This post was written by Kevin Donovan from financialupdate.org.uk. He often writes about how the decisions made by politicians and bankers affect our daily lives and the ability to cope with the economic stress of an ever more debt ridden world.

Every day we see large companies take large substantial hits. This one to wonder: If they can’t survive this bleak economic climate, how can we?

It’s a good sign if you are asking yourself this question because it means that you clearly understand the gravity of the situation. If you have learned to live with debt, that is a start. It means that you probably know enough to not get in any deeper while managing what you have.

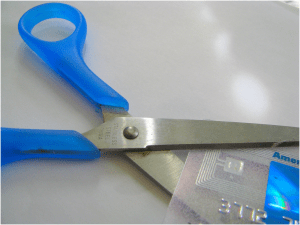

But you can take it further. If you follow these simple steps for how to clear credit card debt, you will be able to pay off your cards and give yourself the much needed chance to start saving some money.

How to Clear Credit Card Debt Steps:

1) Firstly you have to understand why you are getting into debt. Banks and other lending institutions are making it far too easy to apply for a credit card in the first place. Often you can get an application form in the mail or online without having even asked for it.

You have to understand:

- These companies have a vested interest in getting you in debt because that is how they make money.

Often even if you have just stepped into the workforce or became a university student, they will target you by making it even easier to apply. You barely even need substantial income or in some cases any income at all for that matter!

2) You get into debt because you believe that these cards are manageable. They offer you low repayment options and they give you the option of staying in debt indefinitely. Don’t get trapped! If you are already, here are some tips of how to get yourself out of that rut.

- First: Start by ensuring that you have direct payments set up on all your cards for at least the minimum amount. If you can help it, payoff more!! Setting up your account automatically will make it so you don’t have to worry about doing it manually and incur fees.

- Second: Be disciplined and ensure that you stop using the cards altogether. To do this you are going to have to manage your income in such a way that you are always left with enough money to make the more vital purchases you need. Once you have managed to organize this far you are now going to want to try to put a little bit extra aside to start repaying your cards.

3) Consider if you have any consolidation options. If you want to consolidate all of your debt into a single place, make sure that you have a good enough credit rating. Then you can start by trying at your bank, a loan from your bank with a repayment scheme will be the cheapest option on the market.

If this is not an option then you might want to consider about doing a balance transfer onto a single card that offers a low interest rate for an initial period. This will allow you to ensure that your debt is all in one place and that you can have an initial period where you can control the amount of interest you pay.

If you are unable to consolidate your debt due to factors such as your credit score, you have to make sure to resist the temptations of short term loans. The massive interest rates on these will force you further into debt and will in no way help your problem. These should only be used when you are sure that you can pay them off at your next pay cheque and if you have no other options. If your debt has become unmanageable another debt relief option you should consider is debt settlement. This option allows you to settle your debt. Usually your debt can be reduced up to 50%. A debt settlement lawyer should be able to evaluate your case and let you know if you are a good candidate for debt settlement.

4) Lastly if you can’t consolidate your debt and you have multiple credit cards, make sure that you pay off the card with the highest rate of interest first. This will ensure again that you don’t fall any closer to having to declare yourself bankrupt. The main thing you will have to concentrate on during this period, is that you are disciplined enough to not break a constant form of chiselling away at your debts a little at a time.

Readers – How do you help yourself to clear credit card debt? What options have worked for you in the past?

Related Posts:

1) Ten Ways Stock Investments Can Be Used With Your Credit Card Debt Reduction Strategies

2) How Much Could You Save Paying 0% Interest Using Balance Transfer Credit Cards?

3) When You Need Fast Cash Now and Where to Find It

Image courtesy of FreeDigitalPhotos.net

We stay clear of credit card debt by only using our card when we have to and making sure we pay it all back within the interest free period.

Simple, but it works.

