This is exciting news for anyone looking to invest more of their money without the burden of paying taxes on their returns. The Money Design November Update plan I proposed recently will get a big boost from these new increases that will help me to achieve my goals much more quickly and safely.

2013 IRS Contribution Limits:

Here are the official new maximum amounts you’ll be able to save in your tax-sheltered retirement accounts:

• IRA contributions: $5,500 per year (up $500 from last year)

• Employer sponsored plan contributions (401k, 403b, etc): $17,500 per year (up $500 from last year)

Remember That It’s All On You:

Don’t forget that if you haven’t started saving for retirement yet, you’re going to want to (and soon)!

Most of the classic pension plans that the older generation in the U.S. once enjoyed are now gone. The trend has gone from shifting the burden from the employer to the individual. Employer retirement plans like the 401k started becoming popular in the 1980’s and eventually became the dominate offering for most private and public firms. The IRA was created to be a supplementary and very similar type of investment plan, only this one would have no ties to the employer. Every few years the IRS contribution limits for these plans has increased.

Unlike other parts of the world such as the UK where there are very extensive types of public pension plans available, U.S. individuals are on their own for the most part when it comes to planning for retirement (with the questionable exception of Social Security). However, even our friends in the UK will need to consider funding their own pension annuities and ISA accounts if they plan to live comfortably during the golden years.

How Long Is It Going to Take Me to Reach One Million Dollars?

One fun little calculation I like to do with the IRS contribution limits for my accounts like my IRA and 401k is to see how long it theoretically take to reach one million dollars! (There’s nothing really special about the one million dollar mark – it’s just a physiological threshold where a lot of people consider to be rich!)

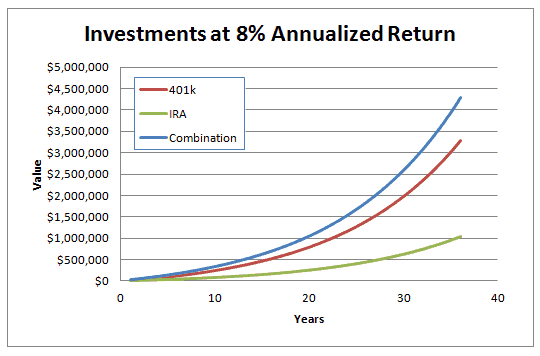

Suppose you first started saving in 2013, stuck to your guns and contributed the full amount each year, and did an EXCELLENT job of not getting greedy and picked some low cost Index Funds with an average annualized return of 8%, then you’d be looking at the following results:

Suppose this all works, then we’d have the following results:

• Using IRA contributions: 35.7 years

• Using 401k contributions: 22.3 years

• Using a combination of IRA and 401k contributions: 19.5 years

That’s right – double-dip and you’re looking at the possibility of becoming a millionaire within 20 years.

Want to really accelerate things? If you and your spouse both work, shoot for stashing away the full amount ($46,000) and you’ll be there even sooner!

If you have more questions about 401k’s or investing in retirement accounts in general, try Smartest 401(k) Book You’ll Ever Read by Daniel Solin a try. You can also consult the My Money Design resources:

- Help! I Just Got My 401k Packet At Work! What Do I Do?

- Traditional vs. Roth IRA – Part 1: The Basics

Readers – Who’s excited about the new IRS contribution limits? Will anyone raise their retirement saving contribution levels next year?

Related Posts:

1) Maxing Out Your 401k Matching – Don’t You Dare Leave Money on the Table!

2) Six Easy Steps to Figuring Out Your Retirement

3) How to Pick Good Mutual Funds for Your 401k or Retirement Plan

Image Credit: freedigitalphotos.net

I saw that about the Roth contributions changing. That is great! I plan to take advantage of that in the next few years!

Sounds good! As long as you’ve got a plan to get there, then eventually you’ll be maxing out!

I saw this as well and think it’s awesome! We’ve not been able to fully max out yet as we have a few other things we’re focuins on right now. That said, should be able to soon. Being self-employed we can have SEP’s which typically have higher contribution limits.

Out of curiosity, what are the SEP contribution limits?

I think it’s great for the people that are able to max out their retirement accounts, but that’s a VERY small percentage of the population. We won’t be adding much more to retirement until we’re out of debt; hopefully one of these days!

Jason, I’d do the same if I had debt to get rid of and it was a priority for my finances. I do agree that only a small percent of the population will be able to max out, which is fine. Even if you don’t get there, it would probably help more people out if they reached for the stars!

I like everything about this post but the chart that shows an 8% annualized return, mainly because I don’t see this as a realistic figure. I’m being nitpicky tho 😉 Overall it is great to contribute to a retirement plan – even better if it is auto-deducted from your paycheck or a bank account. $17k is a big chunk of cash to put aside, but maybe I’ll reach it? We’ll see what 2013 brings.

DC, you’ll reach it! It took me a while, but I got there a few years and love the fact that we max out. By the way, 8% is just the commonly quoted number by most analysts and financial authors, and it helps to illustrate the benefits of saving. I personally believe in using a smaller number like 6% for my own calculations and retirement models.

I will contribute more to my Roth IRA but I am a ways away from maxing out my Roth 401(k). I will be adding half of my raise to my retirement savings though, whatever that turns out to be.

Lance, you are very wise. Years and years of raise increases and diverting them into our 401k was exactly how we got to the maximum limit over time.

I wish I had employer-offered 401k and matching, I would so max that out!

Veronica, I am sad to hear that you don’t get to take advantage of this.

The situation in the UK is a tricky one at the moment. We have a very big hole in our public finances where pensions are concerned, and a large percentage of the population have no private pension at all.

I’m not 100% convinced we will have a state pension, or whether it will be worth taking, by the time I retire, and I’m not sure when that will be either because they keep putting the retirment age back! 2 years ago I was 28 years away from retirement age, and today it’s 29!!

Thanks for the perspective Matt! Sounds kind of like your country’s pension program is very similar to the state of our Social Security program here in the US. Looks like no where in the world safe – we can only rely on ourselves to create a fortune!

Albert Einstein once said that 8th wonder of the world is the law of compounding return! Your article proves his theory well.

It truly is! That’s why I always advocate to young people to start investing as early as possible. If nothing else, time will be on their side!

the 2013 401k limit will be $17,500, not $17,000 – this is the current one

great news about IRA limits, it was high time

Thank you for catching that very important typo in the text body! It has been corrected. The graph was prepared using the proper value.

Great post. Thanks for the info, very helpful. BTW, if anyone needs to fill out a http://www.irs.gov and, I found a blank form here.