If mortgage rates go down, how long do I have to wait to take advantage of that opportunity?

How soon can I refinance my home and lower my monthly payment?

When you’re a frugal son-of-a-gun like me who’s heading towards financial freedom like a locomotive that’s full steam ahead, the answer is: As soon as it makes financial sense to do so!

More specifically: Right away!

Yes, that’s right. After having moved less than a year ago, we’ve already successfully completed a refinance of our home mortgage. This is a move that will save us almost $70 per month!

But the more appealing aspect: It cost us literally nothing out of pocket, and it will pay for itself within 2 years!

Should you refinance your mortgage so soon after just moving into your new house? Let’s go through the steps to see how I arrived at my decision, and we’ll see if that makes sense for you as well.

Always Looking for Ways to Save!

One thing about me is that I’m constantly challenging our household expenses to look for better and creative ways to save more money. For example, we dropped our cell phone insurance with Sprint when I ran the numbers and discovered we could practically buy a new smart-phone for the price they were charging us!

Literally no expense is safe. And I’m always keeping my eyes peeled for new opportunities.

Well, as luck would have it, I found one of those opportunities!

Paying Attention to the Rates Pays Off

Recently, while reading through my usual regimen of daily personal finance articles, I started noticing in the sidebars that there were advertisements for mortgage rates that were significantly lower than mine.

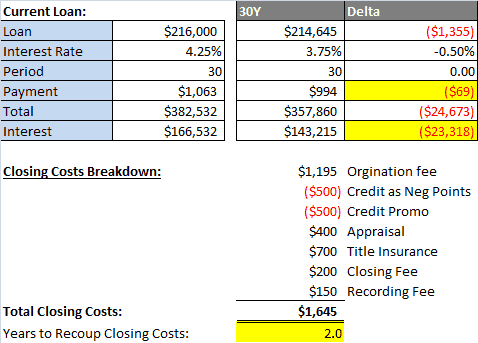

The mortgage I had just signed up for was a year 30-year fixed rate of 4.25%. After doing a little bit of research and making some phone calls, I had discovered that the going rate was now 3.75%.

Hmmmm. A 0.5% difference? Is that really enough to go through all the trouble of pulling the trigger on a total refinance? I had always heard the conventional wisdom that your new rate had to be at least 1% lower to make sense.

What about closing costs and fees? How would they factor into this situation?

It was time to do the thing that I do best: Crunch the numbers!

Comparing My Refinance Rate to My Old Mortgage

Using the ballpark estimates I had received from various lenders, I put the numbers into a spreadsheet and did the math.

Even at this modest 0.5% rate drop, switching from one 30 year mortgage to another would drop my monthly payment by $69.

But over the life of the loan, I’d eventually save $23,318 in interest!

When you look at it from this perspective, it makes sense on all fronts to proceed!

Reducing the Closing Costs

Closing costs are always the big “what if” in any mortgage or refinance discussion because they can vary by SO MUCH! Your estimate can be chucked full of so many different types of fees and categories that it’s hard to really know if you’re comparing apples to apples across different lenders.

Thankfully I found an easy way to take care of it all: Use my current mortgage provider.

My current mortgage provider was able to work with me on our closing costs in the following ways:

- They had a “summer special” going on that included $500 off the origination fee.

- The rate they offered included “negative points” – meaning they paid me for taking a slightly higher rate.

- They were able to use the home estimate that we had just used 10 months ago when we bought the house. This saved us from having to purchase another home estimate, and (more importantly) set the value of our house right where we needed it to be so that we could move forward with the loan!

All in all, our closing costs came out to $1,645. Given the amount of savings per month we’d be getting, essentially we’d break even on this expense within the first two years!

Score!

Why Not a 15 Year Mortgage?

When I first had the thought of refinancing my mortgage, the thing I really wanted to do was go all in and get a 15 year refinance. Not only would that have given me the lowest, best possible mortgage rate, but after calculating it out I would have saved almost $115,000 in interest alone! That’s literally the value of a whole separate house!

The problem: It would mean committing to an increased mortgage payment increase of $408 every month.

Unfortunately, at this time with my aggressive early retirement saving habits, that’s just simply not something that we can permanently adjust to right now. While the prospect of saving so much money over time is enticing, I will always recommend that the first thing anyone should do is to align their finances with their own personal goals. Since early retirement means more to us than having our house paid off more quickly, I decided the 30 year mortgage will do fine.

Besides, with potential long-term investments having the possibility to yield a lot more than 3.75%, it may make even more financial sense to invest the money rather than pay off our house early.

Plus, it’s important to remember that at any time if your finances change you can always essentially create your own fake 15 year mortgage by simply making early principal payments periodically. Sending in just a few bucks here or there once a year can knock 5 or so years off your term, but gives you the flexibility to opt out if you can’t quite do so every time. Bankrate has a fun, free calculator that can let you test out some numbers and see for yourself.

Always Be Challenging Your Bills!

