“I don’t have time for that” – It’s one of the biggest illusions we fool ourselves into believing. We say it about exercising more, going back and getting that degree, spending more time with the people that matter, etc. Yet for many of us I’m willing to bet that if you really did an audit of what actually do with our time, we could be investing it into something that’s a whole lot more beneficial than what we’re doing no.

I truly believe this is absolutely true when it comes to your finances. There are TONS of great resources out there ready to teach you how to manage money wisely and build your wealth.

Investing in your own personal finance education is one of the best things you can do to improve your life and the lives of your family members.

Most of what you need to get started is practically no further away than your keyboard or the local bookstore.

Yet for some reason this one initiative never seems to rank very highly as a priority for some people … that is until you can show them what they’re missing. Let’s quantify how investing in my own financial competency has paid off.

What is the Value of a Financial Education?

Starting Off on the Wrong Foot:

I remember being a young professional with barely a clue about retirement when I first told by HR to sign up for my 401k account. Without knowing anything about it I asked the guy next me how much he was going to contribute and we both decided (based on absolutely nothing) that 8% sounded good.

“Retirement feels so far away …” I thought. “I’ll just contribute more as I get older and make more money. Don’t I need the money NOW more badly?”

Unfortunately this is exactly where financial planning starts and ends for a lot of people. They are told by their company to fill out their retirement plan forms and then they don’t change anything about it for the next 10-20 years. They never make any financial goals, check on their performance to see if they are reaching those goals, or make changes as necessary to stay the course. They use the head-in-the-sand approach and never really give it another thought.

Thankfully I realized early on that this was a BIG deal. It wasn’t long after I started my 401k plan that I started to figure out that the conventional system of creating wealth by being a slave to your employer in hopes for a bigger paycheck was for suckers. If you study how ordinary people become millionaires over time, you’ll find that there’s something to it all. I could tell that this 401k thing was going to be a big part of it.

Using Money Books to Grow My 401k:

And so with that I decided to hit the local bookstore to take in everything I could about how to manage your finances the right way. Before me were rows and rows of books from self-made millionaires and entrepreneurs. Each book was a like a personal one-on-one conversation where they were going to spill their secrets to me.

The only question – would I listen? Would I actually take the time to read what they had written and actually give it a shot.

Absolutely!

One book in particular called “Your Money Ratios” by Charles Farrell really helped me to understand not just my 401k but structuring an overall retirement using several different tactics. If you’ve never read it or just getting started with retirement planning I’d highly recommend you check it out.

10 years and lots of books/websites later I’m proud to report that my 401k balance has outpaced all of my peers at work. There was nothing mind-blowing about what I did to get there. I simply put in the time to learn more about:

- The value of maximizing my contributions

- Diversifying my asset allocation

- Taking advantage of tax deferment

- Getting my full employer match (free money)!

To date my personal contributions to the plan are at $127,249.

But what is my balance? Checking my free Personal Capital account I see that my 401k is all the way up to $340,816!

That’s a whopping 168% return on my effort!

Keep in mind that the $341K figure is both my investment returns and employer matching contributions. I’m counting both as part of the return because hadn’t spent some time learning about my 401k and just simply hid my $127K under my mattress, I would have missed out on all the money my employer was offering to match.

The Beauty of Compound Returns:

Another thing learning more about money taught me – time is your friend! The more you invest now, the better your potential returns look in the future.

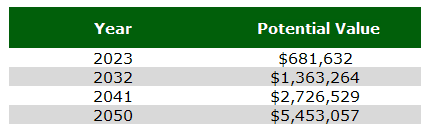

Let’s say I do absolutely nothing but let the money sit idle in the account for the next few decades. If we use the rule of 72 and an 8% return, that means every 72 / 8 = 9 years I should expect my fortune to potently double! Check out the possibilities:

And to think … all I did was read a few good books and follow their advice. I’d say that was well worth my time.

