For those of you who don’t know, DRIP stands for dividend reinvestment plan (or program). It is also sometimes abbreviated DRP. When people say you DRIP stocks, they are usually referring to some system you enroll in where instead of receiving your dividend payments by check or cash each quarter you instead automatically buy more shares of that same dividend paying stock. There are a lot of really strong reasons as to why this is a big advantage to you.

Why Investors Love to DRIP:

As you might guess, the ability to DRIP stocks is one of the great features of dividend investing. Just check out these advantages:

- By using the dividend payments to buy more shares, I’m accelerating the potential growth of my fortune a lot faster than I was before. This is because by buying more shares of that stock, I’m using the power of compound interest to make my money grow more aggressively. And as you might guess: More shares means more dividend payments, and the cycle continues to grow!

- When I DRIP stocks, it allows me to buy fractions of shares rather than whole shares. This is a big advantage. Normally if you wait to buy stocks normally, you can only buy them in whole numbers. But a DRIP will give you the ability to buy shares in fractions (usually above some price or threshold set by the company) which means you get the access to an opportunity that you wouldn’t have normally had.

- Usually the company or broker charges no commissions or fees for the extra purchases. So instead of paying $8 for each stock purchase, I’m basically building up my portfolio free of charge.

- By buying more shares of the company each quarter, I’ll also be taking advantage of dollar-cost averaging. Some people see this as one of the biggest perks to dividend reinvestment. Dollar cost averaging is when you periodically buy investments over a given time and reap the benefits of the highs and lows in prices. Think about it this way: Suppose you just buy stocks in January and that’s it. Who’s to say that wasn’t a point when the stocks were at their highest, and better stock buying opportunities existed throughout the year? That’s how dollar-cost averaging works. You buy a little bit here and there, and by the end you’ve likely bought shares at a time when they were at their cheapest which means potentially more growth for you.

- The purchases will be automatic. This is always the best part for me – I don’t have to do anything! By enrolling, I just sit back and let my portfolio grow. All I need to do is what I originally set out to do: Make judgments about my portfolio once a year and decide if there are any changes I would like to make.

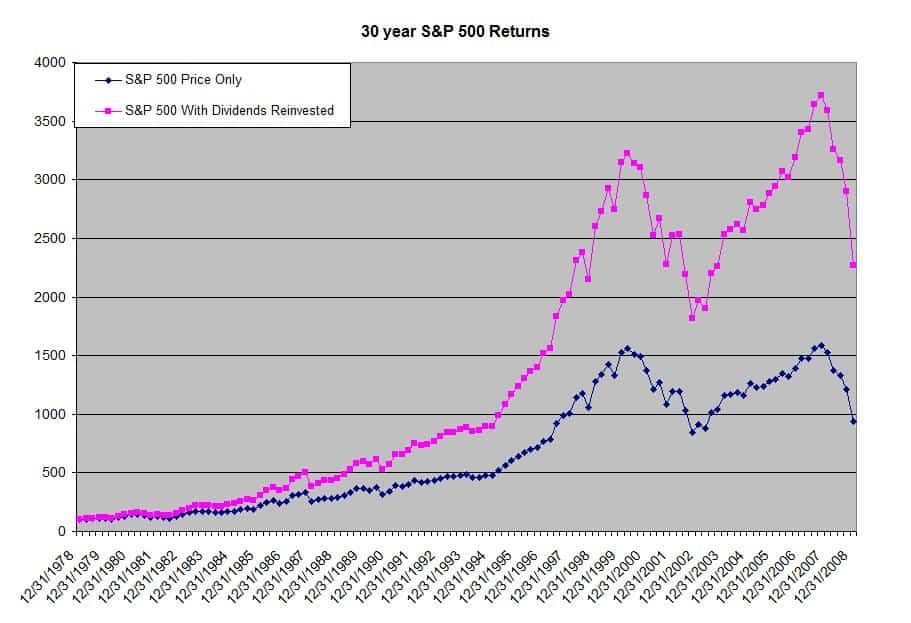

If you’re still skeptical about the impact that this process can have on your portfolio, then check out this interesting graph from the Dividend Growth Investor. A while back they did an article that compared the returns of the S&P 500 Index both WITH and WITHOUT reinvesting the dividends. Guess which one did FAR better?

That’s right. Like all things in finance, it took a while to happen. But over time the reinvestment paid off handsomely for the investor leaving him with nearly twice as big of a portfolio. You can search this Google and find dozens of other examples.

Can I DRIP Stocks Too?

After publishing a few of my dividend paying stock reports now on My Money Design, I’ve received a number of comments by readers asking me why I don’t have a DRIP setup for the dividend payments. To be honest I didn’t think that I could.

