It’s time to let the cat out of the bag! For a while now I’ve been hinting that my next big extra income project will be to officially release an eBook. This is something I’ve wanted to do for a very long time. Quite frankly I’m way overdue and should have tried it a long time ago. As a matter of fact making money writing eBooks was on the table as one of my next projects as far back as this post in 2013. Better late than never though, right? If you remember, I actually did experiment with writing a whole eBook back over the summer. But I got cold feet about taking the next steps and investing the time it takes to edit it, find a cover, etc. And so I ended up releasing it as just one really large epic post on one of my niche … [Read more...] about 14 Reasons Why Writing an eBook Will Be My Next Make-Money Project

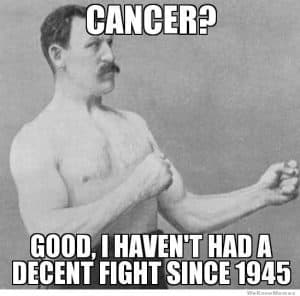

My Cancer Update – 8 Weeks Later

I wanted to give everyone a quick update on my health and how things are going. In case you didn’t know, I found out in January that I have cancer – specifically Type II Hodgkin's Lymphoma. As you can probably guess that came as a HUGE shock to me to because I’m an otherwise pretty young, healthy guy. However, as I’ve learned, cancer doesn’t discriminate its victims. And so now this is just simply something I have to deal with and put behind me without hesitation. Since when I first broke the news to you my dear readers, I’ve received my official regimen of treatments: No radiation and 12 rounds of chemo. Believe it or not I was actually delighted when I first heard this because everything I’ve read so far suggested that … [Read more...] about My Cancer Update – 8 Weeks Later

3 Painless Ways to Build Your Emergency Money Fund

The other day I was having a conversation with a few of my coworkers about how long we'd be "okay" financially if we were to lose our jobs. (None of us were in any sort of trouble, it was just one of those conversations.) Much to my surprise most of them said they didn't think they'd last more than a month. A month? Perhaps I'm brain-washed from living in this money-blog community of mine, but doesn't everyone know by now that you're supposed to have 3 to 6 months worth of emergency money stashed up at all times? Disaster could strike at any time whether you're ready for it or not! And if you're not prepared well in advance to handle such a situation, you'll find yourself in a whole lot of trouble. Why Don’t We Do A … [Read more...] about 3 Painless Ways to Build Your Emergency Money Fund

Ask MMD: Should I Do a Rollover, Pension Lump Sum or Annuity?

How do you know you’re a true financial geek? The answer: You get excited when one of your friends asks you a money question because it means crunching some numbers with Excel! Okay … maybe not to that extreme, but that’s pretty much how I felt recently for a friend who had a question about whether or not to cash out his pension with an old employer. Here was his email: So I attended a webinar today about the buyout (with my old employer). Attached is a snip of the five options they gave us and what the amounts would be. Rollover to an IRA or another employer’s plan = $33,165.41 Rollover to the old employer’s 401k plan = $33,165.41 Take a pension lump-sum cash payment = $23,215.79 (minus taxes) Begin collecting monthly … [Read more...] about Ask MMD: Should I Do a Rollover, Pension Lump Sum or Annuity?

Niche Website Income Report 27 – $1,281 for February 2015

Hello and thank you for checking out my latest Niche Website Income Report and Update for 2015. Every month I like to review what’s going on with my online business and put it all in print for you to see. Not only does this help you out, but it also keeps me accountable and in tune with what works / what doesn’t. Whether you’re a blogger or not, I really do hope that when you read through this post that you see how it is in fact POSSIBLE to earn a decent amount of money on the side. Whether you want to call it passive income or not is up to you. I’m just very pleased to even be earning anything at all and excited by the prospect of what this online business has become. Though it was a short, VERY-cold February here in the … [Read more...] about Niche Website Income Report 27 – $1,281 for February 2015

Unlock Your Financial Philosophy Cheat Codes

Remember video game cheat codes? My son got a cheat code book from his cousin a few months back and he’s finding out just how awesome they are. Take your favorite video game or the hardest video game and the cheat code book gave you power you never thought you could have. Unlimited lives. More firepower. Skipping ahead several levels to defeat the last big boss. Honestly it made winning the game so much easier, and it was awesome! As I got older, I noticed something about cheat codes – there were more of them then just I knew about video games! Clearly all around me there were all kinds of “cheats” going on. And by cheats I mean people who had figured out how to get the things, act a certain way, and live the life I wanted. … [Read more...] about Unlock Your Financial Philosophy Cheat Codes

What are Mutual Funds and How Do I Invest in Them?

What holds you back from investing? Is it stocks? Do they scare you to death? If they do, I really don’t blame you. All the “ifs” in the beginning can be overwhelming! Which ones do I pick? Where will I find the right stock metrics and information to tell me? Why do they keep bouncing around in price? How long until I have a heart-attack? Would you prefer a way to “stick your toe in the water” and not have to deal with such wild fluctuations? If so, then let me introduce you to the world of mutual funds. “What are mutual funds” you ask? Well, for starters, they are where I started when I first invested – long before I ever bought my first shares of individual stock. But even today, after everything else I’ve learned, … [Read more...] about What are Mutual Funds and How Do I Invest in Them?

What To Do With Extra Money In Your Budget – 3 Good Choices

At the beginning of every new year, one of the first things I do with our finances is to take a hard look at our budget and see where we can get the most bang for our buck. At first this usually involves doing the normal thing that most people do - taking a look at our bills and seeing where we can shave some expenses. But there’s something else I like to do with the extra money in our budget that I feel is just as important as cutting corners on expenses. I like to take a look at where we can best grow it! There are lots of good options for what to do with extra money if you’ve got it. You might apply it to some kind of debt you have so that you’ll end up saving a boat-load in interest payments (after all, saving money can … [Read more...] about What To Do With Extra Money In Your Budget – 3 Good Choices