expenses of just $24,000. He spent the better part of his 20’s saving extreme amounts of earnings.

Once he got to the point where he had 25X his needs ($600,000), he knew he was ready to pull the plug and live life according to his terms.

Jeremy and Winnie from Go Curry Cracker

Jeremy and Winnie are the couple behind the blog Go Curry Cracker and another example of a couple that was able to retire in their 30’s.

Their strategy was simply to keep their expenses under $40,000 and build up a straight 25X nest egg. Using only the income comes from dividends and interest, they rarely ever touch their principal savings.

Also, they choose to really make their dollars stretch by living for extended periods of time in places with lower costs of living than we have here in the U.S.

Robert and Robin Charlton from How to Retire Early

One of my favorite examples of a successful early retirement comes from Robert and Robin Charlton and their book “How to Retire Early”.

They went from having almost $0 in savings to $1 million in just 15 years by focusing on their careers, living frugal, and saving a high percentage of their annual income.

Again, with estimated expenses of just $40,000 per year, the $1 million dollar nest egg was all the 25X they needed to declare their financial independence.

Bill Bengen – Creator of the 4 Percent Rule

Even the man behind the 4 Percent Rule, financial planner and former aeronautical engineer Bill Bengen has said that his annual spending in retirement comes pretty close to 4 percent of his nest egg.

The Lesson Learned

What’s the major take-away from each of these examples BESIDES the fact that the 25X rule or 4 Percent Rule works?

A high savings rate and frugal living can go a long ways in helping you to achieve financial freedom.

Don’t believe all the BS you read on those “make money quick” websites about retiring to million dollar mansions and living large. Only 0.001% of people will ever have success at this.

On the other hand, the simple acts of scaling back to a reasonable lifestyle and saving more are techniques that are within the reach of anyone.

Yes, ANYONE!

All it takes is a little self-discipline, but you can get there!

How to Make Your Retirement Plan Even Better

If this 25X strategy works so well, then why does retirement planning seem so complicated?

Good question. It’s a subject that I found so interesting that I wrote an entire book about it.

As I mentioned in the introduction, this calculation is only as good as the numbers you put into it.

Optimizing the Income Variable

For example, you might be tempted to say “I make $80,000 now, and so I’d like to have $80,000 per year when I retire”.

That’s fine. But do the math real quick and you’ll see that you’ll need a nest egg of $2 million dollars.

If you’re a little older and perhaps have less than $100,000 in savings so far, that means you’re going to have a huge savings challenge in front of you.

So what are your options?

One simple solution would be to use the reverse of this calculation and figure how out you might be able to work with less.

As we said, every $10,000 you think you will need works out to another $250,000 you will need to save. So for example, instead of $80,000, try imagining what your life would be like at maybe $60,000 per year? Could you do it? If so, then your savings target drops down to $1.5 million.

What about:

- Paying-off your mortgage?

- Cutting down your bills?

- Eating out less?

- Moving to lower cost of living area?

- Getting in better shape so that you’ll need less healthcare?

What if instead of living off of your retirement savings alone, you:

- Included Social Security into your calculation

- Got a part-time job that brought in a little bit of income

- Acquired income generating assets such as rental properties

The struggle comes not with knowing how much you need to save for retirement, but in actually reaching your target.

As you can see, there are many ways you can manipulate the “how much money you’ll need each year” variable in the equation.

Optimizing the 25X Multiplier

Okay, so now I’m going to throw you for a loop …

In some cases, you can actually do better than 25X your income target!

This is mainly what I cover in my book above. While doing my research, I collected a number of different tricks that would allow you to optimize your safe withdrawal rate above 4 percent.

For example: Did you know that if you didn’t adjust for inflation every year that you could actually safely withdraw as much as 7 percent from your nest egg each year? I know … that’s not practical. But it does give you some idea of the range of benefits that altering your inflation adjustments can have.

Another example comes from paying attention to the market itself: Something called the “Shiller PE”. Basically (contrary to what you might think),when the market is doing poorly, this is actually a good time to retire.

Why?

Because studies show that you can actually use a much higher safe withdrawal rate. You can read more about it at Kitces.

There are of course many more other strategies available. Feel free to Google them, or you can check out my ebook to find out more.

Test Your Own Retirement Plan

Want to see if the 4 Percent Rule will really work for you? Want to try other withdrawal rates to see how it could impact your retirement savings plan?

