I’m serious. You would owe no taxes.

No, you won’t have to live in poverty. In fact if you’ve got enough savings you could withdraw over $100,000 and still not owe the government any money.

Is that even possible? Of course it is. Lots of wealthy Americans take advantage of tax loop holes every day to pay a lower tax rate than their peers. There’s even a famous statement from Warren Buffett where he says that he is paying a lower tax rate than his secretary.

Fortunately for you, we’re going to do a little better than that in this post. We’re going to see if we can’t find a way to pay NO taxes at all!

All we’ll need is to be creative with how we plan to save our money and invest it for retirement.

Assumptions:

- The tax status will be “Married couple filing jointly”.

- This married couple will be of the 401k retirement age over 59-1/2 but younger than age 65. There will be no kids or other dependents to claim on our taxes.

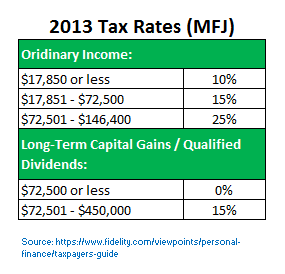

- We’ll use the current 2013 tax bracket system.

- We’ll only be talking about Federal taxes, not State or Local.

The Starting Point – Your Ordinary Income:

Not to make this into a big long boring math lesson on taxes, but you do have to understand your enemy if you want to know how to best attack him! (Thank you to the book “Art of War”)

So to begin, let’s look at our first building block: Ordinary income. Normally ordinary income is the money you make when you work at your job. It can also be money you take in from a side gig or business.

During retirement (usually when we stop working), we replace our working income with our retirement nest egg money. So the kinds of accounts we’d want to draw from for this building block of the plan would be things like your:

- Traditional 401k,

- Traditional IRA,

- 403b,

- Short-term capital gains,

- Social Security, and

- Annuities

- Many others.

For this figure, we’ll want to limit ourselves to $20,000.

Why?

Because that’s exactly the number that is equal to the addition of a Standard Deduction and two Personal Exemptions.

Next – Adding Gains and Dividends:

Of course a retirement based on $20,000 doesn’t exactly conjure up images of lavish days in the sun and cocktails. So let’s add our next building block to the tax free retirement plan by using these two types of investments:

- Long-Term Capital Gains

- Qualified Dividends

These two investments come from your regular brokerage account and are tied to how long you’ve owned the asset. These are not the same as your 401k or IRA investments.

The IRS taxes these two types of investments differently they do ordinary income. Basically you pay 0% tax as long as your income within these two categories does not exceed the 15% tax bracket (which is currently set to $72,500).

So for purposes of illustration, let’s say you’re able to swing a withdrawal of $72,500 every year from your regular brokerage accounts. That will be the next piece of the puzzle we add to our overall design (keep reading to find the summary image below).

The Final Piece – Non-Taxable Income:

$92,5000 isn’t too shabby. That’s over $7,700 per month. But why stop there when you’re on a roll? Can we do any better?

Of course we can.

The third building block will be the special retirement accounts where we DON’T have to pay taxes on the money we withdraw from:

- Roth IRA

- Roth 401k

This is a really good way to increase your retirement income without any taxable consequences. There’s really not an upper limit here – you can take out as much as you want from your Roth accounts without any tax consequences. It all just depends on how much money you have saved up inside these accounts.

To be reasonable and continue with the example, let’s assume you’ll withdraw $40,000 per year for your retirement. Since none of this money counts towards our taxable income, we’re still paying nothing in taxes!

The Final Piece – Non-Taxable Income:

With everything we’ve said so far, here’s what the complete tax free retirement income design looks like:

Not too bad if I do say so myself! That’s over $11,000 per month tax free!

Even More Ways to Have a Tax Free Retirement:

Still not satisfied and want to reduce your taxes even more? There are still a few other things you can try to improve your situation:

- Sell your losing stocks.

- Start a Health Savings Account.

