At first this usually involves doing the normal thing that most people do – taking a look at our bills and seeing where we can shave some expenses. But there’s something else I like to do with the extra money in our budget that I feel is just as important as cutting corners on expenses. I like to take a look at where we can best grow it!

There are lots of good options for what to do with extra money if you’ve got it. You might apply it to some kind of debt you have so that you’ll end up saving a boat-load in interest payments (after all, saving money can sometimes be just as powerful as growing it). Or you might straight-up decide to invest it. Regardless of whatever you choose to do, one thing is for sure – there will be a choice that calculates out to have a higher return than the others.

So if you’re anything like me and wondering what to do with a little excess money in your budget this year, let’s layout a few smart options and see which one works out to make us the most money in the long run. This year I’ve got about $200 per month of extra money to do something with, so that’s the number we’ll be using for our choices going forward (you can of course insert whatever number you’ve got and follow along).

There are three very respectable paths I’d like to explore. They are:

- Paying a little extra each month in mortgage principal

- Buying up more stocks

- Increasing our 403b retirement contribution

All three are good! But let’s dig a little deeper into each one and see how the numbers might actually play out over the next few years.

Option 1 – Paying a Little Extra Mortgage Principal Each Month:

Without even thinking about it, this was the very first thing I wanted to do with the extra money in our budget.

Why? Because everyone knows it’s a great thing to pay off your mortgage early if you can help it! Who doesn’t want to pay down that debt and be 100% owner of their own home?

We all know that we can avoid tens of thousands of dollars of interest AND shave years off our mortgage payment schedule if we can just bring ourselves to send in a hundred extra dollars on top of our regular mortgage payment. If you don’t think so, play around with this calculator and see for yourself what a few extra hundred dollars will do to your mortgage over time. It’s pretty amazing!

Plus paying off my mortgage early supports my initiative to retire early. Just think about how much less money you’d need for retirement if you no longer had to pay a mortgage payment every month.

What Is An Extra Principal Payment Worth Exactly?

One of the great things about applying extra money to your mortgage principal is that from an investment perspective you effectively “lock in” to a rate of return that is equal to your long-term mortgage interest rate.

For example, my mortgage is a 20-year fixed at 3.75%. Therefore whatever extra money I pay forward would be the investment equivalent of getting back 3.75% annually. (By the way, this also works out for high interest debt. For example if you had a credit card that carried a 20% APR on the balance, each extra principal payment you made would be like getting a 20% return. That’s why financial advisers always advise paying down your highest balance debt first.)

The other bonus – when you pay down your down at some fixed interest rate, you’re essentially locking into that fixed rate risk-free! (Because the terms of the debt were already pre-arranged.) That’s not too bad when you consider there aren’t a whole lot of other investment products out there that can claim a 3.75% risk-free return. Have you looked at how poorly CD’s pay lately?

Option 2 – Buying More Stocks:

This was the second thing to come to mind. Since I invest for the long-term, there’s really no reason why I couldn’t take that extra $200 per month, save it up, and then make a dynamite $2,400 lot purchase.

Plus building up my stock portfolio is another big component of my plan for early retirement because it will give me access to income that I can withdraw from anytime I want (unlike how you need to need to wait until age 59-1/2 with your tax-deferred retirement accounts).

What Kind of Return Could I Expect?

I like investing in stable, dividend-paying stocks because I know they classically have a good record of producing consistent returns; approximately 8% year over year when you look at the long-term. Earning closer to an 8% return sounds much better than earning only 3.75%.

But the trade-off here is of course “risk”. Unlike paying off the mortgage early where each extra principal payment is a fixed reduction of interest, stocks don’t work the same way. The stock market is more of a game – realistically anything could happen.

According to the S&P500 returns, the 10-year average annualized returns for the past 40 years could be as high as 19.21% or as low as -1.38%. That would be really unfortunate to invest for 10 years and lose an average of -1.38% year over year by the end of it. So with this option there are some more serious risks and rewards to consider.

Option 3 – Increasing Our 403b Retirement Contribution:

As I was considering the above two options for what to do with our extra money, I re-read one of my previous blog posts and realized that perhaps I had a third and even better way to make this extra cash really grow!

Out of all our retirement accounts, my wife’s 403b (i.e. the government version of a 401k plan) is the only retirement account that we are not currently maxing out. We still have some room to increase our contribution rate before we’re maxed out at the 2015 IRS limit of $18,000 per year.

But with this option there might be a little something extra as far as strategy goes …

Isn’t This the Same Thing as Option 2?

