That’s the fun little experiment I started about 6 months ago when I bought my last round of dividend stocks to add to my money design. Of course this is NOT how I picked my stocks and I would NEVER advise you do this. There are plenty of other ways to evaluate the assets of a company. All the same though, I thought it might be fun to note the “expert opinions” for each of the stocks I bought earlier this year and see how they did every 3 months are so.

Who knows – could any of these experts get all of them right within a 12 month period? We’ll just have to wait and see.

Why I Like Investing in Dividend Stocks:

One of the privileges of being a personal finance blogger is that I’ve gotten to connect with a lot of other blogs that are really doing well with investing in dividend stocks.

Dividend stocks are a truly passive form of income. You don’t have to do anything to get paid from them other than own them.

The thing I like best about dividend stocks is that even if the share price goes down I’ll still get a dividend payment from the company. It’s kind of like an insurance policy in case things don’t go the way I plan. If the share price goes up, then I get the best of both worlds.

Plus dividend stocks can make a great tool for early retirement. Get enough dividend paying stocks and you could create a large enough passive income stream to support yourself every month for the rest of your life.

In the past I’ve always made this process very simple and simply invested in a group of dividend stocks called The Dogs of the Dow. But this year I did some extra research and purchased 10 reputable stocks that I believed would do well this year.

The Experiment – A Quick Re-Cap:

At the time of my last stock purchase I noticed that every major financial media website had some kind of “expert opinion” or “forecast” type of section.

My natural curiosity begged the question:

Are these forecasts really all that accurate?

I would expect that these analysts are experts and would have a much better grasp on how the stock is going to do over the next 12 months than me, the common investor, would have. But then again it’s proven before that not all stock analysts are always right.

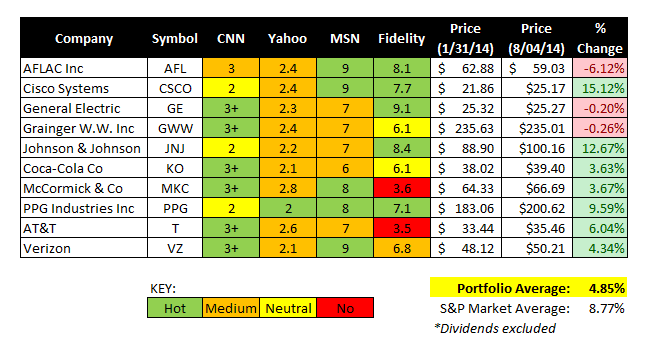

So as a fun experiment during this purchase of dividend stocks I thought I’d note the opinion of each of my picks and track the progress. I decided to use 4 major stock media sources: CNN Money, MSN Money, Yahoo Finance, and Fidelity.

To normalize all of the expert ratings (since each one had their own unique scale), I came up with my own four color rating system. As you’ll notice in almost every situation not all 4 of them agreed.

So How Did My Stocks Do?

Here’s a quick snapshot of my stock portfolio performance:

As you can see my strategy for investing in dividend stocks is currently trailing behind the S&P500 stock market index by about 4 percentage points (5% vs 9%).

That’s unfortunate. But keep in mind that this could change tomorrow. Stocks go up and down every day. To illustrate that point, remember that during my last stock portfolio update my portfolio was beating the index average (3% vs 2%).

Plus I haven’t included my dividend earnings as part of this comparison. That could also tip the scales in the other direction.

Who Were the Biggest Winners?

Cisco Systems and Johnson & Johnson. Both of these stocks have been on a pretty steady upward trail all year. Nice job to Fidelity for identifying both of them as winners. I should also mention that MSN was big on Cisco as well.

Biggest Losers?

Aflac. Unfortunately it’s been a pretty rocky year for Aflac. That’s too bad since MSN and Fidelity seemed to be really hot on it at that time.

Surprises?

Out of all the stocks I bought CNN was very optimistic about both General Electric and Grainger. Both of these companies unfortunately appear to be flat-lining in capital gains this year so far. Fidelity is also guilty since they were very positive about General Electric.

AT&T was forecast to be pretty low by 3 out of the 4 media sites. However shares are up just over 6%. Nice pick CNN.

What Have We Learned So Far?

So can you trust the big media sites to pick your stocks for you?