- If you have a business or side income, claim your expenses.

If you’d like to try out a few different scenarios yourself, there are some good online calculators that will help you test your plan for a tax free retirement. Check out this one on Money Chimp.

This is Only An Example – You Get What You Can Afford:

Of course this entire example was meant to be a gross exaggeration of what you could possibly do if money was no object and you could hit the maximum limits allowed (for the first two blocks at least).

Whether or not you’ve actually got enough retirement savings to actually produce these kinds of withdraws is quite a different discussion! For example, using the 4% safe withdrawal rate as an estimate, you’d need a nest egg somewhere around $3,312,500 to produce this kind of retirement income.

Would Paying No Taxes Even Be the Best Option for You?

The other and more important point: In some instances it may NOT be to your advantage to save money in this manner.

Yes it would be fun to brag to all your friends that you have a tax free retirement and pay the Federal government nothing every year. But in other examples we’ve shown how paying taxes later in life might actually be a much better deal for you.

For example in our post about a traditional vs Roth 401k, we showed how delaying your tax payments until retirement might actually result in as much as one-million dollars more than you have otherwise!

In our post about Tax Deferred vs Taxable Retirement Income Strategies, we showed how using a 401k account instead of a regular brokerage account could result in over two-million dollars more over your lifetime!

Or perhaps you’re like me seeking an early retirement and wanting to become financially independent a lot sooner than later. If that’s your priority, then paying a little bit during your golden years might be a small price to pay to recapture 10-20 years of your so-called working years.

On those points, I think it’s strongly worth looking into to see whether or not paying taxes now or later makes the most sense for your specific situation.

Disclaimer:

Remember that I am just a regular guy. I’m not a financial adviser and I have no background in financial planning. Everything you’re reading here was collected from things I’ve read on other websites, books, and my own tax advisor. So before you go basing your life savings on the plan I’ve outlined here, I can not encourage you enough to speak to a true professional first.

Readers – If you could have a tax free retirement, would you take it? What are you doing to reduce the amount of taxes you’ll owe while still not sacrificing your income level?

Related Posts:

1) Did I Just Find Another Great Retirement Saving Strategy? Understanding the SEP IRA Rules

2) Using a 72t Distribution to Get Early Access to My Retirement Savings

3) How Do You Compare to the Average Retirement Savings of Other Americans?

Images courtesy of FreeDigitalPhotos.net

I feel like I pay A LOT in taxes now and my only hope is that my burden is lessened when I’m much older and earning very little on paper.

Great post MMD. I didn’t realize that long-term capital gains and qualified dividends were untaxed if they didn’t reach a certain amount… that definitely makes a tax-free retirement much more do-able!

I would love a tax free retirement – who wouldn’t! It’s actually not that unreasonable to think that it’s possible to do so. It does depend on the country you live in and your circumstances. I don’t think I would need $92,500 of income in retirement, but you never know.

Wow – I didn’t realize that long term capital gains taxes were zero if the income was under $72,000…. That’s awesome!! This will go a long way towards helping us if this rule is still in place by the time we hit retirement age.

Isn’t it amazing what we can do if we actually take the time to look through the various incentives put into the tax code? It’s incredibly difficult to see in the future, so the best we can do is estimate on what we have now. I personally don’t think the capital gains rate will stay at 0% for those in the 15% tax bracket and below, but you do make a compelling argument for investing in taxable accounts.

Great example.

Thanks for taking the time to explain the tradeoffs between traditional and Roth IRAs, tax sheltering vs not, and the like. So many people make the assumption that reducing taxes is the ultimate goal and supercedes all others. Sure, I hate paying taxes as much as anyone, especially when there are others who earn much more but pay much less. But it’s worth remembering that some things are more important than reducing taxes – family and early retirement are just two examples where it might make sense not to focus on reducing taxes as the primary goal.

Everyone’s situation is unique. So few people take the time to stop and think for themselves what makes the most sense for them.