Our 403b is invested mostly in just whatever stock / bond index related funds are available within the offering. So again we could probably assume an approximate 8% return on whatever money we pour into this option.

And that probably leaves you wondering: Won’t this be just the same thing as Option 2 where we were investing in stocks?

The answer – no.

Remember with a 403b (like a 401k) you get a special tax incentive to save your money for retirement BEFORE taxes are taken out. That will not be the case with the first two options. In Options 1 and 2, I’d be using post-tax money (i.e. the money that’s left over in your paycheck) to pay my extra mortgage payments or invest in stocks.

So since the 403b option is pre-tax money, in reality I’ll have “more money” to effectively save each month without our family budget ever even feeling a ding.

How much more extra money?

Consider that in Options 1 and 2 I was planning to divert $200 per month after taxes ($2,400 per year).

If we assume I’m in the 25% tax bracket, really I’ll have $200 x (1 / (1-0.25)) = $267 per month pre-tax to save ($3,200 per year).

And as you can guess, more capital will certainly be better to work with because that will only help lay the foundation for bigger returns.

The Decision of What to Do With Extra Money in Our Budget:

Like I said – all 3 are good, strong options. But we can only choose one of them.

And so after all that, which choice will hypothetically calculate out to the better option? Here are the results:

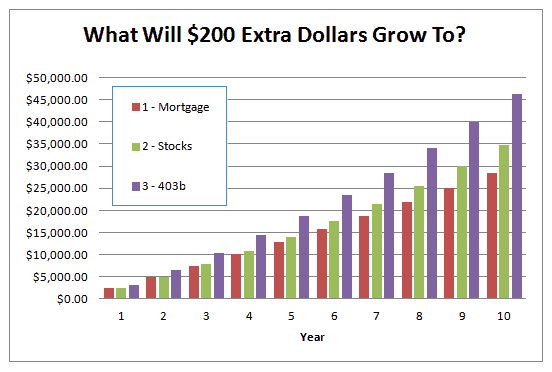

As you can see over an anticipated 10 year stretch:

- Option 1 will save me a respectable $28,483 in total interest. That’s not too bad.

- Option 2 will have a much stronger potential to grow and could work out to as much as $34,768. That’s $6,285 (22%) more than Option 1. However the trade-off is that I’d be taking on a lot more risk.

- Option 3 will have the best potential for growth possibly reaching as high as $46,357. That’s $17,874 (63%) more than Option 1. Again, there would be the risk factor to consider. But the tax-savings incentive really helps to give this one the biggest boost.

So Which One Did We Decide to Go With?

I’m always gunning for the long-term. So I will go with Option 3 and increase our 403b contribution.

Even though I’d love to pay off our house sooner and build up my stock account as high as it can go, the simple fact is that you just can’t ignore how much greater the potential for your money to grow is with Option 3. The tax-deferment helps increase the size of the capital and the investment strategy puts it right on par with how the stock market does. So this will be the one we put our extra $200 per month towards.

Hopefully the next time you’re considering what to do with extra money in your budget, you can look back on this post and see that sometimes the answer requires a little bit of digging. But when you’re talking about tens of thousands of dollars more over time, that helps make it worth the time and energy to thoroughly investigate your options.

Readers – What would you have done with the extra money in your budget? Would you have made a different choice? Would you have picked something else we didn’t even discuss?

Featured Image courtesy of Thomas Guignard | Flickr

My easy answer would be to increase my mortgage payment because the interest on that one is a known factor already. Whereas the interest on investments still varies and I’m not the risky type.

I can totally identify. Paying down the mortgage was my first instinct. And at 3.75% risk-free, that’s a deal worth considering!

MMD, I’d go for the option 3, increasing my 403b retirement contribution. I could never be wrong with this. And I know preparing for retirement is what I am more focused on to shorten the span and boost my long-term savings.

I think you’re right about the long-term prospects; that’s really what drew me into this option the most (other than crunching the numbers). The money we contribute to our 403b will be in there fore a number of decades whereas the mortgage will be over within a matter of 15 years or so. Compound those earnings over time and there would be too much left on the table.

Ah, but if you pay off your mortgage and then invest the amount of your payment in stocks or retirement, how might that play out? I like your strategy if you plan to work until your late 50’s, but I want to have my house paid off before than so I can leave work if I choose. Honestly, you really can’t go wrong with any of those choices, though.

Very creative Kim! It would be interesting to see how that calculates out. Because the pseudo mortgage payments wouldn’t be until the last 2-3 years of my original mortgage schedule, there wouldn’t be much time for the extra investment to compound before we retire early. However, that might not matter since the 403b is there fore longevity and I’d be expecting those earnings to grow for at least another 50 years.