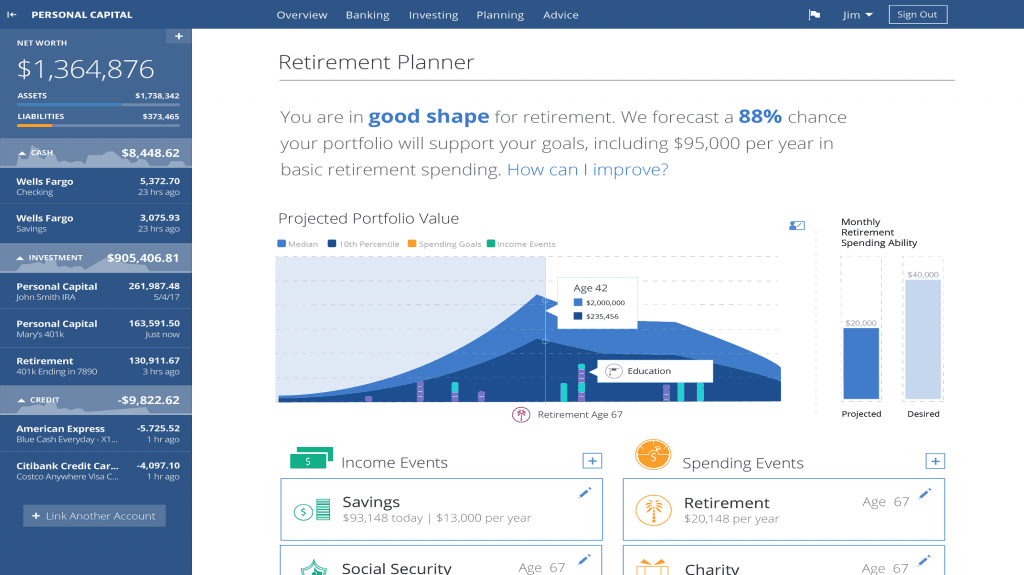

You can do all of this with a good retirement planning tool such as this free one from Personal Capital.

How does it work? Simply start by answering some basic questions such as when you’d like to retirement, how much money you’d like to withdraw, etc. The calculator will then go through thousands of simulations and provide you with a forecast of how long your savings will last. To make it as realistic to your situation as possible, you can link out to your real retirement accounts so that you’ve always got a full real-time picture of exactly how much your nest egg is truly worth. This way, you never have to update anything; you’re always working with your actual numbers!

Again, this retirement planner is completely free to use. So I would definitely recommend giving it a try!

Conclusions

For now, if you’re just starting out and looking for a simple way to figure out how much money you need to save for retirement, using an estimate of 25X your annual target will work just fine.

Though there are many things we can do to enhance these numbers, don’t worry about it just yet. In the meantime, put all of your effort into figuring out how you can increase your savings rate. Trust me – after reading all of those examples from above of bloggers who were able to retire early, you’ll be glad you did!

Readers – Who else recommends 25X to their friends just starting out with retirement planning? Who is using this for their own retirement planning strategy? What are some other examples you’ve seen where this has worked?

Featured image courtesy of Flickr

MMD – a great summary of a powerful formula! Ironically, I used exactly this “simple approach” in a podcast I did last week on Planet Boomerville.

There’s no need to over-complicate thiings.

At the same time, it’s important to realize the assumptions behind “a formula”. You can add me to your list in a year, as I’ll be “FIRED” in June 2018. We’re planning a “flexible spending” approach, and will be adjusting our spending budget every year based on returns in the year prior. Great post.

You’re absolutely right – there is no need to overly complicate retirement planning. The idea behind it is simple: reverse engineer how much you can withdraw and you’ve got your nest egg target. From there, its just a matter of what we put into that equation that can make or break the success of its outcome.

Great job being FIRED by 2018! I believe there’s a lot of benefit in using a flexible spending approach. It’s a little harder for most people to wrap their heads around, but I think it makes good practical sense since your expenses will likely not be the same each year.

does this approach matter to people who want retire early, like in their 40’s? The 25x will only last until the person turns 60’s. How about the remaining years, say the person lives until 80 or even 90?

It totally matters! Although most people apply the 25X rule to traditional retirement, it can also help provide a general guideline for early retirees as well. Most of the examples I mentioned retired in their 30’s or 40’s, and they are doing just fine. You have to remember that the 4 Percent Rule works more than 50% of the time for periods of 50 years or longer; the minimum of 33 years was only one period. If you need more assurances, there are always other ways you can manipulate the 4 Percent Rule such as using the Floor / Ceiling technique, lowering inflation adjustments, delaying adjustments, retiring when the Shiller CAPE is low, etc.

The rule of 25 is much simpler and it can really show you the approximate of how much you need in your retirement. Then, after using this strategy, you may look for a better one to compare and contrast.

If planning to retire early, especially with a family, I recommend adding $10k-$15k to your expected yearly spending. You might not need it every year, but there will be some unexpected expensive years.

Retiring early is great, but it takes a lot of fortitude to stick to the 4% rule, or similar, when experiencing years with poor investment returns. When you start cannibalizing your investment capital for day-to-day living expenses the temptation to find high risk/high returns is pretty storing. The risk of wipe out your retirement savings on bad investments become very real.

Retiring is like a career, it takes proper planning, training, and execution to enjoy it.