There you have it! I would have never guessed that I would have refinanced my home mortgage so soon in less than a year, and only for half of a percent less. But as you saw, we crunched the numbers and it made sense. Not only will it save us more money every month, but the closing costs will take care of themselves within 2 years and we’ll save a boat-load over the life of the entire mortgage!

The important lesson to learned: Always, always be challenging your bills. No matter what they are for or what they cost, there will always be opportunities to make them lower. It’s simply up to you to be on the lookout for them and make it happen.

Related to our mortgage, it was just earlier this year that I challenged our property taxes and got them lowered by a very significant amount!

There are so many different ways to cut your expenses every month. Everything from just a few extra bucks to a few thousand can make a difference. If you’d like to hear of some more examples, I’ve got some more good suggestions to share in my ebook “Save MORE, Earn MORE!” Honestly, once you start auditing yourself and diverting those savings towards your other financial goals, you’ll soon appreciate the effort you’ve invested!

Readers – How many of you have wondered how soon can I refinance my home? How quickly did you act, and how much did it save you? What other things have you done recently to cut down your monthly expenses?

Featured image courtesy of Pexels

Congratulations! I did not know you could refinance at any time that you want, I would assume a lot of people are refinancing given that the interest rates are so low right now.

I agree on always challenging your bills, I look at my bills and think to myself how I can make them smaller. I use less electricity, negotiate to get what was promised to be on my phone bill, and use the car less (my friend amazingly wants to drive everywhere and I offer to change drivers and he always says no). Constant review is the way to be cognizant of where your money is going!

Back when I had my day job, my boss actually refinanced his house like 3 times in one year. It was crazy, haha!

Nice… I’m sort of a refinance junkie. 3 in the last 10 years. Actually considering another right now (and writing a post about it and just saw your post in my RSS feed). When the numbers work, you gotta go for it. Even though it’s a huge hassle. When you calculate the savings on that hassle time, it’s worth it.

-RBD

I say why not! For the few hours of effort you put into it, if you can end up saving tens of thousands of dollars, then it simply makes sense.

Heck yah. If there are cost savings to be found, refinance early and often ;-). The trick is to find a new mortgage with little or no closing costs. Nice job sir.

Thanks! I got really lucky that my current provider was able to minimize the closing costs as much as they were compared to my two other quotes.

Hey that’s great you refinanced. I know this is high level math, but the interest savings and the 70 bucks you will now invest will help the payback period in conjunction speed up the FI time frame as well. ITs a win win even though you are losing 1 full year of mortgage payments. (You restarted the time frame)

You totally caught me on the restarting one year over. Even though that part stinks, the match still works out that the overall savings triumphs the original loan.

I like your point on the time when financial makes sense. It’s really about timing and doing the right thing in refinancing home mortgage.

Thanks Jayson. I truly think its the most important criteria for moving forward.

If we had a mortgage, it’d be the closing costs that would put me off, so as long as there was a net saving – I’d definitely do it. We don’t have a mortgage though..we’re always looking to reduce our bills though (my wife Jasmin is awesome at that!).

I think the first port of call would be go to our current provider and ask if they’d match that better rate.

Tristan

Congrats to you for having a wife that is always working down the bills. Partnership is such a key element in this whole process.

It’s great you were able to refi and save money so quickly. I can’t remember how many times we’ve went through the refi process, but anytime we can save enough money to make closing costs make sense, we do it. We moved to our current home 2 1/2 years ago and have refinanced twice. I’m guessing it won’t happen again, as we are at 3.25%. Thanks for sharing your numbers and congrats on the savings!

If rates go down again (but lets hope not for the sake of the economy), I’m totally open to refinancing all over again. As long as the savings exceeds the closing costs, it simply makes sense.

Love this move! I’m always happy to see others thinking about interest rates and how they come into play. We got a rock-bottom interest rate about four years ago, so we have no plans to refinance. Some of my friend’s parents who bought years ago have interest rates that are 10%+ and I know if I were in their shoes I’d refinance ASAP.

Wow! 10%? There’s no way I would have not looked into a refinance by now. I’m actually surprised that with all the sidebar advertisements on every website and mailers that come to my house that anyone would still have a rate so high.

I am gonna see if it’s the best time to refinance, and I hope I can do it this year as I have been in the mortgage for a few years. It’s about time to check it.

I’m sure you’ll find that you be able to save some money for sure. I’m just going to guess that if it’s been a few years, then maybe $100 or so per month to be saved??

I am currently refinancing my home right now. I currently have a 4.5% rate on a 30 year fixed mortgage and with the new refinance we are dropping down to 3.5% and saving over $100 per month. We are paying $0 in loan fees for the refinance… it’s like free money!

We refinanced our original FHA loan about 1 year ago… and we are refinancing again 1 year later. Not too bad in my opinion 🙂

$100 extra per month for the next 30 years is not bad all! Way to go!

I’m having a hard time wrapping my head around a 15 year vs a 30 year which you can make extra towards (to pay off faster). I understand the % will be better but you have so much more flexibility on a 30 year. Also a 15 year in an area like Seattle is VERY steep. 20% down is $100k+ everywhere you look.