Before I even saw your analysis and conclusion, I was going to comment “100% into tax deferred retirement accounts if they are not maxed out!” Your wife’s 403b is a great place to stash the extra money. Nothing gets me more excited on a Monday morning than tax-deferred investments and compounding interest!

A tough concept to handle for a lot of people who aren’t as knowledgeable as this community, is that paying down the mortgage is usually never the best plan (I said usually). With 30 year mortgage rates hovering around 4% (3% for most people after income tax deduction), you can get way better returns elsewhere. Number one being in tax-deferred retirement accounts.

As someone who’s worked out the math a number of times on different posts on this blog, I can say I totally agree.

Don’t get me wrong. I want my house paid off just as much as the next guy. And I certainly never blame or discourage anyone for trying. But like you I realize that over time (and with risk) there are much better long-term prospects to grow your fortune.

I’ve also got the same exact situation with a car payment at a fixed 1.75%. At such a barely-there interest rate, I’ll probably never pay this one off early. I could invest my extra money in a dividend stock paying 4%, have the stock flat-line all year (although I hope it doesn’t) and still “make” twice as much money when you compare the two side-by-side.

The Maroon household just debated this very same topic. We had already planned to put the maximum into our tax-advantages accounts. We settled on increasing mortgage payment so that it will be paid off at our target FIRE date in 2020. Although likely losing some potential growth in the endowment that we will use to fund our FIRE, the peace of mind of eliminating the recurring debt won out. Plus the endowment has to be much larger to cover a mortgage. By coordinating the two dates, we maximize what is invested while still dumping the mortgage.

Well first off – congratulations on maxing out your tax-advantaged accounts! That’s really something to be proud of, and I’m sure a lot of people would really love to be in your shoes right now having achieved that financial goal.

I think you hit the nail on the head with something you said: “the peace of mind of eliminating the recurring debt won out”. Often I’ve noticed that for most advocates in the pay-off-your-mortgage-early camp, its not about the numbers! They care far more about the psychology of it all: The fact that they never have to make another payment and they can finally call their castle “their own”. Depending on how you feel about that sort of thing, accomplishing that feat could be invaluable.

Excellent! We are in the same boat with a bit of extra money to find something to do with. We have already maxed out all tax advantaged accounts, so more money towards the mortgage won for us. Using that calculator you linked to, we are shaving close to ten years off of our house payments!

Congrats to you as well for maxing out your tax-advantaged accounts! (I’m learning today that I have some very financially astute readers!!)

Wow, your extra payments will shave off 10 years? When I did mine I only lost between 2 and 3 years. If I had enough extra cash to make 10 years possible, I’d be way more pumped mentally about going the whole early mortgage payoff route.

We’re Canadians and we’re paying down our mortgage. Then we’ll be adding to our tax advantaged accounts. Then, who knows?

Honestly – it’s all good stuff to do with your money regardless of what order you take it. Congratulations on making two very strong financial moves.

Options #3 and #2 all the way! Option #1 is a pretty poor choice in today’s low interest rate environment unless you are very risk averse.

Or unless you just want that peace of mind that your home is yours and you are debt-free. But I agree – long-term you should be able to get a much better return than 3.75%.

If your thinking long term growth option 3 is best, but if your thinking fastest route to financial freedom I would divide the 200 by 3 and do all three options. This way you can take advantage of all the benefits of the extra cash flow, and less risk.

Very crafty! EL brings diversification into the strategy. I like it!

I think increasing my mortgage will help with your financial plans. The tax-deferment helps increase the size of the capital and the investment strategy puts it right on par with how the stock market does.I really agree with you!Thanks for sharing.

I would put those priorities in reverse order – Option 3, then 2, then 1. If there’s any extra money in our budget it always goes into retirement accounts first then into individual stock purchases.

That’s pretty much the way I look at it too, but only because the rate of returns were in that order as well as tax-advantaged opportunity.

Two things on your list that I’m going to have to start taking ore seriously, are putting more money toward retirement and buying more stocks. It’s been damn near two years since I’ve really done any real investing, so it’s about time I started building up my portfolio again. At the same time though, I’ve spent way too much of my life thinking I don’t have to put away for my retirement because I’m still young, when I should be focusing on locking in that early start, to get the ball rolling.

I’m with you on this. Our (my wife’s and mine) retirement would be our choice too, as we’re focusing on our long term goals too. We want to be able to retire early!