This is the simplest way, if you are disciplined enough and manage your income wisely you wont have to worry about getting into debt in the first place. I am currently fighting my way out of some debt, and although its going well you often wonder why you didn’t have more self control and I personally feel stupid for putting myself in that situation!

Many people are often in huge debts because of credit card mismanagement. If one uses card responsibly, it would save a lot of heartaches. Personally, I just buy what I really need and pay the amount due before due date.

Again that is the best way, if you can afford to you might as well only have a credit card in case of emergencies and not use it for anything else.

There’s nothing wrong with that strategy. I’m always shocked by how many people buy things with a credit card that they wouldn’t already have cash for.

Thanks for outlining all of this so clearly. Great post!

Thanks Tony, all I can do is hope that no one makes the same mistakes as I did, and if they are unfortunate enough to fall into the same trap, the least I can do is give some useful advice to help people out

We stay away by not creating any credit card debt in the first place. Seems to work well for us and has helped keep us on track to reach our goals.

This is a good tactic and in fact the best one, but often people that get into this kind of debt are young and a card is made available to them far to easily before they have any experience to manage it

Credit card companies intentionally prey on the young and seemingly irresponsible. I wish we could mandate some type of class in high school (before the kids are 18) that taught you the dangers of high interest rates before they get out there on the college campus and sign up for one.

This is true, but I believe it is also a responsibility of the parent to make sure that the kids are clued in before they leave the house and go to university.

Even if they do something simple like giving them a limited weekly pay and nothing more this will help them manage the little they have got.

My Dad did a pretty good explanation with me when it came to credit card interest rates and how they grow out of control. I’m a numbers guy, so I caught on pretty quick. I remember when I’d be talking to my other classmates (back in college), many of them didn’t have the same understanding I had.

Another thing that helped me was having an introductory card. I remember my first credit card at age 18 had a $500 limit. That was a lot to me then, but it was low enough that I couldn’t get myself into too much trouble. It would be nice if more first time cards had a lower rate.

My old student credit card was a complete money making scheme for the bank! every year they used to send me a letter telling me my limit had doubled! I started on 750 and by the time I had done my third year of Uni I could go up to 3000!!!!!!

Good post! It really is too easy to obtain a credit card these days. You would think that banks want to get you into debt! 😉

This is true, as I was saying to Canadianbudgetbinder the banks make these options far too available. this is because they wont actually make any money unless you are in debt

I used the debt snowball method to get out of credit card debt. I prefer to see less bills than going after the highest interest rate.

Although I thought about using this Method Alexa because it does feel like you are ticking more boxes as you go along, if the plan to pay your debt off is long term (6 months +) the snow ball method will inevitably take longer and be more expensive to pay off.

Having a credit card takes a lot of responsibility. I actually just one have credit card for emergency purposes and I use debit card instead which is also good as cash.

Some people really tend to swear by their debit card. I’ve always been okay with using a credit card, and I do quite well with the rewards it brings me. But if I knew that I really wanted a way to keep my balances in check, I’d consider using a debit card instead.

To be honest they do make it easy to keep everything in check these days, my banks mobile app knows the instant I have done any transaction and I can check in advance if I can afford a planned purchase.

Did anyone ever feel that they had a credit card pushed on them when they weren’t even thinking about applying for one? Maybe when they where opening a bank account for savings etc?

I just had a past due collections appear on my credit report from 5 years ago. I knew nothing about it. I called the credit collections company and paid the debt. I I called the collections company and they said “no” that’s up to credit bureau. I just called Transunion again and they said it was no longer on report. Experian won’t answer their phone so went online, all effort to correct this was proven abortive and i need to do this fast for me to qualify for a house mortgage. Few weeks ago I came across this credit coach who many had recommended how he had helped them with their credit score. I contact him via his gmail (cyberhack005@gmailcom) and asked if he could help me. He answer boldly ‘YES’ and explain to me in details the whole process. I give him a try to my greatest surprise he did an amazing job. My score has boost to maximum and all 3 items were removed.