Advice on How to Manage Money Wisely is Out There:

Don’t have a 401k? It doesn’t matter. This same logic applies to practically every aspect helping you master your finances. There are plenty of good websites and books about:

- Budgeting

- Getting out of debt

- Doing a better job saving your money

- Building up your credit

- Insurance

- Investing

- (And my favorite) developing passive income streams

What does it require from you? Usually nothing more than about $20 for a new book (or free if it comes from the library or Internet) and the DESIRE to actually want to make a change in your life. If you want to learn how to manage money wisely and escape the rat-race bad enough, then you’ll find a way to make it work. You’ll find the right advice and tips to get you there. And at some point you’ll look back on your efforts and say – that was definitely worth my time.

Follow these links if you’d like to see my personal recommendations for some good books on finance and other helpful titles I’ve read.

Readers – What do you do to learn how to handle your money better? How do you value financial education and can you quantify what kind of an impact it’s made on your life?

Image courtesy of FreeDigitalPhotos.net

Reading articles on saving money and finances really educates me. Aside from it, I also read books, a lot, which I apply to my money management. And, now I am planning to get a financial advisor so that I can know specific advice that fits my current financial situation. Education is really a key to financial success.

It will be interesting to hear what the financial adviser comes up with for you. Hopefully they can help you outline a path for your specific goals.

Yes, yes, yes, yes, yes! Did I mention: yes!!

Financial education is the most valuable resource anyone has in reaching their long-term financial goals and should definitely be seen as an investment for the future.

Almost everyone I have ever spoken to have some sort of goals for the future which, if not based on wealth, have a pre-requisite of sufficient wealth. However, I meet very few people who take the time to educate themselves in this area.

This is why…and we can’t say this enough…financial education is an absolute must on the school curriculum at all ages!!

I’m glad to hear we can agree on the importance of financial education!

Aside from reading articles and books, I try to attend online classes/courses. It’s sometimes more effective when there is a teacher!

A good teacher can be a mentor and great source of inspiration. I’d much rather listen to a good teacher or speaker than read a book or article any day.

My parents taught me about saving and frugality but I learned about investing on my own. I also learned that about 75% of investing is just doing it. You can read all you want but your knowledge won’t benefit you if you don’t actually put your money on the table.

I can’t agree that most of learning how to manage your money is really just DOING it. I would have never learned as much about mutual funds or stocks if I hadn’t forced myself to get involved with them. Sure you’ll make mistakes here and there, but that’s how you figure out what works and what doesn’t.

I’ve been reading as man financial books as I can get my hands on. Dave Ramsey’s “A total Money Makeover” was the springboard for us paying off over $109k worth of debt.

Now that’s a good example of money and time well spent! Nice work.

I’m inspired to dust off that list of finance books that’s been laying around. After the initial “consume everything in site” rush, I haven’t done much reading on the subject other than online articles (which are great, but not the same thing as chewing through a book). I would also echo Holly’s comment that I too was taught the basics of money by my parents (including a bit about investing), but needed to learn the majority of investing information on my own. That makes me think that I’ll need to remember to clue my kids into basic investing!

Have you tried ebooks at all? I’m finding them to be just as effective as normal books but a nice diversification from the normal laundry list of titles you’ll find on the shelves at your local Barnes and Noble. Plus they are far more in depth than most normal online articles (although there are a lot of good ones out there).

I agree with both you and Holly about passing on this knowledge to our children. It could be one of the most important things I ever teach them.

I think the more finance books you can read the better. Throw in a few that are focused primarily on investing or entrepreneurship and you are even better off. Definitely something to invest in!

When you’re just getting started there really seems to be no end to how many good books you can take in. Now that I’m quite a few years into it, I’m finding myself seeking out very niche and specific ebooks and articles on subjects that I’m passionate about (such as early retirement).

Like you, I do a lot of reading. I learn from those that are in the position and place in life where I aspire to be one day. They made it, so they have some good tips and advice to help me get better with my finances.

Even if you don’t want to spend the money on books, you can borrow for free from your library or find out loads of information by reading certain websites.

It’s amazing how many good titles you can find at the library for free. Websites also have a ton of good info in them; you just have to sometimes look a little harder to find one where the advice is solid.