Here’s the score so far in terms of who was right and who was wrong:

- Yahoo and MSN are tied – 7 points

- Fidelity – 5 points

- CNN Money – 4 points

(One point for each stock you were right about. Green and orange opinions had to be a positive return. Yellow and red opinions had to be a negative return.)

Even though no one has a perfect score, I do think these analyst opinions could be helpful as supplementary data to your other stock picking criteria.

Plus let’s hope my stock portfolio doesn’t continue to lag behind the S&P500 index forever. What’s the fun in investing in dividend stocks if you’re going to worse than an index fund?

Readers – How is your stock portfolio doing so far this year? What do you think of this experiment so far?

Images courtesy of MMD

I haven’t studied their stock at all but that doesn’t surprise me about Aflac. I know from experience that the company is poorly run, or a least parts of it are. We had at least ten different Aflac representatives contact us at my old job and they were always really pushy and rude. I thought that was really weird since they wanted to sell something to the employees (people like me).

That sounds pretty typical of most insurance sales people I’ve met. AFL is still projected to show some modest growth in earnings this year and for the next 5 years after. Plus they have a decent PE and PB. But we’ll see how this all plays out for the next 6 months. I still very well could end up dumping them.

I think anyone who tells you they can pick stocks might as well be selling striped unicorns. You never know when some natural or man made disaster is going to cause something to crumble. I love the idea of dividend stocks, but I love them more in an index fund!

Striped unicorns … that’s great!

It is very well possible that this whole experiment could just teach me to not invest in individual stocks at all and that I would have been better off to go with the index fund. But we’ll see how it goes for the next 6 months. It’s a little bit early to tell. Just a few weeks before this update my portfolio was kicking butt!

It’s certainly an interesting approach. I think it is still too early to make a conclusion one way or the other. I think though in time, you will be happy with your picks. They are all good, solid companies. With the added dividend, you just boost your return.

Thanks Jon. That was actually the most important point for me – invest in well-known reputable brands that all project to do well over the next 1-5 years. Even if they do lag behind the index fund return, I still feel strong about the overall composition of this portfolio.

I just did a three year update on my dividend stock investing, so this article is timely. I bought five stocks (and now have six, thanks to a stock spinoff) from the Dividend Aristocrats list. My results this last year are mixed. McDonald’s, Coca-Cola, and Wal-Mart have been flat, but thank heavens for Johnson & Johnson, right?

Interesting update!

JNJ has made a big bump in my overall return. Thank you commodities!

This is a cool experiement. As I’ve read many of the experts get it wrong like 80% of the time. So you can only tailor your investing to fit in with the correct strategy. I like dividend stocks as well, but I will never stop investing in index funds that cover the whole broad base market. I have both so I am covered from both sides.

Let’s hope this portfolio isn’t 80% wrong 🙂 That’s my money we’re experimenting with!

Interesting experiment. My hubby & I own a few shares in 3 different companies. We’ve owned shares in two of the companies for a very long time (well over 30 years on the one). Those two companies have been consistently paying dividends. With the one company we elected to go with the DRIP. That one has been great fun to watch, especially the last 6 years. They have raised the dividend every year for as long as we’ve been invested. Back in ’08 & ’09 the stars aligned just right and the dividends were purchasing over 1 share of stock every quarter. In the past 52 weeks the stock has more than tripled in value. The last company has been a challenge. We invested in our local bank when they had a public offering. Over-all our shares are worth more than we originally paid so we are still ahead. However the SEC suspended their dividend. Supposedly they are “this close” to re-instating it. I’ll be very interested in seeing how your “experiment” works out.

Congrats on having such a terrific run on the first 2. That’s pretty incredible that the dividend payments were buying over 1 share each quarter. That’s quite a buy!

I can see why you’d want to invest in the local bank. Sometimes the opportunity just seems right and you feel the need to jump on it. However I’ve got a personal requirement not to invest in any stock that doesn’t already have a proven dividend track record. That just gives me confidence that the company is consistently on the right track.

What an experiment this is. Most experts get it really wrong. It is really true that we can taileor the strategy that fits our individual needs. I know how dividend stocks works and I would invest when I know it’s the right time to do so.

I’ll be interested to see how this works out at the one year mark. I’ve still got my fingers crossed that I’ll turn out to be some kind of stock picking wizard. 🙂