A few years ago I read the book The Little Book of Big Dividends” by Charles B. Carlson and first became aquatinted with the concept of a DRIP. Through whatever misconception, I thought that a DRIP was only something that was exclusively setup with the company issuing the stock. For example, if I wanted to DRIP with shares of Johnson and Johnson (JNJ) stock, I thought I had to go their website, contact their investor relations, and sign up directly with the company to participate. That would be fine if you owned one stock, but can you imagine what a pain in the butt that would be for a handful of them?

Then some of the commenters had mentioned that they had brokerage accounts that let them do this automatically with their whole portfolio of stocks. That sounded way more sensible and efficient. But I’ve never seen this offered or advertised by my broker, Fidelity. Do they offer this?

So thinking about it more this week, curiosity got the best of me. I called up Fidelity to see they offered such a plan and it turns out they do!

After spending five minutes on the phone with the helpful Fidelity rep, he led me to a secluded part of the Account navigation where all you had to do was change a few settings and “boom” you’re set. I’m not really sure why they don’t promote this feature more.

And so like that, I’m all set. Instead of letting the dividends sit around in my core cash account, I’ll be putting dollar cost averaging to work and building my portfolio more aggressively.

The only potential negative to this process is that I will need to keep careful record of the purchase price of each stock for when I figure out my taxes. Capital gains are calculated based on the difference between the price you sold and the price you purchased. Since I will have multiple purchases, it just means a little extra book-keeping to make sure I’m doing things right.

Overall, I’m happy to add this strategy to my money design since I’ve got a while until I will need the dividend income to live on. As I often point out: Why should I work harder when I could just make my money work harder for me.

Readers – Does anyone else make a habit to DRIP stocks? Does your broker let you reinvest the dividends for free or do you have other plans for your dividends?

Disclaimer: I am long on JNJ.

Related Posts:

- Exploring My 401k Alternatives – Maybe More Dividend Stocks?

- Using the Dividend Yield Formula to Evaluate a Stock Prospect

- Can the Dividend Payout Ratio Help You Pick a Good Stock?

Image courtesy of FreeDigitalPhotos.net

I love DRIP and for many of the same reasons you listed MMD. I have been doing it for a number of years and is a great option, in my opinion. We have my wife’s accounts at Scottrade and they FINALLY introduced DRIP over the last week or so. The only problem is they do not allow purchasing of partial shares which is just crazy in my book.

That’s too bad they don’t allow the partial purchases. But all in all I think that the program would still be worth it simply for the autopilot feature and no commission fees.

I’m totally with you for the same reasons–great way of spelling them out! Compounding works wonders.

I really can’t wait until ten years from now when the build-up has grown out of control.

To DRIP or not to DRIP! I think it is wise for people to reinvest especially for the reasons you listed. My favorite is being able to buy fractions of shares. Not all companies allow partials though. I never have plans for the dividends except buying more. Maybe later on in life i will use it as income.

The same here! I don’t plan on cashing them out (yet), so I might as well put them to work making me even more money!

I’m also a big fan of DRP for basically the same reasons you listed above. The more compounding that I can get, the better!

Absolutely. If you’ve got the time, let compounding work its magic.

My broker also lets you DRIP any stocks you choose at no cost. This is definitely a very good deal with respect to commissions. I tend to do this more in non-taxable accounts because dividend reinvestment does make for a tax hassle, but I’m hopeful the new tax reporting requirements for brokers will make this a lot easier.

A little bit of caution about those studies that show stocks with dividends reinvested vs not reinvested: the outcome is really much more about compounding than it is about dividends. You would find the same result for any investment that has cash flows. For example, if you had a 30 year 5% bond and compared reinvesting the interest in a similar bond vs just sitting on all the interest received, over time the reinvestment option will clearly outperform.

That’s absolutely true about those graphs and reinvestment. I wanted to show that between doing nothing with the dividend payments and doing something how much further along you’d be. It really doesn’t matter what investment type you put there – reinvesting it almost always has better long term potential than not.

Reinvesting dividends is a great way to put your wealth accumulation on auto-pilot. It’s also incredibly easy to set up with mutual funds. With Vanguard it’s as simple as checking a box. For a long-term investor without immediate income needs, it’s really a no-brainer. Glad you were able to get it set up!

You know what’s funny is that Vanguard forced me to set this up when I first bought my mutual funds, but Fidelity didn’t do the same when I first bought my stocks. Unfortunately I ended up assuming that Fidelity didn’t offer this service. Once I knew where to look, their setup was very similar to Vanguard.

I love automatic reinvestment. No temptation to take that money out for other purposes.

That temptation is probably one of my biggest negatives when it comes to even investing in a taxable account. If I know that it is there, there will always be the possibility that when I need money …

DRIPping really helped me accelerate my wealth and dividend income. I highly recommend to to folks who are building up their dividend portfolios. When the portfolio income is large enough, you may want to consider a more selective, rather than automatic reinvestment program. It will allow you to get maximum value from market mispricing.

Good point. This is a good trick for just getting started. But once those dividends equal out to significant sums of money, there are probably some better opportunities for them as opposed to just blindly buying more of the same stocks.