I believe 95% of people do have time to make positive changes in their lives, financially or otherwise., but they choose to use the time for non-productive things like watching reality TV or updating Facebook. It’s fine to relax and do mindless stuff, but not to the detriment of your retirement. Everyone can stay up and extra hour or get up and hour earlier if they really want it bad enough.

Exactly. It’s perfectly fine to relax. But sometimes you have to ask yourself: What am I prepared to give up or sacrifice in order to get what I want? I really want to be retired early some day, so for me I compare all the things in my free time to this single goal and there’s no contest. I’ll gladly give up an hour of TV or stay up an extra hour later each night to read a new book or earn more money through my blog network. Ambition knows no boundaries.

I love financial books and they keep me on track with day to day types of spending/saving, but I could probably benefit from understanding my portfolio more. People can make time for anything that becomes more of a priority in their life.

Its funny how quickly we can become experts on certain subjects based on what’s currently important in our lives.

I could not agree more MMD. I’m a big reader, when I have the time, and that’s one of the keys I’ve found to staying on top of things and growing myself more. My parents didn’t really do much in terms of teaching me about finances so it’s largely been my own past mistakes that started to guide me as to what I should do and avoid. Working with investors didn’t hurt either in seeing what I should/shouldn’t be doing as well. 🙂

The whole “parents didn’t really teach me about finances” really seems to be a common theme running through all the comments. Though I certainly don’t hold my parents (or anyone’s parents) at fault, it is interesting that so many of us took it upon ourselves to get self-educated about the subject and dive right in.

We were watching an episode of Shark Tank and I was trying to explain to my kids what a stock is. I think it kind of blew their minds. When they get to be 16 and find jobs I may offer to do an IRA Mom-&-Dad matching to entice them to start one.

I think that, for a lot of people, learning about money is incredibly overwhelming. It’s one of those things that seems more complicated than it really is. Plus, we don’t really have the benefit of being able to ask our elders for advice because our elders come from a time when you didn’t need to know how to manage money outside of work hard at your job and be secure with the knowledge that your pension and Social Security will support you for the rest of your days. I remember a post you did about how 401k’s aren’t killing retirement, we are. It still seems to be the case that the idea of learning how to manage our own money is still anathema to us.

I think one of the most important pieces of financial advice is something that NEVER gets mentioned: Get creative and find ways to earn passive income. Easier said than done, but so’s your day job.

Excellent point on the generational gap. 30 years ago you didn’t need to know this kind of stuff. Unless you took up investing on your own there really was no need to get involved. But now things are different. Whether or not you’re retired is all up to you.

Fortunately there are a lot of good resources out there like we talked about in the post here. And if you’re extra ambitious there are plenty of ways to make money on the side that are above and beyond just saving for retirement. Again – it’s all up to you what you want to do with your time.

I was always interested in money and investing from a reasonably young age, but I found that after reading one book in particular, Rich Dad Poor Dad, it really changed my perspective on the world, and sparked something in me that wanted to keep devouring these sorts of books to learn more and more! I think that’s the key – if you’re curious enough to start with, and you make the effort to read one or two of these books, most people will find that the insights you discover are enough to make you want to learn more. Unfortunately, most people just don’t make that first step, and don’t understand what their missing out on!

Even though Robert Kiyosaki is pretty much despised in the personal finance community, I’ll confess – Rich Dad Poor Dad holds a special place for me as well. I’m not embarrassed to admit it. Like you, that was one of the first PF books I ever read in my early 20’s. The whole concept of creating passive income streams and working for yourself were absolutely mind-blowing to me, and it opened the flood-gates to wanting to read more. Even today there’s a lot of times before I buy something or make a new investment when I say to myself “is this going to put money in my pocket or take money away from it?” – good stuff.

That’s a great return on your 401K account, congrats. I had a similar situation with 1 person at work, I lent her the Total money makeover book, and after 4 days she returned it, and said she didn’t have time to read it. Mind you this person is struggling with finances. I guess its more important to continue down the rabbit hole of debt, than to take 2 weeks to read a book.

That’s pretty sad. Sometimes reading a book is a hard pill to swallow for some people.